The forex market remains the largest financial market in the world, regularly facilitating more than $6 trillion in daily trading volume. Due to the high level of liquidity with forex, traders worldwide can easily speculate on price movements by partnering with a well-respected and regulated broker.

This guide will discuss the best low spread forex brokers available to partner with, reviewing which platforms have the most attractive fee structure before touching on what spreads actually are and how low spreads can be beneficial over the longer term.

The Best Low Spread Forex Brokers for 2022

Listed below are several low spread forex brokers, each offering a cost-effective way to place FX trades. We’ll review these cheap forex brokers in the following section, discussing their asset selection, features, and fee structure.

- Capital.com – Overall Best Low Spread Forex Broker

- eToro – Top FX Trading Platform with Innovative ‘CopyTrader’ Feature

- XTB – Low Spreads from 0.1 Pips

- Libertex – Cheapest Forex Broker with Zero Spreads

- AvaTrade – Leading CFD Platform with MT4/MT5 Support

- Interactive Brokers – One of the Best Low Spread Brokers for Experienced Traders

- TD Ameritrade – Great Forex Broker Featuring Excellent Trading Platform

- Skilling – Cheap Forex Broker with Support for cTrader and MT4

- CMC Markets – One of the Best Cheap Forex Brokers with Huge Asset Selection

- Forex.com – Industry-Leading Broker with STP Account

- E*TRADE – Best Low Spread Platform to Trade Currency Futures

Lowest Spread Forex Brokers Reviewed

Low spread forex brokers are ideal for active traders, as fees can rack up quickly when placing multiple trades per day. Fortunately, there is an abundance of low spread brokers to choose from, each offering a slightly different fee structure and feature set. With that in mind, let’s dive in and explore the platforms listed in the previous section:

1. Capital.com – Overall Best Low Spread Forex Broker

Our number one pick when it comes to the cheapest forex brokers is Capital.com. This best high leverage broker is a popular CFD trading platform that boasts low fees and a wide range of tradeable assets. The platform itself is regulated by several leading bodies, such as the FCA, ASIC, CySEC, and MiFID.

Our number one pick when it comes to the cheapest forex brokers is Capital.com. This best high leverage broker is a popular CFD trading platform that boasts low fees and a wide range of tradeable assets. The platform itself is regulated by several leading bodies, such as the FCA, ASIC, CySEC, and MiFID.

Capital.com offers 138 currency pairs to trade, which includes some of the most volatile forex pairs on the market, making it easy to find trading opportunities every day. These pairs are traded via CFDs, meaning that all of Capital.com’s fees are built into the spread. Fees for FX trading are relatively low, averaging at just 0.6 pips for EUR/USD during peak trading hours. With such competitive spreads, Capital.com has gained a reputation among investors as one of the best scalping brokers on the market.

Aside from trading fees, Capital.com doesn’t levy any non-trading fees – meaning that deposits and withdrawals are free to make. The minimum deposit threshold is only $20, with users able to fund their accounts via credit/debit card, bank transfer, Apple Pay, or PayPal.

Capital.com’s trading process is also streamlined, as users can trade on the web portal, MT4, or the proprietary mobile app – one of the best investment apps on the market. Numerous order types are offered to users, including the rare ‘trailing stop’ order, which can be helpful in the FX market. Capital.com even enables price alerts to be set and provides a vast array of educational content for beginners.

What we like:

- 0% commission when opening an FX trade

- Numerous order types to choose from

- Full support for MT4

- One of the best ASIC regulated forex brokers with tight spreads

- Over 130 currency pairs to trade

- Deposits accepted via Apple Pay and PayPal

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

2. eToro – Top FX Trading Platform with Innovative ‘CopyTrader’ Feature

Another great option when it comes to the cheapest forex brokers is eToro. eToro has a stellar reputation within the trading scene, serving over 26 million clients in countries across the globe. In terms of regulation, eToro is policed by several leading organizations, including FinCEN, FINRA, CySEC, ASIC, and the FCA.

