Like any other tradable asset, forex prices are also determined by the supply and demand of the market. However, there are a number of currency pairs that are extremely volatile, presenting more tradable opportunities for buyers and sellers.

In this guide, we discuss the most volatile forex pairs for trading in 2022. We will also offer some insight into forex trading and discuss what factors can affect the volatility of currency pairs.

Top 10 Most Volatile Forex Pairs to Trade in 2022

After conducting extensive research and analysis of the currency market, we found the following to be the most volatile forex pairs to trade in 2022.

- GBP/NZD – Overall Best Volatile Forex Pair for Trading

- GBP/AUD – Volatile Minor Pair With High Liquidity

- GBP/JPY – Most Traded Minor Forex Pair

- USD/RUB – Exotic Pair With High Volatility

- AUD/JPY – Highly Correlated Currency Pair

- CAD/JPY – Currency Pair Closely Associated With Oil Market

- USD/TRY – Volatile Forex Pair With Moderate Liquidity

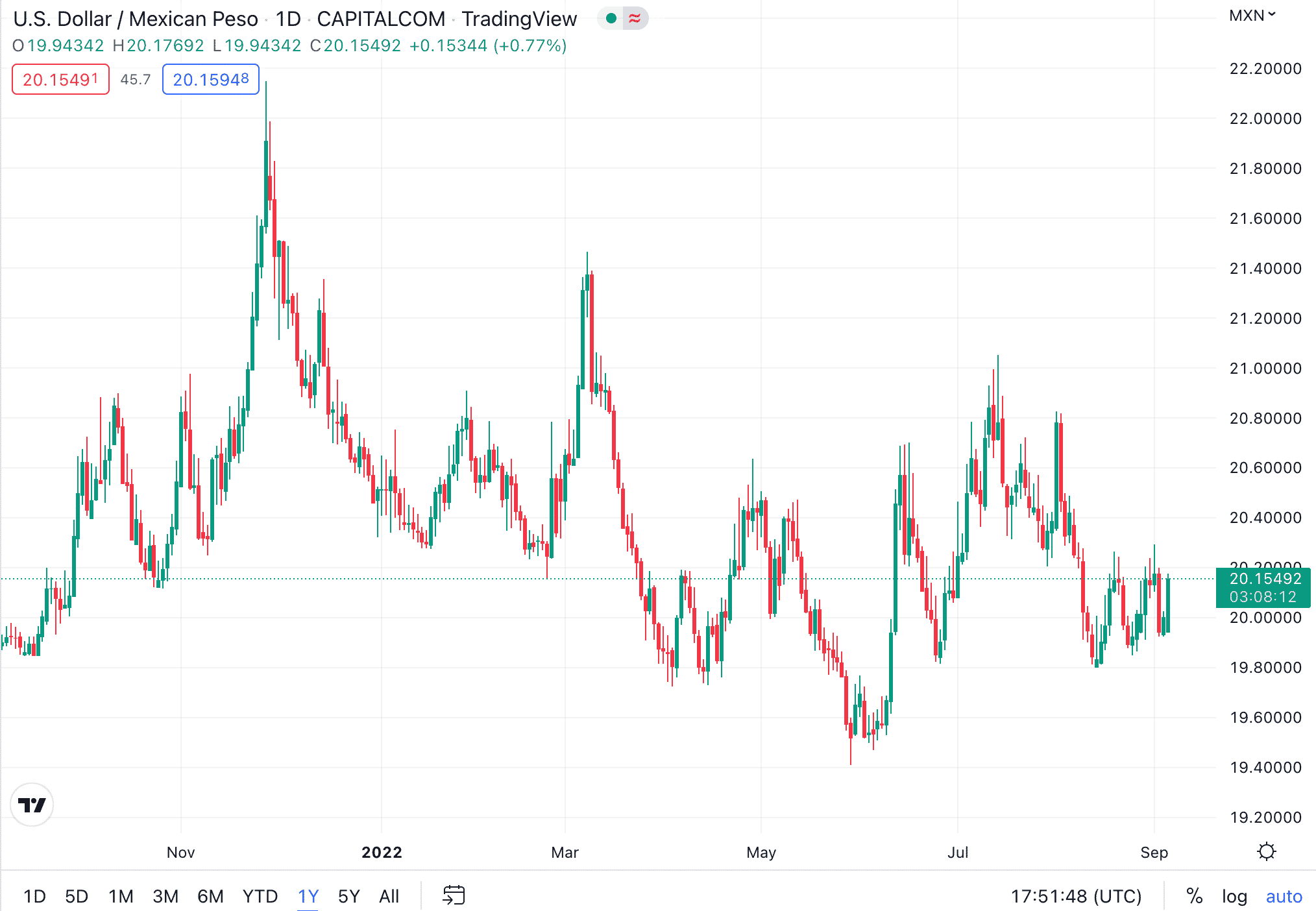

- USD/MXN – Popular Exotic Forex Pair for Currency Speculators

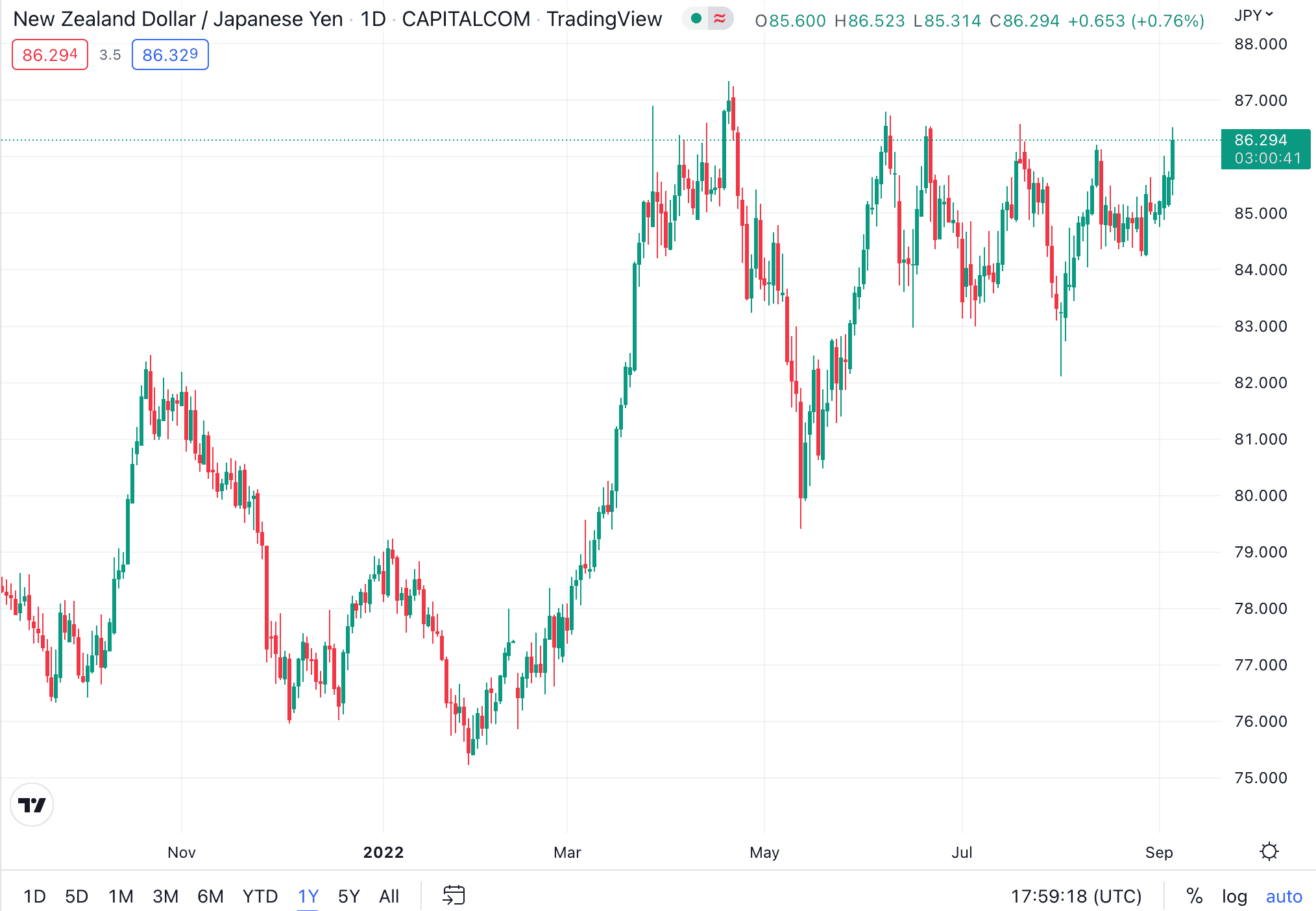

- NZD/JPY – Highly Liquid Minor Forex Pair

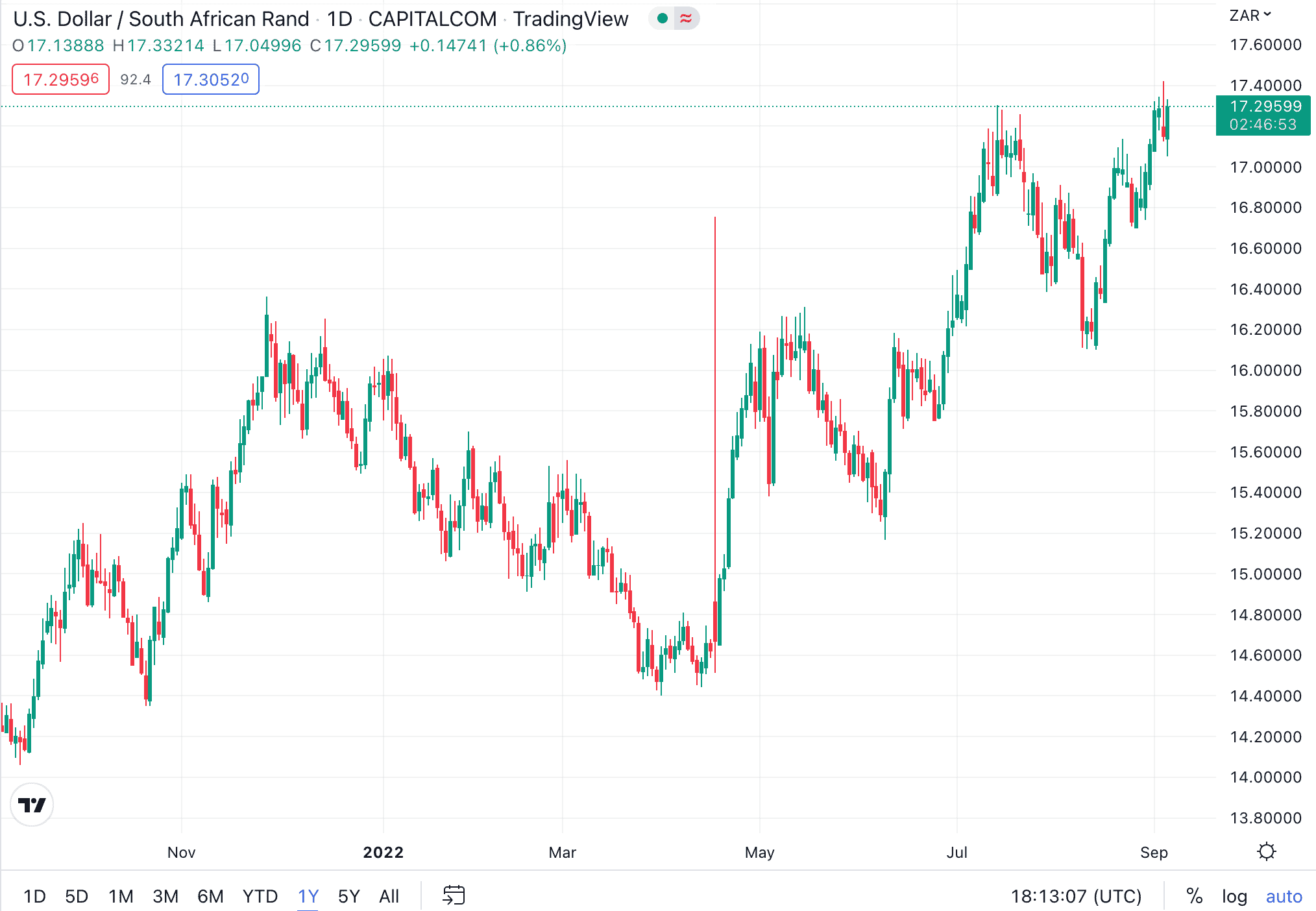

- USD/ZAR – Currency Pair Influenced by the Price of Gold

In the following section of this guide, we will discuss the above currency pairs, highlighting what affects their price movement within the forex market.

80.61 of retail investor accounts lose money when trading CFDs with this provider.

Most Volatile Forex Pairs Reviewed

The currency market remains open around the clock, seven days a week. Regardless of this accessibility, finding the right currency pair to trade can be a challenge.

Forex pairs are easily influenced by factors such as interest rates, economic growth, and the political environment of the country in question.

Read on to learn about the most volatile forex pairs in 2022.

