Percentage Allocation Management Module brokers, commonly referred to as PAMM brokers, allow traders to allocate their capital to a designated money manager who will then trade on their behalf. Through this process, traders can fully automate the trading process, generating profits in a hands-off manner.

This guide discusses the best PAMM account forex brokers on the market, reviewing a selection of platforms that allow traders to make profits passively before presenting a quick step-by-step guide showing how to get started with a PAMM forex broker today.

The Best PAMM Account Forex Brokers in 2022

Choosing which forex PAMM account to opt for can be challenging – especially for newcomers to the market. However, the list below highlights the best forex brokers offering this investment service in a safe, low-cost environment.

- AvaTrade – Overall Best Forex Broker for PAMM Accounts

- Pepperstone – One of the Best PAMM Brokers for Experienced Traders

- eToro – Leading FX Platform with Innovative ‘CopyTrader’ Alternative

- Capital.com – Popular Forex Broker Offering Automated Trading Through MT4

- OANDA – Best PAMM Account with Strict Regulation

- BDSwiss – Top Alternative to PAMM Accounts with 17,000 Partner Traders

- BlackBull Markets – Widely-Used FX Broker with ECN Account

- FxPro – Respected Forex Broker Offering MAM Account for Professionals

- FP Markets – Dedicated PAMM/MAM Accounts with ECN Trading

- RoboForex – Popular PAMM Account with Low Minimum Investment

71% of retail investor accounts lose money when trading CFDs with this provider.

Best PAMM Account Forex Trading Platforms Reviewed

Both beginners and experienced traders can benefit from PAMM accounts, as they provide access to a fund manager’s experience and trading knowledge. Furthermore, the entire process is passive, meaning traders avoid having to monitor the markets or conduct preliminary analysis – thereby freeing up lots of time each day.

With that in mind, let’s take a closer look at the best forex PAMM brokers listed above, covering how they work and what they can offer clients:

1. AvaTrade – Overall Best Forex Broker for PAMM Accounts

Topping our list of the best PAMM account forex brokers is AvaTrade. For those unaware, AvaTrade is one of the world’s leading CFD trading platforms, allowing clients to trade equities, currencies, ETFs, commodities, and more. Since the Central Bank of Ireland heavily regulates AvaTrade, clients also benefit from high safety and credibility.

Topping our list of the best PAMM account forex brokers is AvaTrade. For those unaware, AvaTrade is one of the world’s leading CFD trading platforms, allowing clients to trade equities, currencies, ETFs, commodities, and more. Since the Central Bank of Ireland heavily regulates AvaTrade, clients also benefit from high safety and credibility.

Although AvaTrade isn’t directly a PAMM forex broker, clients can automate their trading through a similar process. This process uses AvaTrade’s partnership with ZuluTrade – one of the best copy trading platforms globally.

Since AvaTrade offers full support for MT4, clients can link ZuluTrade and AvaTrade together, creating a similar service to PAMM account brokers. This means clients can follow and copy experienced traders ranked based on performance. These traders can be invested in from as little as $200, making it easy for beginners to get started.

Clients can also benefit from AvaTrade’s appealing fee structure, which charges no commissions when a trade is placed. Moreover, spreads remain tight across the board, averaging less than one pip for EUR/USD. Deposits are also easy to complete with AvaTrade, as users can fund their accounts using a credit/debit card, bank transfer, or e-wallet (e.g. PayPal).

AvaTrade is also one of the best trading platforms for beginners, offering a free demo account to new users. Finally, since there are over 50 FX pairs to trade with AvaTrade, automating the process through ZuluTrade can provide an abundance of opportunities each day.

What we like:

- 0% commissions on FX trades

- Regulated by the Central Bank of Ireland

- PAMM-like service through ZuluTrade

- Minimum investment is only $200

- Over 50 FX pairs to trade

71% of retail investor accounts lose money when trading CFDs with this provider.

2. Pepperstone – One of the Best PAMM Brokers for Experienced Traders

Another of the best forex PAMM accounts to consider is Pepperstone. Pepperstone is a world-renowned CFD broker regulated by top-tier entities such as the FCA, ASIC, and BaFin. Established in 2010, Pepperstone has grown exponentially in the past decade and offers more than 60 forex pairs to trade.

Another of the best forex PAMM accounts to consider is Pepperstone. Pepperstone is a world-renowned CFD broker regulated by top-tier entities such as the FCA, ASIC, and BaFin. Established in 2010, Pepperstone has grown exponentially in the past decade and offers more than 60 forex pairs to trade.

