Meme stocks refer to publicly traded companies that have developed a cult-like following on the internet, usually through social media channels.

In this guide, we reveal the popular meme stocks in 2022. We also divulge how to invest in popular meme stocks without paying any commission.

Popular Meme Stocks to Watch in 2022

Here are some of the popular meme stocks to watch this year:

- Tamadoge – Overall Most Popular Upcoming Meme Game That Sold Out $19m Presale

- Battle Infinity – New Trending Metaverse Game

- Tesla

- Bed, Bath & Beyond

- GameStop

- Virgin Galactic

- Nio

- Nokia

- Blackberry

- Palantir Technologies

- AMC Entertainment

- Snap

If you’re new to equity trading then you might be wondering how to buy stocks safely and efficiently. We’ll answer that question further down.

As you can see, we’ve included a range of different sectors and industries. Next, you will find our full evaluation of the popular meme stocks.

A Closer Look at the Popular Meme Stocks

The way stock prices move isn’t always connected to business fundamentals. As such, finding meme stocks with potential may be done in a number of ways.

Below we offer more information on a dozen of the most popular meme stocks right now:

1. Tamadoge – Overall Most Popular Upcoming Meme Game That Sold Out $19m Presale

Our top pick is not a stock – but meme crypto assets have outperformed even meme stock bull cycles like that of GameStop and more recently AMTD Digital.

For example, while GameStop and AMTD Digital rose by tens of thousands of percentage points when Reddit traders rushed to buy them, so-called ‘meme coins’ like Dogecoin (DOGE) and Shiba Inu (SHIB) rose by an order of magnitude more. Shiba Inu exploded 52 million percent in 2021 alone, and by more when measured from its 2020 valuation.

Buying Tamadoge is an opportunity to potentially invest in the next Shiba Inu or the next Dogecoin at their 2020 valuations.

Tamadoge raised $19 million from more than 10,000 investors, resulting in the presale selling out. But investors have a chance to buy TAMA during a major exchange listing on OKX scheduled for 27 September 2022 at 12 pm BST. More information about the listings is available on the Tamadoge Telegram channel (admins never DM subscribers first. Watch out for imposters).

Tamadoge aims to offer more utility than meme tokens which mainly exist as a ‘joke’ based on internet memes. Meme cryptocurrencies often still captured the interest of retail investors leading to an explosive bull run – however without a use case that is eventually followed by a protracted correction as there is little incentive to hold meme assets long term.

Tamadoge (TAMA) is set to be a rewards token earned while playing the Tamadoge game, in which players mint Doge pets as NFTs, then feed, train and do battle with them for leaderboard spots and rewards.

2. Battle Infinity – New Trending Metaverse Game

Investors may also not consider Battle Infinity to be a meme stock, but it’s the best investment we’ve seen in the Metaverse. The developers of this play-to-earn game combined the virtual world with gaming elements to create an NFT fantasy game.

On top of that, players have access to several other platforms such as the Battle Stake, Battle Market and Battle Arena. Although playing this game is one of the benefits, players can also explore the mystical Metaverse game while interacting with other players and earning rewards.

To take advantage of everything Battle Infinity offers, players need to hold IBAT, the platform’s native token. It’s a BEP-20 token developed on the Binance Smart Chain, enabling players to earn higher rewards than competing players in the Battle Stake. Players can also use IBAT on Battle Swap to convert rewards to another currency. Battle Swap is integrated with Battle Market, making purchases efficient and hassle-free.

IBAT Premier League is the core part of the game, using NFTs that are tradeable. NFT passes enable players to enter the Leagues and Matches. Players can sell their NFTs on Battle Swap and use IBAT for advertising on billboards within the platform and monetise their land. IBAT is also part of the global staking pool, with transaction fees entering that pool and rewarding the most active players.

IBAT coin holders can get updates to everything involving this ecosystem on the Telegram group. With this concept’s growth potential and innovation, investors should be able to see its growth potential and not sleep on it.