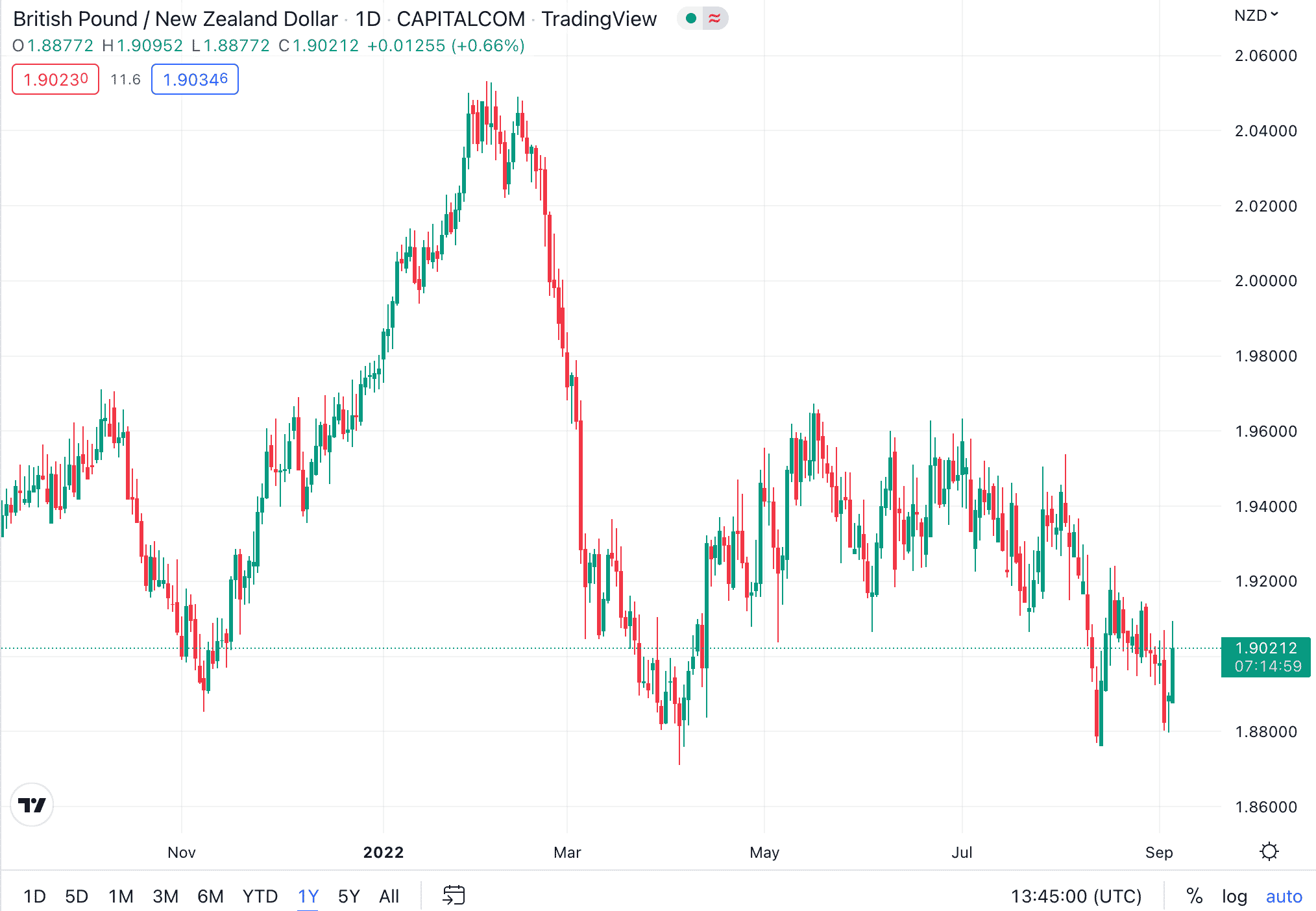

1. GBP/NZD – Overall Best Volatile Forex Pair for 2022

The GBP/NZD pair is made of the British pound and the New Zealand dollar as the base and the quote currencies, respectively. Both of these are among the world’s most traded currencies. On one side, there is the sterling – a premier reserve currency, which also happens to represent the largest financial center in the world.

On the other hand, the New Zealand dollar is often deemed as a proxy for Chinese growth due to the close trading relationship between the two countries. Historically, this currency pair has moved 300 to 500 pips a day. And therefore, the GBP/NZD pair is considered one of the highest volatility forex pairs to trade.

The price change of this currency pair rides on the economic conditions of the British and New Zealand economies. As such, when trading GBP/NZD, it is important to pay attention to factors such as GDP growth, import/export data, employment figures, as well as inflation and interest rates of both these countries.

Your capital is at risk. 80.61 of retail investor accounts lose money when trading CFDs with this provider.

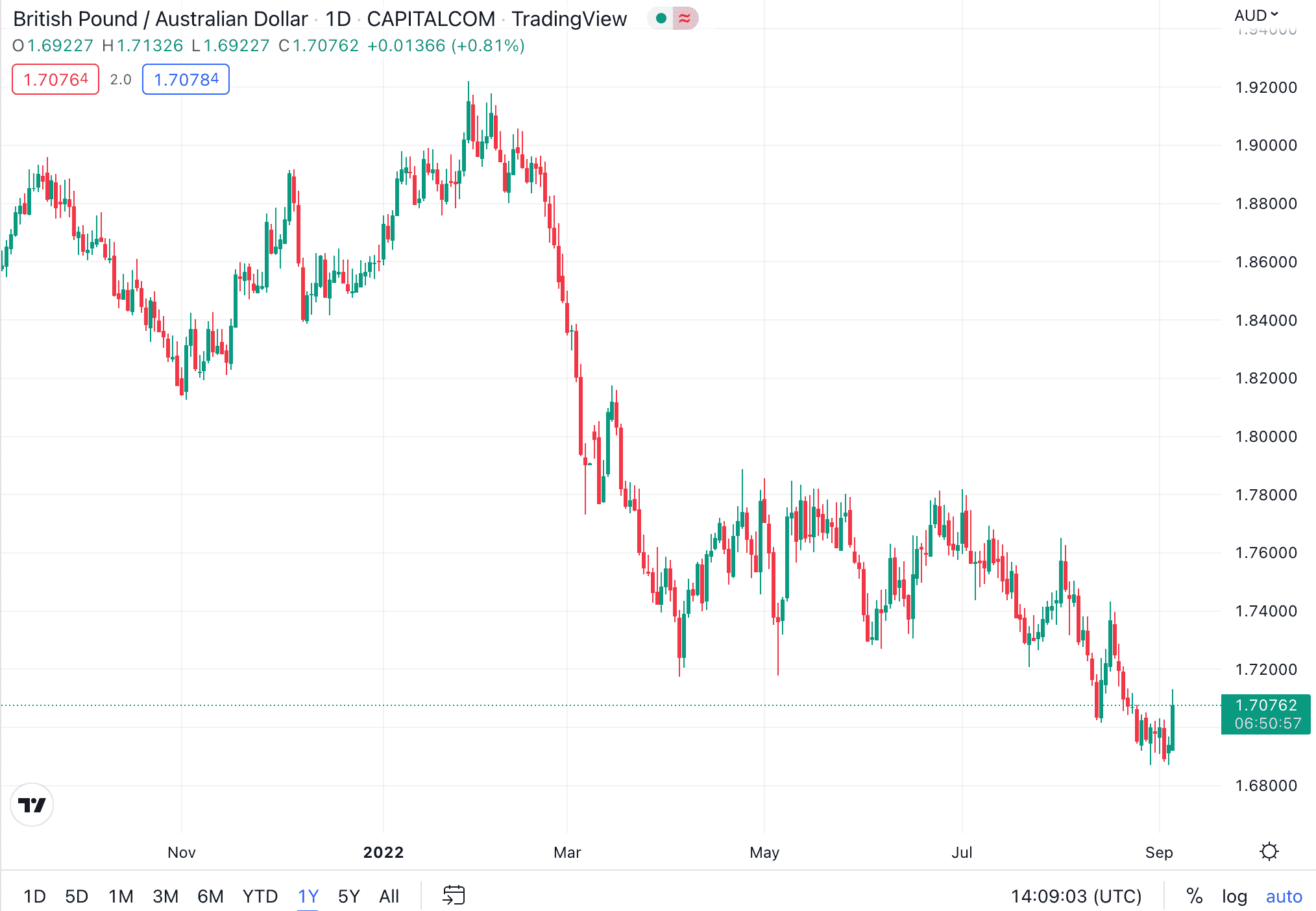

2. GBP/AUD – Volatile Minor Pair With High Liquidity

GBP/AUD is one of the most widely traded currency pairs in the forex market. These two currencies are correlated as Australia is part of the Commonwealth. While the UK economy affects the value of GBP, the price of AUD is impacted by the import and export industry of Australia.

