Automated forex trading software offers a service exactly as described – traders can buy and sell currency pairs without needing to do any research or place any market orders.

On the contrary, the chosen software program will automate the trading process – meaning that investors can access the forex market passively.

The purpose of this comparison guide is to explore the 7 best forex automated trading software in the market today through comprehensive and impartial reviews.

Best Automated Forex Trading Software in 2022

We concluded that the 7 best automated forex trading software providers are those listed below:

- eToro Copy Trading – Overall Best Automated Forex Trading Software with Low Fees and Tight Spreads

- MT4 via Capital.com – Mirror the Buy and Sell Positions of Automated Strategies

- MT5 via XM – Copy Successful Forex Traders in an Automated Manner

- Zulutrade via Avatrade – Invest in and Copy a Seasoned FX Trader

- Forex Fury – Automated Forex Trading Bot for MT4 and MT5

- Duplitrade via Pepperstone – Popular Automated Forex Social Trading Platform

- CTrader via Pepperstone – Leading Forex and Algorithmic Trading Platform

Each of the above automated trading forex providers will differ in one way, shape, or form. As a result, in order to select the best automated forex trading software, consider reading our comprehensive provider reviews.

78% of retail investor accounts lose money when trading CFDs with this provider.

Top Automated Trading Platforms Reviewed

Automated forex traders will need to conduct in-depth research when finding a suitable software provider. Metrics such as how successful the software or trader has been historically in terms of monthly returns, as well as risk and fees, should be considered.

Below, we discuss the 7 best automated forex trading software providers in the market today.

1. eToro – Overall Best Automated Forex Trading Software with CopyTrader and CopyPortfolios

Overall, we would argue that eToro is the best-automated forex trading platform for traders of all levels of experience. Put simply, eToro offers an innovative and proprietary Copy Trading tool that operates in conjunction with its low-cost brokerage platform.

Overall, we would argue that eToro is the best-automated forex trading platform for traders of all levels of experience. Put simply, eToro offers an innovative and proprietary Copy Trading tool that operates in conjunction with its low-cost brokerage platform.

