To buy stocks from the comfort of home in Singapore, investors need to choose an online broker.

In this guide, we explain how to buy stocks in Singapore in 2022.

We also offer comprehensive reviews of regulated stock brokers in Singapore, alongside a list of popular shares to watch in 2022.

How to Buy Shares in Singapore with a Regulated Broker

- ✅ Step 1: Open a Trading Account – Head over to the broker’s website and click on the sign-up button. The platform will also require some basic information regarding the user’s identity and will ask for some ID and proof of address.

- 💳 Step 2: Deposit Funds – The minimum deposit varies depending on which stock trading platform you choose. Most brokers accept credit and debit cards, as well as bank wire transfers.

- 🔎 Step 3: Search for Shares – To find the correct stock, type it into the search bar on the main dashboard. When the correct stock appears, click it.

- 🛒 Step 4: Research Shares in Singapore – Once you’ve conducted the right market research. Click ‘Buy’ and enter the desired stake to complete the order.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Where to Buy Stocks in Singapore in 2022

Once a trader has familiarized themselves with how to buy stocks in Singapore, it’s a matter of choosing a regulated trading platform to fulfill the order.

Traders can find information on the number of stocks available, deposit options, features, and more.

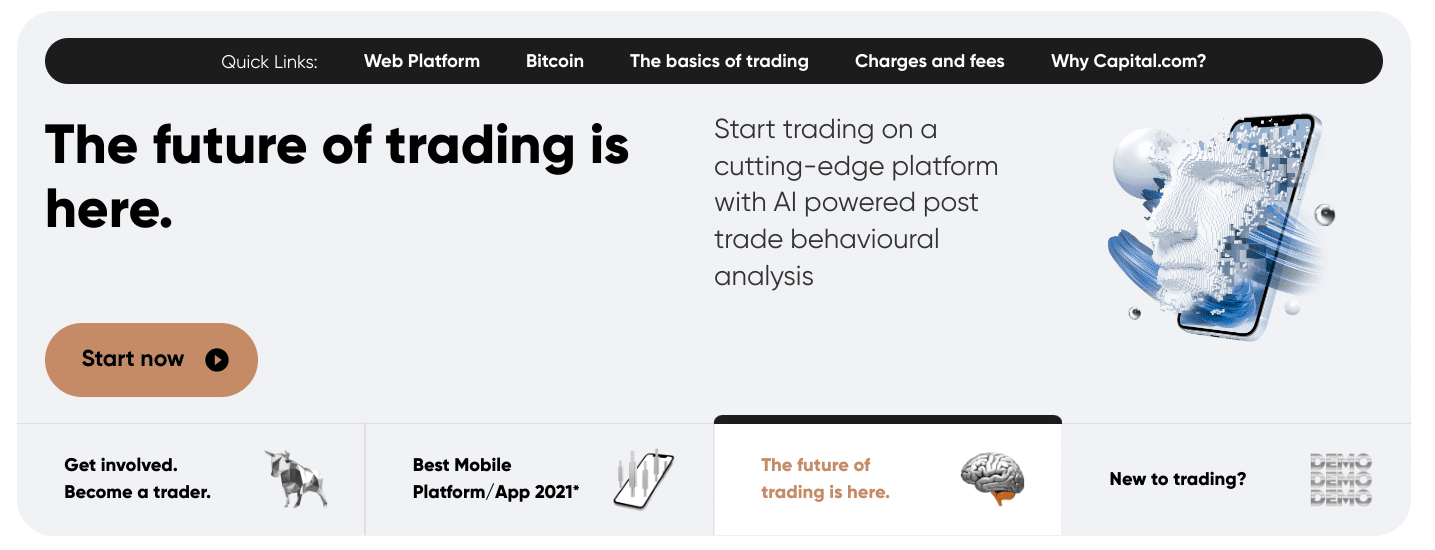

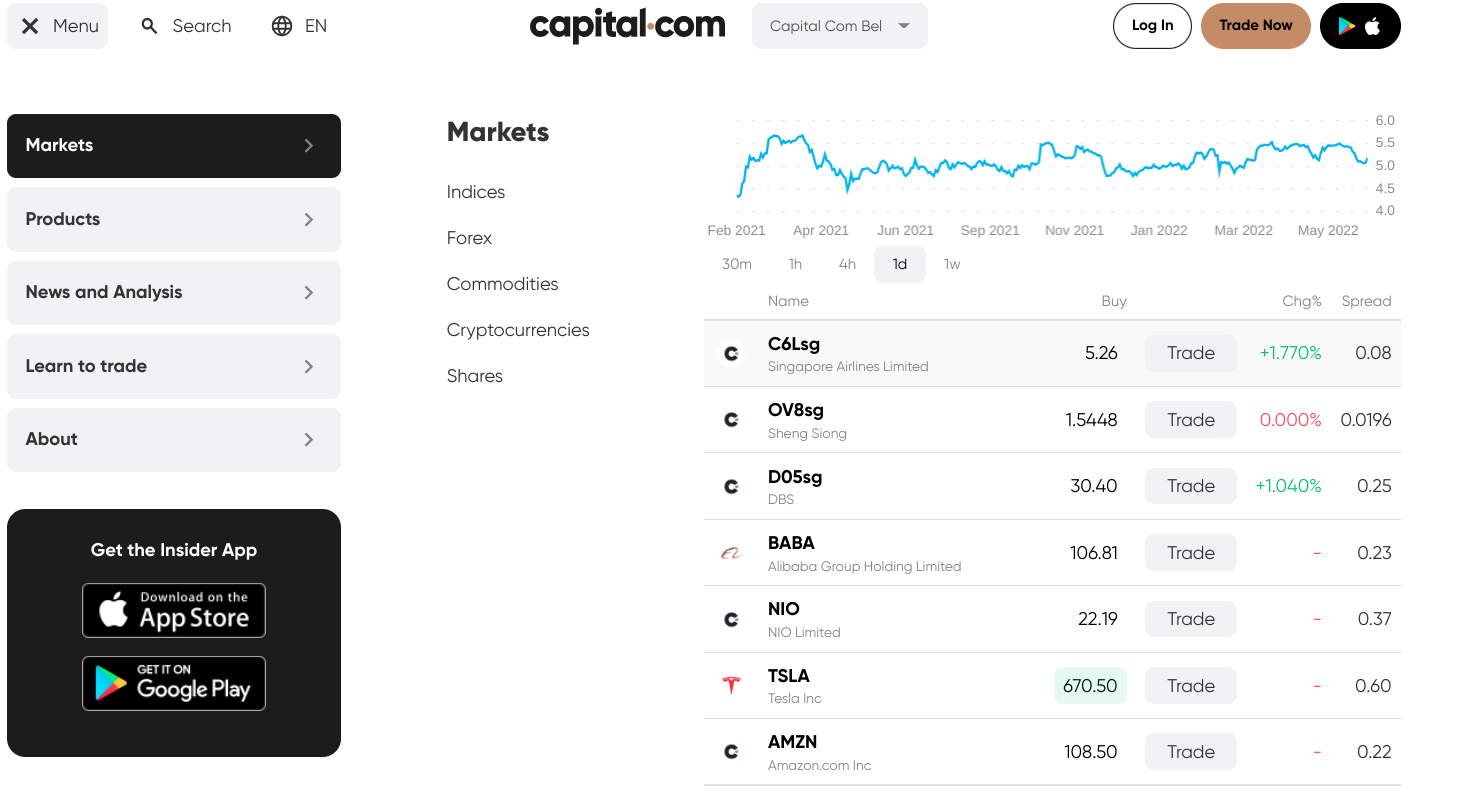

1. Capital.com

![]()

Capital.com is a stock CFD trading platform in Singapore. Here, people can speculate on more than 5,000 shares and those who qualify can trade with leverage.

For those unaware, CFDs allow people to predict the rise or fall of a share price without having to own the stock. Instead, the CFD merely tracks the underlying asset. This also enables traders to open a larger position than their funds would otherwise allow. Ever wondered what the most popular crypto exchange in Singapore is? Capital.com also offers access to crypto CFDs which means traders can buy Bitcoin CFDs and speculate on the price movements of the world’s largest cryptocurrency.

CFDs also allow people to speculate in either direction, meaning they can try to make gains from a stock that is falling in value. Leverage up to 1:5 is offered on stocks. Inexperienced Singaporean traders should use leveraged trading with caution, as it also magnifies losses.