The cryptocurrency markets are noted for being easier to ‘beat’ and profit from than the stock market, when it comes to day trading. Investing at ICO (the crypto equivalent of an IPO) or during a presale also offers the lowest price point with the most upside potential.

Battle Infinity’s presale sold out in just 24 days and IBAT has since successfully launched on PancakeSwap and LBank, with more listings to come in the near future.

3. Tesla

Tesla was founded in 2003 and is often talked about as the original meme stock. The company designs, manufactures, leases, and sells electric vehicles. Tesla also makes energy generators, storage systems, and more. Tesla’s most popular products include well-received EVs like its Model S, X, 3, and Y.

Other products include Solar Roof Tesla Energy Software, Powerpack, Megapack Solar Panels, and the company’s integrated battery system – Powerwall. Moreover, in 2021, Tesla signed a supply agreement with Arevon, a leading renewable energy company.

The agreement was for Tesla to supply Arevon with a record quantity of Megapack batteries, totaling 2 GW/6 GWh. These are to be used for multiple new energy storage projects. The most recent joint project between Tesla and Arevon is the Townsite Solar and Storage Facility.

This site is located in Nevada and includes over half a million solar panels. This will provide 360 MWh of Megapacks to help maximize the use of solar energy. The Megapack project will power 60,000 households.

As we touched on, a meme stock is a traded company that is highly influenced by online interest. To offer an example, between October and November 2021, Tesla made history by making the biggest 12-day gains the stock market had ever seen.

Online rumors about a transaction with rental vehicle firm Hertz appears to have been the key catalyst that propelled it above the $1 trillion market valuation. Immediately after, this resulted in a one-day increase of 13% to $1,025 per share. By 2030, Hertz intends to electrify its fleet in collaboration with the EV firm.

Although, as Elon Musk pointed out on Twitter, the acquisition will have little impact on Tesla’s economy because demand continues to outweigh supply.

4. Bed, Bath & Beyond

US-based retail chain Bed, Bath & Beyond was founded in 1971. The omnichannel retailer operates locations throughout the Americas and sells a diverse range of products in a number of significant consumer areas. In 2021, Bed, Bath & Beyond pledged to launch eight new brands and it has succeeded with this goal.

Nestwell was the first of its owned brands to emerge in the year, and this was followed by Our Table, Wild Sage, and Simply Essential. The company’s three-year recovery strategy involves investing in technology, expanding its omnichannel plans, and refurbishing stores.

Bed, Bath & Beyond is one of the popular meme stocks. Amateur investors gathered to identify highly shorted securities they could buy in bulk, and as a result, Bed, Bath & Beyond stock experienced a major boost in 2021.

Within that audience, Bed Bath & Beyond is still one of the most popular meme stocks. For instance, this company’s stock was at $17.80 on the last day of 2020, and by the end of January 2021, it had risen to almost $35 following a meme rally. This is an increase of almost 97%.

Furthermore, it was announced online that activist investor and GameStop chairman Ryan Cohen had bought a 9.8% stake in Bed Bath & Beyond in March 2022. This caused shares to increase again. The stock was trading at $16 at the end of February 2022, and by the close of March, shares were at almost $23 each.

As such, the shares were trading over 43% higher following the news. At the time of writing, Bed, Bath & Beyond is trading just over 79% lower than its all-time high of $79.

5. GameStop

Texas-born video-game retailer GameStop was founded in 1984. GameStop is a one-stop shop for people looking to buy video games, accessories, consoles, and a range of other products. The company has over 4,500 brick-and-mortar stores and also has an online presence.

GameStop stock was listed on the NYSE in 2002. During 2017, and a few years after, shares remained under $25. This is when everything changed for GameStop, as it gained a cult following online and the meme effect shook the stock market. In a nutshell, at the beginning of 2021, GameStop shares were trading at $17.

By the end of the month, following a short-squeeze kick-started by WallStreetBets members, the stock increased by over 1,800% to $325. By early February 2021, shares had plummeted back down to the $50 mark. However, this didn’t last long. In true meme-stock form, another rally began which sent the share price to a high of almost $265 by mid-March.