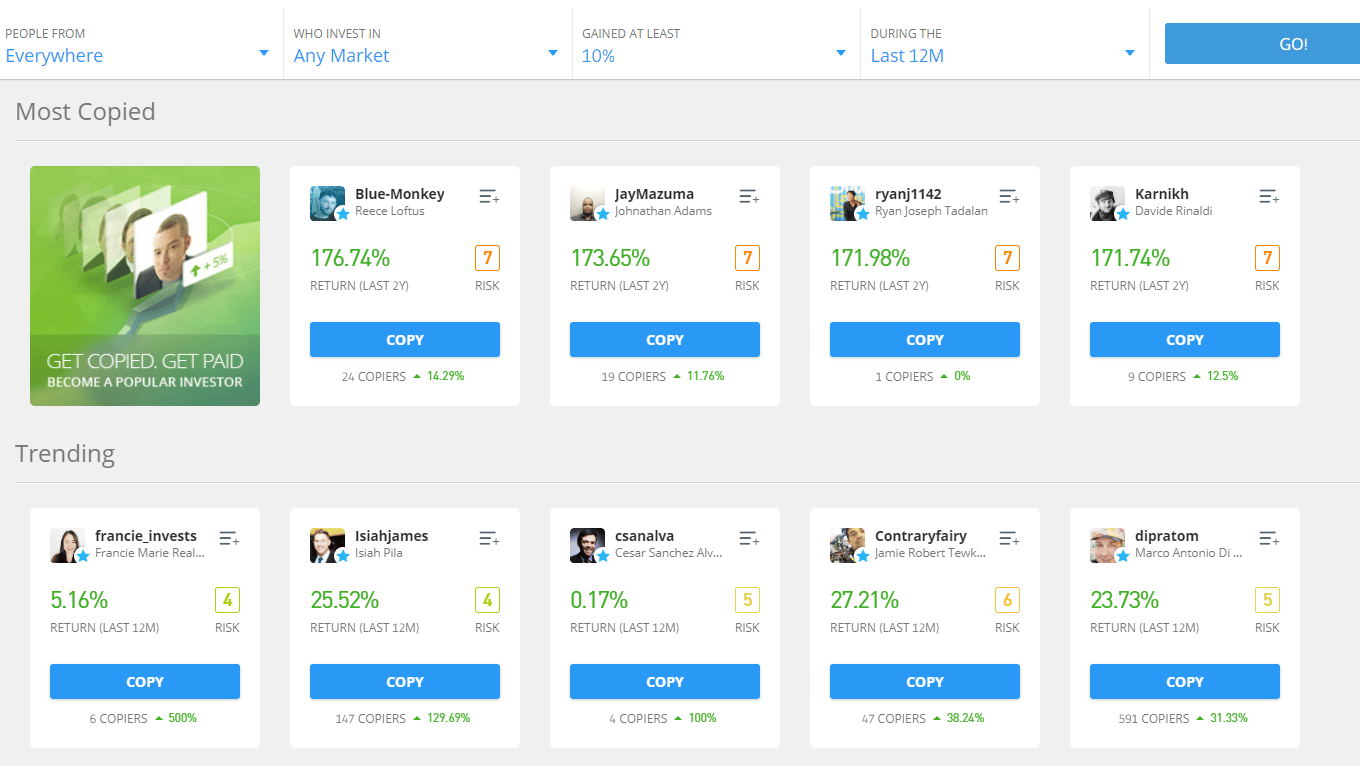

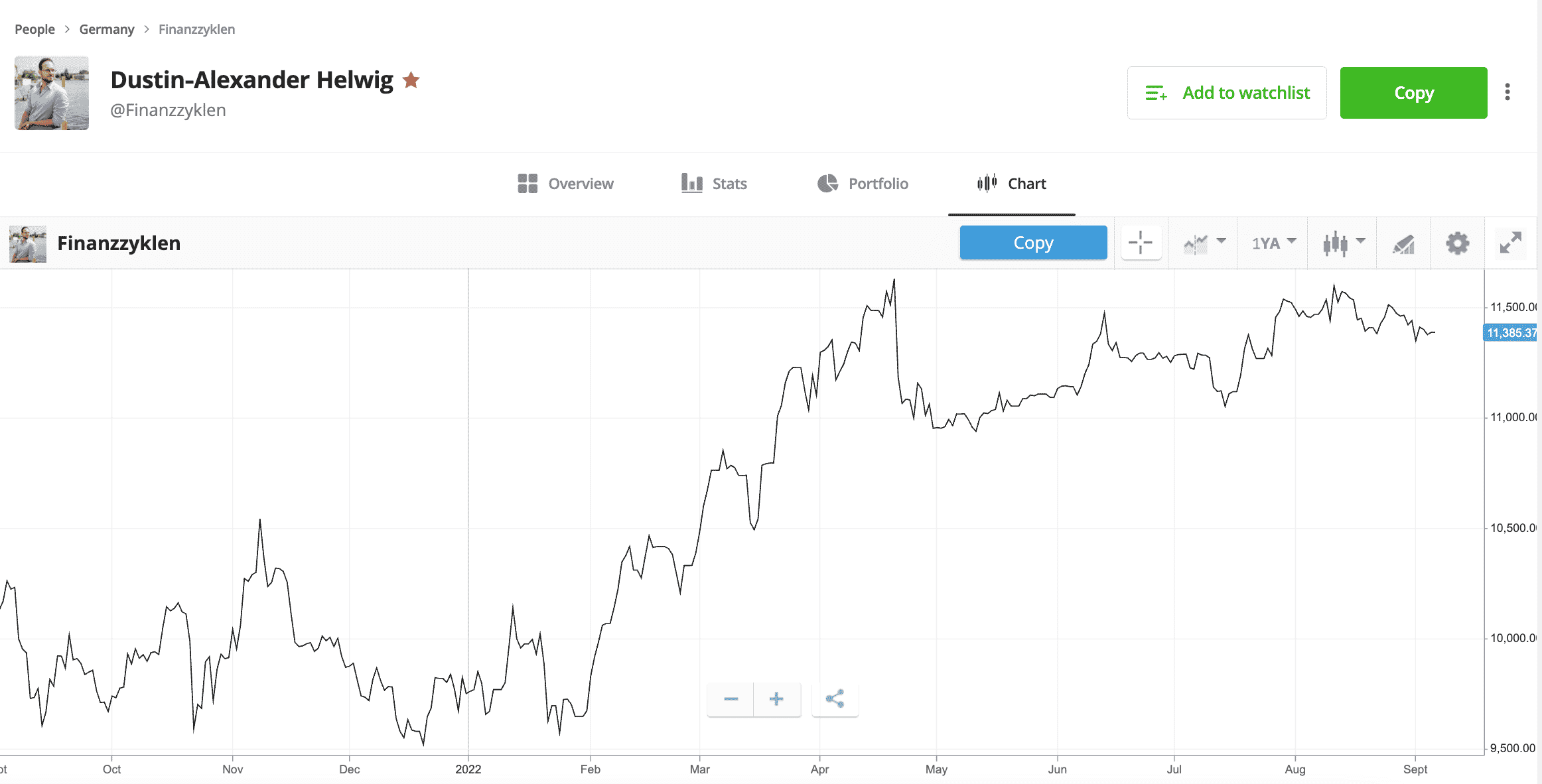

After opening an account with eToro, traders will have access to thousands of verified investors that can be copied at the click of a button. Auto forex traders on the eToro platform can be vetted through an extensive research process. This means that all trading positions entered by the individual are viewable. It also offers an alternative to managed forex accounts.

For example, after filtering the many thousands of verified traders down by forex specialists, eToro users can assess how the individual has performed each month since joining the eToro platform. This illustrates how successful the forex automated trader is in terms of monthly and overall gains.

Ideally, it is wise to select a forex trader with a long-standing track record of success that exceeds at least two years of trading. Additionally, eToro offers lots of other useful data regarding the performance of the forex trader. This includes how much risk they typically take, the average position duration, and how much capital is invested in the individual from other eToro users.

After making a decision, the eToro user can then elect to invest in the forex trader from just $200 and subsequently copy all future positions automatically. For instance, let’s say that the trader risks 5% of their capital going short on USD/CAD. By investing $1,000 into the trader, the eToro user will automatically mirror the position at a stake of $50 (5% of $1,000).

Unlike other copy trading platforms in the forex space, eToro does not charge any additional fees and it does offer one of the best forex cent accounts with a 0.01 minimum Lot size. Instead, the eToro user will simply pay the respective spread when automating their positions. For instance, eToro offers forex markets on a spread-only basis, with the likes of EUR/USD starting at 1 pip per slide.

In addition to being one of the best forex brokers in the market, eToro is also popular for its 2,500+commission-free stocks and ETFs. eToro also offers access to hard metals, energies, and indices. It is also possible to invest in cryptocurrency at eToro at a minimum stake of $10. This offers the chance to diversify among many Copy Trading investors and asset classes.

Being one of the best Skrill forex brokers deposits and withdrawals made in US dollars will not incur any fees. In contrast, other currencies are charged an FX fee of 0.5% of the total payment amount.

eToro also offers an automated forex trading app with the best micro forex account. This connects to the main eToro account and is compatible with iOS and Android devices. In particular, the app is useful for keeping tabs on each Copy Trading position. It is also important to note that eToro, as a regulated brokerage, enables investors to trade on a DIY basis.

Pros

- Overall best forex automated trading software in the market

- No additional fees to copy other investors

- The minimum deposit starts at just $10

- Automated investments across forex, stocks, crypto, and more

- Regulated by the SEC, FCA, ASIC, and CySEC

- Top-rated mobile app and demo account

Cons

- $5 withdrawal fee on non-USD payments

78% of retail investor accounts lose money when trading CFDs with this provider.

2. MT4 via Capital.com – Mirror the Buy and Sell Positions of Automated Strategies

![]() One of the most popular ways to automate the forex trading process is via a bot. These are pre-programmed software files that have the capacity to buy and sell forex pairs in an autonomous manner. This means that after the bot is deployed, no further input is required from the investor.

One of the most popular ways to automate the forex trading process is via a bot. These are pre-programmed software files that have the capacity to buy and sell forex pairs in an autonomous manner. This means that after the bot is deployed, no further input is required from the investor.