Another great option when it comes to the cheapest forex brokers is eToro. eToro has a stellar reputation within the trading scene, serving over 26 million clients in countries across the globe. In terms of regulation, eToro is policed by several leading organizations, including FinCEN, FINRA, CySEC, ASIC, and the FCA.

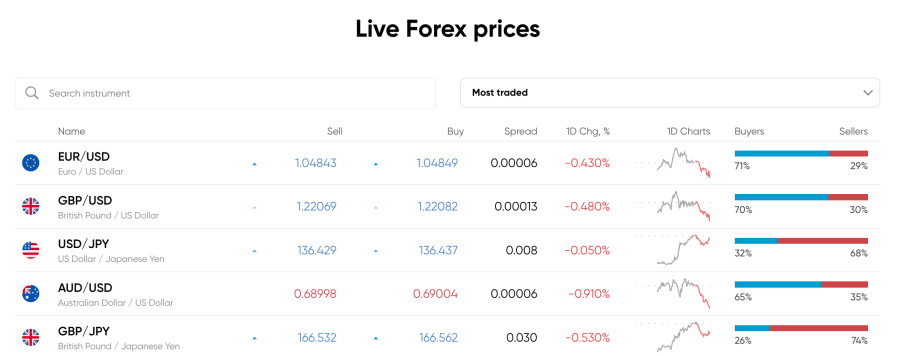

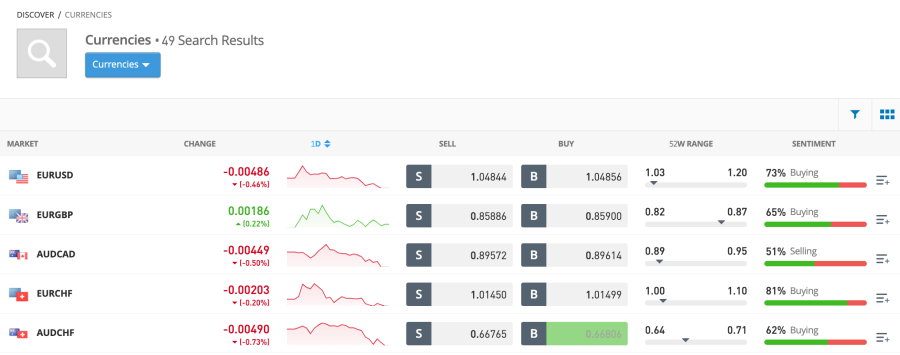

eToro currently offers 49 currency pairs to trade, including majors, minors, and a selection of exotics. All of eToro’s FX pairs are available to trade via CFDs, meaning that users do not have to pay any commissions when opening or closing a trade. Instead, eToro’s fees are built into the bid/ask spread – starting from just one pip for liquid pairs like EUR/USD and USD/JPY.

Furthermore, eToro also offers up to 30:1 leverage for retail traders trading the majors, allowing positions to be magnified by up to 30x. Leverage on minors and exotics is capped at 20:1, with the minimum trade size being only $10. These characteristics make eToro one of the best forex brokers for beginner traders.

Regarding deposits, eToro accepts credit/debit cards, bank transfers, and e-wallets – including PayPal, Skrill, and Neteller. The minimum deposit threshold is also only $10 and arrives immediately when funding via card or e-wallet. Notably, eToro’s base currency is USD, meaning that US-based traders do not have to pay any deposit fees when funding their accounts.

This Best Swap-Free Account Broker also boasts a selection of valuable features, including its popular ‘CopyTrader’ feature. This allows users to automatically copy the trades placed by other eToro users – with no additional fees. Much like the best forex signals, this feature helps to automate the trading process and is ideal for newcomers looking to make positive returns whilst still learning the market.

