Forex brokers allow retail clients in the UK to buy and sell currency pairs with the view of making trading profits.

In this guide, we compare the 10 best forex brokers in the UK right now. The forex brokers discussed on this page offer a wide selection of forex pairs at low fees, alongside an assortment of trading tools and features.

The 11 Best Forex Brokers in the UK

Below is a list of the best forex brokers in the UK – as per our comprehensive market research. Most of these forex brokers are also considered to be amongst the best trading platforms in the UK.

- Capital.com – Overall Best Forex Broker in the UK

- eToro – FCA-Regulated Forex Broker With Copy Trading Tools

- XTB – Trade Forex Pairs With Micro-Lot Stakes

- Axi – Award-Winning Forex Broker Offering Copy Trading

- AvaTrade – Tax-Free Forex Trading Servies via Spread Betting

- Pepperstone – Top Forex Broker for Raw Spread Accounts

- Forex.com – Specialist Forex Broker With 80+ Pairs

- IG – UK Forex Broker With Competitive Fees

- XM – ECN Broker with 55+ Forex Pairs

- FXTM – Popular Forex Broker With Three Account Types

- CMC Markets – Trade More Than 330+ Forex Pairs

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Best UK Forex Brokers Reviewed

In the sections below, we rank and review the 10 best forex brokers in the UK.

Each broker differs from the next in terms of supported forex markets, fees and spreads, customer support, and trading tools. As such, there is a forex broker to suit all investor profiles.

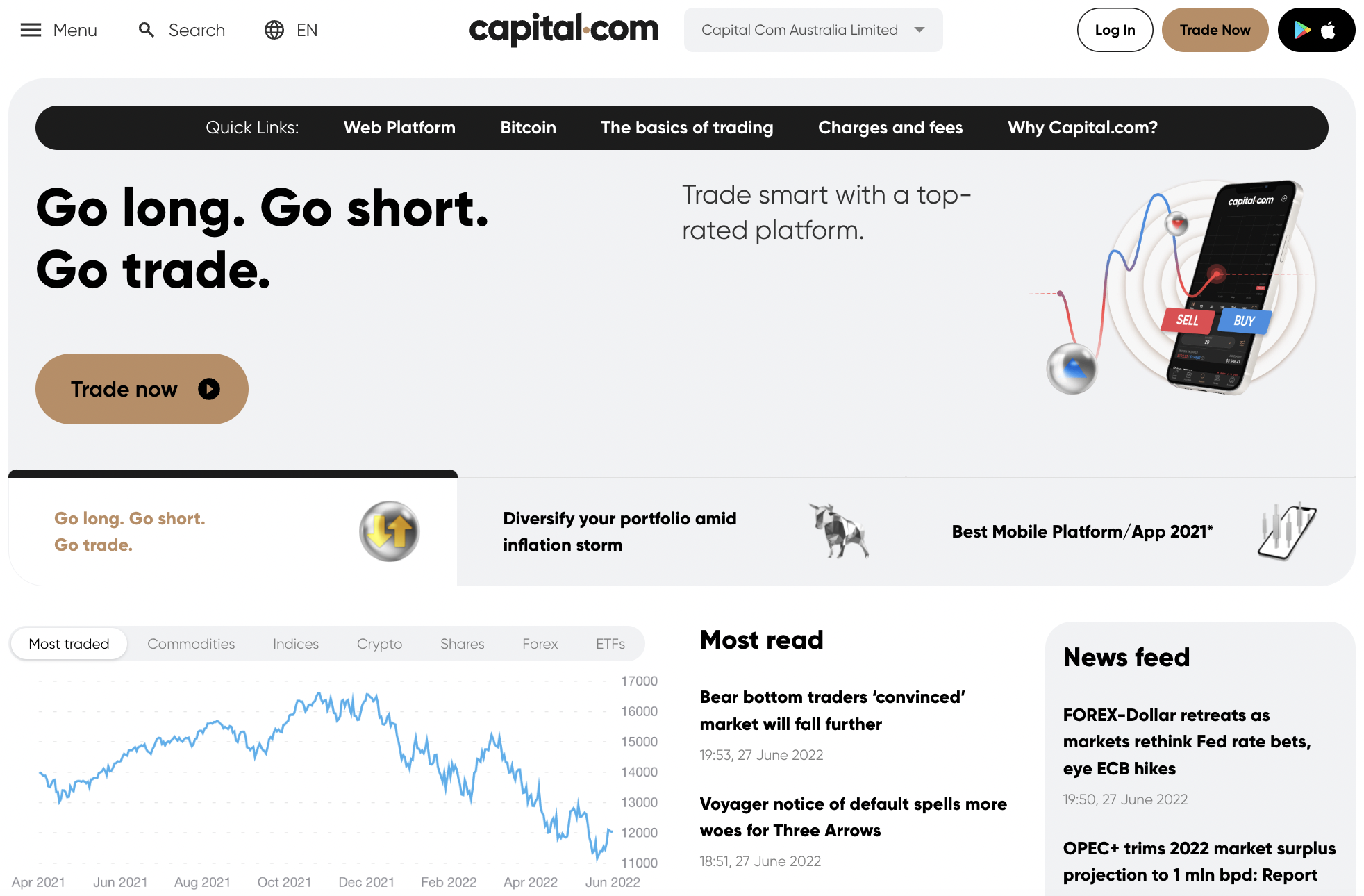

1. Capital.com – Overall Best Forex Broker in the UK

![]()