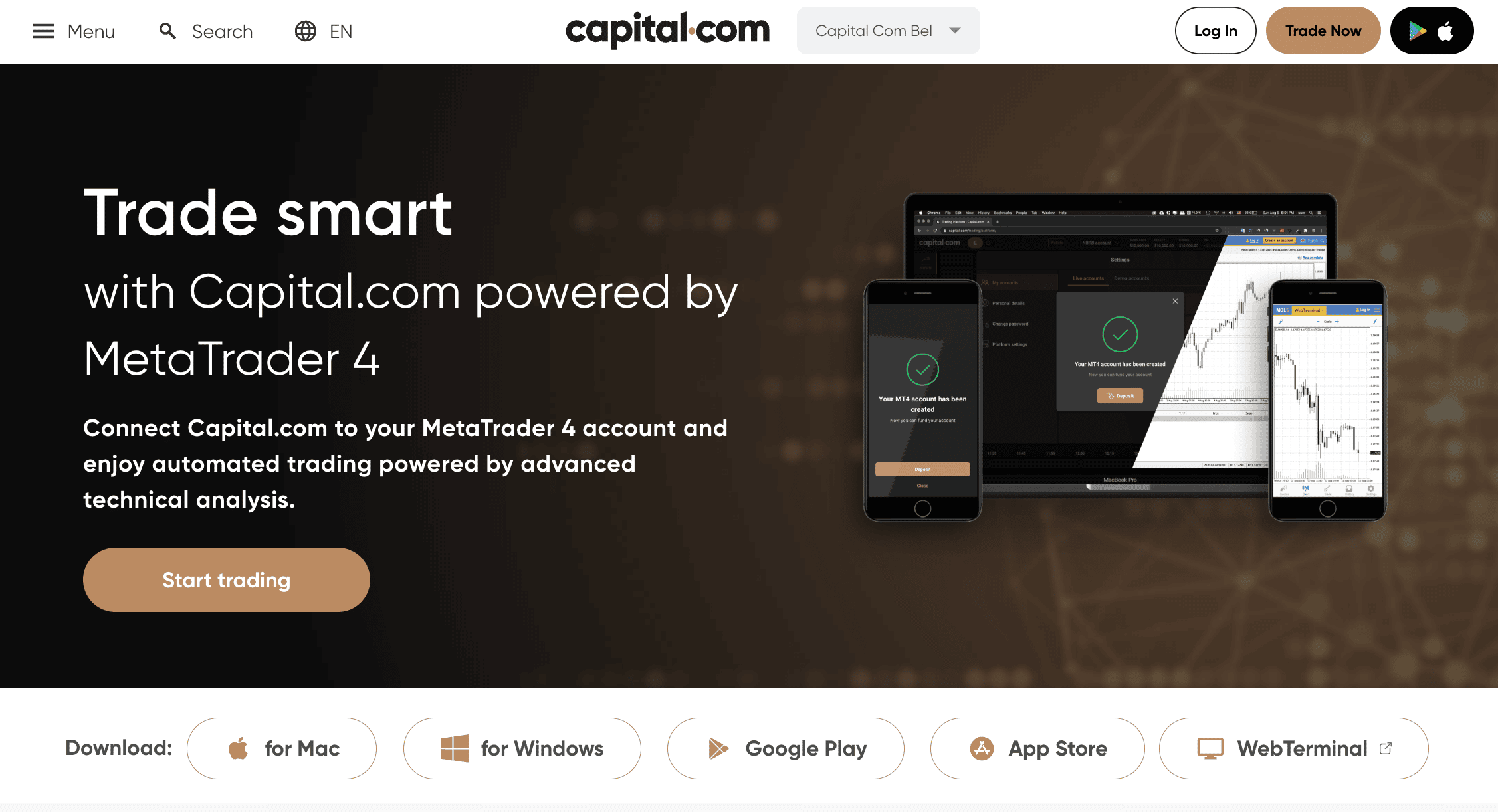

Automated forex trading bots require a third-party platform like MT4 to operate. Furthermore, in order to access live forex markets, MT4 will need to be connected to a regulated MT4 brokerage account. For this purpose, we like Capital.com. Not only does Capital.com support third-party forex systems via MT4, but lists more than 138 currency markets including some of the most volatile forex pairs such as GBP/NZD and GBP/AUD.

This offers the trading bot plenty of opportunities to enter suitable positions throughout the day. The first step to take is to choose a suitable automated forex strategy to copy via the MT4 marketplace. The best forex auto trading software systems hosted on MT4 come with a fee. Although there are some free forex strategies too, these generally do not perform very well.

After choosing an automated bot to copy, the investor can then head over to Capital.com to open an account. In doing so, the investor can deposit from just $20 on a fee-free basis via a debit/credit card or e-wallet. In terms of trading fees, Capital.com does not charge any commissions on any of its supported markets.

Moreover, Capital.com enables retail clients to obtain leverage on their forex positions. In most cases, retail clients will have access to limits of up to 1:30 on major forex pairs. After setting up an account, it’s then just a case of linking Capital.com to MT4 – which can be achieved in just a few clicks.

Crucially, however, Capital.com also offers a free demo account that comes with $10,000 in paper trading funds. This means that the investor can deploy their automated forex trading robot in live market conditions but without risking any of their account balance. Only when it appears that the forex bot has what it takes to make consistent gains should it be deployed in ‘real mode’.

In addition to forex, it is also possible to trade stocks, ETFs, cryptocurrencies, indices, and commodities. All assets available on Capital.com are traded as CFD instruments, which means no US-based clients. All in all, Capital.com – owing to its FCA, CySEC, ASIC, and NBRB regulation offers a safe place to automate the forex trading process.

