Casual forex traders might be on the lookout for a broker that offers micro lots. This amounts to 1% of a standard lot, so USD/CAD, for instance, would amount to a minimum position size of 1,000 units – or $1,000.

In this guide, we review the best micro forex accounts for fees, tradable markets, analysis tools, customer service, regulation, spreads, and more.

The 8 Best Micro Account Forex Brokers in 2022

The best micro forex accounts as per our comprehensive market research can be found in the list below:

- Capital.com – Overall Best Micro Forex Account for 2022

- eToro – Micro Lot Forex Accounts With Copy Trading Tools

- XTB – 0.01 Lot Account With Spreads That Start From 0.1 Pips

- Avatrade – 0% Commission Forex Broker With Tight Spreads

- Pepperstone – Raw Spread Accounts With a Minimum Lot Size of 0.01

- XM – Trade 50+ Forex Pairs with Spreads from 1 Pip

- CMC Markets – More Than 330+ Forex Pairs and Lots From 0.004 Units

- IG – US-Friendly Forex Broker With Micro Lot Accounts

To assess which micro lot account is suitable, consider reading our in-depth brokerage reviews – which can be found in the sections below.

![]()

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Best Micro Forex Accounts Reviewed

In order to select the best micro forex account, traders should focus on what fees the broker charges, what the minimum deposit amounts to, and how competitive spreads and commissions are.

Other important metrics to consider include customer support, tradable currency pairs, and the availability of analysis tools.

Below, we offer in-depth reviews of the best forex micro lot accounts in the market right now.