There are multiple drawing tools on the Capital.com platform and over 75 indicators for those who wish to carry out technical analysis. The ‘learn to trade’ section includes basic trading guides covering various assets, as well as some finance courses.

The ‘news and analysis’ suite covers webinars, insights, explainers, and an economic calendar. In terms of safety. Capital.com is regulated by the FCA, ASIC, NBRB, and CySEC. As such, this is one of the safest places to trade stocks in Singapore.

Moreover, according to regulatory guidelines, Capital.com stores its clients’ money in segregated bank accounts. Capital.com offers 24/7 support. Investors can contact the team via email or phone. There is also a comprehensive FAQ section that usually resolves the most common queries.

The minimum deposit is $20 and accepted payment methods include wire transfer, credit/debit card, WebMoney, Skrill, and Neteller. Note that wire transfers require a minimum deposit of $250 (around S$346). The minimum stake to trade stocks is only $1.

| Supported Shares | 5,000+ |

| Share Trading Commission | 0% |

| Minimum Share Purchase | $1 |

| Minimum Deposit | $20 |

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. EasyEquities

EasyEquities is a popular option for traders who want to add stocks to their portfolio in fractional quantities. On this platform, the minimum trade amount is just $1.

There is a wide range of stocks listed on EasyEquities. This platform also offers baskets and bundles, which refers to a group of pre-selected shares people can add to their portfolio via a single investment.

The trading fee to buy and sell stocks is 0.25% of the transaction. The platform states that there is a 1-cent minimum on smaller transactions. There is also a clearing service and admin fee listed in the fee table, which is 0.31% on buy and sell orders.

This platform also offers ETFs. Regulation comes from the FSCA and ASIC. EasyEquities is based in South Africa but international payments can be made to fund a USD-based account on the platform.

Traders can fund their EasyEquities account via a credit/debit card or bank transfer. There is no deposit fee charged by the platform. However, it’s wise to check the potential charges from the card provider.

| Supported Shares | Multiple global exchanges |

| Share Trading Commission | 0.25% |

| Minimum Share Purchase | $1 |

| Minimum Deposit | None stated |

3. Alpaca Trading

Alpaca Trading allows Singaporean residents to buy and sell stocks via algorithmic tools. Put simply, traders can link the account to Alpaca’s automated trading system. This enables orders to be executed automatically based on pre-defined rules and conditions.

Traders can get started by allocating as little as $1, which in most cases means they are buying a fraction of a share. This platform is also a popular broker for US stocks in Singapore. In fact, the platform only offers US-listed stocks. Regulatory fees might apply on sell orders placed at Alpaca Trading.

The platform also states that traders who choose to buy or sell stocks with a wire transfer will be charged 1.5% or $25, depending on which is less. This applies to all incoming and outgoing transactions. That said, when traders buy, sell and short US stocks via the API, this will be on a commission-free basis.

There is no minimum deposit to open a live account. For anyone unsure about utilizing APIs for algorithmic stock trading, there is a demo account available.

| Supported Shares | 8,000+ including ETFs |

| Share Trading Commission | 0% when using APIs |

| Minimum Share Purchase | $1 |

| Minimum Deposit | None stated |

4. Passfolio

Passfolio offers Singaporean traders acces to over 6,000 stocks, ETFs, ADRs and REITs. The minimum investment when buying stocks is $5 via fractional trading. The platform lists lots of US stocks, albeit, international equities are offered as ADRs.

In terms of fees, international credit/debit cards will incur a fee of 5%. Wire transfer deposits are free, whereas withdrawals attract a fee of $35. When buying and selling stocks, the first 10 are commission-free on US-listed shares.

After this, the platform charges 0.25% per order, with a minimum and maximum of $1 and $8 respectively. Third-party payment providers such as Revolut and TransferWise are free of charge.

All stocks valued at less than $5 per share will attract a fee of $0.02. Passfolio allows traders to utilize automated investing tools via the platform’s Robo Advisor. Passfolio will ask the trader some questions about their risk tolerance and goals.

