Is a Demat Account Really Required to Enter the Stock Market

Thinking about stepping into the world of stock market investing? If so, your first move isn’t buying stocks—it’s opening a demat account. This account acts as your official gateway into the market. Without it, participating in the buying or selling of shares isn't possible.

In this article, we’ll explore the role of a demat account, why it’s essential, the perks it brings, and how you can set one up quickly. Let’s dive in!

Understanding a Demat Account: Your Digital Locker for Investments

A demat account, short for dematerialised account, is like a digital locker where your financial securities—such as shares, bonds, and mutual funds—are safely stored in electronic format. It works similarly to a bank account, except instead of storing money, it holds your investment assets.

Let’s understand this with a simple scenario: Suppose you invest in a company listed on the exchange. Earlier, you’d receive a physical certificate for those shares. This was time-consuming and involved a lot of paperwork. However, with the introduction of demat accounts in India in 1996, all securities are now held electronically, making transactions seamless and hassle-free.

Today, when you purchase shares, they're directly credited to your demat account digitally—no paper, no waiting. Whether you're trading on the NSE or BSE, your demat account is mandatory for all settlements and trade executions.

Key Advantages of Having a Demat Account

Let’s take a look at the most notable reasons why a demat account is indispensable:

No Need for Paper-Based Certificates

Gone are the days of safeguarding fragile paper documents. With a demat account, all your shares are stored electronically, eliminating the risk of theft, loss, or damage.

Centralized, Convenient Storage

Whether you're holding 10 shares or 10,000, your demat account can accommodate them all. It’s easy to manage, track, and transfer your holdings from a single platform.

More Than Just Shares

A demat account allows you to hold a variety of financial instruments—mutual funds, government bonds, ETFs, and even insurance-linked securities. You can create a diversified investment portfolio all in one place.