Pros

- One of the best automated forex trading platforms for MT4

- 0% commission on all supported markets

- Best Western Union forex brokers

- Trade forex, crypto, stocks, ETFs, commodities, and more

- Get started with an account in minutes from just $20

- Regulated and authorized by the FCA, CySEC, ASIC, and NBRB

Cons

- CFD-only platform – so US clients are not eligible to trade

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

3. MT5 via XM – Copy Successful Forex Traders in an Automated Manner

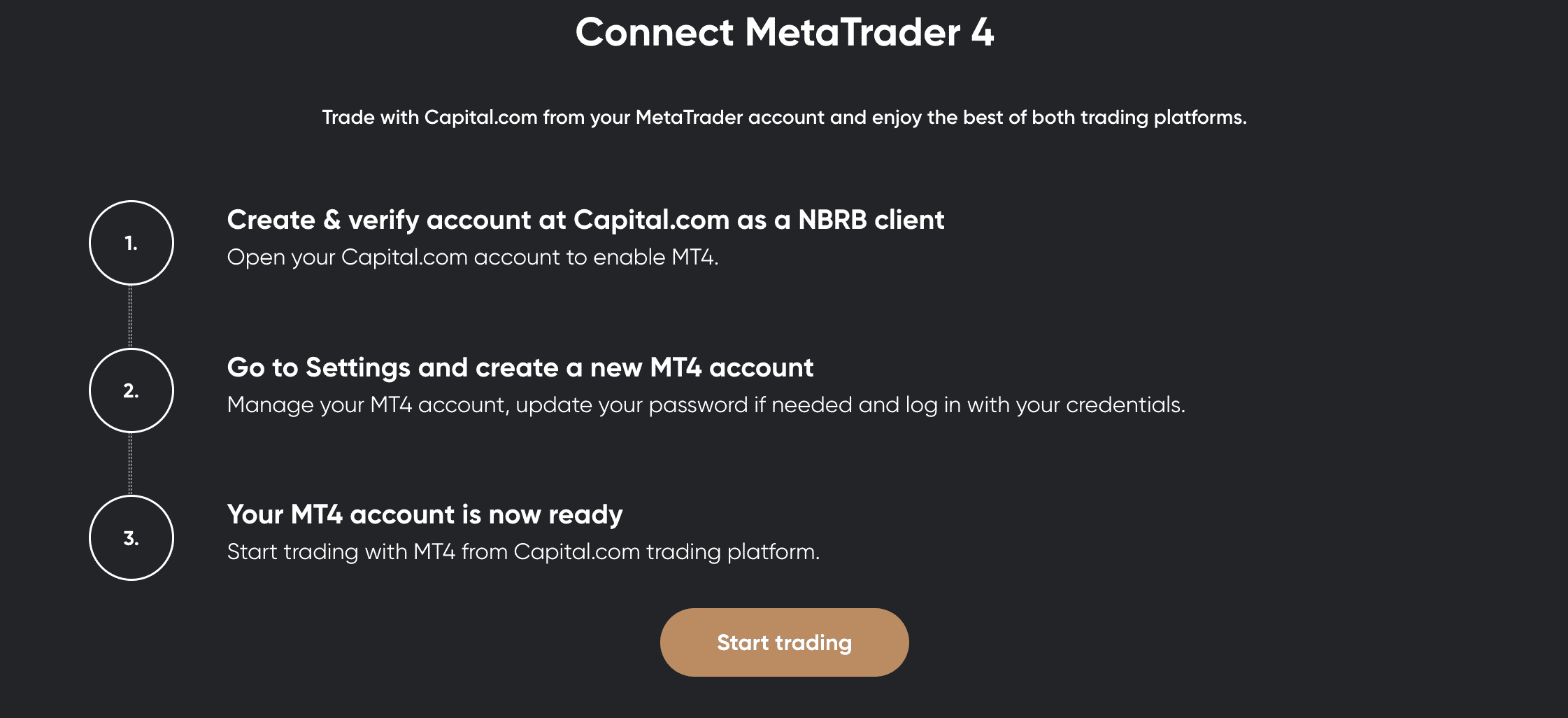

Similar to MT4, MT5 is a third-party trading platform that is very popular among forex traders. The platform offers a full suite of high-level trading features – such as technical indicators, chart drawing tools, and customizable charts. Moreover, MT5 supports automated forex trading.

Similar to MT4, MT5 is a third-party trading platform that is very popular among forex traders. The platform offers a full suite of high-level trading features – such as technical indicators, chart drawing tools, and customizable charts. Moreover, MT5 supports automated forex trading.

MT5 offers this service through a Copy Trading-style tool. Investors will first need to head over to the MT5, create an account through its partner MQL5, and then choose a trader to mirror. In order to choose a suitable forex trader, investors will need to spend some time researching the many statistics that MT5 provides.

This covers everything from the total balance in US dollars and lifetime ROI to the average duration and maximum leverage limit. In a similar nature to the previously discussed MT4, MT5 offers both free and paid-for forex auto traders that can be copied. Once again, the most successful traders will rightly charge a fee for their service.

And, just like MT4, in order to engage in automated forex trading via MT5, the investor will need to open an account with a suitable broker. One of the best MT5 brokers in the forex space is XM. The broker offers both commission-free spread (Standard) and ECN accounts with low commissions for different trading styles.

Spreads are very competitive too. Traders can buy the EUR/USD trading pair from just 1.0 pips. The minimum account balance to get started is just $5 and XM accepts instant payments via debit/credit cards and e-wallets.

Another benefit of choosing XM for the purpose of automated MT5 forex trading is that the broker offers demo accounts. As noted earlier, this will enable the investor to backtest their chosen trader in a risk-free environment. If and when the investor is confident that the trader is worth copying with real money, they can switch over to a live portfolio.

Pros

- Best MT5 broker for automated forex trading

- Industry-leading fees and spreads

- Just $5 is required to open an account

- Dozens of forex pairs are supported

- Regulated broker with global footprint

Cons

- Does not offer its own proprietary automated software portal

Your capital is at risk.

4. Zulutrade via Avatrade – Invest in and Copy a Seasoned Currency Trader

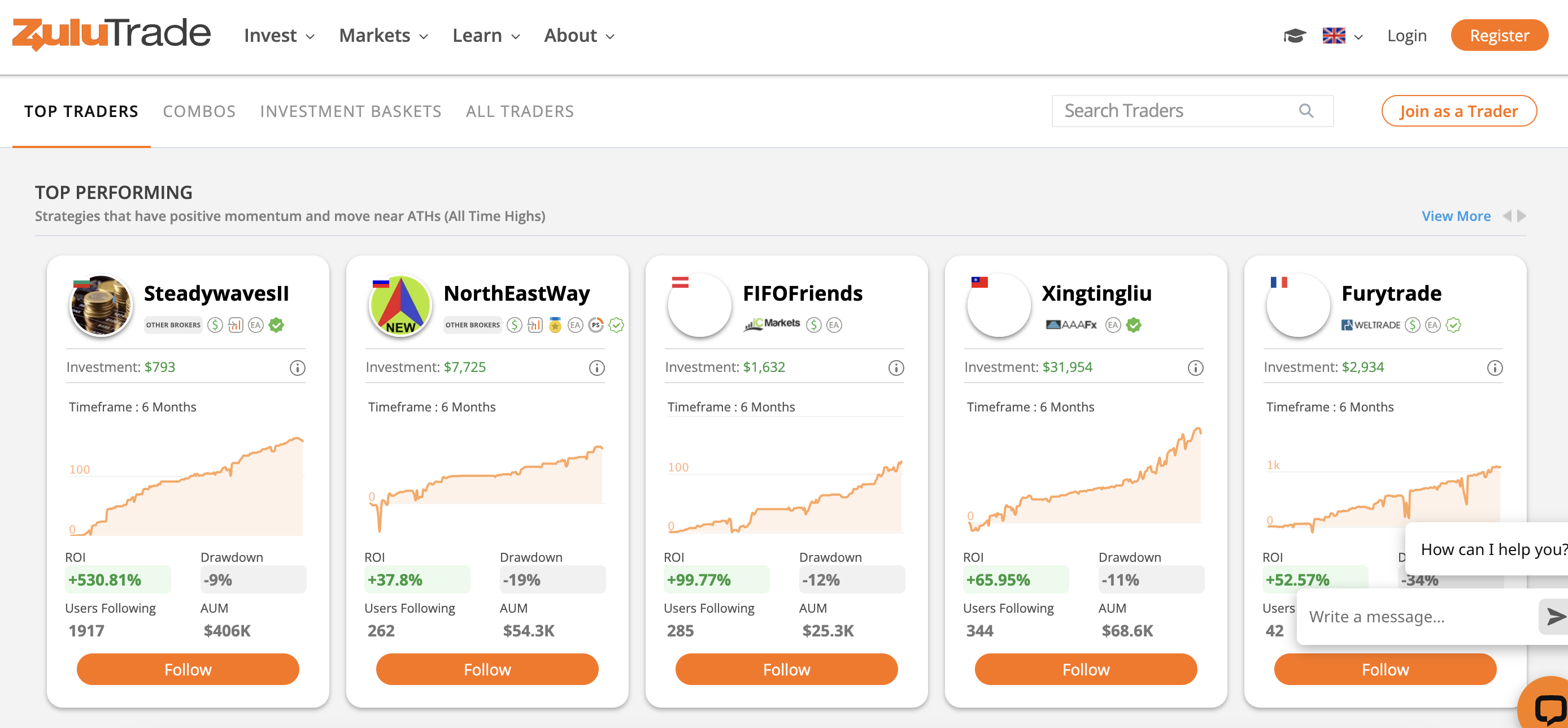

![]() Zulutrade offers a very similar service to eToro, insofar as it enables clients to copy the forex trading positions of an experienced currency investor. However, it should be noted that when compared to eToro, we found that Zulutrade offers access to a much lower number of traders.