Sharp price fluctuations like this continued throughout 2021 and the stock never dropped below $150. According to the company’s fourth quarter and fiscal year 2021 results, net sales were at $2.25 billion, up from $2.12 billion in 2020. At the end of March 2021, GameStop revealed its plans to undertake a stock split, in the shape of a stock dividend.

6. Virgin Galactic

Richard Branson’s space flight company Virgin Galactic was founded in 2004. The company’s rocket plane was the first commercial space-liner the world had ever seen. Virgin Galactic’s goal is to make space tourism a huge commercial industry. Whereby it will be as normal to buy tickets to go to space as it is to book a flight to a foreign country.

Only the Space Agency in Russia has successfully completed commercial space trips like this so far. This is something Richard Branson, amongst others such as Elon Musk, is hoping to change. Virgin Galactic became one of the most popular meme stocks in early 2020.

Hoards of Reddit retail traders caused shares to go from just under $12 at the start of January 2020, to almost $44 by the end of February. 2020 was full of ups and downs thanks to some major setbacks for the company. Its flight-test program was facing delays, there was a shakeup in terms of management, and the market value of the company had fallen.

By early 2021, it was trading at around $25. However, after another rally, Virgin Galactic stock increased to over $54 per share. By mid-May 2021, shares had fallen to $16. However, by the end of June 2021, the stock had skyrocketed again to around $56.

This came following the announcement that Virgin Galactic had been granted the much-needed regulatory approvals for commercial space travel and had completed a successful test flight. Virgin Galactic has already sold hundreds of seats for future space trips, with thousands more having paid advance deposits.

While the first space tourists are mostly scientists, celebrities, and other highly affluent people, the long-term aim is for the trips to be cheap enough for your average Joe to afford. According to Virgin Galactic, it plans to launch up to 400 flights each year, tickets cost $450,000 per person and each will carry six passengers and two pilots.

7. Nio

Nio was founded in 2014. The company designs manufacture and sells EVs. Nio is a market leader in China’s premium smart EV industry. It also creates next-generation batteries and digital technologies. The company also develops and markets industry-leading battery switching and battery-as-a-service technology.

Nio is also working on its own self-driving technologies for autonomous vehicles. In terms of stock performance, Nio entered 2020 at under $4 per share. However, following a rally prompted by Reddit stock traders, between October and November 2020, Nio stock skyrocketed to around $54.

This illustrates a return of 1,250%. The rally in 2020 also made Nio the fifth largest car manufacturer by market cap, with a valuation of $75 billion. In January 2021, Nio stock experienced an all-time high of around $62. However, following reports on semi-conductor shortages, by March 2021, Nio shares had pulled back to a little over $38.

Despite the lack of semiconductors, the firm reported a healthy volume of deliveries and revenue growth. The company supplied 91,429 EVs in 2021, an increase of over 100% year over year. Moreover, in early 2022, there was a resurgence of interest in Nio stock on Reddit making it one of the most popular meme stocks again.

In the first quarter of 2022, the EV maker delivered 25,768 vehicles, a new quarterly high. Moreover, cumulative EV deliveries reached almost 192,840 as of the end of March 2022. This EV stock was scheduled to begin delivering its ET7 sedan in March 2022. It successfully did so, and on time despite challenges.

As a result, Nio shares went from $14 to $19 in two days, showing an increase of almost 36%.

8. Nokia

If you’re looking for the most undervalued stocks and cheap meme stocks, Nokia is worth a look. The Finish company was founded in 1865 and although it was a paper mill back then, over the decades the company has shifted through many stages before focussing its attention on telecommunications as early as 1991.

Nokia is a well-known cell phone brand and hasn’t been without its struggles over the years. Nokia stock was flying high from the mid-1990s to the early 2000s. In June 2000, shares reached their highest value to date – around $58. By 2012, Nokia was engulfed by competition from the likes of Android and Apple and the stock fell to an all-time low of around $4.