Another consideration is that Australia is a key trade partner of China. However, since the trade war with the US, China has reduced imports from Australia. As such, currency pairs with AUD have witnessed increased volatility over the prior few years.

Your capital is at risk. 80.61 of retail investor accounts lose money when trading CFDs with this provider.

3. GBP/JPY – Most Traded Minor Forex Pair

GBP/JPY represents two of the world’s most powerful currencies. For the same reason, the pair is considered highly volatile, offering multiple trading opportunities in almost all market sessions. Throughout history, the GBP/JPY pair has experienced wild price swings.

Since the Japanese yen is a currency with low-interest rates, and the British pound is a high-yielding alternative, the GBP/JPY pair is also popular among carry traders. For those unaware – carry trading is a strategy that involves borrowing from a lower interest rate currency to fund the purchasing of one that provides a higher rate.

As such, some experienced traders prefer using high leverage forex brokers when speculating on the GBP/JPY pair.

Your capital is at risk. 80.61 of retail investor accounts lose money when trading CFDs with this provider.

4. USD/RUB – Exotic Pair With High Volatility

The Russian ruble is widely regarded as one of the most volatile currencies in the world. In fact, traders can expect daily changes as high as 5% in the value of this currency. Therefore, while this comes with plenty of speculative opportunities, trading USD/RUB can also be highly risky.

The currency pair has remained particularly vulnerable to volatility since Russia invaded Ukraine – especially in February and March of 2022. However, since then, the price of this pair has witnessed more gradual movements. Nonetheless, the ruble has lost significant value in the forex market after the collapse of Russia’s international payments system.

78% of retail investor accounts lose money when trading CFDs with this provider.

5. AUD/JPY – Highly Correlated Currency Pair

AUD/JPY represents the Australian dollar paired against the Japanese yen. The reason why this pair enjoys high volatility is that these currencies are inversely related. To elaborate – the price of the Australian dollar is heavily linked to the country’s exports of minerals, metals, and agricultural products.

This makes the Australian dollar a conventionally risk-seeking currency correlated to growth and international trade. On the other hand, the Japanese yen is widely deemed as a safe-haven currency and is associated with stagnant economic growth. And as such, the price movement of this currency pair can be very dramatic based on the global economic outlook.

Your capital is at risk. 80.61 of retail investor accounts lose money when trading CFDs with this provider.

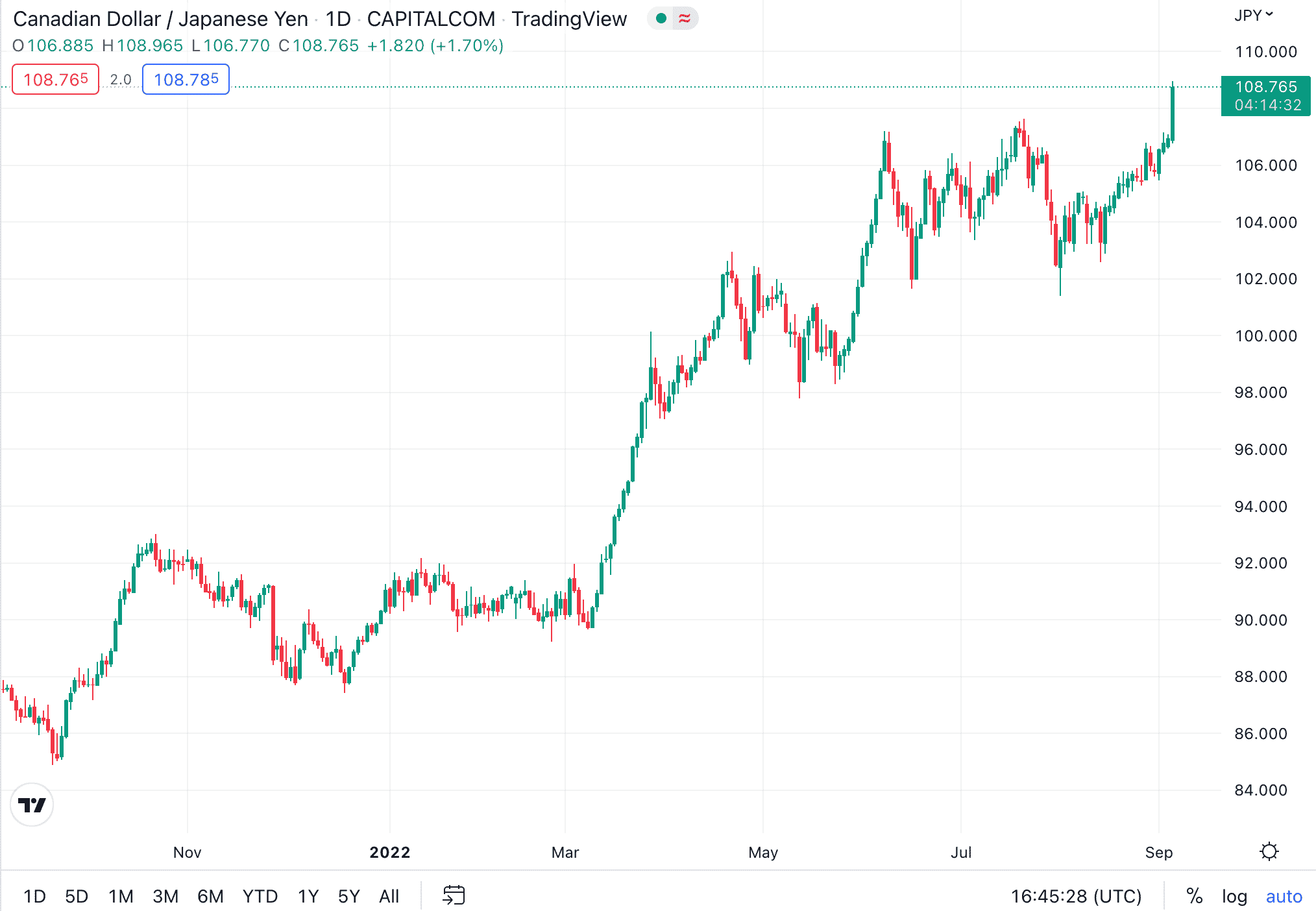

6. CAD/JPY – Currency Pair Closely Associated With Oil Market

The CAD/JPY pair tells us how much Japanese yen is required to buy a single Canadian dollar. As we mentioned before, the yen is seen as a safe haven in the global marketplace. On the other hand, the Canadian dollar is a commodity currency that is influenced by the price of oil.