Zulutrade offers a very similar service to eToro, insofar as it enables clients to copy the forex trading positions of an experienced currency investor. However, it should be noted that when compared to eToro, we found that Zulutrade offers access to a much lower number of traders.

Nonetheless, after creating an account with Zulutrade, investors can browse through the traders that have signed up for the Copy Trading program. Investors can explore metrics surrounding their historical gains, average trade duration, and more. Crucially, however, we should note that Zulutrade offers access to just 13 pairs, which is much lower than other platforms in this space.

When it comes to fees, the Zulutrade profit-sharing model is not only complex but expensive. In its most basic form, commissions will apply for any profitable positions above the High Water Mark (HWM). This represents the peak value of the Copy Trading portfolio for the respective trader.

Anything above the HWM will be charged at 25%. Of this figure, 20% and 5% go to the trader and Zulutrade, respectively. Zulutrade also offers diversified trading portfolios known as Combos. Each Combo will consist of a group of traders that meet certain criteria. As such, the Zulutrade automated forex trading platform offers various ways to trade passively.

Irrespective of which strategy is chosen, Zulutrade is not a brokerage firm. This means that just like MT4 and MT5, Zulutrade needs to be connected to a suitable broker account. AvaTrade is a popular option here, as the platform offers dozens of forex pairs at 0% commission and tight spreads. Plus, AvaTrade is heavily regulated and the minimum deposit amounts to just $100.

Pros

- Automate the forex trading process by mirroring other traders

- Very user-friendly client interface

- Offers the best forex VPS in 2022

Cons

- High profit-sharing commissions

5. Forex Fury – Automated Forex Trading Bot for MT4 and MT5

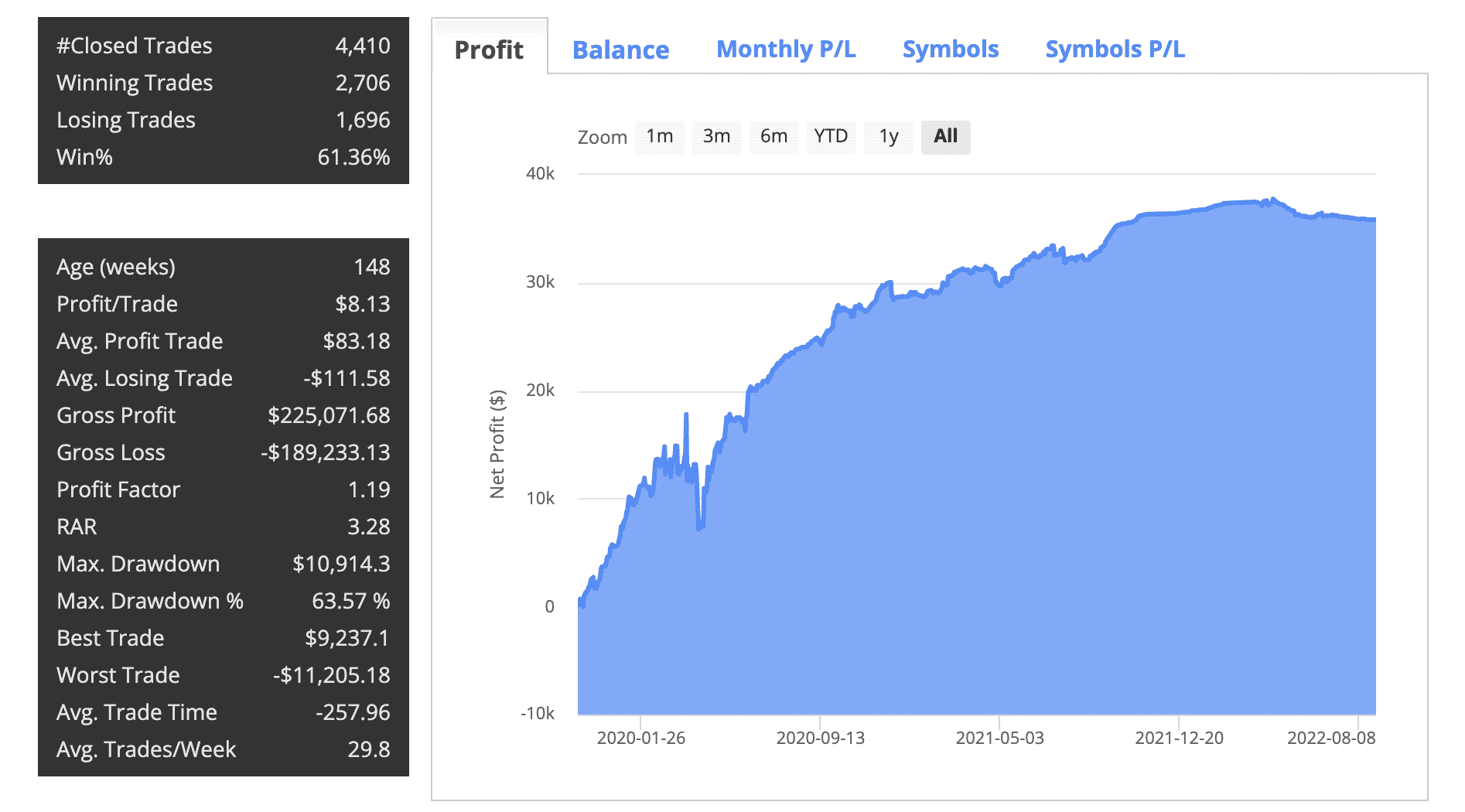

Forex Fury offers an all-in one package for those seeking the best forex automated trading software bot. This trading bot operates in a fully autonomous manner, so once deployed, it will begin trading on behalf of the investor.

Forex Fury offers an all-in one package for those seeking the best forex automated trading software bot. This trading bot operates in a fully autonomous manner, so once deployed, it will begin trading on behalf of the investor.

Forex Fury is compatible with a range of third-party platforms, including MT4 and MT5. This forex trading bot might appeal to beginners, as it comes with a step-by-step installation guide. This includes the process of choosing a suitable low, medium, or high-risk strategy. Forex Fury is compatible with any forex pair in addition to crypto assets.

With that being said, the Forex Fury bot is far from cost-effective. On the contrary, the cheapest plan available will cost $229.99. This does, however, offer a lifetime license to the bot.