Fast forward almost a decade to early 2021 and Nokia became one of the popular meme stocks when it experienced a resurgence in investor interest. Yet, after collapsing during the initial round of meme craze, by August 2021 it had gradually risen to above $6 per share.

Nokia entered 2022 at around $6, and after a brief dip to a little under $5 in March, shares had grown to over $5.50. As well as the speculative frenzy in 2021, this increase was attributable to better fundamentals. Nokia was a bit of a disappointment to investors when it came to securing 5G arrangements with telecom firms prior to 2021.

However, in March 2022, Nokia and Chunghwa Telecom entered a two-year deal to work together to improve its 5G network in Taiwan’s central and southern regions. Nokia will deliver equipment from its latest energy-efficient AirScale portfolio to 4,000 additional locations as part of the arrangement, which will enhance capacity and performance.

Nokia is also collaborating with Google Cloud to create new 5G radio technologies. Nokia’s RAN edge cloud technology will combine with Google Cloud’s edge computing platform and applications ecosystem. Furthermore, by the end of 2022, US cellular’s standalone 5G core, supplied by Nokia, should be available.

Nokia has increased its portfolio of affordable 4G and 5G cell phones that run on Android. At the time of writing, Nokia is around 90% lower than its all-time high.

9. Blackberry

Blackberry was founded in 1984. The company is known for its mobile devices which were hugely popular in the 2000s. Blackberry now focuses on selling software systems, and cyber security technology. Unlike some other meme stocks, BlackBerry appears to have more solid business fundamentals.

The firm has evolved from a pioneering mobile device manufacturer to a significant cybersecurity player. Some of Blackberry’s biggest partnerships include IBM, Amazon Web Services, Qlik, and Intel. Despite this, Blackberry became a meme stock in early 2021, courtesy of Reddit.

Blackberry stock ended 2020 at a price of $6.60. After becoming one of the popular meme stocks on the aforementioned platform, Blackberry increased to $14 per share. This illustrates an increase of over 112% in less than a month.

Blackberry started 2022 at over $9 per share. However, after releasing its fourth-quarter results in March, some analysts lowered its price guidance and shares fell. The company reported revenue of $185 million for Q4 2021, which is down 11.9% year-on-year. This was mostly due to supply chain issues.

The company has plenty of notable projects in the pipeline. This includes IVY tech software, which is a collaboration with Amazon’s AWS division and will be used in the sensors in vehicles. Automakers should be able to use the software to cut costs and enhance operations.