Pepperstone offers fully-fledged PAMM accounts, yet these are only for fund managers – not retail traders. However, traders can reap the same benefits through Pepperstone’s partnership with DupliTrade, a leading social trading marketplace.

A minimum deposit of $5,000 is required to use DupliTrade, which integrates with Pepperstone and MT4 to enable a passive experience for clients. Much like PAMM accounts, clients can choose which trader they’d like to ‘invest in’, at which point the trades will be placed automatically – no need to monitor the market or conduct analysis.

Those wondering how to invest $1,000 in FX will find this process highly streamlined, especially since Pepperstone’s fees are so appealing. No commissions are charged on the Standard account, with spreads for EUR/USD averaging just 0.77 pips each day. Pepperstone also offers leverage of up to 30:1 to boost potential profits.

The account opening process with Pepperstone is quick and easy, with a ‘Razor’ account offered for those looking to benefit from ECN spreads. Finally, Pepperstone even enables free deposits and withdrawals for all traders, accepting credit/debit cards, bank transfers, and e-wallets – including PayPal.

What we like:

- Accepts PayPal deposits

- Wide range of traders/strategies to invest in

- No commissions on the Standard account

- Regulated in several jurisdictions worldwide

74% of retail investor accounts lose money when trading CFDs with this provider.

3. eToro – Leading FX Platform with Innovative ‘CopyTrader’ Alternative

Those looking to benefit from the services offered by forex PAMM brokers may wish to consider eToro. eToro is one of the largest trading platforms in the world, serving over 28 million clients. As a CFD broker, eToro enables users to trade various assets – including over 45 currency pairs.

Those looking to benefit from the services offered by forex PAMM brokers may wish to consider eToro. eToro is one of the largest trading platforms in the world, serving over 28 million clients. As a CFD broker, eToro enables users to trade various assets – including over 45 currency pairs.

Although eToro doesn’t directly offer one of the best PAMM accounts, users can receive similar benefits by utilizing the ‘CopyTrader’ feature. This feature is native to the eToro platform and allows users to copy the trades placed by top-performing investors without additional fees.

Each investor’s profile is available to the public, allowing users to view their historical performance, trading stats, and risk score. The minimum amount required to copy a trader is $200, although the minimum for each copied position is just $1, making this feature accessible to all.

Many of the available investors provide exposure to the best pairs to trade in forex in real-time, much like a PAMM account would. Moreover, eToro’s CopyTrader feature also uses social trading aspects since there’s a Twitter-style newsfeed where users can share opinions and engage in trading-related discussions.

eToro’s fee structure is also appealing, as no commissions are charged, and spreads are as low as one pip for EUR/USD. Finally, since eToro is directly regulated by the likes of the FCA, ASIC, CySEC, FinCEN, and FINRA, users are provided with a high level of investor protection worldwide.

What we like:

- Innovative CopyTrader feature is an alternative to PAMM accounts

- No additional fees to copy trades

- Regulated by the FCA, ASIC, CySEC, FinCEN, and FINRA

- Minimum to begin using CopyTrader is just $200

78% of retail investor accounts lose money when trading CFDs with this provider.

4. Capital.com – Popular Forex Broker Offering Automated Trading Through MT4

Capital.com is a leading CFD broker that offers a PAMM-like service. Through Capital.com, clients can automate the trading process by ‘investing’ in traders via MT4. All that’s required is for users to create a Capital.com account, download the MT4 application, and link the two together.

Although this process may differ slightly from the best PAMM brokers, the outcome is very similar. Many of the best forex signals providers work with Capital.com through MT4 – with clients able to facilitate trades with no commissions. Furthermore, since Capital.com offers up to 30:1 leverage, there’s scope to boost potential winnings.

The minimum deposit at Capital.com is just $20, which can be made via credit/debit card, bank transfer, PayPal, or Apple Pay. Opening a Capital.com account is easy, as no paperwork is required, and clients tend to be accepted in just one business day. Capital.com offers the best micro forex accounts. You can open a micro forex trading account in a matter of minutes with Capital.com.

Finally, Capital.com also provides an array of guides, videos, and webinars to make the trading process easier for beginners.

What we like:

- Full support for trading through MT4

- Massive library of educational resources

- Regulated by the FCA, ASIC, CySEC, and the FSA

- 0% commission fee structure

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

5. OANDA – Best PAMM Account with Strict Regulation

OANDA is a US-based forex broker with more than 25 years of industry experience. By partnering with OANDA, clients can begin API trading, which allows them to connect their accounts to an external platform. Through this process, clients can automate the trading process by providing their capital to money managers.