In terms of performance, Forex Fury claims that its robot aims for a monthly return of 10-20%. There is, however, no guarantee that the bot will be able to achieve trading results of this magnitude. Also see our full Forex Fury review.

Pros

- Fully automated forex trading bot

- Offers low, medium, and high-risk trading strategies

Cons

- Cheapest option costs $229.99

- Forex bots cannot incorporate fundamental analysis

6. Duplitrade via Pepperstone – Automated Forex Social Trading

![]() Another third-party option to consider when searching for the best forex automated trading software is Duplitrade. In a nutshell, Duplitrade is home to a carefully selected group of experienced forex traders that have been pre-vetted and audited.

Another third-party option to consider when searching for the best forex automated trading software is Duplitrade. In a nutshell, Duplitrade is home to a carefully selected group of experienced forex traders that have been pre-vetted and audited.

After choosing a suitable trading system, all future positions can be mirrored automatically. As a third-party platform, Duplitrade will need to be connected with a regulated broker. Moreover, the minimum investment per Duplitrade strategy is $5,000. As a result, this option won’t be suitable for those on a budget.

In total, there are just under a dozen automated trading strategies to choose from at Duplitrade. One of the most popular strategies is Neptune, with more than 4,400 individual followers. This strategy has generated a net profit of 337% since its inception in 2019. Moreover, Neptune places between 200-250 positions per month, which illustrates a day trading strategy.

When it comes to utilizing Duplitrade via a regulated broker, Pepperstone is perhaps worth considering. This popular provider offers commission-free and raw spread accounts across dozens of forex pairs, stocks, indices, and more. Pepperstone is regulated by ASIC and as such, offers a safe and transparent trading environment.

Pros

- 11 strategies to choose from

- All strategies have been pre-vetted and audited

Cons

- Need to connect Duplitrade with a suitable broker

- Minimum capital outlay of $5,000

74% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

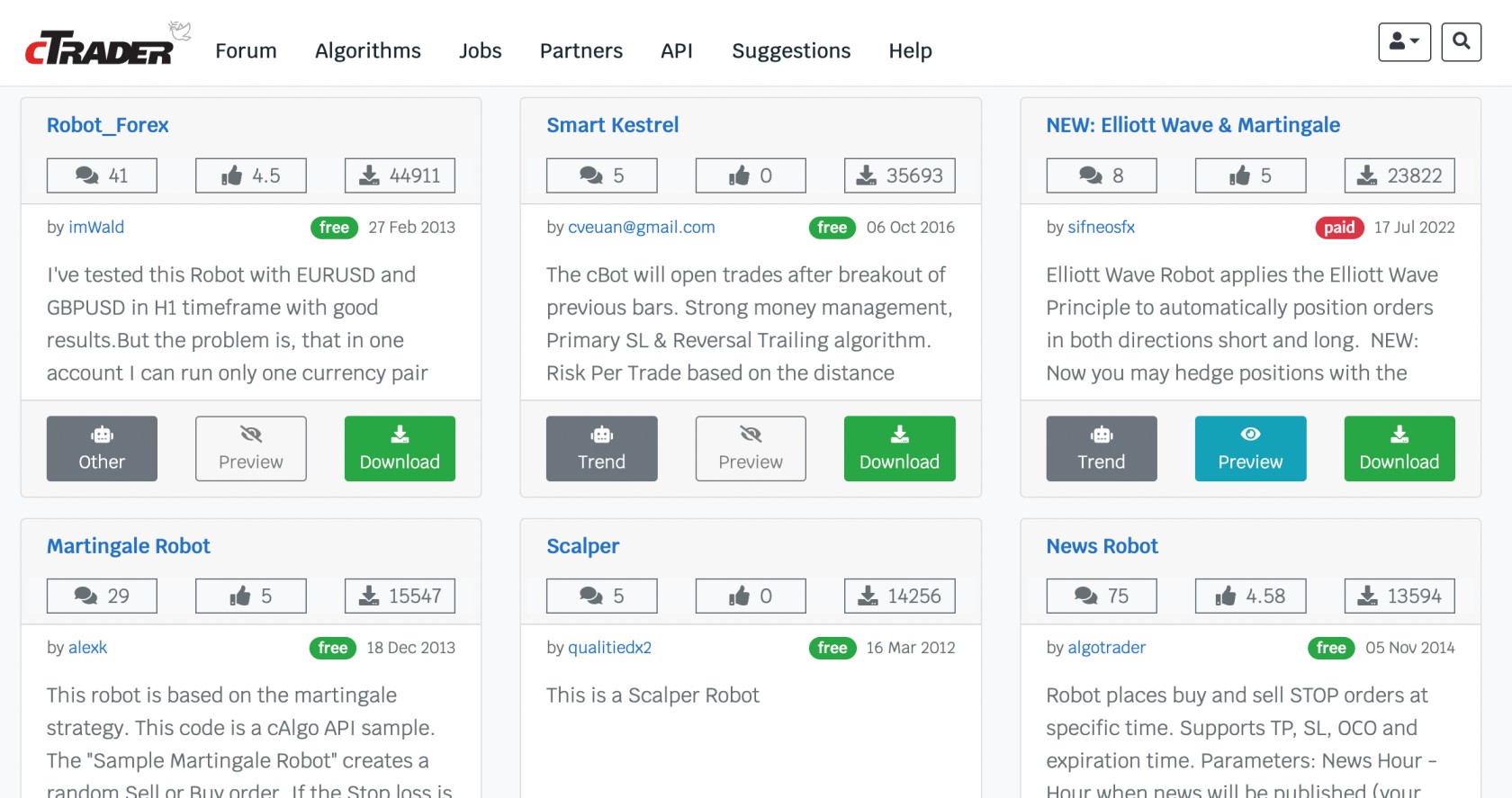

7. CTrader via Pepperstone – Forex and Algorithmic Community

Regarding the former, cTrader enables users to communicate in a social setting, with the view of sharing market insights. cTrader is home to a wide variety of algorithmic indicators that can be copied like-for-like. Each indicator will have its own pre-built strategy that focuses on a particular trend.

For example, the AlphaTrend Indicator at cTrader seeks to buy currency pairs when it falls below their perceived market value. In addition to this, cTrader also offers automated forex bots that have been created by third parties. The most popular bot in terms of installations is simply entitled Robot_Forex. In a nutshell, this bot focuses on GBP/USD and EUR/USD via the H1 timeframe.

Once again, cTrader needs to be accessed through a broker and Pepperstone is also a great choice here. As noted above, Pepperstone is heavily regulated and it offers access to dozens of forex pairs, including the aforementioned GBP/USD and EUR/USD. Moreover, it takes just five minutes to open an account with Pepperstone before connecting to cTrader.

Pros

- Social trading tools

- Automated forex bots can be mirrored

Cons

- Bots are created by unverified third parties

74% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

What is Auto Forex Trading?