What we like:

- Wide selection of majors, minors, and exotics to trade

- Popular ‘CopyTrader’ feature makes it one of the best forex copy trading platforms

- Spreads start from only one pip

- Minimum trade size is only $10

- Heavily regulated in numerous jurisdictions

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

3. XTB – Low Spreads from 0.1 Pips

XTB is a well known forex broker as well as supporting indices, commodities, cryptocurrency, stock CFDs and ETF CFDs. Their forex trading spreads are low – from around 0.1 pips depending on the instrument.

Traders can learn to trade forex with XTB’s educational courses aimed at beginner and intermediate traders, as well as keep up to date with the forex markets and all the latest FX news in their Market Analysis section.

XTB have dozens of positive ratings and five star reviews on TrustPilot for both their low spreads and the general usability of the platform with its range of features on offer. Micro-lot trading is also available.

XTB also implement industry-leading security protocols, and have built up a good reputation online for their safety, winning multiple awards from online forex review and comparison sites.

What we like:

- Safety & Security Prioritized

- Fast Deposits & Withdrawals

- Micro-lot Trading Available

Your capital is at risk. 81% of retail investor accounts lose money when trading CFDs with this provider.

4. Libertex – Cheapest Forex Broker with Zero Spreads

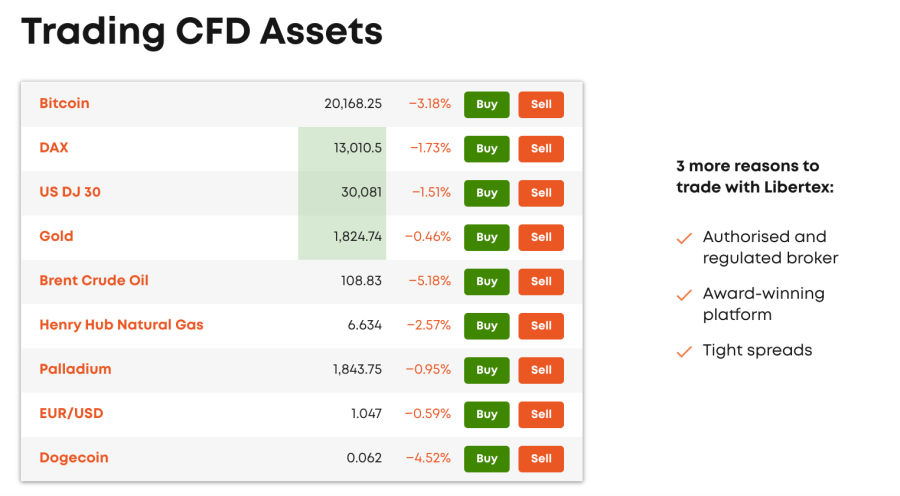

Investors looking for the lowest spread forex broker should look no further than Libertex. This is because Libertex occupies a unique position in the market because the platform charges no spreads on FX trades and is also considered to be one of the best MT5 brokers. Instead, Libertex charges a commission when trades are placed, which varies depending on the asset.

Investors looking for the lowest spread forex broker should look no further than Libertex. This is because Libertex occupies a unique position in the market because the platform charges no spreads on FX trades and is also considered to be one of the best MT5 brokers. Instead, Libertex charges a commission when trades are placed, which varies depending on the asset.

However, specific pairs do not come with a commission, such as EUR/USD and GBP/USD. Other pairs will be accompanied by a small commission of around 0.0003%, calculated using a multiplier when the position is opened. Aside from these commissions, Libertex does not charge any monthly account fees or deposit fees.

The maximum leverage for retail traders on major pairs is 30:1, although this drops to 20:1 for minors and exotics. Libertex offers over 50 pairs to trade at the time of writing, although users can also invest in stocks and ETFs and buy cryptocurrency.