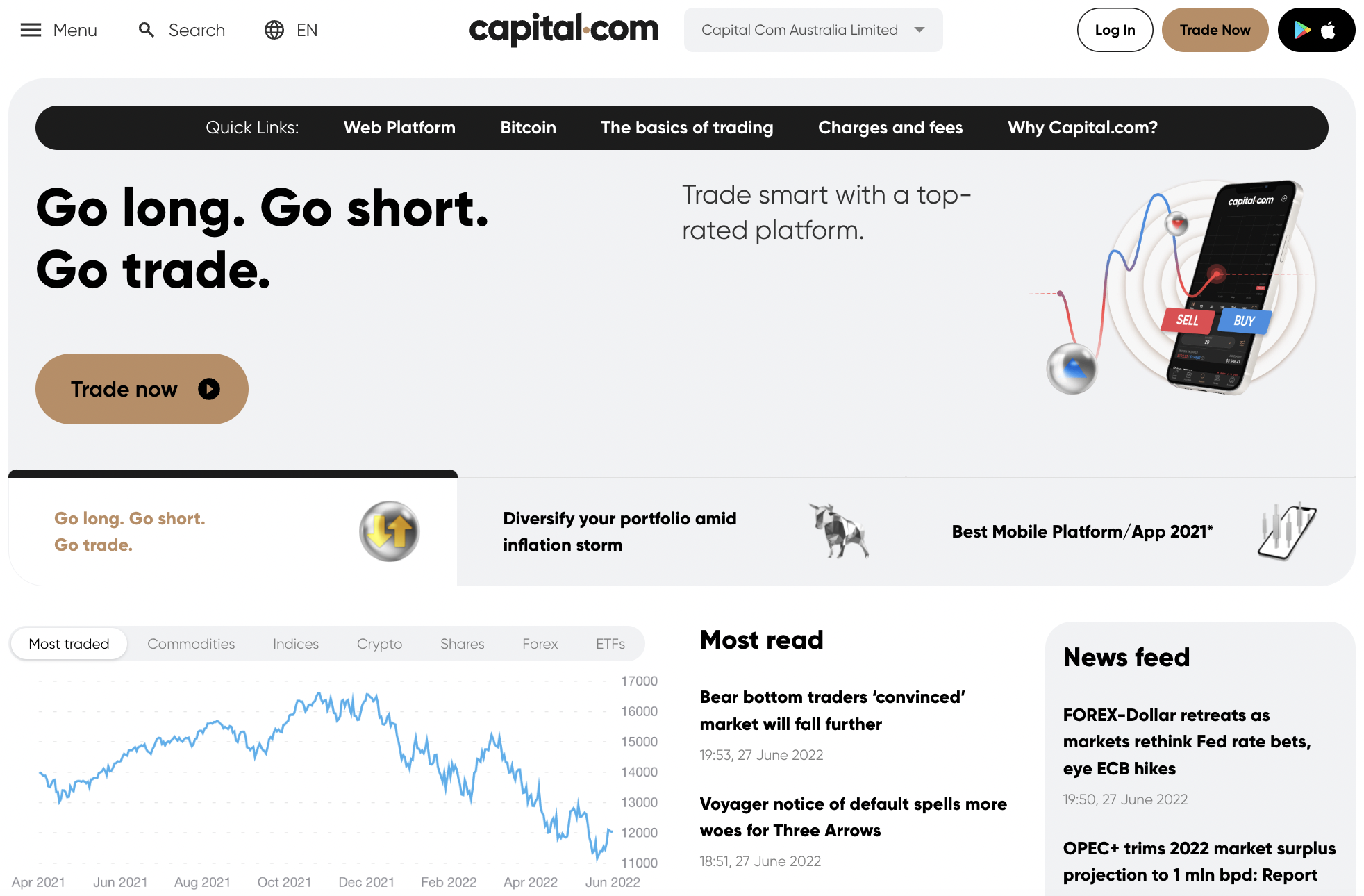

1. Capital.com – Overall Best Micro Forex Account for 2022 with Tight Spreads

![]()

We found that in terms of fees, minimum balance requirements, supported markets, and safety – Capital.com offers the overall best micro forex account. It takes less than five minutes to register a micro lot account at Capital.com and the minimum deposit amounts to just $20.

This is on the proviso that the trader utilizes a debit/credit card or e-wallet. Otherwise, if opting for a bank wire transfer, a minimum of $250 must be deposited. After getting set up, traders can then enter forex positions at a minimum lot size of 0.01 – or 1,000 currency units. In total, Capital.com offers access to 138 forex pairs.

This is in addition to thousands of other CFD markets, including commodities, ETFs, crypto, stocks, and indices. All supported assets and markets on Capital.com – including forex, can be traded on a commission-free basis. Capital.com is also known for offering tight spreads, with EUR/USD starting at 0.6 pips per slide.

There are no account management fees nor any charges to deposit and withdrawal funds. Bearing in mind that micro lot forex accounts require a minimum position size of 1,000 units, traders might need the assistance of leverage. At Capital.com, eligible retail clients can trade forex with leverage of up to 1:30.

This means that when trading USD/JPY, for instance, a $1,000 position would require an upfront stake of just over $33. Leverage of 1:20 is offered on minor/exotic forex pairs and gold, and less on other asset classes. We like that Capital.com offers several options when it comes to choosing a platform. This includes its native web trading platform, MT4, and an iOS/Android app.

Newbies might choose to start off with the Capital.com demo account, which offers a risk-free way to trade forex. The demo account will be pre-loaded with paper funds to the value of $10,000. In addition to demo accounts, Capital.com offers educational tools and even a dedicated learning app that offers quizzes and mini-courses.

There should be no concern with safety when trading micro lots at Capital.com, as the platform is heavily regulated. Licensing comes from the FCA, NBRB, ASIC, and CySEC. Finally, Capital.com offers plenty of analysis and research tools, such as technical indicators, financial news, and market insights from industry experts.

All in all, Capital.com is home to the overall best micro forex account.