As the name suggests, forex auto trade strategies enable investors to trade currencies in a completely passive nature. This means that the investor will not need to dedicate countless hours performing technical analysis, or placing buy and sell orders manually. Instead, the chosen automated forex trading software will perform all required duties.

For example, this might come in the form of a forex bot that can be installed into MT4. The bot will scan the forex markets on a 24/7 basis and subsequently enter positions when a trading opportunity has been discovered. This option, while permitting around-the-clock autonomous trading, can be risky.

This is because forex robots do not have the capacity to extract information outside of a pricing chart. For instance, if a real-world story breaks that hugely impacts the value of GBP, the bot will not be able to take this into account. As a result, Copy Trading platforms are perhaps a suitable alternative to bots.

This will see the investor allocate capital to a proven forex trader. Each and every position that the forex trader enters will subsequently be mirrored in the investor’s portfolio. Ultimately, the overarching objective of auto forex trading is to completely remove the need to have any input in investment-related decisions.

Types of Auto Trading Forex Systems

As discussed throughout this guide, there are many different types of automated forex systems.

Each system will come with its own pros and cons, which we explore in more detail in the following sections.

Copy Trading

Copy Trading, as noted above, is perhaps the best option when searching for an automated forex system. This is because the investor will be allocating funds to a proven forex trader that uses a regulated broker like eToro.

This means that when the chosen trader enters a position, the same trade will be copied over to the eToro portfolio. This will, however, be at proportionate stakes as per the total investment.

Crucially, Copy Traders utilize eToro for their own investment endeavors. This means that the trader is risking their own capital. This should act as a major safeguard, considering that the trader’s own money is at stake.

Moreover, eToro generates a risk score on each trader based on the types of markets being targeted, the average trade duration, and more. eToro also allows investors to add or remove positions from their Copy Trading basket.

APIs

Application programming interfaces (APIs) enable investors to fully automate the forex trading process through the usage of high-level algorithms.

The API essentially forms a bridge between the algorithm and regulated forex brokerage. APIs are typically utilized by financial institutions that engage in quantitive trading practices.

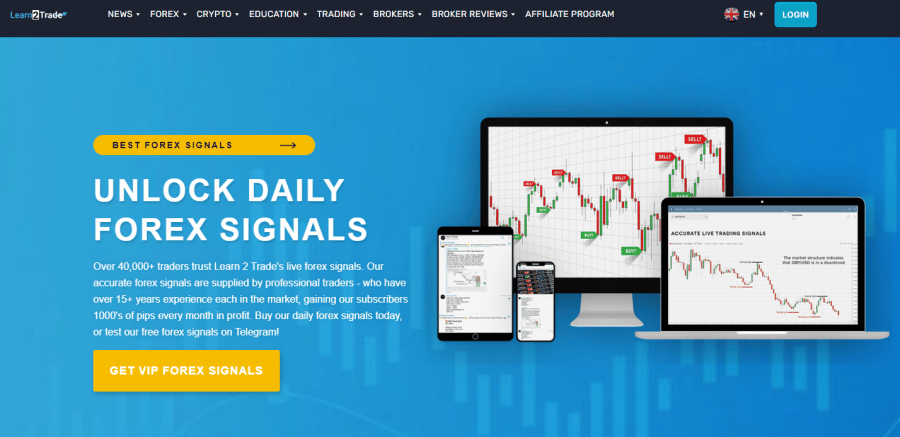

Signals

It is also possible to semi-automate the forex trading process via third-party forex signals. For instance, Learn2Trade has a team of in-house analysts that scan the forex markets on behalf of its members.

The analysts will then send a trading signal via the Learn2Trade Telegram group. This will highlight the pair and respective buy/sell position, alongside a stop-loss, entry, and take-profit order.

The member can then head over to their forex broker to place the suggested orders. While signals are not fully-automated, they do remove the need to perform any technical or fundamental analysis.

Trading Bots

Trading bots are becoming more and more popular in the forex space. The reason for this is that they offer a truly automated forex trading process, on a 24/7 basis.

The attraction is that even while you are sleeping, the bot will be scanning the forex market and placing suitable buy and sell orders. The bot is, however, only programmed to follow pre-defined conditions.

This means that forex bots do not have the capacity to make sentient decisions. Instead, the bot can only follow the pre-built conditions it has been instructed to follow.

As a result, traders should not be surprised if they wake up to check in on the bot to find that their entire account balance has been lost.

The best way to avoid such an event is to ensure that stop-loss orders are installed before the bot starts trading in live market conditions.

Is Automated Forex Trading Profitable?

Whether or not automated forex trading is profitable will depend on the underlying system, bot, or trader.

In other words, if the underlying bot goes on a prolonged run of form, then this will result in the trader making money. However, equally, there is every chance that the bot then blows through the entire account balance in one trading day.

As a result, it might be best to stick with a Copy Trading platform like eToro, which enables investors to mirror human traders. It is possible to install certain safeguards when copying a forex trader, such as stop-loss orders and even take-profits.

Furthermore, and perhaps most importantly, Copy Traders on eToro are utilizing their own capital when placing orders.

How to Start Auto Forex Trading

The step-by-step guide below will explain how to get started with an automated forex trading account with eToro in under five minutes from start to finish.