In addition to this, Japan is also a top importer of oil. This means that when the price of oil increases in the commodity market, the amount of JPY needed to buy CAD also goes up.

So, for instance, if there was a limited supply of oil supply from other countries in the world, such as Russia, the value of CAD can increase, which can lead to a rise in the price of CAD/JPY.

Your capital is at risk. 80.61 of retail investor accounts lose money when trading CFDs with this provider.

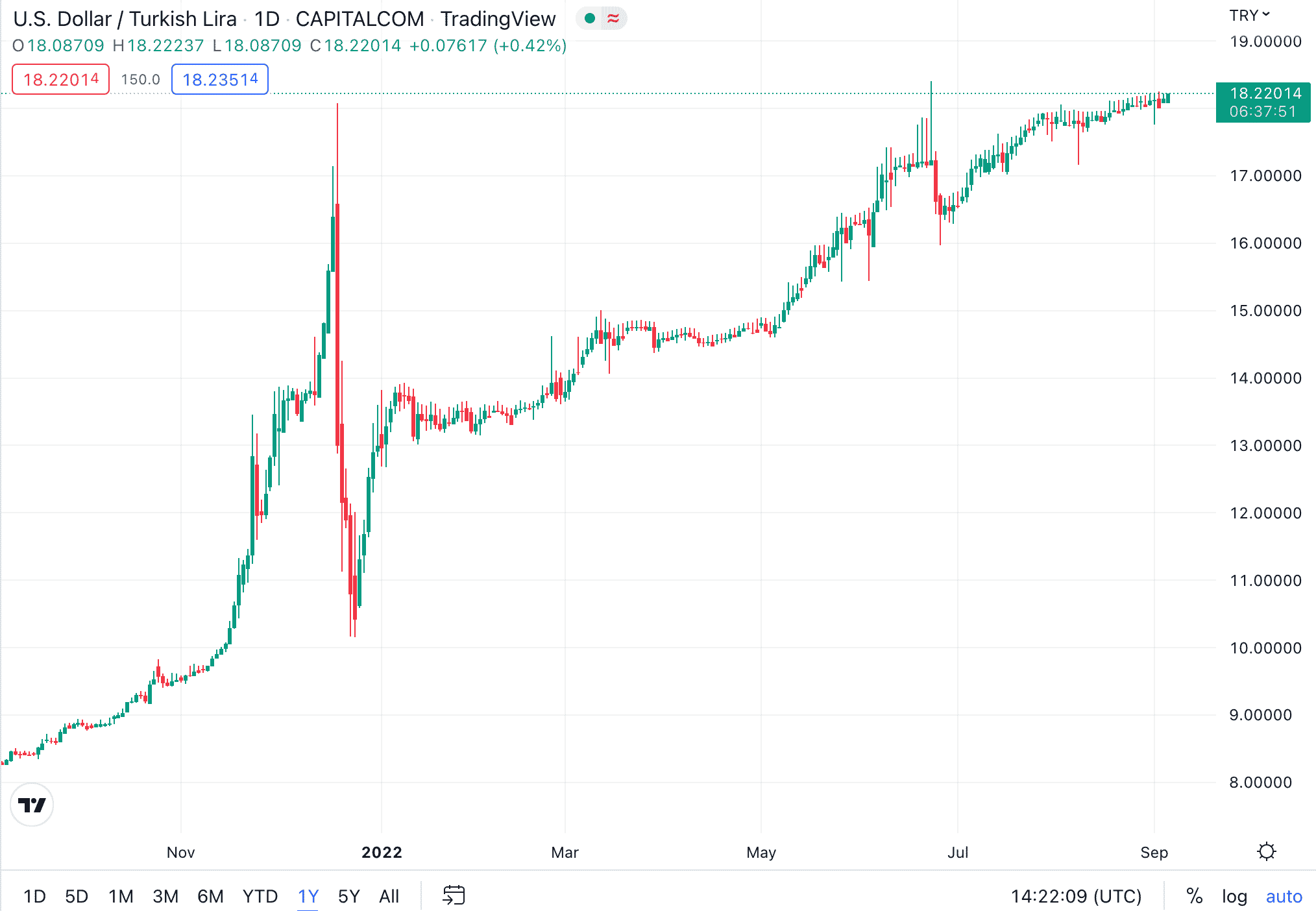

7. USD/TRY – Volatile Forex Pair With Low Liquidity

USD/TRY pairs the US dollar against the Turkish lira. Due to the geopolitical landscape of Turkey, the lira has always been highly volatile. And it is likely to remain so until the ongoing political unrest in Turkey settles.

However, this uncertainty surrounding the Turkish lira can turn out to be advantageous for forex traders. USD/TRY derives its volatility from that of the Turkish lira, and as such, traders can realize profits by going either long or short on this pair.

That being said, USD/TRY is prone to low liquidity levels, which means that traders should keep an eye out for unfavorable spreads.

Your capital is at risk. 80.61 of retail investor accounts lose money when trading CFDs with this provider.

8. USD/MXN – Popular Exotic Forex Pair for Currency Speculators

In recent decades, the Mexican peso has transformed from being just a domestic currency to a widely traded international financial instrument.

Many investors consider the Mexican peso as a gateway to gain access to emerging growth opportunities in the Latin American market, and as such, the currency has also become highly liquid. However, it also continues to be volatile.

Ongoing tensions between the US and Mexico are one of the main factors contributing to the volatility of the pair. Furthermore, the COVID-19 pandemic and the subsequent bear market have also resulted in the Mexican peso losing value against the dollar.

Due to this vast disparity, the USD/MXN pair is also favored by carry traders.

Your capital is at risk. 80.61 of retail investor accounts lose money when trading CFDs with this provider.

9. NZD/JPY – Highly Liquid Minor Forex

With this minor forex pair, the New Zealand dollar is trading against the Japanese yen. As with Australia, New Zealand is also heavily reliant on its commodity exports.

As such, its currency is significantly influenced by the price of agricultural products such as dairy, eggs, meat, and wood.

So, any changes in the price of these products can have an impact on the value of the NZD. As a consequence, the NZD/JPY market also goes through extreme price fluctuations, making it one of the most volatile forex pairs today.

Your capital is at risk. 80.61 of retail investor accounts lose money when trading CFDs with this provider.

10. USD/ZAR – Currency Pair Influenced by the Price of Gold

When trading USD/ZAR, traders will have to pay attention to the price of gold. There are a couple of reasons behind this. Firstly, gold is one of the main exports of South Africa. And secondly, gold is quoted in US dollars in the global market.

This means that if gold goes up in value, South Africa can generate more dollars on its exports. But this could also imply that it will be expensive to buy USD with ZAR.