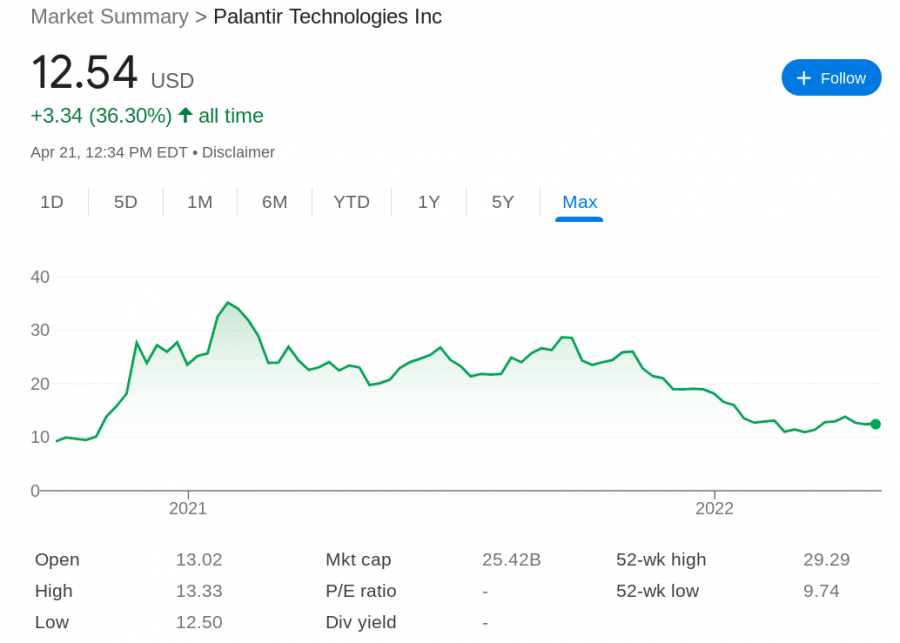

10. Palantir Technologies

Palantir Technologies was founded in 2003 and the firm provides extremely secure data to a range of clients. Its three product divisions are Apollo, Foundry, and Gotham. In 2011 Palantir assisted in the capture of Osama bin Laden. This meme stock investigates criminal, communication, medical, secret service, and financial records.

One of the first outside investors in Palantir was the CIA, and the company is very selective about to who it sells its software to. It began as a corporation dedicated solely to government clients, therefore its products were created with security as a foundation.

This company’s data mining software is also used by over a dozen countries to follow medical supply networks, anticipate breakouts in pandemic hot zones, and track COVID-19 infections. Palantir Technologies became a publically listed company in 2020 and its stock opened at $10.

In 2021, Palantir Technologies became one of the most talked-about meme stocks and as a result, it enjoyed a sudden influx of support from retail investors. Palantir Technologies entered 2021 at $23.50, and the aforementioned meme rally saw shares increase by almost 50%, peaking at an all-time high of around $35.

During the first three months of 2022, Palantir Technologies floated between a high of around $16 and a low of $10. At the time of writing, the stock is down approximately 64% from the all-time high in 2021. However, it has started to pick up momentum again.

For full-year 2021, the company reported revenue growth of 41%, and its US commercial division increased by over 100% year on year. Palantir Technologies expanded its contract with CDC for disease and monitoring response in April 2022. The company also partnered with Carahsoft to increase its reach in the US government market. It has also extended its partnership with Ferrari.

Foundry will allow power unit engineers to analyze data and maximize performance from sources including test bench results and Grand Prix data.

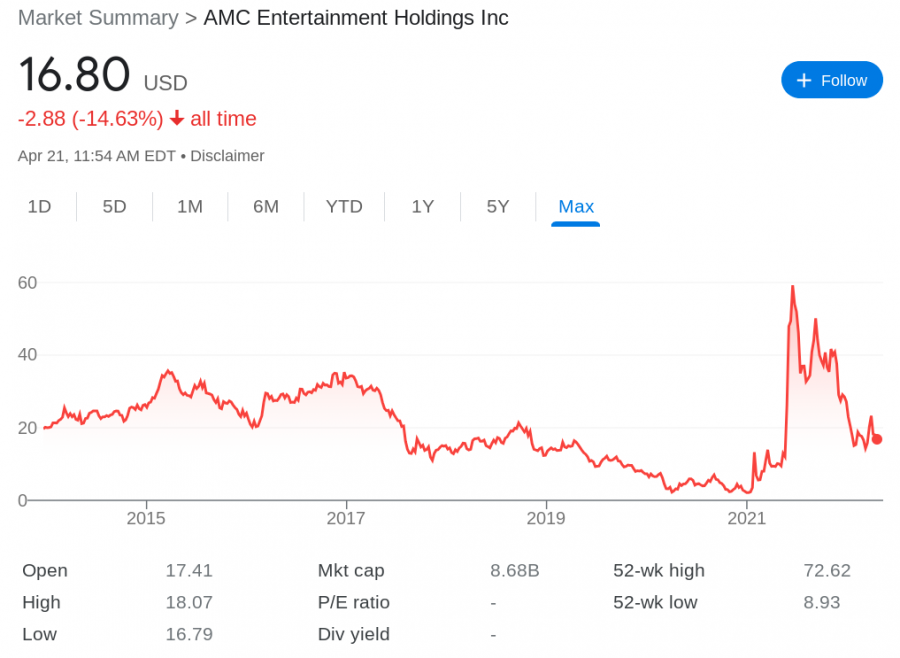

11. AMC Entertainment

AMC Entertainment was founded in 1920. This company is one of the world’s major movie theater companies. It has over 10,000 screens in 950 theaters throughout the world – which should give you an idea of its magnitude.