Next, the platform will choose a suitable portfolio of stocks and manage it using a sophisticated algorithm. Passfolio also offers a mobile phone app that permits trading on the move.

| Supported Shares | 6,000+ including ETFs, ADRs and REITs |

| Share Trading Commission | 0.25% (min $1, max $8) per order after 10 monthly trades. Securities less than $5 cost $0.02 per share. |

| Minimum Share Purchase | $5 |

| Minimum Deposit | None stated |

5. MooMoo

MooMoo is a popular choice for those who want to buy US stocks in Singapore. All US stocks are offered commission-free for one year. After that, the fee is $0.99 per order, which is around S$1.40.

Traders can also access popular shares on the SGX and also the HKG. Although note that the commission fee, in this case, is 0.03% of the transaction amount, with a minimum of $0.99 per order.

MooMoo also lists a platform fee of 0.03% of the transaction amount. There is also a trading fee of 0.0075% noted, as well as a clearing charge which is 0.0325% of the transaction amount.

This platform is also popular for its sign-up offers. For instance, at the time of writing, MooMoo offers a list of rewards that includes a spin on the wheel for a free share up to the value of S$1,000.

There is also a S$30 Fund Cash coupon up for grabs and S$10 for stocks. When trading via the MooMoo app, the equities are offered by Futu, which is licensed by the MAS in Singapore. The platform states that it has also been given approval in principle for SGX membership.

Deposit methods include bank transfers and Instant DDA. The latter is only possible if the DDA function has been activated. There is no fee, and the platform estimates this takes around 15 minutes to clear. A bank transfer may attract fees depending on the provider and this can take up to 2 business days to arrive.

| Supported Shares | Several thousand |

| Share Trading Commission | 0% on US stocks for the first year, $0.99 after. SGX stocks carry a commission of 0.03% |

| Minimum Share Purchase | $1 |

| Minimum Deposit | None stated |

6. TD Ameritrade

Traders who want to learn how to buy US stocks in Singapore might come across TD Ameritrade. This platform lists over 3,500 stocks, as well as ETFs, futures, and options.

US stocks are offered without commission. However, this does not apply to other exchanges and markets. Moreover, option trades attract a fee of $0.70 and OTC stocks are charged at $7.44 (around S$10.30).

We found some other fees at TD Ameritrade. This includes an outgoing wire transfer fee of $25. Traders can fund their TD Ameritrade account via bank wire, cheques, transfers from other brokers, and also DBS/POSB.

There are lots of trading tools at TD Ameritrade. This includes the Thinkorswim platform which is packed with advanced charts, indicators, and other tools needed to perform technical analysis. There is also an educational area with simple guides and tutorials.

| Supported Shares | 3,500+ |

| Share Trading Commission | 0% on US stocks |

| Minimum Share Purchase | N/A |

| Minimum Deposit | $3,500 |

7. Syfe Trade

Syfe Trade has an introductory offer for all new traders. The first five trades will be free from charges. After this, a charge of $0.99 is applied to each trade.

Traders can buy fractional shares at Syfe Trade from just $1. Moreover, people can invest in a basket of assets via a single trade.

The managed portfolio is called The Syfe Equity 100. This features over 1,500 stocks from the US, China, and more. There is more than one to choose from and the portfolios are fully allocated and managed by the platform. This allows traders to diversify passively.

The platform states there are over 10,000 US-listed stocks available to buy and sell. For safety, Syfe Trade is registered with the MAS and is also a member of SIPC. The latter serves as a sub-custodian for traders’ accounts.

Deposit methods include PayNow and FAST transfer/internet banking. Like many platforms, Syfe Trade also offers a free mobile app.

| Supported Shares | 3,500+ |

| Share Trading Commission | 0% for the first five trades, $0.99 thereafter |

| Minimum Share Purchase | $1 |

| Minimum Deposit | N/A |

Popular Singapore Stock Brokers Compared

Below is a table that compares the above-mentioned platforms.

| Stock Brokers | Supported Shares | Commission | Min Share Purchase | Min Deposit |

| Capital.com | 5,000+ | 0% | $1 (around S$1.40) | $20 (around S$28) |

| EasyEquities | Multiple exchanges | 0.25% | $1 | None stated |

| Alpaca Trading | 8,000+ including ETFs | 0% when using API | $1 | None stated |

| Passfolio | 6,000+ including ETFs, ADRs and REITs | 0.25% (min $1, max $8) per order after 10 monthly trades. Securities less than $5 cost $0.02 per share. | $5 (around S$7) | None stated |

| Moomoo | Several thousand | 0% on US stocks for the first year, $0.99 after. SGX stocks carry a commission of 0.03% | $1 | None stated |

| TD Ameritrade | 3,500+ | 0% on US stocks | N/A | $3,500 |

| Syfe Trade | 10,000+ | 0% for the first five trades, $0.99 thereafter | $1 | N/A |

The Basics of Buying Stocks in Singapore

It’s important for traders to understand the basics of how to buy shares in Singapore safely.