Capital.com is the overall best spread betting platform and best forex broker in the UK. This day trading platform offers no less than 138 forex pairs as of writing, which covers all majors and minors, alongside plenty of exotic currencies. Each and every supported forex pair can be traded at 0% commission at Capital.com.

Spreads on this platform are also very competitive. The likes of EUR/USD, for example, can be traded at a minimum spread of just 0.6 pips. When entering a position, Capital.com supports both long and short orders. In turn, this means that UK traders can attempt to profit from both rising and falling currency prices.

Furthermore, as per UK regulations, Capital.com enables its users to trade major forex pairs with leverage of up to 1:30. This means that for every £100 staked, trading capital of £500 can be obtained. When trading minor and exotic pairs, UK traders will be offered leverage of up to 1:20.

When attempting to predict the currency markets, Capital.com offers plenty of useful tools and features. For example, traders will have access to real-time pricing charts, technical indicators, and risk-management orders. Those wishing to take their technical analysis endeavors to the next level might consider trading via MT4. Users who prefer to gain exposure to the markets anytime and anywhere will appreciate Capital.com’s top-rated stock trading app UK.

When it comes to safety, Capital.com is regulated on multiple fronts. This includes licenses with the FCA, ASIC, CySEC, and NBRB. Capital Com (UK) Ltd is also a member of the FSCS. In addition to forex, Capital.com is one of the best platforms in the UK to trade stocks. In total, users will have access to over 5,400 stock CFDs from multiple UK and international markets.

Capital.com is one of the best CFD brokers in the UK. As such, users can access CFDs that track ETFs, hard metals, energies, indices, and much more. Those in the UK wishing to start trading at Capital.com right now will only need to meet a minimum deposit of £20 (debit/credit cards and e-wallets) or £250 (bank transfers). UK residents benefit from fee-free deposits on all payment methods.

What We Like

- Overall best forex broker in the UK

- Trade forex with leverage

- Regulated by the FCA, ASIC, CySEC, and NBRB

- Supports commodities, forex, stocks, and indices

- 0% commission and tight spreads

- CFDs and tax-free spread betting markets

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. eToro – FCA-Regulated Forex Broker With Copy Trading Tools