By offering loyalty and subscription programs and supplying its signature commercial-grade power-recliner chairs, the business has pushed the industry forward over the years. AMC Entertainment’s subsidiaries include Odean, Finnkino, and Carmike Cinemas.

This hundred-year-old theatre company was forced to near bankruptcy in 2020. This came as a result of the COVID-19 pandemic, lockdowns, and the mass closure of movie theatres around the world. However, in mid-2021, independent investors on the WallStreetBets group on Reddit rallied together to buy up AMC Entertainment stock in their droves.

As a result, the stock went from $12 at the end of May to over $59 by mid-June, which remains its all-time high at the time of writing. The company has managed to raise over $2 billion as a result of people rallying to buy shares. This has enabled the company to take the 500 million share dilution it previously announced off the table.

AMC Entertainment also had the best quarter it’s had in the last two years. In mid-March, 2022, AMC announced that it will purchase 22% of Hycroft Mining Holding Corporation. Shares in both companies increased in the days leading up to the announcement. Moreover, AMC Entertainment plans on maximizing gains for shareholders by growing the business further.

The company’s plans includes reducing debt, investing in acquisitions and mergers, and upgrading its theatres. AMC Entertainment will also accept payments using cryptocurrencies. Additionally, the firm also venturing into the world of NFTs and is planning on airdropping benefits such as discounts to holders.

12. Snap

Snap was founded in 2011. This is the parent company of the social and multimedia platform Snapchat. The firm offers a cell phone app and what makes it different from many other platforms is that photos and messages are usually automatically deleted after a few seconds of sending.

Unlike platforms such as Facebook, Snapchat has been praised in the past for making the majority of users feel happy, rather than isolated, or anxious. In terms of its business model, Snapchat makes its revenue from digital advertising, which accounts for up to 99% of its incoming cash flow.

Snap became a publically listed company in 2017 at around $27 and gradually fell throughout the year. From 2018 to late 2020, Snap shares were trading between a low of $5 and a high of $40. In 2021, meme investors took Snap to its all-time high of over $83. At the time of writing, shares are 64% lower than their all-time high.

In early 2022, social media apps like Snap experienced a loss due to Apple’s privacy updates. In a nutshell, it requires social media apps to obtain permission from users for tracking purposes, and also allows people to block this kind of activity entirely. This company recorded revenues of $1.06 billion in the first quarter of 2022.

This fell short of analysts’ expectations of $1.07 billion. That said, Snap has adapted to the aforementioned iOS updates and is also moving into the next phase of modernization via augmented reality.

The company is updating its technology by integrating AR, albeit, this is something that other social media giants are also working on. Moreover, Snapchat’s daily active users increased 18% year over year to 332 million in the first quarter of 2022.

What are Meme Stocks?

Meme stocks are companies that experience sharp increases in their share price following online interest. Meme stocks can be those that are nostalgic brands, firms that have a large online following or a charismatic CEO, or companies that are simply undervalued.

To further explain, let’s offer an example using GameStop, one of the popular meme stocks:

- In 2020, Wall Street veterans saw gaming company GameStop on its knees and began short-selling the stock

- Meanwhile, tens of thousands of individual investors gathered in an online forum on the prominent website Reddit

- These individual retail investors were eager to strike out at the financial markets and fight for the underdog

- Instead of decreasing the price of GameStop stocks, WallStreetBets gathered together to acquire as many shares as they could

- This caused the GameStop share price to rise and forced short-sellers to lose billions of dollars for their failed bet

By the 29th of January 2021, GameStop stock had risen to $325. This beat the stock’s previous all-time high of around $60 years earlier in 2007.