OANDA is a US-based forex broker with more than 25 years of industry experience. By partnering with OANDA, clients can begin API trading, which allows them to connect their accounts to an external platform. Through this process, clients can automate the trading process by providing their capital to money managers.

This makes OANDA the best PAMM forex broker for simplicity, which is bolstered further since there is no minimum deposit threshold, and users can benefit from a commission-free trading structure. Moreover, OANDA offers trade sizes below micro lots, which is ideal for beginners.

Full MT4 support is provided by OANDA, with customer service available 24/5 to answer any queries. The platform is regulated by the CTFC, NFA, and FCA, providing a high degree of safety. Finally, since there are more than 65 FX pairs to trade (including minors and exotics), clients will always find abundant opportunities in the market.

What we like:

- Regulated by several leading entities

- Offers API trading to enable investment in money managers

- No minimum deposit to open an account

6. BDSwiss – Top Alternative to PAMM Accounts with 17,000 Partner Traders

Many PAMM account reviews mention BDSwiss as one of the best options on the market. BDSwiss offers a ‘Broker Programme’ whereby money managers can introduce their clients to the platform. However, BDSwiss also provides a copy trading feature (similar to eToro) that mimics a PAMM account.

There are over 17,000 traders to copy, with more than €7 million paid out each month. All of a lead trader’s statistics are easily viewable, with clients able to begin and stop copying at any time. Although forex is the most popular asset class, clients can also copy positions related to stocks, indices, and commodities.

The minimum deposit to begin using BDSwiss is just $100, with full support for MT4 and MT5. BDSwiss itself was established back in 2012 and is regulated by the FSC and the FSA – ensuring the platform has a solid reputation regarding safety.

What we like:

- Up to 500:1 leverage

- Over 17,000 traders to copy

- Regulated by the FSA and FSC

7. BlackBull Markets – Widely-Used FX Broker with ECN Account

BlackBull Markets is one of the best MT4 brokers in operation, offering over 70 FX pairs to trade. Users flock to BlackBull Markets due to its ‘ECN Prime’ account, which charges a $3 commission per lot, yet offers spreads that average just 0.2 pips for EUR/USD.

BlackBull Markets is one of the best MT4 brokers in operation, offering over 70 FX pairs to trade. Users flock to BlackBull Markets due to its ‘ECN Prime’ account, which charges a $3 commission per lot, yet offers spreads that average just 0.2 pips for EUR/USD.

BlackBull Markets offers a similar service to the best forex PAMM accounts through ZuluTrade and Myfxbook. Clients can ‘invest’ in traders through these third-party services and automatically copy their trades. However, BlackBull also offers a ‘lead and follow’ service, which operates similar to a PAMM platform, yet requires an institutional account to use.

Clients can trade using MT4, MT5, or even directly through TradingView – offering an option for those who wish to be more actively involved. Finally, BlackBull Markets can even be considered one of the best Islamic brokers since it offers a trading account that complies with Sharia law.

What we like:

- ECN account offered

- Leverage extends up to 500:1

- Integrates with TradingView

8. FxPro – Respected Forex Broker Offering MAM Account for Professionals

FxPro is one of the best high-leverage brokers on the market, offering up to 500:1 leverage on certain assets. Although the minimum deposit at FxPro is slightly higher, set at $100, users can trade via MT4, MT5, or even cTrader.

FxPro has a dedicated service that allows experienced traders to become money managers for PAMM and MAM accounts. However, retail traders can still invest in experienced pros through the MT4 integration, benefitting from FxPro’s zero-commission offering.

There are no deposit, withdrawal, or account fees with FxPro, whilst users can complete the account opening process in minutes. In addition, eight base currencies are supported, and users can fund their accounts using various methods, including PayPal, Skrill, Neteller, UnionPay, and more.

What we like:

- Supports eight base currencies

- Accepts PayPal, Skrill, and Neteller deposits

- Can trade via cTrader

9. FP Markets – Dedicated PAMM/MAM Accounts with ECN Trading

FP Markets offers dedicated PAMM and MAM accounts which lets clients enable a portfolio manager to access their capital. This process is facilitated through MT4 and MT5, offering deep liquidity through ECN trading. This also ensures traders avoid slippage in most instances.

FP Markets offers dedicated PAMM and MAM accounts which lets clients enable a portfolio manager to access their capital. This process is facilitated through MT4 and MT5, offering deep liquidity through ECN trading. This also ensures traders avoid slippage in most instances.