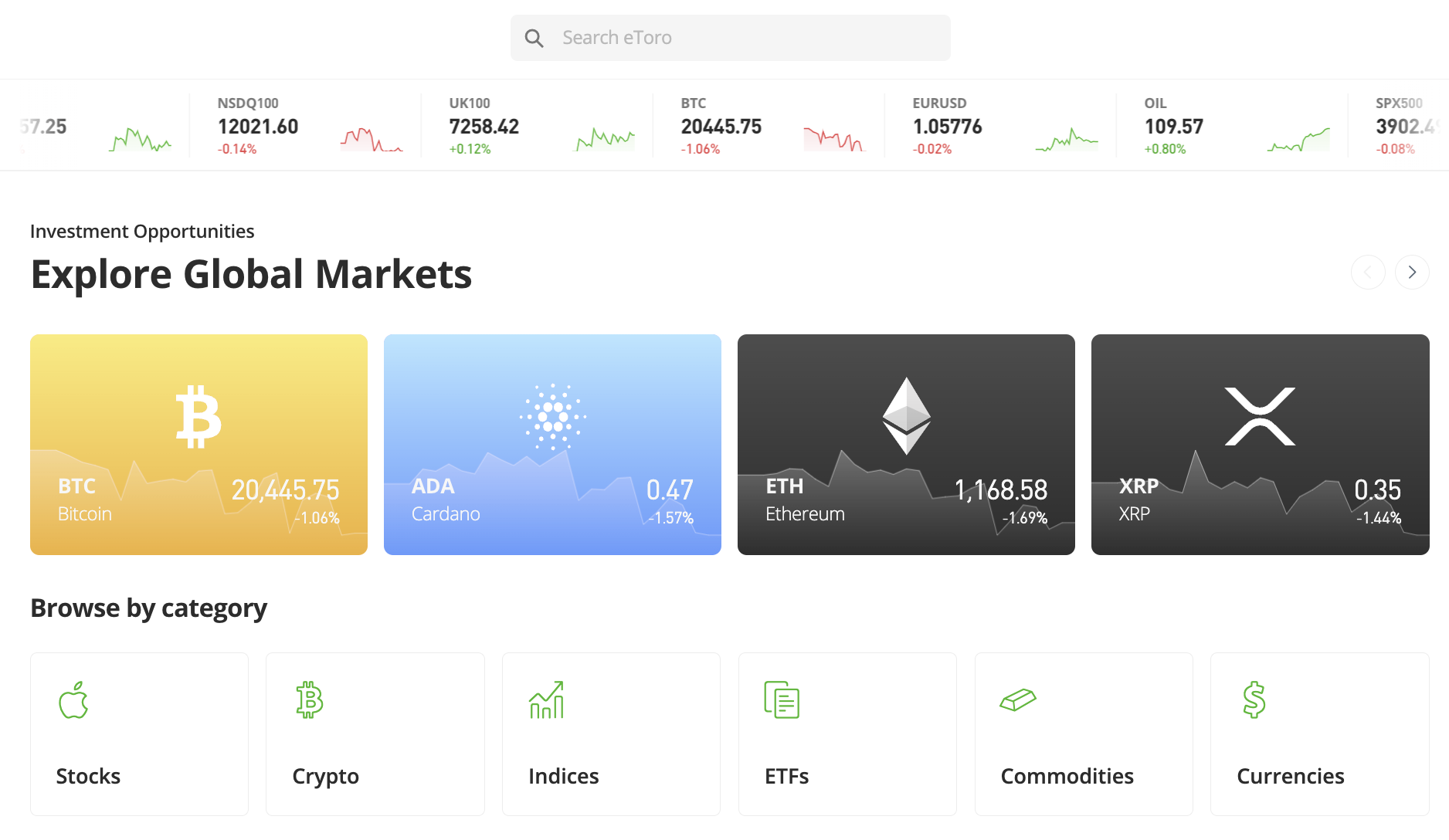

eToro is a regulated forex broker that is authorized and licensed by the FCA, SEC, CySEC, and ASIC. The platform is also covered by the FSCS. We like eToro for many reasons, one of which is that the platform is perhaps the best forex trading platform in the UK for beginners.

Its web-based trading suite is very user-friendly, and traders will have access to simple but highly customizable pricing charts. The filter and search functions at eToro make it easy to find a suitable forex pair to trade and placing orders is a straightforward process.

When it comes to fees, eToro allows UK traders to buy and sell forex pairs on a spread-only basis. Spreads will vary depending on the instrument, albeit, EUR/USD starts at 1 pip. Leverage is offered to UK forex traders up to 1:30. This means that the minimum stake when utilizing the full leverage limit is just $33.33 – or about £28.

In total, eToro offers dozens of forex pairs, most of which come from the major and minor categories. A small number of exotic currencies are supported too. We also like that eToro allows UK residents to buy stocks and ETFs at 0% commission. This covers markets in the UK alongside the US, Hong Kong, France, Canada, and more.

Additional asset classes supported by eToro are inclusive of commodities and indices. Furthermore, UK residents can buy cryptocurrency assets at a fee of just 1% plus the market spread. eToro supports nearly 80 different cryptocurrencies and the minimum investment requirement is a mere $10 – or about £8. This means you can buy Bitcoin in the UK with low fees and tight spreads.

Perhaps, the overarching reason why eToro is one of the best brokers for forex in the UK is that it offers an industry-leading copy trading service. In a nutshell, this enables eToro users to copy the investments of a successful and proven forex trader. Therefore, each and every trading position entered by the investor will be copied over to the user’s eToro portfolio.

Crucially, the copy trading feature allows complete beginners to trade forex in the UK without needing to have any prior knowledge of how this investment space works. Moreover, we also like that eToro offers social trading tools. This allows users to communicate and share trading ideas with other eToro investors.

Those looking to start trading forex with eToro right now can open a verified account in under five minutes. The minimum first-time deposit for UK traders is just $10. Instant deposits can be made with a debit/credit card or an e-wallet like Paypal. Bank transfers are supported too.

Read More: Our comprehensive eToro review UK can be found here.

What We Like

- The best forex broker for beginners in the UK

- FCA regulated and FSCS protected

- Trade dozens of forex pairs on a spread-only basis

- Supports Copy Trading and Smart Portfolios

- Low minimum deposit of just $10 (about £8)

- Offers access to one of the best crypto wallets in the UK

Visit eToro Now

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider

3. XTB – Trade Forex Pairs With Micro-Lot Stakes

XTB is a CFD trading platform that offers everything from stocks and indices to ETFs and commodities. UK residents can also access a forex trading facility that covers 48 currency pairs. Micro-lot trading is supported, which means that investors can speculate on the forex markets with low stake requirements.

XTB notes that spreads start from just 0.1 pips when trading forex and no commissions are charged. Leverage of up to 1:30 is offered on major pairs and 1:20 on minors/exotics. Each and every XTB user will have access to a personalized account manager. The market analysis section of the XTB website offers plenty of useful tools for forex traders.