Due to this complex connection, traders dealing with the USD/ZAR pair should conduct a thorough analysis of gold as well as the associated currencies.

And as such, this pair might be best suited for experienced traders who know their way around the commodity and forex markets collectively.

Your capital is at risk. 80.61 of retail investor accounts lose money when trading CFDs with this provider.

Choosing a Volatile Currency Pair When Trading Forex

Now that we have reviewed some of the most volatile forex pairs in the currency market, let us take a closer look at how to trade them.

Each country has an ISO code for its currency. For instance, the US dollar is represented as USD, the euro is denoted as EUR, and so on.

In the forex trading space, currencies are always listed in pairs – such as USD/EUR, USD/JPY, and EUR/CHF. The price of each pair represents the exchange rate for the two currencies.

Here is how to interpret the information from a forex pair – we will take GBP/NZD as an example.

- In a forex pair, the currency on the left is always called the base currency.

- In the case of GBP/NZD – this would be GBP.

- The currency on the right (NZD) is the quote currency.

- The exchange rate tells how much of the quote currency is required to purchase one unit of the base currency.

- In other words, in a forex pair, the base currency will always be expressed as one unit.

- On the other hand, how much of the quote currency is required to buy the base currency varies based on the market conditions.

- To give an example, if GBP/NZD is quoted as 1.8 – this means that 1.8 New Zealand dollars will buy 1 British pound.

- If the exchange rate goes up, it means that the base currency has gone up in value relative to the quote currency.

- Conversely, when the exchange rate goes down, this means that the base currency has declined in value.

That being said, forex trades are not made for exchanging one currency for another. Rather, traders speculate on future price movements to make a profit. In other words, pairs with high volatility present more trading opportunities.

When searching for the highest volatility forex pairs, traders should also know about majors, minors, and exotics.

Majors

Majors are the world’s most traded currency pairs. This includes the likes of EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

The main advantage of trading majors is that they offer high liquidity. And as a result, majors are considered the least volatile forex pairs.

Minors

Minor forex pairs are made of one major currency and a weaker one. However, currency pairs that do not include the US dollar are also called minors in the forex market.

Examples include EUR/JPY, GBP/JPY, EUR/GBP, and AUD/JPY. Minors are also typically less liquid than major currency pairs.

Exotics

Finally, we have exotics, which are made of one major currency like the US dollar and an emerging one like the Hungarian forint. Exotics pairs come with low liquidity and high volatility. Therefore, there is a high risk of forex slippage and a wide spread.

The above-mentioned points are some of the basic aspects of the forex market.

Interested to learn more about forex trading in detail? Read our elaborate guide on what is forex trading here.

How to Choose the Most Volatile Forex Pair

So far, we have answered the question – what are the most volatile forex pairs to trade in the market right now?

However, the volatility of these currency pairs depends on several factors. Therefore, when deciding on trading forex pairs by volatility, investors should monitor the economic calendar.

Any economic events or decisions made by governments can move the markets. By tracking the news in real-time. traders will be in a better position to anticipate volatility to a certain extent.

That being said, how traders make a profit from the forex volatility will depend on how they react to these price fluctuations. Alternatively, investors can also consider using the best automated forex trading software to profit from the volatility in the currency markets.

When using such software, trades will be triggered on predefined conditions so that there is no need to watch over the market all the time.

Nevertheless, gaining a better understanding of how the currency market works can help traders identify the most volatile forex pairs.

Put simply, there are a few currency pairs that are conventionally volatile. That being said, there are other factors that can influence the volatility of a pair – which we discuss in the next section.

What Influences the Volatility of a Forex Pair?

Volatility is the measure of price changes over a certain period of time. So, if a forex pair witnesses wild price fluctuations, it is thought to be highly volatile.

Let us take a look at some factors that cause volatility in the forex market.

Geopolitical Factors

The forex market is extremely sensitive to geopolitical events – especially those that can have an effect on the prevailing currency rates. This includes events such as wars, riots, or any other civil unrest.

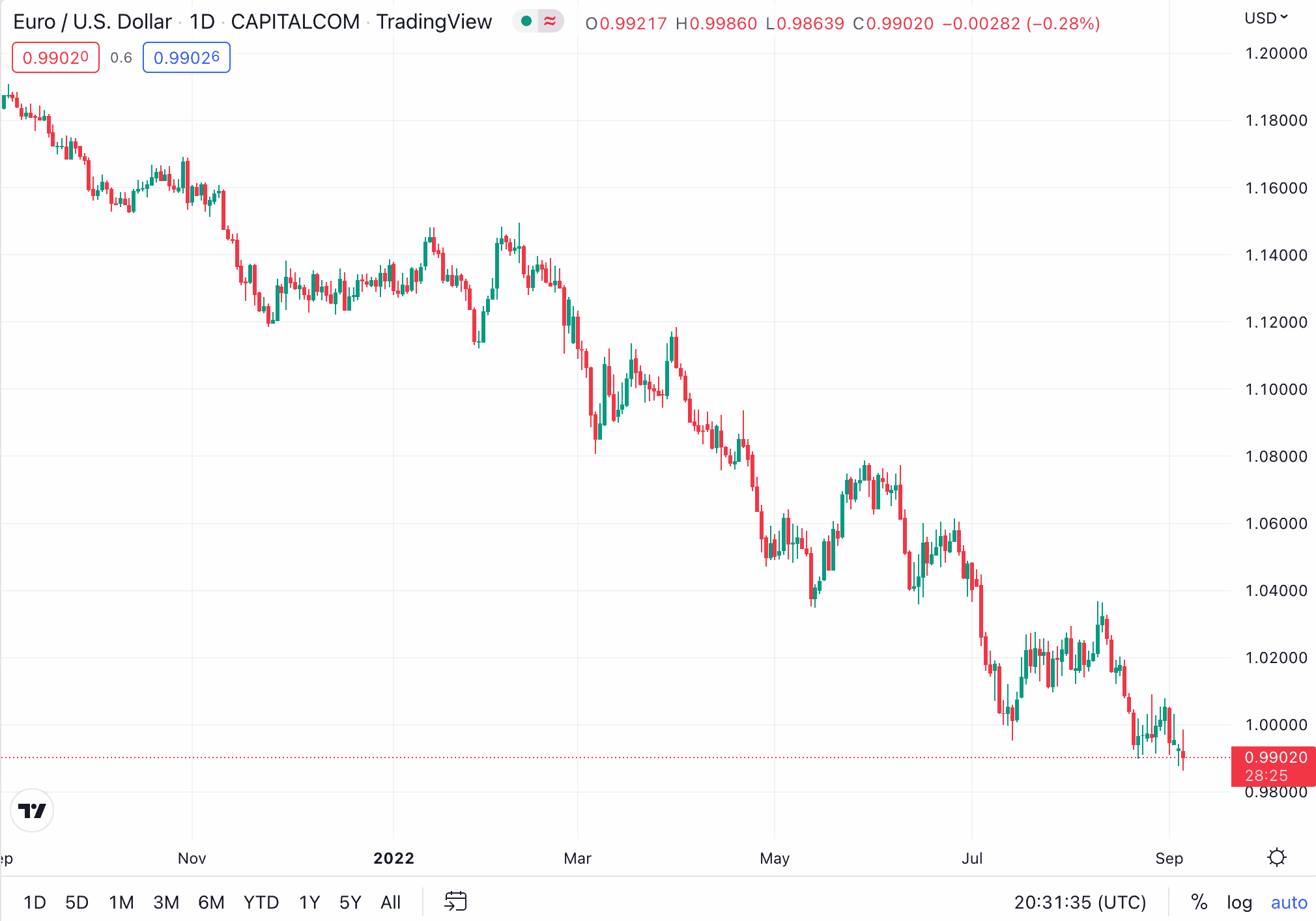

For example, the geopolitical tensions between Russia and Ukraine have had a monumental impact on the EUR market.