The great thing about FP Markets is that there are various options for clients to choose from since money managers can customize their commissions, currencies, performance fees, and more. Clients can also withdraw their funds anytime and use real-time performance reports.

FP Markets is also one of the best ASIC-regulated forex brokers and has more than 16 years of industry experience. What’s more, FP Markets even provides a free demo account and a selection of e-books and tutorial videos that streamline the learning process for beginners.

What we like:

- Offers dedicated PAMM/MAM accounts

- Tight spreads through ECN trading

- Can withdraw funds from the account at any time

10. RoboForex – Popular PAMM Account with Low Minimum Investment

Concluding our list of the best PAMM account forex brokers is RoboForex. As the name implies, RoboForex is an online FX broker that focuses on trade automation – specifically by allowing clients to invest in other traders, much like a PAMM account.

The minimum investment in other traders is just $100, with thousands of community members to consider. RoboForex showcases each trader’s profitability, max drawdown, and the number of days trading, making it simple to choose a trader that suits each client’s needs.

RoboForex is also regulated by the FSC and offers negative balance protection whilst providing 20 different ways for users to fund their accounts. Although deposits are free to make, there is a commission of between $10 to $15 per trade, depending on volume.

What we like:

- Abundance of traders to invest in

- Leverage extends up to 2000:1

- Supports cTrader

Top PAMM Account Forex Trading Platforms Compared

Once a trader has researched what is PAMM account in forex, it’s time to begin trading. To help streamline the broker decision-making process, the table below compares the platforms reviewed earlier in terms of account types, minimum deposit thresholds, and leverage amounts:

How We Select the Best PAMM Account Forex Brokers

Like choosing between the best forex trading apps, deciding which PAMM account broker to partner with can be challenging. To make the process easier, below are some of the most important factors to keep in mind when choosing a platform:

Regulation & Safety

Regulation is one of the most critical elements to consider when choosing a PAMM broker. Since clients will be providing access to their trading capital, partnering with a broker strictly regulated by top-tier entities is vital.

Regulation is one of the most critical elements to consider when choosing a PAMM broker. Since clients will be providing access to their trading capital, partnering with a broker strictly regulated by top-tier entities is vital.

An example of this is AvaTrade, which is regulated by ASIC, MiFID, CySEC, and the Central Bank of Ireland. Due to the high-profile nature of these institutions, AvaTrade’s clients can trade confidently, knowing they are protected from scams.

Range of Forex Pairs

Forex is a popular recommendation for how to invest according to Reddit – yet it’s essential to choose a PAMM broker that provides a range of FX pairs to trade. Although all FX brokers will offer the majors, many will provide minors and exotics.

By partnering with a broker like AvaTrade that offers a vast asset selection, it ensures a steady stream of market opportunities which can enhance profitability.

Fees

Naturally, the fees associated with opening a position will directly affect a trader’s profitability. Most of the PAMM brokers on our list offer commission-free trading and include their ‘cut’ in the bid/ask spread – which varies depending on market conditions.

However, non-trading fees must also be considered. These include deposit, withdrawal, inactivity, and monthly account fees – all of which can add up behind the scenes.

| Platform | Monthly Account Fees? |

| AvaTrade | No |

| Pepperstone | No |

| eToro | No |

| Capital.com | No |

| OANDA | No |

| BDSwiss | No |

| BlackBull Markets | No |

| FxPro | No ($30 per month for VPS) |

| FP Markets | No |

| RoboForex | No |

Tools & Analysis

The best PAMM brokers will offer MT4/MT5 support since these platforms are the gold standard within the industry. By using these platforms, traders can link their accounts to third-party traders through their chosen broker or another company.

It’s also a good idea to use a broker that offers technical indicators, real-time price charts, and portfolio reports, as these can provide a way to contextualize the decisions made by the money manager.

Minimum Deposit

The best investment apps with PAMM accounts will provide a low minimum deposit threshold, making them accessible to beginners. A prime example of this is AvaTrade, which offers ZuluTrade integration from just $200.

Demo Account

Although there’s no way to practice PAMM trading without actually providing capital, many brokers will offer a free demo account feature. This feature mirrors the live trading experience and enables beginners to get a feel for how trades are placed.

Mobile App

Brokers like AvaTrade and eToro offer mobile apps which allow traders to monitor their positions whilst on the go. What’s more, AvaTrade even integrates with MT4, meaning traders can download the MT4 app to their smartphone or tablet and keep tabs on the markets that way.

Payment Methods

The top low-spread forex brokers that offer PAMM accounts will support a range of payment methods to make it easy for clients to fund their accounts. Keep an eye out for those that accept credit/debit cards, PayPal, Skrill, or Neteller, as deposits using these methods tend to arrive instantly.