This includes a financial news portal that updates XTB users with key market developments. The xStation 5 platform – which is native to XTB, offers lots of trading tools, technical indicators, and real-time charts. When it comes to deposits, no fees are charged on debit/credit card or bank account payments. Skrill, on the other hand, comes with a fee of 2%.

Also see our full XTB review.

What We Like

- One of the best forex brokers with low spreads

- 0% commission on all supported financial instruments

- Swap-free accounts available

Visit XTB Now

Your capital is at risk. 76% of retail investor accounts lose money when trading CFDs with this provider.

4. Axi – Award-Winning Forex Broker Offering Copy Trading

Although Axi provides access to stocks, commodities, indices and precious metals, it specializes in forex markets. In fact, it’s such an expert that it has won awards for best forex broker and best CFD provider. One of the reasons Axi is a top UK forex broker is that it offers $0 commission trading and access to more than 70 currency pairs.

Majors, minors and exotics are available on this fast execution platform that caters to beginners and advanced traders. The MT4 platform is available with advanced tools, but traders can test out the platform with a $50,000 demo account before going live. Trading a popular pair such as EUR/USD includes a spread of 1 pip, and traders can use 30:1 leverage to increase their positions.

A minimum deposit isn’t required for the standard and pro accounts, but the elite account has a minimum of $25,000. Spreads for the pro and elite account start from 0.0 pips, whereas the standard account spreads start from 0.4 but it doesn’t include commission.

Traders can optimize their trading by using Copy Trading, enabling traders to copy the trades of professionals, or incorporate PsyQuation and AutoChartists. These tools reduce traders mistakes by providing performance analytics and alerts of potential trades by scanning the market.

Another key aspect separating Axi from other brokers is the plethora of free educational material. Video tutorials, guides and webinars are available about trading and the platform. The Axi academy provides in-depth trading tuition.

What We Like

- Free educational content

- Copy Trading, PsyQuation and AutoChartist

- Three different account options

Your capital is at risk. 81.6% of retail investor accounts lose money when trading CFDs with this provider.

