Similarity and possible reasons for the increase

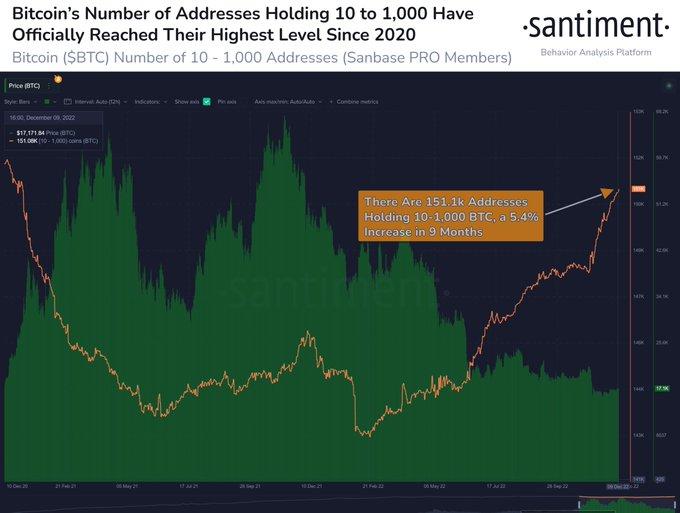

Santiment reported a dramatic surge in the number of Bitcoin addresses holding 10 – 1000 BTC as of 11 December. According to the data, the addresses rose to almost 151,000, a number that was last seen in 2020. The chart also revealed a precipitous decline following 2020’s peak.

The similarities could be explained by taking a closer look at the chart. The most significant factor would be an anticipated increase in the value of Bitcoin. There was a decrease in holdings, which occurred at the same time that the price of BTC increased.

Investors who purchased at a lower price sold their assets when the price rose. This could suggest that the current address increase was a precursor to an anticipated BTC bull run.

Bitcoin in the daily timeframe

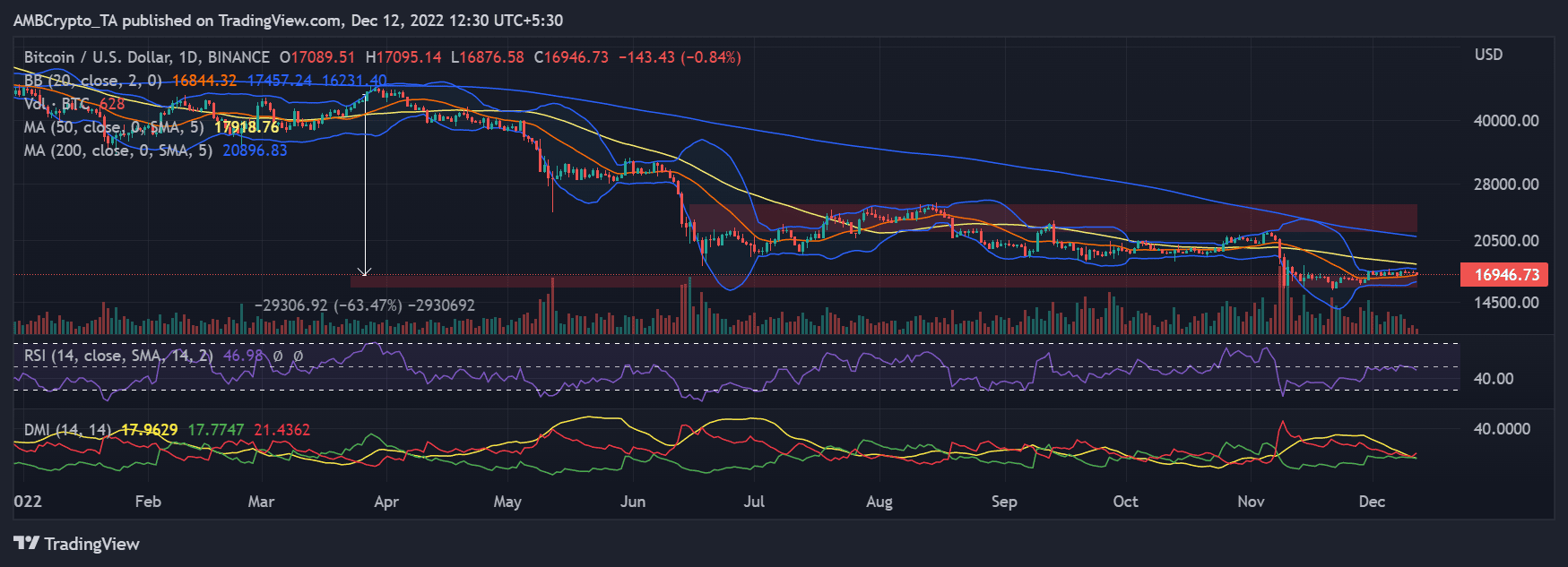

Bitcoin [BTC] was trading at over $45,000 in late March and early April 2022, according to the daily timeframe. It was, however, trading for about $16,900 at the time of writing, pointing to an obvious massive decline. Plotting the price range revealed that the asset had declined by 60% in the time frame.

The short Moving Average (yellow line) on the price chart also served as resistance. With the yellow line in its current location, the initial observed resistance was around $18,000. In the long-term, however, the resistance observed was between $21,000 and $25,000.

While there have been no obvious higher highs in the current price movement, a breach of the current resistance levels could spark a BTC rally. Once the bull run begins, its price could rise to where it was before, around $40,000, and even higher.

Source: TradingView

Additionally, the Bollinger Bands (BB) shrank, indicating less price volatility for BTC. The contraction could, however, also be a sign of impending volatility.

Upcoming events that could impact BTC

These forthcoming events may affect the price of BTC due to the correlation between traditional markets and its price movement in the past. The Consumer Price Index for November will be revealed on 13 December; the next day, the Federal Reserve will announce its current interest rate.

Though it is assumed that the total number of addresses may change, the effects of these occurrences still need to be discovered.