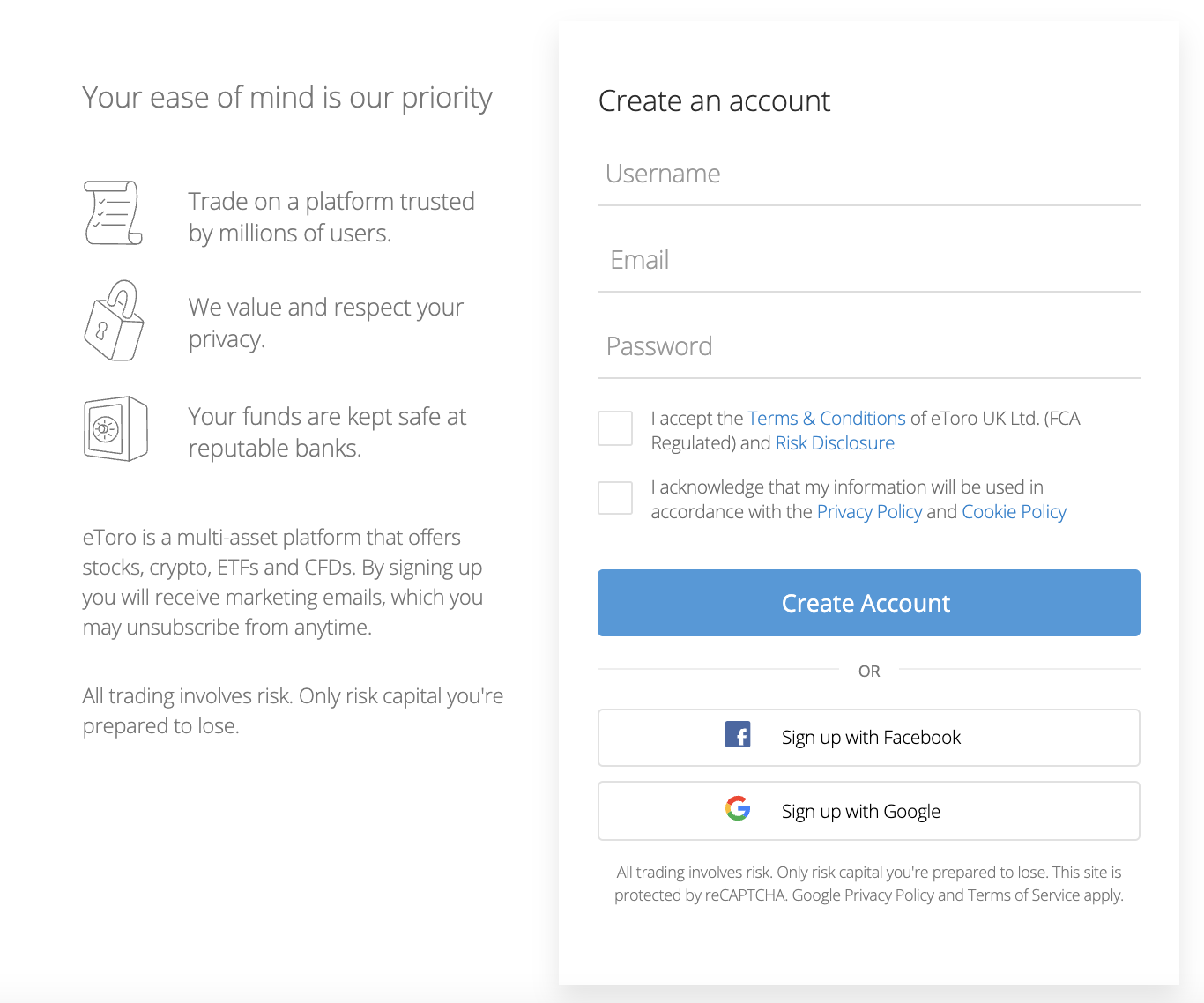

Step 1: Open an eToro Account

The first step is to register an account with eToro. This is a simple process that will initially require the trader to choose a username and password, and enter an email address.

Next, the trader will need to supply their name, nationality, home address, and any other personal information required by eToro.

Step 2: Upload ID

eToro is regulated by several tier-one licensing bodies, so the KYC process is a core requirement. This should only take a few minutes, however.

Simply upload some ID and a recently issued utility bill or bank statement to get the eToro account verified.

Step 3: Deposit Funds

To automate the forex investment process via the Copy Trading tool, a minimum deposit of $200 is required.

Choose from a debit/credit card, bank wire, or a supported e-wallet. Traders will pay 0.5% in deposit fees unless USD is the primary payment currency.

Step 4: Choose Forex Trader to Copy

Click on the ‘Discover’ button, followed by ‘View All’ next to the CopyTrader™ tab. This will then provide access to thousands of verified traders that can be mirrored automatically.

Utilize the filters on offer to find a suitable forex trader. Be sure to focus on key metrics surrounding average trade duration, risk, and historical monthly returns.

Click on ‘Copy’ to populate an investment order form.

Step 5: Confirm Automated Forex Trading Investment

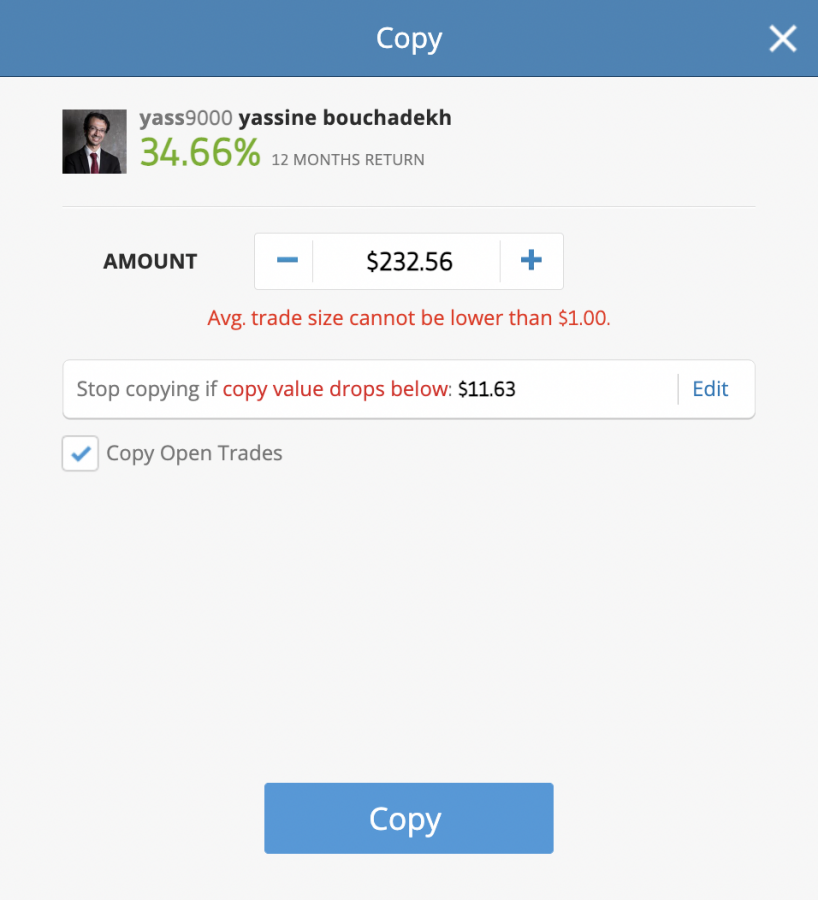

The investor should now see an order form, like in the image below.

In the ‘Amount’ box, type in the required investment stake (from $200).

Ensure that the ‘Copy Open Trades’ box is ticked. This will copy all existing and future positions into the eToro portfolio.

Finally, click on ‘Copy’ to confirm the automated forex trading position.

Conclusion

This guide has reviewed and ranked the best forex automated trading software in the market. We found that overall, the Copy Trading service offered by eToro ticks all of the right boxes.

Not only does this permit automated forex trading in a regulated environment, but eToro is very cost-effective. No additional fees are charged when using the Copy Trading tool and all 49 forex pairs can be traded on a spread-only basis, from just $200.

#forextrader #trading #forextrading #money #forexsignals #cryptocurrency #trader #investment #crypto #forexlifestyle #investing #business #entrepreneur #invest #binaryoptions #blockchain #forexmarket #forexlife #stocks #success #daytrader #btc #bitcoinmining #investor #stockmarket #binary #fx #finance