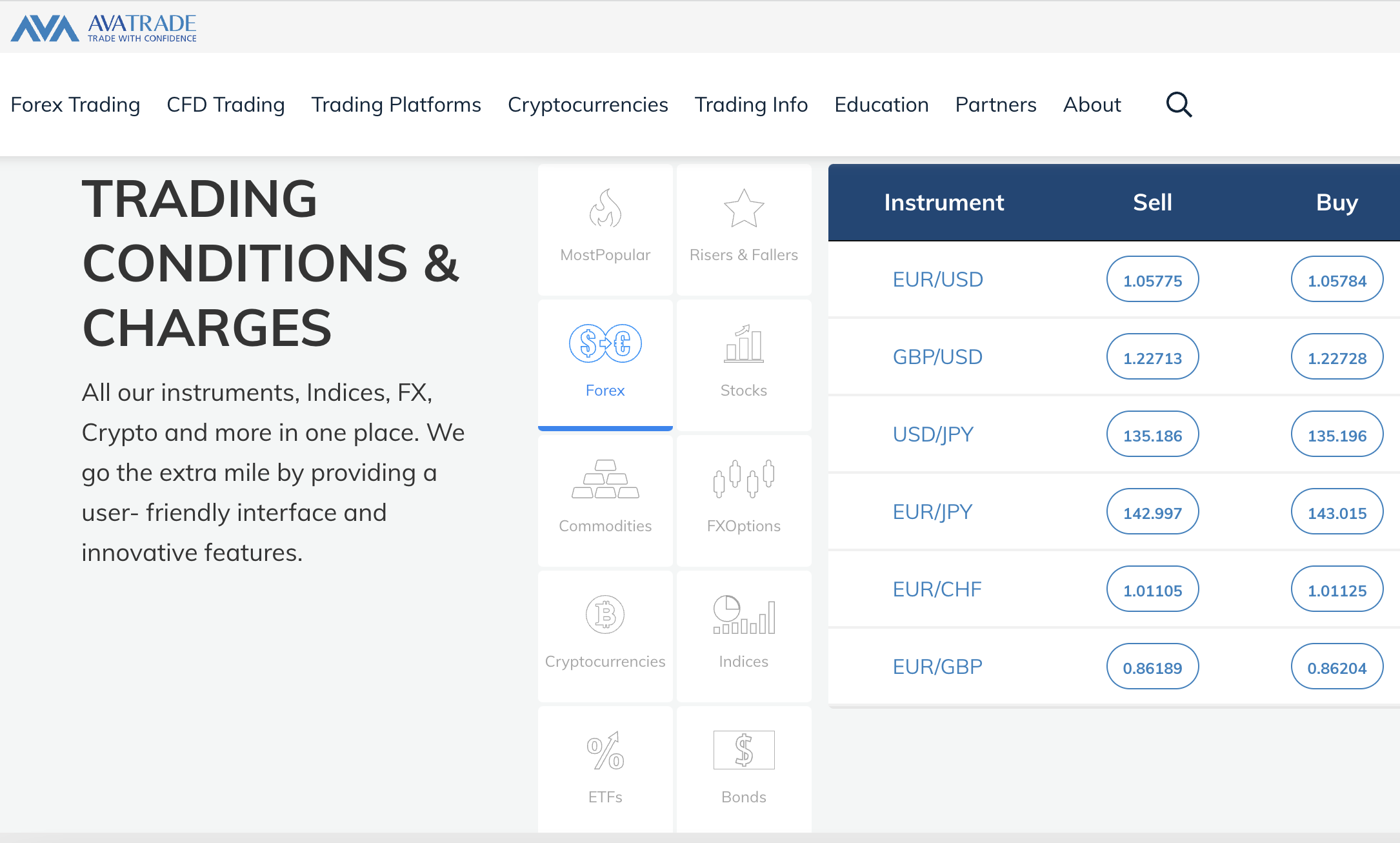

5. AvaTrade – Tax-Free Forex Trading Services via Spread Betting

AvaTrade is one of the best forex brokers in the UK for those looking to trade currencies on a tax-free basis. The reason this is possible is that AvaTrade offers a spread betting facility. In a nutshell, spread betting markets at AvaTrade track the real-time value of currency pairs.

Any gains made from a forex spread betting position are tax-free in the UK. Plus, AvaTrade offers leverage of up to 1:30 in its spread betting facility and both long and short positions are supported. Another major benefit of choosing AvaTrade is that no commissions are charged by the broker.

Spreads here are slightly higher than the market average, however, with EUR/USD costing a minimum of 0.9 pips. Nonetheless, we also like AvaTrade for its fee-free deposits, which is inclusive of debit/credit cards. Moreover, AvaTrade offers several platforms for traders to choose from, including both MT4 and MT5.

What We Like

- Connect to MT4, MT5, or cTrader

- Tax-free spread betting markets for UK forex traders

- Leverage offered on all markets

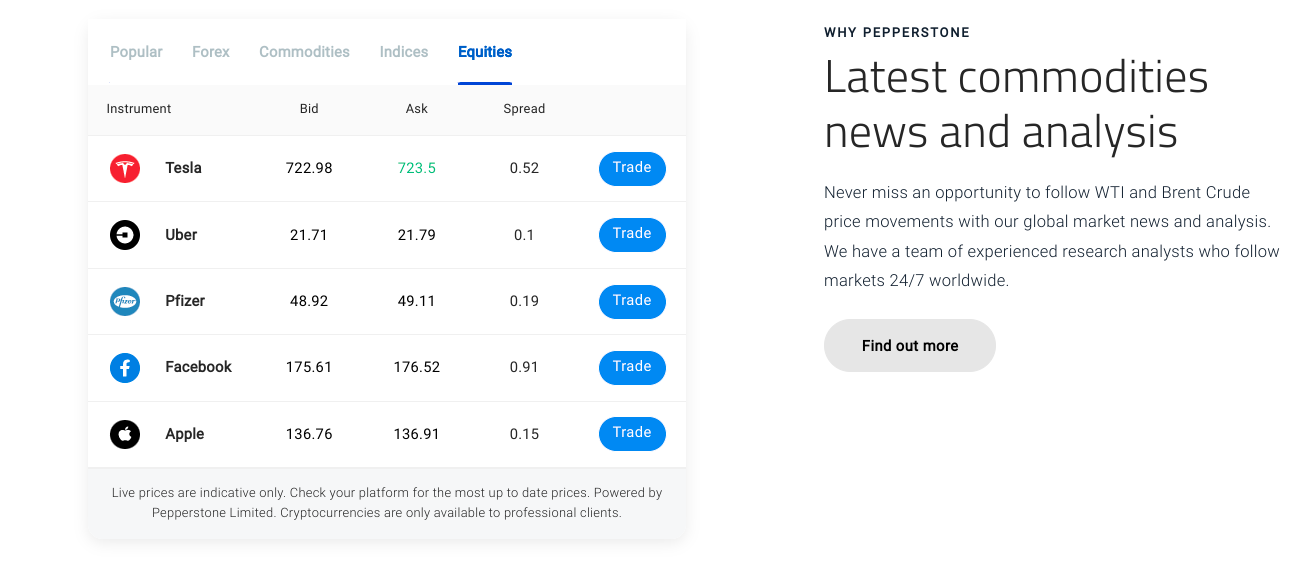

6. Pepperstone – Top Forex Broker for Raw Spread Accounts

![]()

Pepperstone is the best forex broker in the UK for raw spread accounts. This account type will suit investors who trade forex regularly, not least because major currency pairs can be accessed at 0 pips. The raw spread account attracts a commission of $3.50 for every lot traded.

Standard accounts are offered by Pepperstone too. This account type offers spreads from 0.6 pips on EUR/USD and all positions can be entered on a 0% commission basis. When it comes to funding, Pepperstone offers instant deposits via Paypal and debit/credit cards.