Libertex is regulated by CySEC, which is only of the world’s leading regulatory bodies. Regarding the trading experience, Libertex offers full support for MT4 and MT5, along with the ability to trade on a browser-based platform or the forex trading app. Finally, Libertex also provides a free demo account feature, complete with €50,000 in virtual money.

What we like:

- Zero spread fee structure

- Full support for MT4 and MT5

- Offers a free demo account facility

Your capital is at risk. 70.8% of retail investor accounts lose money when trading CFDs with this provider.

5. AvaTrade – Leading CFD Platform with MT4/MT5 Support

One of the best low spread forex brokers to consider when it comes to strict regulation is AvaTrade. AvaTrade is a CFD trading platform that offers 55 currency pairs to trade, with leverage that extends up to 30:1. Regarding oversight, AvaTrade is policed by the Central Bank of Ireland, ASIC, FSA, and FSCA – offering a high degree of investor protection.

One of the best low spread forex brokers to consider when it comes to strict regulation is AvaTrade. AvaTrade is a CFD trading platform that offers 55 currency pairs to trade, with leverage that extends up to 30:1. Regarding oversight, AvaTrade is policed by the Central Bank of Ireland, ASIC, FSA, and FSCA – offering a high degree of investor protection.

As AvaTrade’s currency pairs are traded via CFDs, no commissions are levied when a trade is opened. Although AvaTrade isn’t the lowest spread forex broker on our list, since spreads start from 0.9 pips for highly-liquid pairs, the platform does offer numerous other trading instruments.

AvaTrade also offers a PAMM forex trading account which enables users to allocate fractions of their investing capital to a professional money manager who then invests those funds on behalf of the user.

These include ‘vanilla options’ for FX pairs, which are ideal for experienced traders. AvaTrade also offers full support for MT4 and MT5, along with a free demo account feature. Finally, AvaTrade’s minimum deposit threshold is set at $100, which can be made via credit/debit card, wire transfer, Skrill, or Neteller.

What we like:

- Supports MT4 and MT5

- Offers a selection of vanilla options

- Heavily regulated throughout the world

6. Interactive Brokers – One of the Best Low Spread Brokers for Experienced Traders

Another of the best trading platforms offering low FX spreads is Interactive Brokers. Interactive Brokers is a US-based platform regulated by several leading bodies, such as the SEC and the FCA. Users can trade 105 different currency pairs, meaning this platform has one of the largest selections on our list.

Another of the best trading platforms offering low FX spreads is Interactive Brokers. Interactive Brokers is a US-based platform regulated by several leading bodies, such as the SEC and the FCA. Users can trade 105 different currency pairs, meaning this platform has one of the largest selections on our list.

In terms of fees, Interactive Brokers charges a commission based on each user’s monthly trading volume. For volumes less than $1,000,000, a 0.20 basis point (BPS) commission is levied, with a minimum charge of $2. Aside from this, Interactive Brokers does not charge any additional hidden fees to place FX trades.

Interactive Brokers has no minimum deposit threshold, and the platform supports 23 base currencies. US-based traders can fund their accounts via ACH transfer, check, or online bill payment – although credit/debit cards are not currently supported. Finally, each user’s first monthly withdrawal is free of charge, although subsequent withdrawals will have a fee depending on the payment method.

What we like:

- No minimum deposit threshold

- Over 100 currencies to trade

- Regulated by the SEC

7. TD Ameritrade – Great Forex Broker Featuring Excellent Trading Platform

TD Ameritrade is one of the cheapest forex brokers for US-based traders since no commissions are charged when a trade is opened or closed. This is the case for all 70 trading pairs that TD Ameritrade offers – which includes exotics like ZAR/JPY and NOK/SEK.

All of TD Ameritrade’s fees are built into the spread, which varies depending on the pair but remains competitive with the other platforms on this list. The account opening process is fully digital and requires no minimum deposit, although users looking to trade with margin will need to fund their account with at least $2,000.