- Carefully select a reputable and regulated brokerage: When choosing a broker, look for a provider that’s regulated by more than one financial body. Brokers that hold a licenses will have to comply with various regulatory guidelines and offer a fair service to all traders.

- Research stocks in full and consider goals: It’s vital that traders carry out research of their own prior to investing in stocks. For instance, for some traders, US-listed equities are preferred. There’s also the option of seeking out dividend-paying stocks, or those that are in a specific industry.

- Decide how many shares to buy: Some stocks are valued at thousands of dollars. As such, traders can first think about how much they wish to allocate to stock trading.

How do I Find Popular Stocks to Watch in Singapore?

The task of finding popular shares to invest in can be daunting. There is a wide variety of SGX stocks, not to mention markets in the US, the UK, Australia, Hong Kong, and beyond.

Consider the Industry or Sector

Traders can choose a stock located in an industry they are particularly interested in, such as technology for example.

- Some of the most common sectors to trade are healthcare, consumer staples, and energy

- However, there are more niche markets that focus on a specific product, like insurance or computer chips

- Some traders identify which industry or sector they want to invest in by checking out what the current trends are

- For example, the renewable energy sector and EV companies have seen a huge rise in interest

- This was helped by the widespread concerns surrounding climate change

Ensure the stock broker chosen to fulfill the order is able to offer a wide range of shares from different industries to make diversification possible.

Look at the Company’s Financials

All publicly-traded companies are required to release financial information on a quarterly basis and this can be very telling.

Of course, if a company is considered a start-up, or has been hit particularly hard by COVID-19, such as the travel industry, we might expect some negatives.

That said, if a company seems to be doing well financially, this usually bodes well with potential investors. As supply and demand go, the more people that invest, the higher the stock price tends to go and the more likely it is a trader can make a profit.

10 Popular Stocks to Watch Right Now in Singapore in 2022

Below we explore 10 popular stocks to buy right now:

1. Apple

Apple needs very little introduction. The company brought products such as the Mac computer, the iPhone and iPad, Apple Pay, and its own range of smartwatches to the masses.

This company’s shares are traded on the NASDAQ. Over the last five years, Apple stock has gone up by nearly 276%. In its most recent earnings report, the multi-trillion-dollar company generated an increase in revenue of 8.59%. Additionally, Apple’s net income increased by 5.84%.

Apple moves with the times, has a loyal customer base, and the company’s growth seems likely to continue for the foreseeable future. More recently – Apple moved into the buy-now-pay-later space. In 2021, this market was estimated to be worth over $125 billion.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