Customer Service

Since trusting another person with trading capital can be challenging, it’s wise to partner with a broker that has a dedicated customer service team. Look for brokers with telephone or live chat support, as these approaches offer quick and tailored help.

How to Start Trading PAMM Account Forex with a Regulated Broker

Before concluding our discussion of the best PAMM account forex brokers, it’s crucial to provide an overview of the investment process. As noted earlier, AvaTrade is our go-to for these accounts, as users can trade commission-free whilst also benefitting from strict regulation by top-tier organizations.

With that in mind, the six steps below showcase how to set up an AvaTrade account and invest in a top-performing trader today.

Step 1 – Open an AvaTrade Account

Head over to AvaTrade’s website and click ‘Register Now’. On the page that appears, provide a valid email address and choose a password for the account.

71% of retail investor accounts lose money when trading CFDs with this provider.

Step 2 – Complete Verification

Click ‘Upload Documents’ on AvaTrade’s dashboard and provide proof of ID (e.g. passport) and proof of address (e.g. bank statement). AvaTrade will review these documents and send an email when everything is complete.

Step 3 – Make a Deposit

Click ‘Deposit’ on AvaTrade’s dashboard and then click ‘Fund your account’. The minimum deposit with AvaTrade is only $100; however, users must deposit $200 to begin investing in traders through ZuluTrade. In terms of payment methods, AvaTrade accepts the following:

- Credit card

- Debit card

- Wire transfer

- Neteller

- Skrill

- WebMoney

Step 4 – Download MT4

Head to the MetaTrader 4 page of AvaTrade’s website and choose the relevant operating system. AvaTrade offers the MT4 client on PCs and smartphones, although users can also trade directly from their browser.

Once MT4 has been downloaded, click ‘File > Open an Account’ and search for AvaTrade’s server. Following this, click ‘Existing trade account’ and enter the login credentials made in Step 1.

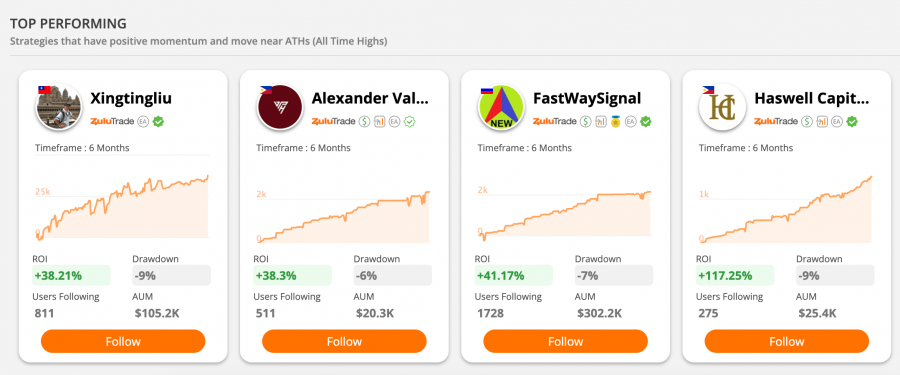

Step 5 – Open a ZuluTrade Account & Link to AvaTrade

Go to ZuluTrade’s website, opt to ‘Open a Live Account’, then follow the on-screen instructions to create an account and link it to AvaTrade.

Step 6 – Begin Trading

After ZuluTrade and AvaTrade have been linked, clients can browse the broad selection of traders to invest in. Once a trader has been found, click ‘Follow’ to begin mirroring the placed trades automatically.

Best PAMM Account Forex Brokers – Conclusion

The best PAMM account forex brokers allow clients to invest their capital in top-performing traders, providing a way to benefit from their skills and market experience. Although nothing is certain in the FX market, partnering with a PAMM broker can streamline the trading process and boost results.

AvaTrade is our recommended option since clients can invest in experienced traders through integration with ZuluTrade. Moreover, no commissions are charged when using this service, and clients can begin with just $200.

Those looking for an alternative may also wish to consider eToro. Although eToro doesn’t have a dedicated PAMM account, it does provide a CopyTrader feature that offers a similar service. No additional fees are charged to use CopyTrader, and clients can invest in leading traders from only $200.

#forextrader #trading #forextrading #money #forexsignals #cryptocurrency #trader #investment #crypto #forexlifestyle #investing #business #entrepreneur #invest #binaryoptions #blockchain #forexmarket #forexlife #stocks #success #daytrader #btc #bitcoinmining #investor #stockmarket #binary #fx #finance