Pros

- Overall best micro forex account

- 0% commission on all supported markets

- Trade forex, crypto, stocks, ETFs, commodities, and more

- Get started with an account in minutes from just $20

- Regulated and authorized by the FCA, CySEC, ASIC, and NBRB

Cons

- No support for US clients

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

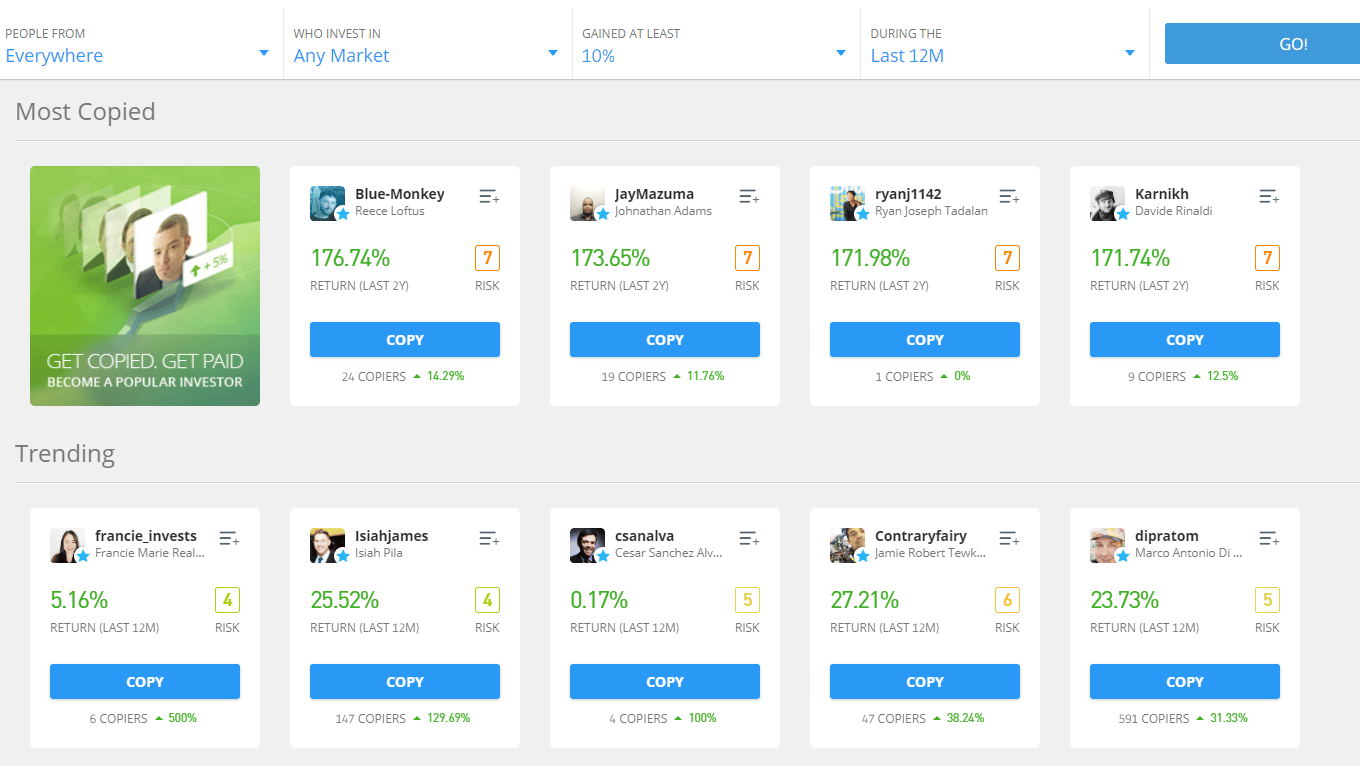

2. eToro – Micro Lot Forex Accounts With Copy Trading & CopyPortfolios

Often billed as one of the best forex brokers for beginners, eToro is another top-rated option to consider today. This user-friendly platform offers a minimum lot size of 0.01 alongside leverage. As a result, retail clients wishing to stake the absolute minimum will only require a capital outlay of $33.33 per trade.

Often billed as one of the best forex brokers for beginners, eToro is another top-rated option to consider today. This user-friendly platform offers a minimum lot size of 0.01 alongside leverage. As a result, retail clients wishing to stake the absolute minimum will only require a capital outlay of $33.33 per trade.

As noted earlier, this is based on a lot size of $1,000 alongside leverage of 1:30. eToro offers access to nearly 50 currency pairs across the majors and minors, alongside a selection of popular exotics. The platform operates a spread-only pricing system that starts from 1 pip on EUR/USD.

Commodities and indices are also offered on a spread-only basis here, while stocks and ETFs are commission-free. Those opting to invest in crypto can do so at 1% per slide. Back to forex, eToro offers an innovative tool called Copy Trading. This enables eToro account users to ‘copy’ the positions of an experienced forex trader automatically. As such, eToro has become one of the best automated forex trading platforms on the market.