Not only that, but over just ten days the shares increased by more than 1,700%, as a result of these small investors rallying to buy GameStop stock.

Where to Buy Meme Stocks?

After researching the popular companies to focus on from this marketplace, you will need to make a decision on where to buy meme stocks.

To save you some legwork, below you will see a full review of a popular brokerage that lets you purchase meme stocks.

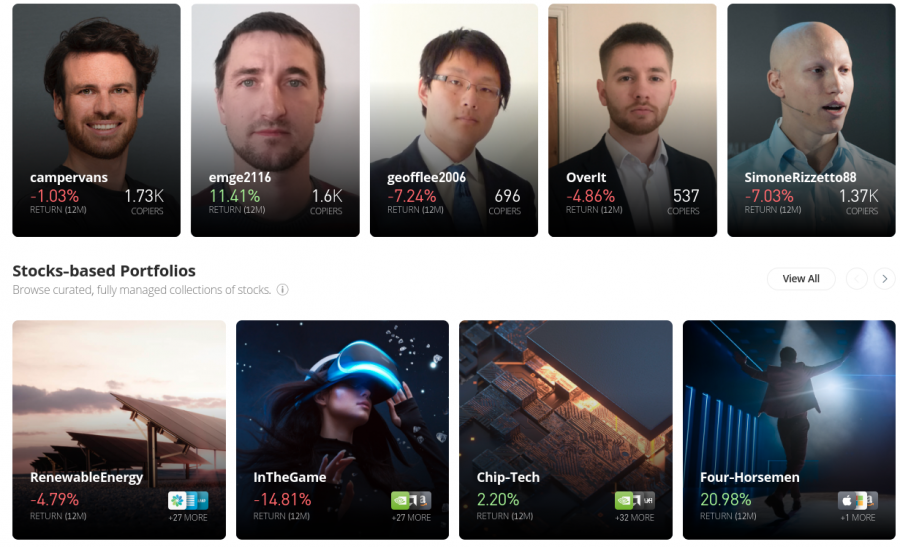

eToro

eToro offers a safe and jargon-free place from which to buy meme stocks. The platform has been approved to operate as a stockbroker in the US. Not to mention holding a license from the FCA, ASIC, and CySEC.

With eToro, users can access over 2,500 shares with 0% commission. This brokerage is also a cost-effective solution for US traders as there is no fee on USD deposits.

There is a range of supported payment types comprising wire transfers, ACH, credit/debit cards, and e-wallets. The latter includes PayPal, Skrill, and Neteller. All of the 10 popular meme stocks we’ve discussed in this guide are available at eToro and you can also access a free mobile app for iOS and Android. This means that you can buy stocks with PayPal on eToro with zero deposit fees.

Not only that, but if you decide to diversify at a later date, US clients can also access meme crypto coins with low commissions. Another way to diversify is to allocate some of your funds to copy trading or smart portfolios.

US investors can allocate $200 to a seasoned investor that is listed in the copy trading area of the platform. Whatever stocks that person chooses to buy or sell will also be copied across to your portfolio – automatically.

Smart portfolios refer to a basket of assets that have been chosen by eToro and will be rebalanced and managed on your behalf. All you have to do is allocate some funds to your chosen portfolio and you will have a ready-made basket of stocks.

Conclusion

When it comes to buying the popular meme stocks, options are vast and include everything from low-cost nostalgic brands and failing businesses to billion-dollar companies with a strong social media presence.

Users interested in meme stocks can conduct their research and begin investing with a suitable broker of their choice. As an alternative to trading the stock markets, our top two picks were new crypto assets, including the newest meme coin.

#stocks #stockmarket #trading #forex #trader #wallstreet #daytrader #forextrader #finance #options #pips #forexsignals #forexlife #investing #forextrading #nyse #invest #investment #forexmarket #profit #daytrading #stocktrading #wealth #nasdaq #technicalanalysis #currency #foreignexchange #billions #investments #investor