One of TD Ameritrade’s most appealing features is its ‘thinkorswim’ platform, which is considered the best in the industry. This platform offers real-time data, hundreds of technical indicators, backtesting features, and more. Users can also trade on TD Ameritrade’s mobile app, which can easily sync with the thinkorswim platform.

What we like:

- Industry-leading thinkorswim platform

- No commissions when placing trades

- Offers a selection of exotics

8. Skilling – Cheap Forex Broker with Support for cTrader and MT4

Another of the best forex brokers with low spread to consider is Skilling. Skilling is a relatively new trading platform that offers a wide range of asset classes, including over 70 currency pairs. As a CFD broker, Skilling’s fees are built into the spread – which can be as low as 0.3 pips for EUR/USD.

Another of the best forex brokers with low spread to consider is Skilling. Skilling is a relatively new trading platform that offers a wide range of asset classes, including over 70 currency pairs. As a CFD broker, Skilling’s fees are built into the spread – which can be as low as 0.3 pips for EUR/USD.

Skilling also makes trading extremely easy, as users can trade on ‘Skilling Trader’, cTrader, or MT4. The latter two are best suited for experienced traders, allowing for automated trading and advanced risk management functionality.

Users can choose the Standard, Premium, MT4 or MT4 Premium accounts – each offering varying features and minimum deposit thresholds. The Premium account is particularly attractive, as spreads can be as low as 0.1 pip, with full support for micro lot trading. Finally, all accounts have negative balance protection, which is ideal for beginner traders.

What we like:

- Various account types to choose from

- Spreads as low as 0.1 pips

- Support for micro lot trading

9. CMC Markets – One of the Best Cheap Forex Brokers with Huge Asset Selection

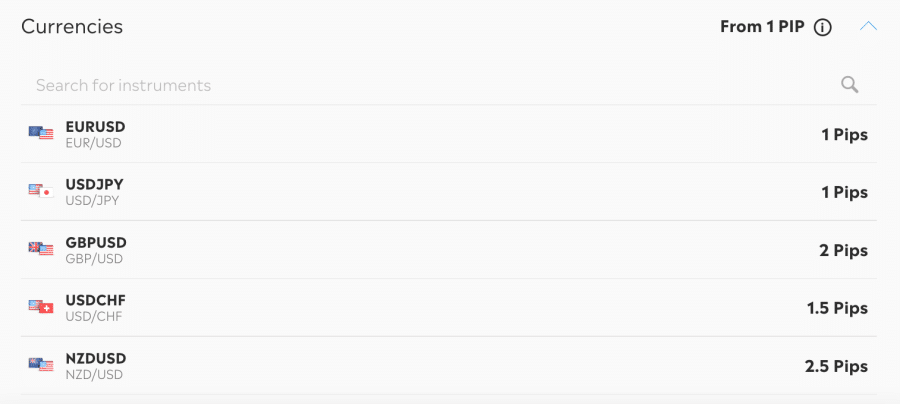

CMC Markets is considered one of the best low spread forex brokers in terms of reputation since the platform has been in operation since 1989. It is also regulated by the FCA, with the platform’s parent company listed on the London Stock Exchange, adding considerable credibility.

CMC Markets is considered one of the best low spread forex brokers in terms of reputation since the platform has been in operation since 1989. It is also regulated by the FCA, with the platform’s parent company listed on the London Stock Exchange, adding considerable credibility.

CMC Markets has a vast asset selection, as users can trade over 330 currency pairs. This platform also employs ‘precision pricing’, which uses fees from various banks to offer the best price to users. CMC Markets also boasts lightning-fast execution, ensuring little to no slippage.

Spreads are particularly low with CMC Markets, averaging around 0.7 pips for EUR/USD during peak trading hours. CMC Markets also doesn’t charge any deposit, withdrawal, or monthly account fees – although there is an inactivity fee after a year of no trading. Finally, this platform has no minimum deposit threshold, and users can fund their accounts via credit/debit card, bank transfer, or PayPal.