So, let’s say that the eToro user invests $500 into the forex trader, who subsequently risks 10% of their capital going long on EUR/USD. Automatically, the eToro user would find a $50 EUR/USD buy position in their portfolio. When the forex trader cashes this position out, the eToro user will do the same automatically.

Those who prefer to trade forex on a DIY basis will find plenty of useful tools and features at eToro. For example, the ProCharts platform offers real-time pricing feeds alongside the ability to deploy dozens of technical indicators and drawing tools. Moreover, eToro offers real-time financial news – much of which can have a direct impact on the value of currency pairs.

Beginners will also appreciate the educational materials offered by eToro, such as trading guides, webinars, market insights, and podcasts. This is in addition to a free virtual portfolio that not only mirrors the live forex markets but comes preloaded with $100,000 in paper funds.

To get started with eToro – which is regulated by the SEC, ASIC, CySEC, and FCA, a minimum first-time deposit of $10 is required for those based in the UK and US. With a small number of exceptions, all other nationalities can get started with just $50. Accepted payments include debit/credit cards, e-wallets, and bank wires – and USD payments are processed fee-free. eToro also offers the best forex bonus with users receiving $250 when they deposit $5,000 or more into their live trading account.

Pros

- One of the best forex brokers for beginners

- Micro lots supported

- The minimum deposit starts at just $10

- Copy trading supported for forex, stocks, crypto, and more

- Regulated by the SEC, FCA, ASIC, and CySEC

- Top-rated mobile app and demo account

Cons

- $5 withdrawal fee on non-USD payments

78% of retail investor accounts lose money when trading CFDs with this provider.

3. XTB – 0.01 Lot Account With Spreads That Start From 0.1 Pips

XTB is another option to consider when searching for the best micro forex account. It takes just five minutes to get set up with XTB and there is no first-time deposit to meet. Payments can be made via a debit/credit card without charge, or Skrill at a 2% fee.

XTB is very competitive when it comes to fees. No commissions are charged when trading forex or any other supported market and spreads start from just 0.1 pips. There are more than 2,100 CFD instruments on offer at XTB, which, in addition to forex, includes stocks, ETFs, crypto, and commodities.

XTB offers its own native trading platform called xStation, which is accessible via web browsers, desktop software, and mobile/tablet apps. Leverage of up to 1:30 is offered to retail clients on the standard account. XTB account holders can access educational tools, market analysis, and webinars.

Read our full XTB review here

Pros

- 0% commission on all supported financial instruments

- Forex spreads start from 0.1 pips

- No minimum deposit requirement

Cons

- CFD instruments only

81% of retail investor accounts lose money when trading CFDs with this provider.