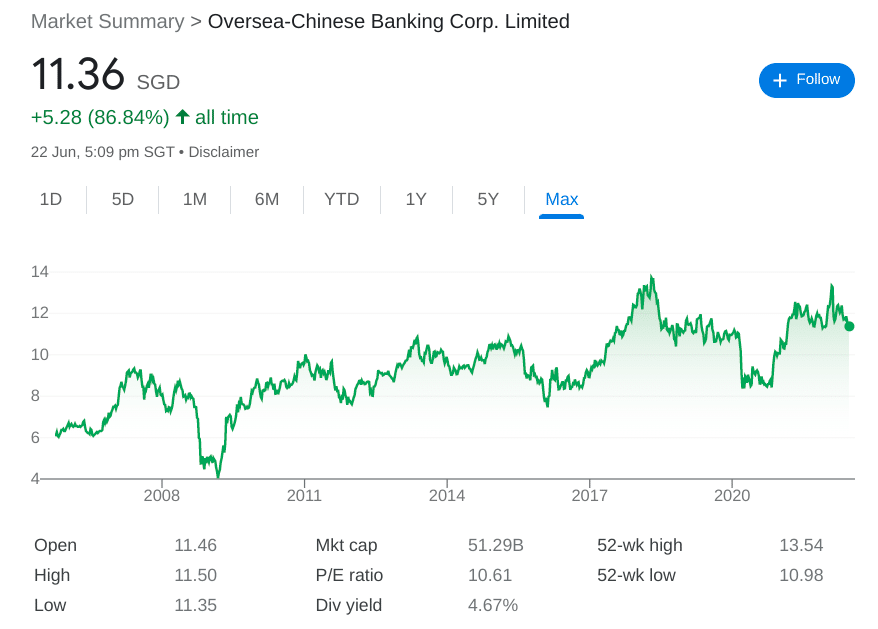

2. OCBC Bank

The Oversea-Chinese Banking Corp was founded in 1932 and is based in Singapore. The firm is referred to as OCBC Bank by many and is listed on the SGX. OCBC Bank is one of the largest banking companies in Singapore.

Other key markets include Greater China, Malaysia, and Indonesia. OCBC Bank is one of the major players in the market for personal lending, small and medium-sized businesses, home loans, and bancassurance sales.

Over five years of trading on the SGX, OCBC shares have increased by 6.57%. This is a high-yield dividend-paying stock. At the time of writing, the running dividend yield is over 4.6%.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

3. Coca-Cola – Large-Cap American Multinational Beverage Company

Coca-Cola is known all around the world for its fizzy beverages and its stock has increased by around 34% in the last five years of trading.

The company is a market leader in its field. In Coca-Cola’s quarterly financials in April 2022, the company reported a revenue increase of 16.31% year-on-year. Net income increased by 23.88% and its net profit margin was 6.51% higher.

Coca-Cola has more than 200 brands and is also gaining traction in the alcoholic beverage space. This is a dividend-paying stock, with the running yield as of writing at nearly 3%.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

4. Silverlake Axis – Customized Banking Software Solutions Company

This is a Malaysian company that has been operational since 1989 and was added to the SGX in 2003. When it comes to core banking software, Silverlake Axis is the industry leader in Southeast Asia.

Major companies in the retail, banking, insurance, logistics, and payments sectors use its unique software. Anyone looking at how to buy dividend stocks in Singapore could also consider Silverlake Axis. The firm pays a modest running dividend of 1.39%.

In terms of the company’s performance on the SGX, in the last year of trading, shares have increased by 50%. According to its March 2022 quarterly financials, the company’s revenue was up by over 21.99% year-on-year

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

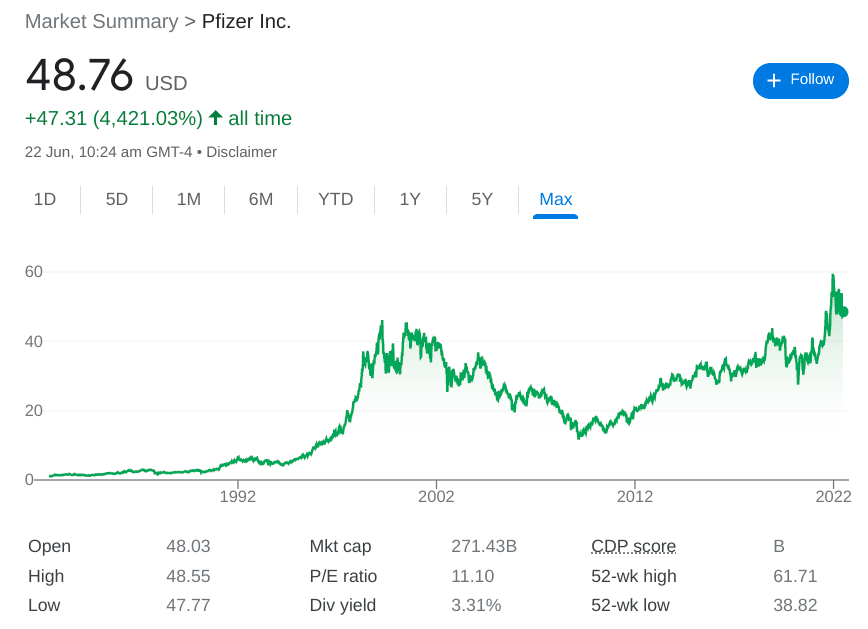

5. Pfizer – Biotech and Pharmaceutical Corporation on the NYSE

Interested in learning how to research international shares in Singapore? If so, Pfizer stock is listed on the NYSE. This is an American multinational company that many people know for its development of the COVID-19 vaccine.

