This does not sound fair. I wonder what made them come to a tough decision to ban users from New York. This is not going to end well I think.

Forums

Cryptocurrency Forums - Join the Bitcoin Chat and Forum - Live Bitcoin Discussion about cryptocurrency trends and Chat Platforms.

Ethereum Exchange IDEX Waves Goodbye to New York Traders

IDEX, a self-described decentralized cryptocurrency exchange (DEX) that allows traders to trustlessly exchange Ethereum tokens, has announced that it will no longer provide trading services to customers with IP addresses originating from New York.

Ethereum DEX to Block New York IP Addresses

Beginning tomorrow, Oct. 25 at 6 pm UTC, New York users will be barred from placing new orders on the platform, the exchange operator announced on Twitter.

Aurora (IDEX) *Not Giving Away ETH*

@Aurora_dao

***Notice: #IDEX will begin blocking new orders from users with New York State IP addresses on Thursday, October 25th (6pm UTC). Cancels and withdrawals will remain active.

9:08 AM - Oct 24, 2018

147

226 people are talking about this

According to the platform’s terms of service, which was last updated on Sept. 20, users in Washington state and North Korea are also prohibited from trading on the exchange.

“Any user that is found to be using the Service from one of the aforementioned jurisdictions will lose access to their account,” the service agreement reads, “their funds will be frozen until the direct withdrawal function activates and the user can interact with the IDEX contract directly to withdraw their assets.”

Presumably, traders in New York and other prohibited regions could still access the platform by using a VPN to mask their actual locations, though it’s unclear whether the service will blacklist Ethereum addresses previously associated with IP activity from prohibited areas.

New York, the creator of the controversial “BitLicense” framework, maintains one of the strictest regulatory regimes for cryptocurrency exchanges, which is why only a handful of cryptocurrency companies have received authorization to operate in the state and provide services to New York residents.

Such regional restrictions, along with the ever-increasing number of centralized cryptocurrency exchange hacks, have many within the industry optimistic about the current and future development of decentralized exchanges, which allow traders to swap between cryptocurrency tokens while retaining custody of their funds. Major centralized exchanges including Binance, OKEx, and Huobi have even announced plans to build their own DEX-like platforms to complement and perhaps eventually replace their centralized services.

How Can a Decentralized Exchange Block IP Addresses?

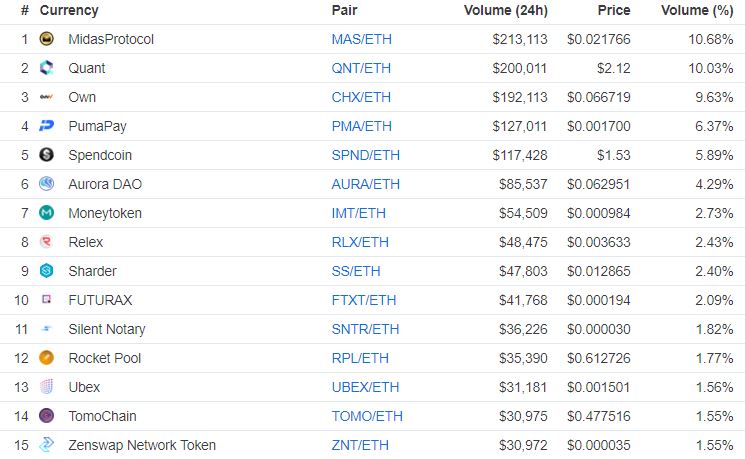

IDEX allows users to trade more than 400 Ethereum-based tokens against ether (ETH), though most of these markets are thinly-traded. | Source: CoinMarketCap

However, needless to say, the fact that an operator of a self-described DEX retains enough control over the platform to block users from a particular jurisdiction raises questions about how decentralized that platform actually is.

IDEX is operated by the Panama-registered Aurora Labs S.A., which has developed a variety of blockchain applications, cryptocurrency tokens, and protocols. According to TokenData, the firm raised $5.3 million in an initial coin offering (ICO) concluded in January. CoinMarketCap ranks IDEX as the 114th-largest cryptocurrency exchange (DEX or centralized), with daily turnover of $2 million and 30-day volume of $39 million.

While Aurora describes IDEX as a decentralized exchange — hence the “DEX” in IDEX — it also relies on some centralized off-chain infrastructure, namely a trading engine that allows users to trade continuously without waiting for individual transactions to be mined on the underlying Ethereum blockchain. Meanwhile, the IDEX smart contract trustlessly stores funds and settles funds based on the off-chain trading data.

“By separating trade matching from execution, IDEX provides the speed and user experience of centralized exchanges combined with the security and auditability of the Ethereum Blockchain,” the firm explains.

That hybrid model certainly improves the user experience over some other decentralized trading platforms while maintaining the crucial feature of leaving funds under user control. At the same time, however, it requires IDEX to be the only entity authorized “to submit signed trades to Ethereum,” which could make the company more vulnerable to scrutiny from authorities in more highly-regulated jurisdictions like New York. Consequently, traders who desire a fully-decentralized experience may have to resign themselves to platforms that trade a friendlier user experience for reduced reliance on off-chain services.

CCN has reached out to IDEX for more information on the IP ban and will update this article upon receiving a reply.