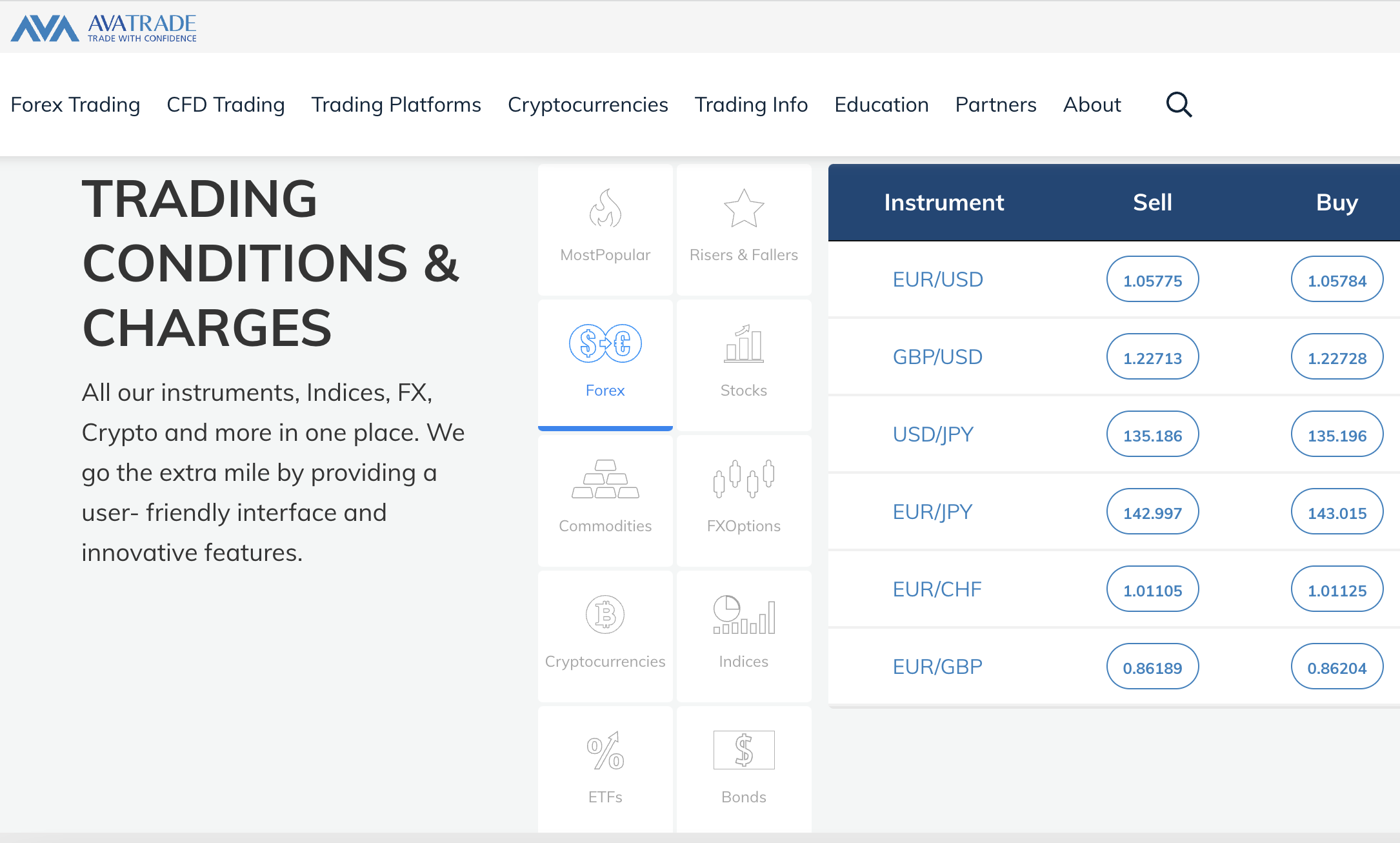

4. Avatrade – 0% Commission Forex Broker With Tight Spreads

The next broker to consider on our list of the best micro forex accounts is AvaTrade. This heavily regulated CFD trading platform offers 0% commission markets across all of its supported asset classes. This is inclusive of 55 forex pairs, alongside commodities, crypto, indices, and stocks.

The next broker to consider on our list of the best micro forex accounts is AvaTrade. This heavily regulated CFD trading platform offers 0% commission markets across all of its supported asset classes. This is inclusive of 55 forex pairs, alongside commodities, crypto, indices, and stocks.

Spreads are typically competitive here considering the 0% commission pricing structure on offer. For instance, EUR/USD starts at just 0.9 pips. Moreover, no deposit or withdrawal fees are charged by AvaTrade and the minimum first-time funding requirement amounts to just $100. Debit/credit cards are supported too.

AvaTrade users can choose from a variety of native and third-party trading platforms. The latter is inclusive of MT4, MT5, DupliTrade, and ZuluTrade. AvaTrade also offers its own proprietary platform for web and mobile trading. All supported platforms enable traders to perform high-level technical analysis.

Pros

- 0% commission forex trading

- 0.01 minimum lot size

- $100 minimum deposit

Cons

- A limited number of stock CFDs

71% of retail investor accounts lose money when trading CFDs with this provider.