This multi-billion dollar company has a wide range of other products and has strong anti-viral sales.

In the quarterly financial report released in April 2022, the company announced a year-on-year increase in revenue of 76.78%. Net income increased by 61.25%.

Over the last five years of trading, shares in Pfizer have increased in value by almost 50%.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

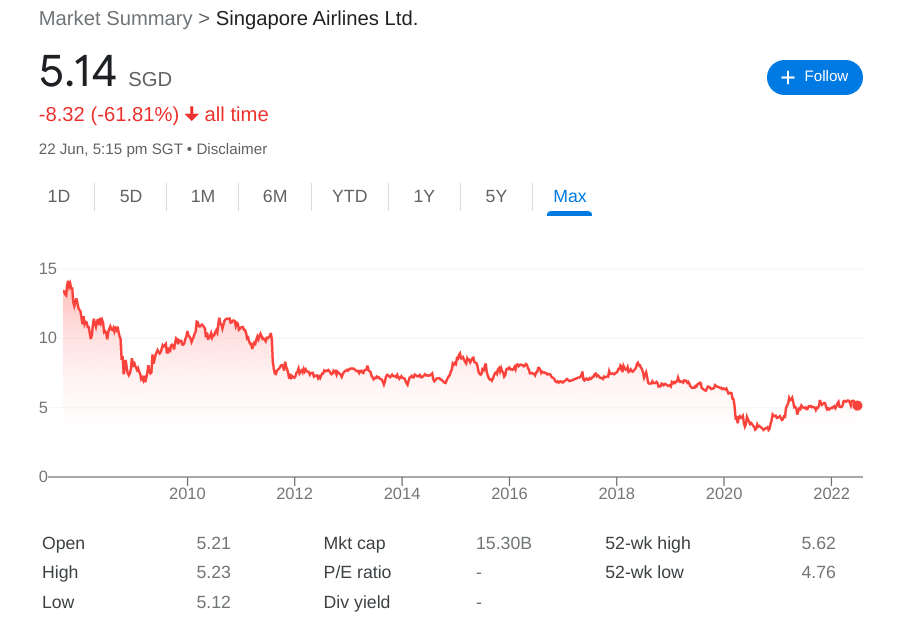

6. Singapore Airlines – SGX-Listed Stock Reporting Strong Financials

As more travel restrictions are lifted and airlines recover following the global pandemic, this company has the potential to be one of the poopular SGX stocks to watch. Singapore Airlines is one of the most notable airlines globally and has won multiple awards over the years.

Anyone who learned how to buy SIA shares a year ago would have seen their stock investment increase by 2.39%. This isn’t bad considering the impact COVID-19 and its variants have had on the travel industry. Moreover, this company announced strong financials in its March 2022 quarterly report.

Singapore Airlines’ revenue was up by over 119% year-on-year, and net income increased by more than 84%. Its net profit margin was almost 93% higher.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

7. Singapore Telecommunications – Telecommunications Conglomerate in Midst of Expansion

Singapore Telecommunications was founded in 1879. The company is usually referred to as Singtel. Some market analysts think this is one of the leading SGX stocks to watch right now. The firm is expanding its already vast broadband and mobile network as well as its digital ecosystem.

Moreover, Singtel is a telecommunications giant driven by a vision of building a more sustainable future. It ranks among Singapore’s biggest providers of mobile networks. More recently, Singtel has partnered with Ericsson.

This collaboration helped it to become the first company in Southeast Asia to achieve download speeds of 5.4 Gbps on 5G standalone New Radio-Dual Connectivity. In the past year of trading, Singtel stock has increased by almost 10%.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

8. Ford – Legacy Car Maker Accelerating its Commitment to EVs

Singaporean traders that are interested in the electric vehicle market might not have considered Ford. This car manufacturer was founded in 1903 and its stock trades on the NYSE.

Ford has committed to manufacturing vehicles that are kinder to the planet. The company plans to produce two million EVs every year by 2026 and will invest billions of dollars to make it possible.

