If you want to refinance your home loan or purchase a home with a mortgage, you will be required to fill out a loan application and sign a set of disclosures to initiate the process.

This bundle of documents includes things like the Loan Estimate, an authorization to run credit, a Social Security release form, the USA Patriot Act disclosure, homeownership counseling disclosure, and many more.

They provide important details about your loan, the company you’re working with, and allow the bank or mortgage broker to gather sensitive information about you.

Without them, lenders wouldn’t be able to access your employment and credit history, bank statements, income documents, and so forth.

When all the initial disclosures are signed, the loan process can formally begin.

The Collection of Mortgage Documents

- When you apply for a mortgage you’ll be asked to sign an initial disclosure package

- This allows the lender to run your credit and collect important paperwork related to your finances

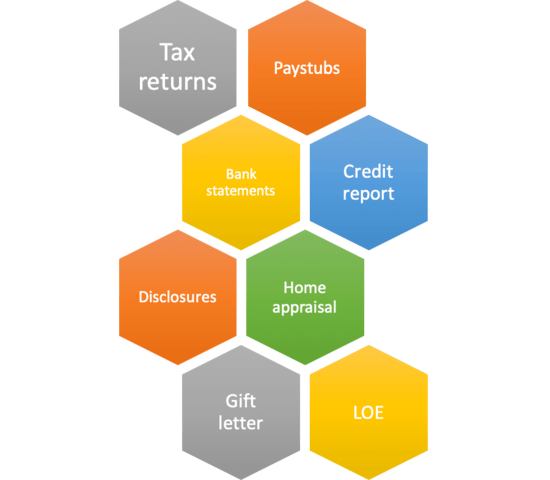

- You’ll then need to provide things like tax returns, pay stubs, bank statements, and so on

- Once your home loan is underwritten and approved you’ll receive a list of conditions

- After those are satisfied you’ll be able to sign loan documents and eventually fund your mortgage

When you first begin the home loan application process, you’ll be asked to sign a lot of forms.

This is one of the first steps in the mortgage refinance process (or home buying process), at least with respect to the bank/lender.

Once disclosures are out of the way, the loan officer or mortgage broker will be able to collect important documents from you and submit your loan application to the underwriter for review.

These days, they want a complete package before it lands on the underwriter’s desk to avoid delays and missing information requests.

This may include tax returns, pay stubs, bank statements, and any other relevant paperwork. Thanks to advancements in technology, a lot of this paperwork can now be gathered electronically.

For example, you might be able to link your financial accounts to their loan origination software for automatic retrieval, or upload electronic documents via an online portal.

If your mortgage application is approved, you will receive a conditional approval from the mortgage underwriter with a set of conditions that need to be met in order to receive loan documents.

These are called “prior to document” conditions, or PTDs, because they must be satisfied before loan documents can be drafted and sent out to the borrower.

After those requests are taken care of, you can get your loan documents and arrange a signing with a notary public.

Once loan documents are signed, any remaining “prior to funding” conditions will need to be met to ensure the loan actually funds and records.

These are usually sent back along with the loan documents from title/escrow and hopefully minimal.

Below is a list of mortgage documents you’ll need to provide to get your loan funded based upon documentation type:

Full Doc:

Signed loan application and disclosures

Latest 2 years tax returns and/or recent pay stubs

Latest 2 months bank statements, Verification of Deposit (VOD), or other acceptable asset reserves

*CPA letter and/or business license if self-employed stating 2+ years employment in same job or field.

The bank or lender will call your employer if you are W-2 and do a verification of employment.

Gift letter for down payment (if applicable)

Rental history (typically 12 months of cancelled rent checks) if currently renting or verification of rent (VOR)

Home Appraisal

Preliminary Title Report

Proof of insurance (Hazard, Flood, etc.)

Letter of Explanation(s) (for any issues that need clarification)

Stated Income Verified Assets:

Signed loan application and disclosures

Income is simply stated (written) on the 1008/1003 (loan application)

Latest 2 months bank statements, VOD, or other acceptable asset reserves

*CPA letter and/or business license if self-employed stating 2+ years employment in same job or field.

The bank or lender will call your employer if you are W-2 and do a verification of employment.

Gift letter for down payment (if applicable)

Rental history (typically 12 months of cancelled rent checks) if currently renting or VOR

Home Appraisal

Preliminary Title Report

Insurance (Hazard, Flood, etc.)

Letter of Explanation(s) (for any issues that need clarification)

No Ratio:

Signed loan application and disclosures

No income information is provided whatsoever

Latest 2 months bank statements, VOD, or other acceptable asset reserves

*CPA letter and/or business license if self-employed stating 2+ years employment in same job or field.

The bank or lender will call your employer if you are W-2 and do a verification of employment.

Gift letter for down payment (if applicable)

Rental history (typically 12 months of cancelled rent checks) if currently renting or VOR

Home Appraisal

Preliminary Title Report

Insurance (Hazard, Flood, etc.)

Letter of Explanation(s) (for any issues that need clarification)

Stated Income Stated Assets:

Signed loan application and disclosures

Income and assets are simply stated on 1008/1003 (loan application)

*CPA letter and/or business license if self-employed stating 2+ years employment in same job or field.

The bank or lender will call your employer if you are W-2 and do a verification of employment.

Gift letter for down payment (if applicable)

Rental history (typically 12 months of cancelled rent checks) if currently renting or VOR

Home Appraisal

Preliminary Title Report

Insurance (Hazard, Flood, etc.)

Letter of Explanation(s) (for any issues that need clarification)

No Income No Assets:

Signed loan application and disclosures

*CPA letter and/or business license if self-employed stating 2+ years employment in same job or field,

The bank or lender will call your employer if you are W-2 and do a verification of employment.

Gift letter for down payment (if applicable)

Rental history (typically 12 months of cancelled rent checks) if currently renting or VOR

Home Appraisal

Preliminary Title Report

Insurance (Hazard, Flood, etc.)

Letter of Explanation(s) (for any issues that need clarification)

No Documentation:

Signed loan application and disclosures

Income, assets, and employment are not revealed to the bank or lender.

A CPA or business license is not necessary.

Gift letter for down payment (if applicable)

Rental history (typically 12 months of cancelled rent checks) if currently renting or VOR

Home Appraisal

Preliminary Title Report

Insurance (Hazard, Flood, etc.)

Letter of Explanation(s) (for any issues that need clarification)

Read more: Do I qualify for a mortgage?