Bank transfers are accepted too but can take up to three working days to arrive. In terms of supported markets, in addition to offering over 60+ forex pairs, Pepperstone also lists stocks, ETFs, commodities, and indices. Finally, Pepperstone supports a wide selection of trading platforms, which includes MT4, MT5, cTrader, and TradingView.

What We Like

- One of the cheapest forex brokers for spreads

- Leverage offered on all supported markets

- MT4 forex broker

7. FOREX.com – Specialist Forex Broker With 80+ Pairs

Forex.com allows UK-based traders to access the currency markets at competitive fees. Across more than 80+ pairs, the broker does not charge any trading commissions.

Spreads start at 1 pip per slide on major pairs and Forex.com can be accessed online or via its mobile app for iOS and Android. Moreover, Forex.com also offers a desktop trading suite. Leverage is offered to UK retail clients at up to 1:30 on major forex pairs. The Forex.com platform offers plenty of trading tools.

This includes forex signals, technical insights, economic calendars, and news imported from Reuters. Forex.com users can also trade other financial instruments, which include stocks, commodities, indices, and more. Once a Forex.com account has been opened, UK traders can make a fee-free deposit via a debit/credit card, bank transfer, Skrill, or Neteller.

What We Like

- Free demo account

- MT5 forex broker

- Best forex broker in the UK for chart drawing tools

8. IG Markets – UK Forex Broker With Competitive Fees

Established in 1974 and based in the UK, IG is a popular brokerage and share dealing platform. This provider offers access to more than 80+ currency pairs, which covers a diversified blend of majors, minors, and exotics. Leverage of up to 1:30 is offered to UK retail clients and the platform offers negative balance protection.

We like that IG offers three different ways to trade forex on its platform. This covers tax-free spread betting and CFD instruments, as well as a DMA (Forex Direct) account. The latter is, however, only available to professional clients. Nonetheless, both the spread betting and CFD accounts are commission-free.

When it comes to spreads, IG offers EUR/USD at a minimum of 0.6 pips. This does, however, average 1.13 pips across the trading day. In total, IG offers more than 18,000 markets, which include real stocks and funds, as well as CFD indices, commodities, and more. UK clients are required to deposit £250 or more at IG and debit/credit card payments cost 1% when using Visa.

What We Like

- More than 18,000 financial instruments

- 80+ forex pairs

- Huge range of trading tools and features

9. XM – ECN Broker with 55+ Forex Pairs

XM is a global CFD broker that offers both standard spread trading accounts and ECN accounts with spreads as low as 0.0 pips. An ECN account at this broker requires just a £5 minimum deposit, making it one of the most accessible platforms for ECN forex trading in the UK.

At XM, traders can buy and sell more than 55 major and minor forex pairs. The broker offers leverage up to 1,000:1 for major forex pairs. Traders can access MetaTrader 4 or MetaTrader 5, although XM does not offer its own proprietary trading platform.

XM offers a variety of research tools for traders, including daily trade ideas and technical analysis summaries. The broker also has an economic calendar, weekly forex webinars, and educational resources for new traders.

What We Like

- ECN account with £5 minimum deposit

- Trade with MT4 or MT5

- Research tools including daily technical analysis

10. FXTM – Popular Forex Broker With Three Account Types

![]()

FXTM is a popular forex broker that offers three different account types to UK residents. This ensures that all investor profiles are catered for. First, the micro account offers commission-free trading with spreads that start at 1.5 pips.

The minimum deposit on the micro account is £50. Those able to deposit a minimum of £500 might consider opening an advantage account. While there is an average commission of between $0.40 and $2 applied to each trade, spreads start from 0 pips.

The advantage plus account offers the same pricing model as the micro option, but this also offers access to a higher margin call ratio of 80%. In terms of payments, FXTM supports debit/credit cards and e-wallets. UK residents are not charged any deposit fees.

What We Like

- Three account types offered to UK residents

- Deposit from just £50 to get started

- 0% commission accounts offered

11. CMC Markets – Trade More Than 330+ Forex Pairs

CMC Markets is the best forex broker in the UK for currency diversity. The reason for this is that CMC Markets offers UK investors access to over 330+ forex pairs. As such, this will suit traders that are looking to speculate on the future value of exotic currencies like TRY and ZAR.

Moreover, CMC Markets does not charge any trading commissions on forex. This is also the case for other supported asset classes, apart from stocks. The most competitive spread offered by CMC Markets is 0.7 pips, which is available across USD/EUR, USD/JPY, and AUD/USD.

Leverage of up to 1:30 is offered on all major pairs, and up to 1:20 on minors and exotics. We also like that CMC Markets offers traders the choice between CFDs and spread betting instruments. CMC Markets offers fast execution times, which an average execution speed of 0.0045 seconds.

What We Like

- Buy and sell more 330+ forex pairs

- Forex spreads start from 0.7 pips

- Heavily regulated

Top UK Forex Trading Platforms Compared

The 10 best forex brokers in the UK are compared in the table below:

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

How we Select the Best UK Forex Brokers

In order to separate the best forex trading platforms in the UK from the bad, we focused on a list of key criteria.