The euro has declined by more than 16% since the beginning of 2020. As the war is prolonged, there is a high level of uncertainty, which can further affect the price of both the euro and the Russian ruble in general.

Trade Wars

A trade war is another factor that can spur volatility in the forex market. In simple terms, a trade war can damage the currency of the country it targets.

A recent example of this is the US-China trade war. In 2020, the United States imposed a raft of tariffs on Chinese goods imported to the country.

This made Chinese items less attractive to US buyers – which led to less demand for the country’s currency in the forex market.

Monetary Policies

Central banks of different countries can also play a key role in managing the value of their currencies. They can regulate not only the amount of money in circulation but also the index rate levels.

This is one of the reasons why forex traders should keep an eye out for decisions made by central banks – such as the European Central Bank, US Federal Reserve, Bank of England, and others.

Ultimately, how these socioeconomic conditions affect the forex market will depend on traders.

So, when trying to find what is the most volatile currency pair, traders should look at the prevailing sentiment. This is, perhaps, one of the reasons why trend trading is very popular in the forex market.

Risks of Trading Volatile Forex Pairs

When dealing with the most volatile pairs in forex, traders should ensure that they continuously review their strategies. This is because a steep change in market sentiment can lead to unfavorable losses.

Therefore, traders should keep an eye on market conditions and ensure that they have proper risk management strategies in place.

It is a good practice to use stop-loss orders to minimize risk when trading volatile pairs. This will ensure that any potential losses are accounted for beforehand. This is particularly important when trading with leverage, where losses can be significant.

Where to Trade Volatile Forex Pairs – Safest Brokers Reviewed

When trading a volatile forex pair, choosing a trusted and regulated broker is absolutely essential.

Below, we review two of the best forex brokers in the market that offer volatile currency pairs with low fees.

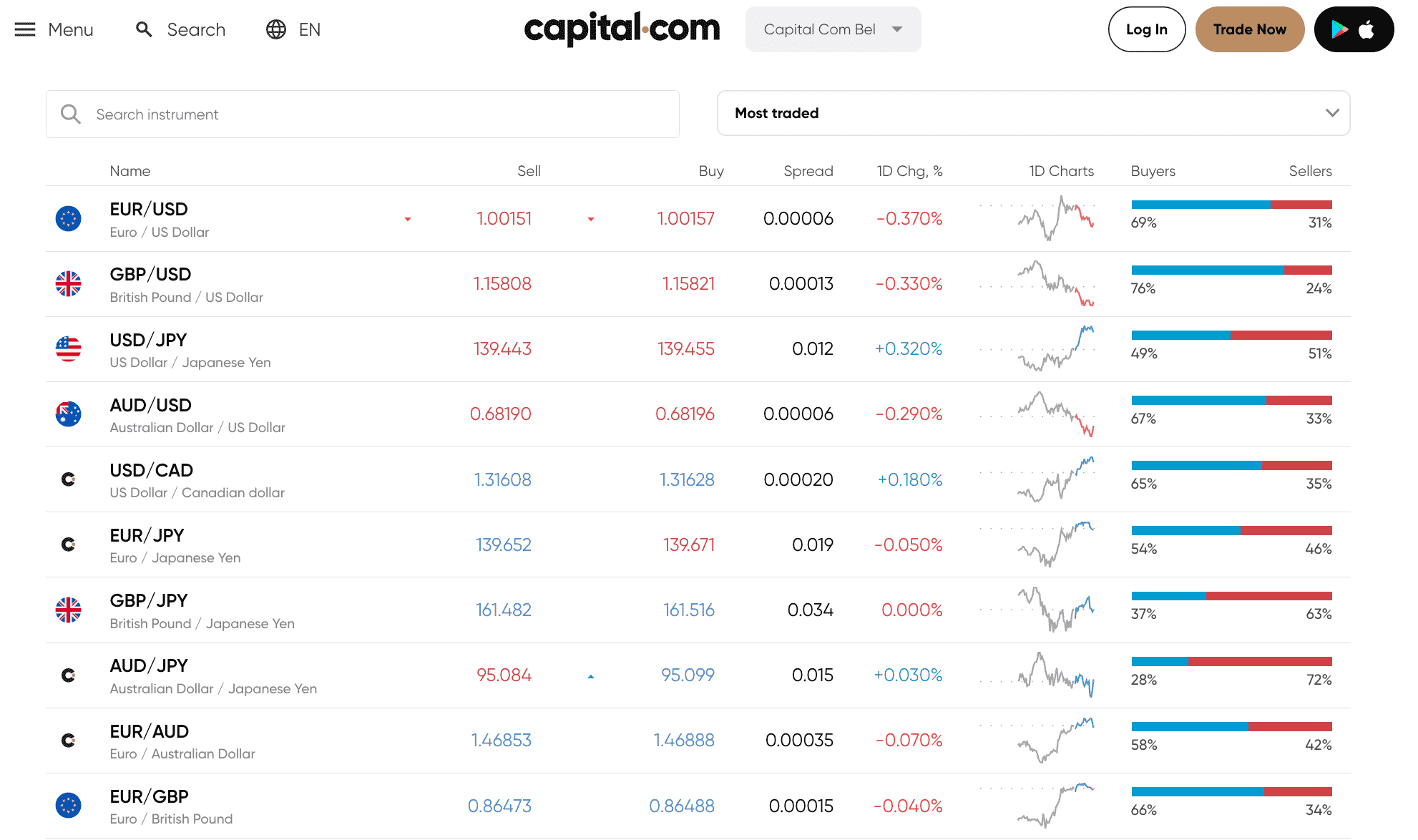

1. Capital.com – Trade Majors, Minors, and Exotics at 0% Commissions

![]() Capital.com is a CFD trading platform that lists one of the most extensive selections of forex pairs. It gives users access to 138 forex pairs in total, which not only include majors and minors but also volatile exotics such as USD/TRY and USD/MXN.

Capital.com is a CFD trading platform that lists one of the most extensive selections of forex pairs. It gives users access to 138 forex pairs in total, which not only include majors and minors but also volatile exotics such as USD/TRY and USD/MXN.

This trading platform is also cost-effective, as it charges no commissions for forex trading. It is also one of the best low spread forex brokers out there, which makes it easy to trade highly volatile pairs. Moreover, Capital.com levies no deposit or withdrawal fees whatsoever.