What we like:

- Over 330 currency pairs to trade

- No minimum deposit threshold

- ‘Precision pricing’ feature

10. Forex.com – Industry-Leading Broker with STP Account

As the name implies, Forex.com is a trading platform that specializes in currency trading, having been launched back in 2001. This platform is heavily regulated worldwide and policed within the US by the CFTC. Furthermore, Forex.com’s parent company is also listed on the NASDAQ.

As the name implies, Forex.com is a trading platform that specializes in currency trading, having been launched back in 2001. This platform is heavily regulated worldwide and policed within the US by the CFTC. Furthermore, Forex.com’s parent company is also listed on the NASDAQ.

Forex.com offers over 90 FX pairs to trade, with max leverage of 30:1 for major pairs – although US-based traders can trade with up to 50:1 leverage. Minors and exotics can be traded with 20:1 leverage, and all fees are built into the spread. However, average spreads are slightly higher than other options on our list, usually hovering above one pip for EUR/USD.

Users can also opt for a commission-based account, which offers lower spreads but a $5 fee for every $100,000 traded. Finally, Forex.com even offers a straight-through processing (STP) option, which sets spreads as low as 0.1 pip for EUR/USD – although commissions can be high for traders who do not trade regularly.

| Number of Currency Pairs | 90+ |

| Spread for EUR/USD | As low as 0.1 pips |

| Max Leverage | 50:1 |

| Accepts U.S. Clients? | Yes |

What we like:

- STP account offered

- Up to 50:1 leverage

- Listed on the NASDAQ exchange

11. E*TRADE – Best Low Spread Platform to Trade Currency Futures

Rounding off our list of the best low spread forex brokers is E*TRADE. E*TRADE is a highly-respected trading platform within the investment industry since it is now a subsidiary of Morgan Stanley. Furthermore, E*TRADE is heavily regulated in the US by the SEC and FINRA.

The critical thing to note is that E*TRADE doesn’t offer FX trading in the traditional sense. Instead, users can trade currency futures contracts, which will appeal to more advanced investors. There are nine futures contracts to trade, featuring top currencies like EUR, GBP, and JPY.

The price per contract is only $1.50, and E*TRADE has no short-selling restrictions, allowing investors to trade both sides of the market. There is also no minimum deposit threshold with E*TRADE, although users can only fund their accounts via checks, ACH transfer, or wire transfer.

What we like:

- Division of Morgan Stanley

- Regulated by the SEC and FINRA

- No minimum deposit threshold

Top Low Spread Forex Trading Platforms Compared

The low spread forex brokers reviewed above have been derived through extensive research and testing, ensuring there’s an option for all investor types. To help streamline the decision-making process even further, the table below compares the asset selection, spreads, leverage, and accessibility of the ten brokers discussed in the previous section:

How Do Spreads Work in Forex?

Before we answer this question, it’s important to know what the forex industry is. As such, for any readers who want a crash-course in currency pair trading then you can read our article on what is forex trading as well.

Much like the process investors must take to buy stocks, there are certain fees to be aware of when trading forex. The most significant charge is called the ‘spread’, or the ‘bid/ask spread’, which represents how each trading platform is compensated for facilitating FX trades. Spreads can vary from broker to broker and may be fixed or variable.

Spreads work like this – whenever a currency pair’s price is quoted on a trading platform, it will have a ‘bid’ and an ‘ask’ (or a sell/buy) price. This setup tends to look like this:

- GBP/USD – 1.3055/1.3058

The number on the left represents the price for which the platform will buy the currency, while the number on the right is the price for which the platform will sell the currency. The difference between the two prices is defined as the ‘spread’.

Naturally, the number on the left (the ‘bid’ price) will be less than the number on the right (the ‘ask’ price) since each trading platform will be looking to buy a currency pair for less than they’re willing to sell it – thus making a ‘cut’ on each trade.