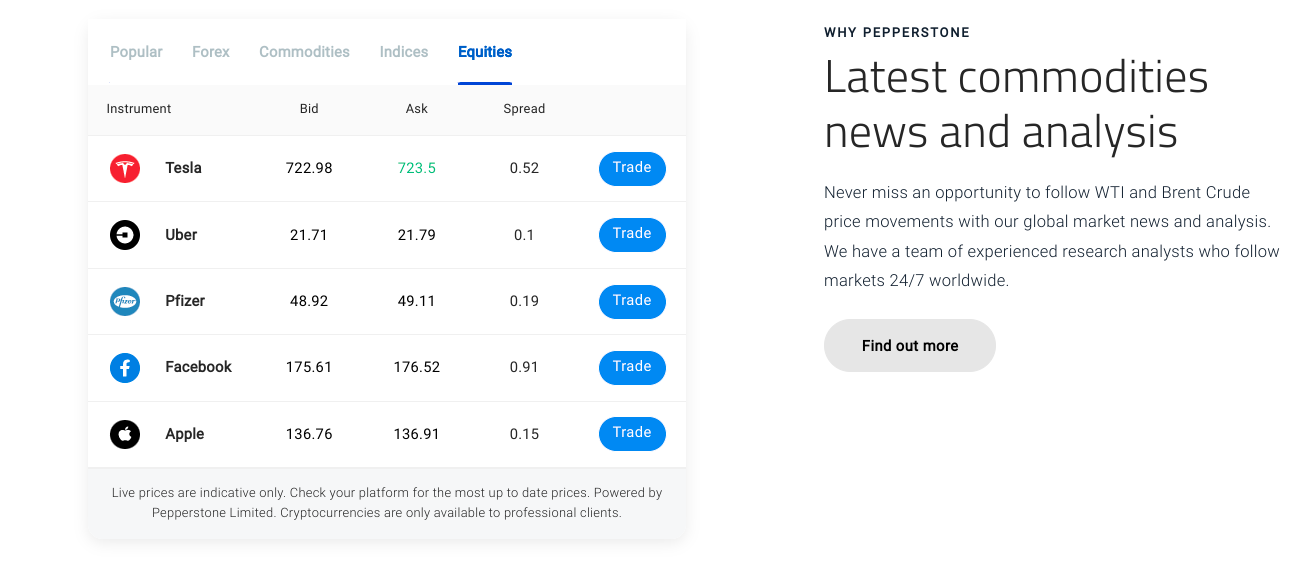

5. Pepperstone – Raw Spread Accounts With a Minimum Lot Size of 0.01

![]() Pepperstone is a regulated CFD broker that offers one of the best micro forex accounts for those seeking low spreads. Put simply, the Pepperstone razor account offers ECN-like spreads, not least because traders will have access to institutional-grade currency quotes.

Pepperstone is a regulated CFD broker that offers one of the best micro forex accounts for those seeking low spreads. Put simply, the Pepperstone razor account offers ECN-like spreads, not least because traders will have access to institutional-grade currency quotes.

Not only that, but the razor account comes without a minimum deposit requirement and lots of 0.01 can be traded. To benefit from ECN-like spreads, a commission of $3.50 will be taken from each lot that is traded. Therefore, by trading the minimum of 0.01 lots, this would amount to a commission of under 4 cents.

Those that prefer to trade forex on a commission-free basis are also catered for at Pepperstone. Spreads will, however, start from 0.6 pips, which is still competitive. Pepperstone users have access to over 60 forex pairs alongside other CFD instruments, such as stocks, indices, hard metals, energies, and crypto.

Those that prefer to trade forex on a commission-free basis are also catered for at Pepperstone. Spreads will, however, start from 0.6 pips, which is still competitive. Pepperstone users have access to over 60 forex pairs alongside other CFD instruments, such as stocks, indices, hard metals, energies, and crypto.

- Razor account offers ECN-like spreads

- Commission of just $3.50 per 1 lot on razor accounts

- Lots of third-party platforms supported

Cons

- Does not have a native trading platform

Visit Pepperstone Now

74% of retail investor accounts lose money when trading CFDs with this provider.

6. XM – Trade 50+ Forex Pairs with Spreads from 1 Pip

XM offers a micro forex trading account with 50+ currency pairs and spreads from as little as 1 pip. A single lot in the micro account is worth 1,000 contracts and traders only need a minimum deposit of $5, making it fairly accessible to new forex traders. In addition, XM allows 10 different base currencies for the micro account: USD, EUR, GBP, JPY, CHF,

XM offers a micro forex trading account with 50+ currency pairs and spreads from as little as 1 pip. A single lot in the micro account is worth 1,000 contracts and traders only need a minimum deposit of $5, making it fairly accessible to new forex traders. In addition, XM allows 10 different base currencies for the micro account: USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, SGD, ZAR.