In the last five years of trading, shares have increased by a little over 5%. Ford pays a dividend yield of 3.46% at the time of writing.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

9. Revlon – Global Beauty Products Company

Looking at the financials of the company, it’s easy to see why Revlon filed for bankruptcy protection.

Revlon stock experienced an increase in June 2022, following reports on the potential acquisition of the company to save it. According to market analysts, if a company such as Reliance offers Revlon a buy-out, the firm stands a better chance of improving its long-term outlook by reorganizing its legacy capital structure.

In a similar fashion to what happened to companies like Gamestop and AMC, retail investors have taken notice of Revlon’s struggles and it seems to have become a meme stock. On June 13th, 2022, Revlon stock was $1.17. By the 22nd, it had skyrocketed by over 650% to almost $8.80.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

10. DBS Group – Singapore-Based Banking Group

DBS Group conducts business through its subsidiary, DBS Bank. This company provides a variety of commercial banking and financial services, primarily in Asia. The firm’s main segments are Consumer Banking/Wealth Management, Institutional Banking, and Treasury Markets.

This is one of the biggest companies of its kind in Singapore and its stock is listed on the SGX. The company also has a presence in 18 other markets. Notably, DBS Group’s financial reports in March 2022 showed us that year-on-year revenue had fallen by 3.95% and net income had dropped by 10.35%.

Losses were also reported by other major Singaporean banks. This is likely down to weaker economic growth. That said, a relaxation of COVID-19 restrictions and rising interest rates could work out well for the banking group.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Fundamentals of Investing in Stocks

Dividend Gains

As we touched on in our list of popular stocks to watch right now, some companies pay dividends.

As such, traders who are looking to learn how to buy stocks in Singapore for a passive income should research dividend-paying firms. Most dividend-paying companies distribute a payment on a quarterly basis.

One of the popular SGX stocks to watch now for dividends is OCBC bank, with a running dividend yield of 4.67% at the time of writing.

Coca-Cola also springs to mind. Following a 4.8% rise in its quarterly distribution per share to $0.44 in 2022, it became a member of the six-decade dividend growth club.

Capital Gains

This refers to the profit made from the sale of shares. Capital gains are therefore received when the selling price of the stock exceeds its purchase price.

For example, if a trader buys 50 shares for $100 each, the total investment value is $5,000. If the investors sell the same shares for $7,000 at a later date, the capital gains amount is $2,000.

Compound Interest

Investors can compound their returns by reinvesting dividends received into their overall share pool rather than withdrawing them.

How to Buy Penny Stocks in Singapore

Once a trader has learned how to invest in stocks in Singapore, they can also buy penny shares. Penny stocks refer to shares in companies that trade for less than a dollar.

Beginners might be better off sticking with more liquid offerings, such as the shares we’ve talked about today. In this case, cashing out at a later date won’t be a problem.

Are Shares Taxed in Singapore?

Sales of shares, fixed and intangible assets and gains made in capital transactions are not subject to taxes in Singapore.

Conclusion

Today we have explained the ins and outs of how to research stocks in Singapore. We’ve also listed a handful of popular stocks to watch now in Singapore and explained how traders can find them.

#cryptocurrency,#cryptocurrencynews,#cryptocurrencytrading,#cryptocurrencyexchange,#cryptocurrencymining,#cryptocurrencymarket,#cryptocurrencycommunity,#cryptocurrencys,#cryptocurrencyinvestments,#cryptocurrencyinviestments,#cryptocurrencyeducation,#cryptocurrencyrevolution,#allsortofcryptocurrency,#cryptocurrencytop10,#cryptocurrency_news,#instacryptocurrency,#cryptocurrencymemes,#investincryptocurrency,#cryptocurrencyinvestment,#cryptocurrencyisthefuture,#cryptocurrencyinvesting,#newcryptocurrency,#cryptocurrencylife,#cryptocurrencytrade,#cryptocurrencylifeinvest,#cryptocurrencymillionaire,#cryptocurrencytrader,#cryptocurrency_updates,#tradingcryptocurrency,#cryptocurrencysignals,#cryptocurrencytradingplatform,#cryptocurrencysolution,#cryptocurrencytraders,#cryptocurrency_for_dummies,#cryptocurrencymalaysia,#cryptocurrencytakingover,#cryptocurrencybali,#cryptocurrencyinvestors,#cryptocurrencyindex,#cryptocurrencyattorney