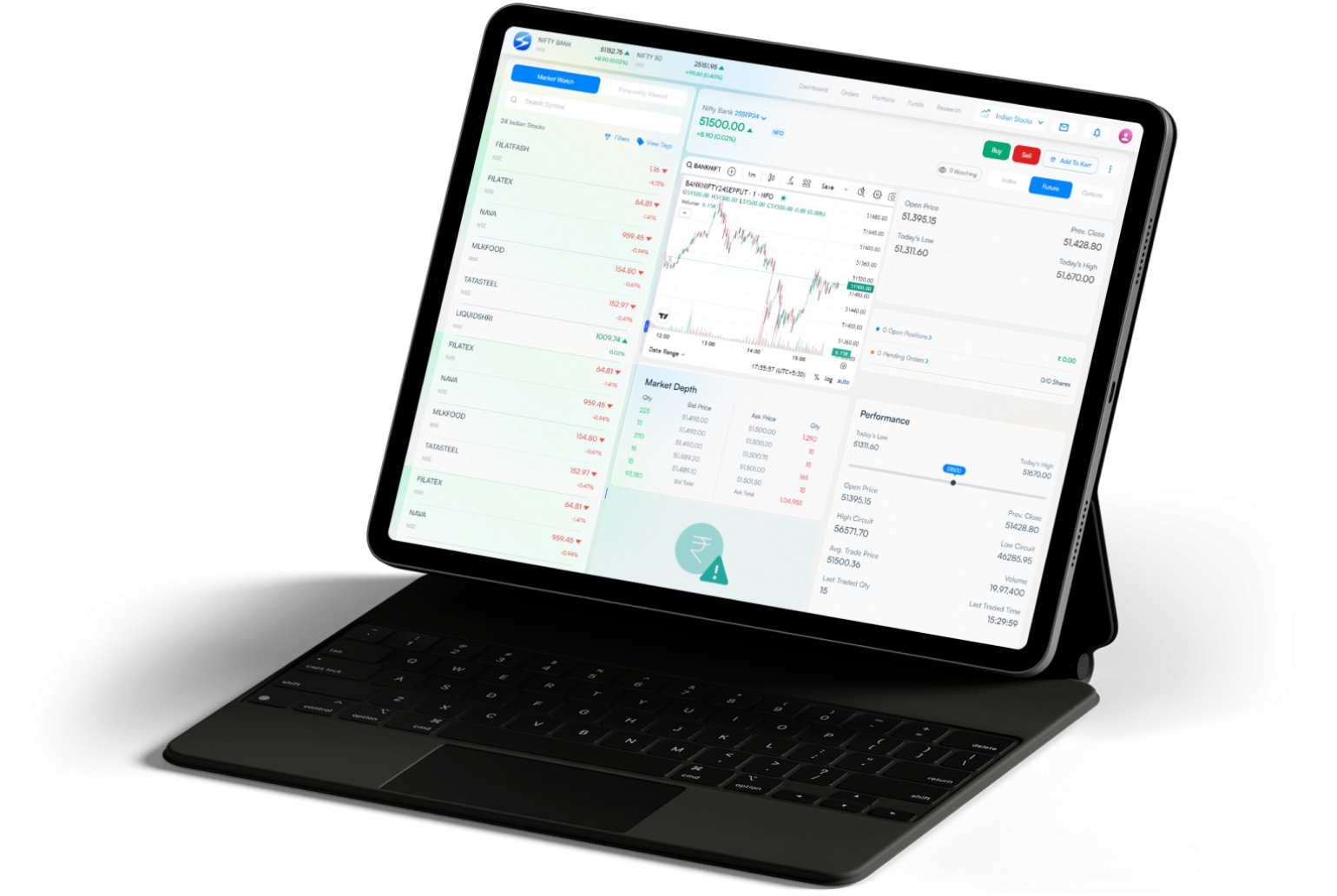

Anywhere, Anytime Access

With internet-enabled access, you can log into your demat account from your phone or laptop. This allows you to monitor and manage your investments on the go—whether you’re at home or travelling.

Nomination Facility for Future Planning

Demat accounts support the nomination feature. You can designate a legal heir who will inherit your investments in case of your demise, helping prevent legal hurdles for your family.

How Can You Open a Demat Account in India?

Now that you know why it’s important, let’s look at how to set up your demat account.

In India, demat accounts are managed by two major depositories: NSDL (National Securities Depository Limited) and CDSL (Central Depository Services Limited). To open an account, you need to go through a Depository Participant (DP)—this can be a bank, brokerage firm, or financial institution.

For instance, many banks such as HDFC Bank act as DPs. You can also open your account through user-friendly stock trading apps like HDFC Sky, which allow you to open a free demat account online with just a few clicks.

No minimum balance is required, and once the account is set up, you’ll receive a login ID and password to access it digitally anytime.

Pro Tip: Before choosing a DP, compare their annual maintenance charges and additional fees, as these differ across service providers. Also, while it’s legal to hold multiple demat accounts, you can only open one with the same DP under a single PAN card.

Final Thoughts: Your First Step Towards Investing

To sum it all up—yes, a demat account is absolutely essential to invest in the stock market. It’s your digital vault for holding and managing securities securely. Without it, trading isn’t possible in today’s electronic-based stock market ecosystem.

Once your demat account is ready, you can explore delivery-based trading—where you buy and hold stocks long-term without extra fees—using platforms like HDFC Sky, which makes investing smooth, simple, and reliable.

Frequently Asked Questions (FAQs)

Can I invest in SIPs without a demat account?

No, to invest in stocks through SIPs (Systematic Investment Plans), you must have a demat account. It acts as the digital repository for the securities you purchase.

Is it compulsory to link a bank account with a demat account?

Yes, linking a bank account is necessary for handling fund transfers related to buying and selling shares. It ensures smooth transactions.

What’s the minimum age required to open a demat account?

You must be 18 years or older to open a demat account in your name. Minors can open an account through a guardian.

Why is a demat account required to trade in the market?

Because it enables electronic holding and transferring of shares. Without it, trading on the stock market isn’t possible in India.