XM doesn’t offer its own trading platform, but traders have access to MetaTrader 4 and MetaTrader 5. The brokerage also provides professional market research each day along with weekly forex webinars, an economic calendar, and in-depth educational videos for new trades. XM also has a $100,000 demo account that traders can reset at any time.

This forex broker offers 24/7 customer support and doesn’t charge fees on debit, credit card, or e-wallet deposits.

Pros

- Only requires a minimum $5 deposit

- MT4 and MT5 supported

- Daily market research

Cons

- Does not offer its own native web trading platform

Visit XM Now

Your capital is at risk.

7. CMC Markets – More Than 330+ Forex Pairs and Lots From 0.004 Units

CMC Markets is a popular CFD trading platform that offers more than 300 currency pairs. This will appeal to investors that seek high volatility, not least because CMC Markets is home to dozens of exotic currencies. Moreover, when trading major pairs like EUR/USD, the minimum trade value is 400 units.

Therefore, this equates to a minimum lot size of 0.004. No commissions are charged by CMC Markets when trading forex. The minimum spread on EUR/USD amounts to just 0.7 pips. Eligible clients can trade forex and other supported markets with leverage. Both long and short orders are supported.

In addition to forex, CMC Markets supports indices, stocks, commodities, crypto, and bonds. There is no minimum deposit requirement to meet at this brokerage.

| Forex Pairs | 330+ |

| Minimum Lot Size | 0.004 |

| EUR/USD Spread | From 0.7 pips |

| Min Deposit | No minimum deposit requirement |

| Trading Platforms | Native NGEN platform for web and mobile trading, MT4 |

Pros

- More than 330+ pairs supported

- Minimum forex trade of just 400 units (0.004 lots)

- No commissions charged

Cons

- CFD instruments only

8. IG – US-Friendly Forex Broker With Micro Lot Accounts

We found that IG is perhaps the best micro forex account for US traders. This established forex broker offers direct access to more than 80 currency pairs on a commission-free basis. The minimum trade size at IG is 0.01 lots or 1,000 units of the base currency.

We found that IG is perhaps the best micro forex account for US traders. This established forex broker offers direct access to more than 80 currency pairs on a commission-free basis. The minimum trade size at IG is 0.01 lots or 1,000 units of the base currency.

The tightest spread on offer here is 0.8 pips, which is available on EUR/USD and USD/JPY. US clients can obtain leverage of up to 1:50 at IG on major pairs. IG offers a choice between MT4 or its own native platform. All supported platforms can be accessed online or on smartphone devices.

Getting started with IG requires a minimum first-time deposit of $250. IG notes that in most cases, accounts can be verified instantly. Finally, those based outside of the US can access other asset classes, including real stocks, ETFs, and CFD instruments.

Pros

- Spreads from 0.8 pips

- US-friendly

- No commissions charged

Cons

- US clients only have access to forex

Top Micro Account Forex Trading Platforms Compared

The best micro forex account providers reviewed above are summarized in the comparison table below:

| Brokers | Forex Pairs | Min. Lot Size | EUR/USD Spread (From) | Min. Deposit (From) | Trading Platforms |

| Capital.com | 138 | 0.01 | 0.6 pips | $20 | Capital.com web platform and mobile app, MT4, TradingView |

| eToro | 49 | 0.01 | 1 pip | $10 | Proprietary eToro platform for web browsers and mobile devices |

| XTB | 48 | 0.01 | 0.1 pip | $0 | xStation for web, mobile, tablets, and desktop software |

| Avatrade | 55 | 0.01 | 0.9 pips | $100 | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, DupliTrade, ZuluTrade |

| Pepperstone | 60+ | 0.01 | 0.0 pips | $0 | MT4, MT5, cTrader, TradingView |

| XM | 50 | 0.01 | 1.0 pips | $5 | MT4, MT5 |

| CMC Markets | 330+ | 0.004 | 0.7 pips | $0 | Native NGEN platform for web and mobile trading, MT4 |

| IG | 80+ | 0.01 | 0.8 pips | $250 | Native platform for web and mobile trading, MT4 |

What is a Forex Micro Account?

When banks and large financial institutions trade forex, they do so in standard lots of 100,000 units. This means that USD/CAD, for instance, would be traded in lots of $100,000.