This is the case for payments made using debit/debit cards and e-wallets, which stipulate a minimum deposit of $20. Bank wires are also accepted, but this requires a minimum deposit of $250.

Capital.com is regulated on multiple fronts. Licensed by the FCA, NBRB, CySEC, and ASIC, this provider offers a safe place to trade volatile forex pairs. Capital.com is not only suitable for trading forex, but it also supports other assets such as stocks, commodities, and cryptocurrencies.

Capital.com is also popular among margin traders. This platform offers leverage of up to 1:30 for retail traders. However, when keeping positions open overnight, traders will have to pay funding fees.

This broker also has an innovative AI-powered trading platform that comes with a wide range of technical indicators and charting tools. With a Capital.com account, users can also access TradingView and MetaTrader 4 – both of which are advanced platforms widely used by seasoned forex traders. The provider also features demo accounts and user-friendly educational resources.

Your capital is at risk. 80.61 of retail investor accounts lose money when trading CFDs with this provider.

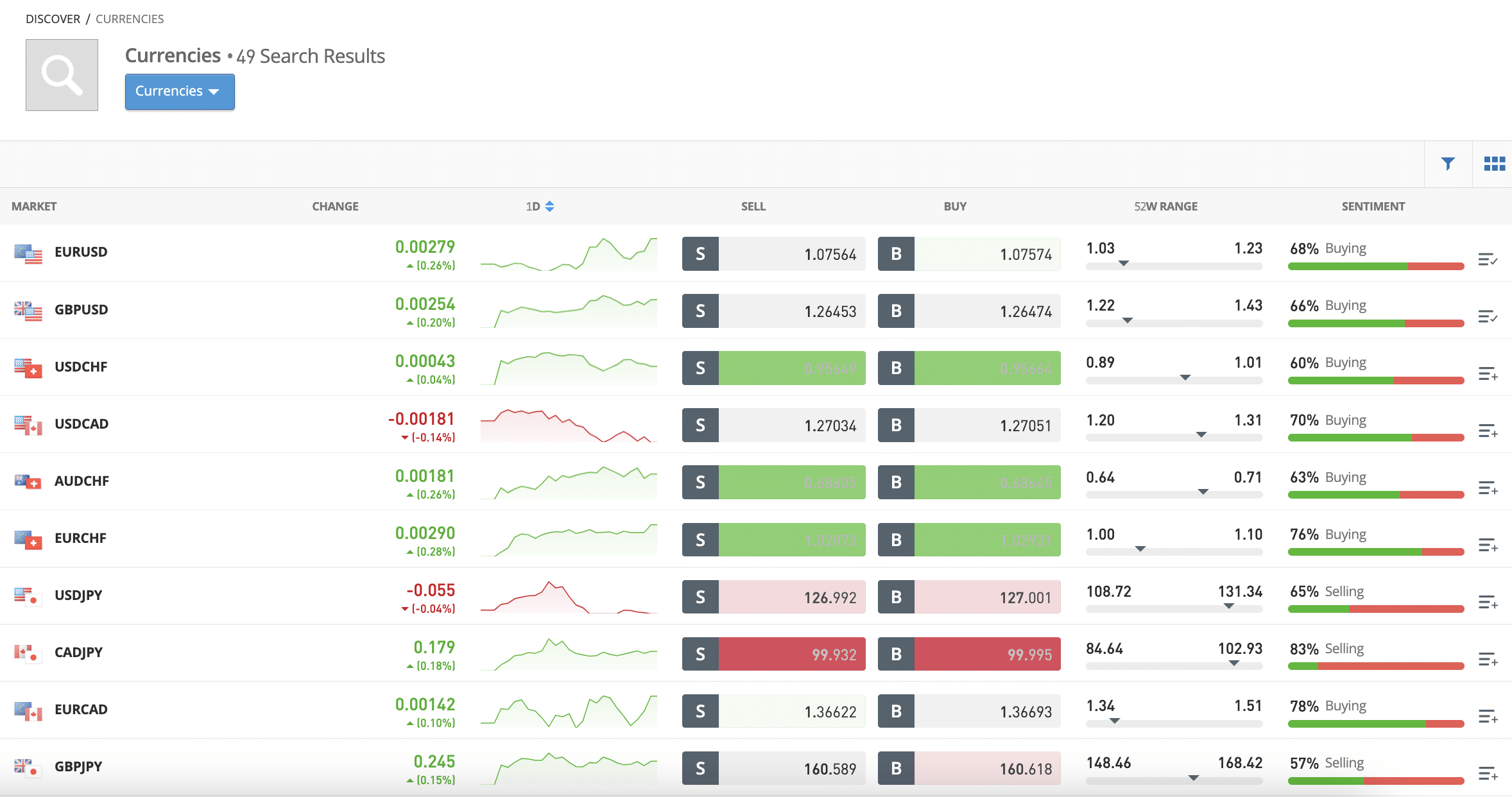

2. eToro – Forex Broker With Copy Trading tools

Launched in 2007, eToro is an online broker with more than 25 million clients. This platform supports a wide range of asset classes at the click of a button. This includes stocks, cryptocurrencies, indices, ETFs, metals, and more. The platform is particularly preferred by traders for its low-cost service.

Launched in 2007, eToro is an online broker with more than 25 million clients. This platform supports a wide range of asset classes at the click of a button. This includes stocks, cryptocurrencies, indices, ETFs, metals, and more. The platform is particularly preferred by traders for its low-cost service.

Moreover, eToro is best known for its forex Copy Trading feature. This works by choosing an expert trader on eToro and investing a minimum of $200 in them. After making the investment, all ongoing forex positions of the chosen trader will be mirrored in the user’s portfolio.

Like Capital.com, eToro is also regulated by multiple governing bodies – namely the SEC, FCA, CySEC, and ASIC. The platform operates on a spread-only basis. Users can trade 49 forex pairs and access tight spreads.

In terms of deposits, eToro accepts funding via bank transfers, credit/debit cards, and e-wallets. The minimum deposit required is only $10. The platform processes USD deposits for free but charges an FX fee of 0.5% for other currencies.

eToro also features an advanced trading platform that offers market insights, charting tools, and access to other technical indicators. Retail clients can also unlock up to 1:30 leverage on this platform. Find out more about this online broker by reading our full eToro review.

78% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

Volatile forex pairs offer seasoned currency investors plenty of trading opportunities. In this guide, we discussed some of the most volatile currency pairs and what to consider when trading them.

However, these volatile pairs come with an inflated degree of risk. For the same reason, it is important to choose a regulated broker when buying and selling volatile currencies.

Capital.com is one of the best forex trading platforms available today. It is licensed by multiple financial authorities and offers 0% commission trading not only on majors and minors, but volatile exotics too.

#forextrader #trading #forextrading #money #forexsignals #cryptocurrency #trader #investment #crypto #forexlifestyle #investing #business #entrepreneur #invest #binaryoptions #blockchain #forexmarket #forexlife #stocks #success #daytrader #btc #bitcoinmining #investor #stockmarket #binary #fx #finance