Below, we unravel the core metrics that we look for when ranking UK forex brokers.

Regulation

When choosing a forex broker, UK traders should look for platforms that are adequately regulated.

The best forex brokers in the UK that we reviewed today – which includes both Capital.com and eToro, are authorized and regulated by the FCA.

The best-regulated forex brokers in the UK are covered by the FSCS too.

Range of FX Pairs

Each and every forex platform discussed today offers access to major and minor pairs. The overall best forex brokers, however, also offer a wide selection of exotics.

Capital.com, for instance, offers 138 forex pairs in total as of writing, which covers plenty of emerging currencies.

Trading Fees

Trading fees typically cover commissions and spreads. No commissions are charged by top forex brokers in the UK, and spreads should be competitive.

As a prime example, Capital.com users will pay no commissions when trading forex and spreads start at 0.6 pips.

Non-Trading Fees

Non-trading fees can include charges on deposits, withdrawals, and inactive accounts. This should be checked when researching the best forex brokers in the UK.

Tools and Analysis

Irrespective of the trading strategy being utilized, forex speculators will need to have a range of tools at their disposal. At the forefront of this are technical indicators, economic calendars, custom order types, and comprehensive pricing charts.

We also like the copy trading tool offered on the eToro platform – which is fee-free. This enables the user to follow and copy the buy and sell orders of an experienced forex trader. And thus, this permits a passive way to speculate on the currency markets.

Minimum Deposit

The best UK forex trading platforms allow retail clients to get started with a small minimum deposit. At Capital.com, this amounts to a minimum of just £20. At eToro, the minimum is just $10 – or about £8.

Demo Account

It is useful to choose a forex broker that offers a free demo account. This will mirror live market conditions and give the user access to paper trading funds. And, in turn, the user can practice forex trading strategies without risking real money.

The best forex demo account that we came across is offered by eToro. All UK residents will get a paper trading balance of $100k – or about £80,000. There are no time limits on the eToro demo account, unlike other forex brokers in this space.

Mobile App

Forex brokers usually offer a mobile app that connects to the user’s account.

- The overall best forex trading app in the UK is offered by Capital.com, which is available to download for free on iOS and Android devices.

- For newbies, we found that eToro offers the best forex app in the UK for beginners.

We talk about the best forex brokers for mobile trading shortly.

Payment Methods

Most forex brokers in the UK allow account holders to deposit and withdraw funds via a debit/credit card. At Capital.com, traders can also choose from a number of e-wallets or perform a UK bank transfer.

Customer Service

We found that the best forex brokers in the UK offer customer support on at least a 24/5 basis. Top-rated platforms in this industry offer first-class customer service via live chat.

Best Forex Signals UK

Those in the UK looking for the best forex signals in the market might want to consider Learn2Trade, which has been active in this space for 15 years.

After signing up with this provider, members will receive up to three forex signals per day. Each signal that is posted will contain a range of important metrics that subsequently allow investors to trade forex without doing any research.

For example, Learn2Trade will explain which forex pair should be traded and whether the member should place a buy or sell order. The specific order prices on limits, stop-losses, and take-profits are also provided.

Learn2Trade offers a 30-day moneyback guarantee and 1-month premium plans start from £40.

Your capital is at risk.

Top Forex Apps UK

UK residents in the market for a top forex trading app should look for a list of core features, such as:

- Instant price alerts via notifications

- Real-time order execution

- Fully optimized trading experience for either iOS or Android

- Ability to check a portfolio at the click of a button

- Technical analysis tools

- Forex market news

- And more

As noted above, the overall best forex trading app in the UK is offered by Capital.com.

How to Start Forex Trading in the UK

We will now explain the required steps to start trading forex in the UK at Capital.com without paying any commission.

Step 1: Open a Capital.com Forex Broker Account

Visit Capital.com and open a forex broker account. Follow the on-screen instructions by providing the broker with some personal information. A username and password will also need to be entered.

For the KYC process, Capital.com requires a copy of the user’s passport or driver’s license. We found that in the vast majority of cases, the newly created account will be verified near-instantly.

Step 2: Deposit Funds

When making a deposit into a Capital.com account with an e-wallet or debit/credit card, UK residents will only need to cover a £20 minimum. However, this is increased to £250 when performing a UK bank transfer.

Choose the preferred payment type, specify the amount, and confirm the deposit.