This cut is measured in ‘pips’, which is the change in the fourth decimal place on a price quote. So, using the presented earlier, there would be a three pip spread on the broker’s GBP/USD offering.

What’s Considered a Low Spread?

As the name implies, low spread brokers offer relatively tight bid/ask spreads, thereby allowing traders to make more profit on each trade. However, each broker will have a slightly different approach, whether that be a ‘dynamic’ (or ‘variable’) spread or a fixed spread.

Dynamic spreads change depending on market conditions, so spreads tend to be lower when liquidity is high. On the other hand, when momentum is down, and not many people are trading, spreads are more elevated. The difference in spreads between busy and quiet trading hours can be pretty drastic – which is why most traders opt to trade during peak times.

Fixed spreads remain at the same level, regardless of the time of day. An example is the structure offered by eToro, which ensures that EUR/USD spreads are always quoted at one pip.

However, in terms of what is considered a ‘low spread’, this is all relative. A general rule of thumb is that spreads of 1 pip or below are relatively low, so traders tend to gravitate towards platforms that offer these levels. Some brokers provide ECN or STP trading, which can mean spreads are as low as 0.1 pips – although these brokers usually charge a commission for facilitating trades.

Other Forex Trading Fees

Although low spread brokers look to limit the bid/ask spread size, there are often other trading fees to be aware of. These can either be trading fees or non-trading fees.

Trading Fees

Those who invest in stocks will know that buying or selling financial assets usually involves paying some form of trading fee. Regarding FX trading, this usually comes in the form of a spread, which we have discussed above.

However, certain brokers (especially those that offer ECN or STP approaches) will charge a commission, which tends to be based on each user’s monthly trading volume. Thus, although spreads may be lower (or non-existent), the commissions charged by the broker tend to wipe out any cost savings – or may even be more expensive.

Non-Trading Fees

Non-trading fees are defined as any fees that occur outside of placing trades. The most common fees within this area are deposit and withdrawal fees, which tend to be a set charge when a user funds their account or opts to withdraw money.

Other non-trading fees include inactivity fees, which are charged when no activity takes place on a user’s account for an extended period – usually 12 months. Conversion fees may also be charged when a user deposits a non-supported currency. Finally, some platforms may even charge a ‘management fee’ or ‘account fee’, which is essentially a monthly or yearly subscription to use the service – although this is relatively rare.

| Platform | Other/Non-Trading Fees |

| Capital.com | N/A |

| eToro | Withdrawal fee, inactivity fee, conversion fee for non-USD deposits |

| Libertex | Withdrawal fee (specific payment methods), inactivity fee |

| AvaTrade | Inactivity fee |

| Interactive Brokers | Withdrawal fee (first withdrawal every month is free) |

| TD Ameritrade | Withdrawal fee (for wire transfers) |

| Skilling | Withdrawal fee (first withdrawal every month is free) |

| CMC Markets | Inactivity fee |

| Forex.com | Inactivity fee |

| E*TRADE | Withdrawal fee (for wire transfers) |

Best Low Spread Forex Brokers – Conclusion

To summarize, this guide has reviewed a selection of low spread forex brokers, highlighting their fees, features, and asset selection. Choosing which broker to partner with can be challenging at first – but by reviewing the information presented in this guide, investors can be sure to find a platform that suits their needs.

Our pick for the lowest spread forex broker is Capital.com. Capital.com offers over 130 currency pairs, including majors, minors, and exotics, all of which can be traded with zero commissions. Moreover, this platform’s spreads can be as low as 0.6 pips for liquid pairs – with a minimum deposit of only $20.

#forextrader #trading #forextrading #money #forexsignals #cryptocurrency #trader #investment #crypto #forexlifestyle #investing #business #entrepreneur #invest #binaryoptions #blockchain #forexmarket #forexlife #stocks #success #daytrader #btc #bitcoinmining #investor #stockmarket #binary #fx #finance