Forex micro lots, on the other hand, represent a trading size of 0.01 – or 1,000 units. Therefore, forex micro lot accounts enable the trader to speculate on pairs like USD/CAD at a minimum of $1,000.

Crucially, traders are not required to meet the full $1,000 minimum when utilizing leverage. For instance, those based in the US can trade major pairs with leverage of 1:50. Which means that trading a micro lot would require a total stake of just $20.

Ultimately, the best micro forex accounts that we came across are aimed at casual, retail traders that wish to risk smaller amounts.

Benefits of Micro Forex Lot Trading

The overarching benefit of trading via a micro forex lot account is that smaller trade sizes are permitted. After all, even with leverage, it is unlikely that the average trader will have the financial means to speculate on standard lots of 100,000 units each.

Instead, by trading micro lots, this enables the trader to access the forex markets with a much lower amount of capital. As noted above, this minimum trade value on a micro lot without leverage is 1,000 units.

As such, EUR/USD would require a minimum position worth €1,000. But with leverage, the amount of capital required upfront to execute a micro lot forex trader can be reduced significantly.

How we Select the Best Micro Account Forex Brokers

To assess how we select the best micro accounts for forex, we will now explain the key criteria that we look for.

Regulation

All of the micro accounts that we discussed today are offered by regulated forex brokers. This ensures that the broker complies with strict licensing guidelines on investor safety.

Supported Pairs

The best micro forex accounts support a wide range of major, minor, and exotic pairs. Capital.com, for instance, offers access to 138 forex markets.

Fees

Consider choosing a micro account provider that not only offers tight spreads, but zero-commission trading. eToro offers a spread-only pricing model from 1 pip.

| Brokers | EUR/USD Spread (From) | Commission | Account Fees |

| Capital.com | 0.6 pips | 0% | None |

| eToro | 1 pip | 0% | 0.5% on non-USD deposits, $10 inactivity fee, $5 withdrawal fee |

| XTB | 0.1 pip | 0% | $10 inactivity fee |

| Avatrade | 0.9 pips | 0% | $50 inactivity fee |

| Pepperstone (razor account) | 0.0 pips | $3.50 per lot | None |

| XM | 1.0 pips | 0% | $15 inactivity fee |

| CMC Markets | 0.7 pips | 0% | $10 inactivity fee |

| IG | 0.8 pips | 0% | 1% on Visa, 0.5% on MasterCard, $18 inactivity fee |

Tools and Analysis

The best micro forex accounts come packed with trading tools and features. This should include high-level charting and drawing tools, technical indicators, and research materials.

Those wishing to trade forex passively might also consider the eToro Copy Trading tool.

Minimum Deposit

While micro accounts support a minimum trade size of 1,000 units, it is also important to assess what the first-time funding requirement amounts to. At eToro and Capital.com, this stands at $10 and $20, respectively.

Demo Account

The best forex trading micro accounts also come with a demo platform. This enables traders to practice their chosen forex strategy and get to grips with the broker in question.

Mobile App

Capital.com and eToro both offer convenient forex trading apps. Most of the micro accounts discussed today offer a proprietary mobile app for iOS and Android. Some, on the other hand, supported third-party apps such as MT4 and MT5.

Payment Methods

The best forex trading micro account providers support instant payment methods – such as debit and credit cards. The likes of Capital.com and eToro also support an assortment of e-wallets.

Customer Service

Ideally, it is best to open an account with a micro lot broker that offers 24/7 support via live chat and/or telephone. This will offer peace of mind when assistance is required.

Conclusion

In conclusion, micro forex accounts enable traders to access the currency markets with a much smaller amount of capital. Instead of trading lots of 100,000 units each, this account type permits a minimum trade of 1,000 units.

To get started with a commission-free micro lot account in under five minutes, consider Capital.com. This platform offers spreads from 0.6 pips and the minimum first-time deposit amounts to just $20 on debit/credit card and e-wallet payments.

#forextrader #trading #forextrading #money #forexsignals #cryptocurrency #trader #investment #crypto #forexlifestyle #investing #business #entrepreneur #invest #binaryoptions #blockchain #forexmarket #forexlife #stocks #success #daytrader #btc #bitcoinmining #investor #stockmarket #binary #fx #finance