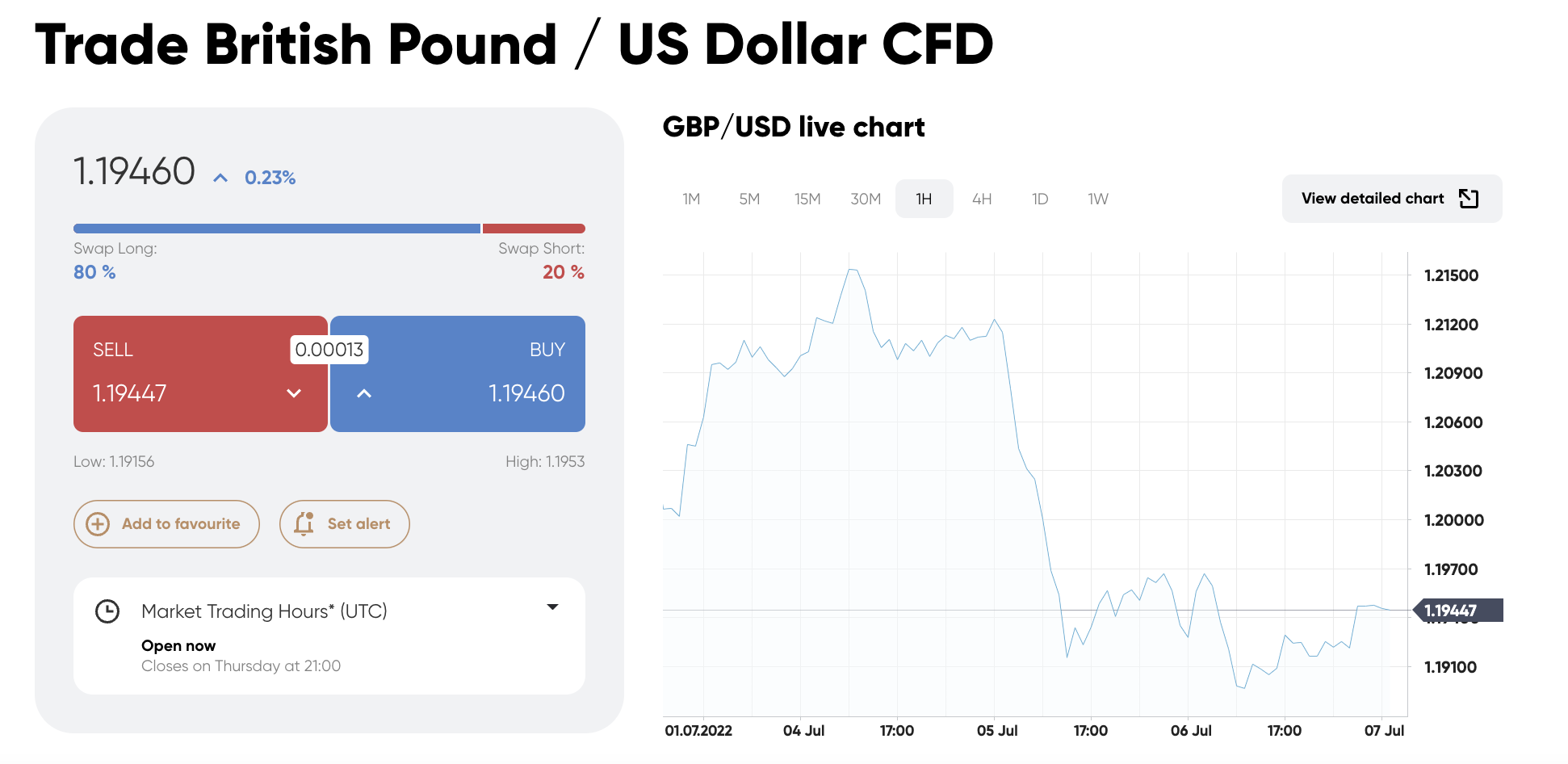

Step 3: Search for Forex Pair

Look for the search bar towards the top of the page. The user can then type in the forex pair that they want to trade.

In the image above, we are searching for GBP/USD. This will see us trade the British pound against the US dollar.

Step 4: Trade Forex

Finally, an order will need to be created so that Capital.com knows what position the user wishes to take on their chosen forex pair.

- Choose from a buy (long) or sell (short) order

- Enter a limit order price or opt for a market order to have the trade executed instantly

- Choose a leverage ratio of up to 1:30, if applicable

- Set up a stop-loss and take-profit order

After confirming the position, this will then be executed by Capital.com. No commission will be charged on the trade.

Conclusion

This guide has ranked and reviewed the 10 best forex brokers in the UK. Our comprehensive research has covered key talking points surrounding supported markets, commissions, spreads, payments, and more.

In conclusion, we found that Capital.com is the overall best UK forex broker to consider joining today. No commissions are charged by this platform and spreads are competitive across its 138 supported pairs.

Furthermore, it only takes a few minutes to open a Capital.com account and UK residents can get started with a minimum first-time deposit of just £20.

#forextrader #trading #forextrading #money #forexsignals #cryptocurrency #trader #investment #crypto #forexlifestyle #investing #business #entrepreneur #invest #binaryoptions #blockchain #forexmarket #forexlife #stocks #success #daytrader #btc #bitcoinmining #investor #stockmarket #binary #fx #finance