Samsung Electronics is the world’s biggest smartphone producer and the second-biggest producer of semiconductor chips. Thanks to slackening demand for consumer electronics and supply chain issues for chips, the Samsung stock price today is at a 52-week low.

Below we look into a few popular places to buy Samsung stock online. We explore Samsung’s financials and all key metrics.

How to Buy Samsung Stock in 2022

- ✅Step 1: Open a trading account with a regulated broker — Get started by supplying a few personal details.

- 🔑Step 2: Verification — Supply some ID. Most regulated brokers keep everybody safe by following anti-fraud KYC (Know Your Customer) rules.

- 💳 Step 3: Deposit — Fund your account by selecting from credit/debit card, ACH, bank transfer or e-wallet.

- 🔎 Step 4: Search for Samsung Stock — Find Samsung stock by entering the Samsung stock label ‘SMSN.L’ in the broker’s search toolbar.

- 🛒 Step 5: Buy — Before investing in any financial assets it’s important that you conduct your own market research.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

Whether an investor is looking at popular tech stocks like Samsung or aiming for much cheaper companies via penny stocks, brokers nowadays make it simpler to buy any stock online.

In reviewing where to buy Samsung stock, smart investors should look out for:

- Security and regulation

Both eToro and Webull are regulated in the US. Both benefit from coverage by the SIPC, which gives individual investors insurance coverage of up to $500,000 in the event of fraud or bankruptcy. Regulation does not spare the investor from losing money if the markets go the wrong way. But a regulated company is one that can be trusted more than most. - Zero commission on stock transactions

Neither eToro nor Webull charge commission on buying or selling shares. When it comes to trading fees, investors looking to buy Samsung stock need only consider spread fees. - Tight spread fees

The spread is the difference between the buying and selling price offered by a broker at any particular time. With any broker, investors will find that they are offered a buying price that is slightly above the list price and a selling price that is slightly below. The tighter the spread, the less spread fee is effectively charged. eToro charges a spread of just 0.3% on Samsung stock.

1: eToro

Founded in 2007, eToro serves 25m+ verified users worldwide. 154,000 eToro investors follow Samsung stock. Fully-regulated in the US and elsewhere, eToro offers many trading features such as copy trading and ProCharts.

Founded in 2007, eToro serves 25m+ verified users worldwide. 154,000 eToro investors follow Samsung stock. Fully-regulated in the US and elsewhere, eToro offers many trading features such as copy trading and ProCharts.

No commission is charged on stock purchases with eToro. And a spread fee of just 0.3% applies to Samsung stock and many others. US investors can deposit funds with no deposit fee or currency conversion fee. The minimum deposit is just $10.

In all, eToro offers 3,000+ stocks. Over 900 are stocks from 15+ international exchanges that US investors can access. Tech stocks like Samsung are fully represented, and searchable via sector and exchange. eToro is notably quick to update its selection with the popular new stocks too. Users can flag up stocks they want to keep an eye on in a personal watchlist.

To deal with choppy markets, eToro provides two trading tools: CopyTrader and Smart Portfolios.

- With CopyTrader, investors set aside some funds and copy other traders’ deals for free in real-time. eToro’s 65+ Smart Portfolios are popular with all types of investors.

- Each Smart Portfolio takes a particular strategic angle on a sector. Investors can buy in to all positions held by the portfolio with a minimum stake of $5,000. 6% of the Asian Dragon Smart Portfolio comprises Samsung stock, for example.

When it comes to security, eToro features optional Face and Touch ID log-in. eToro has never been hacked, and is extensively insured.

| Number of Stocks: | 3000+ (international) |

|---|---|

| Pricing System: | No commission. Spread fee only |

| Cost of Buying Samsung: | Spread fee of just 0.3% |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

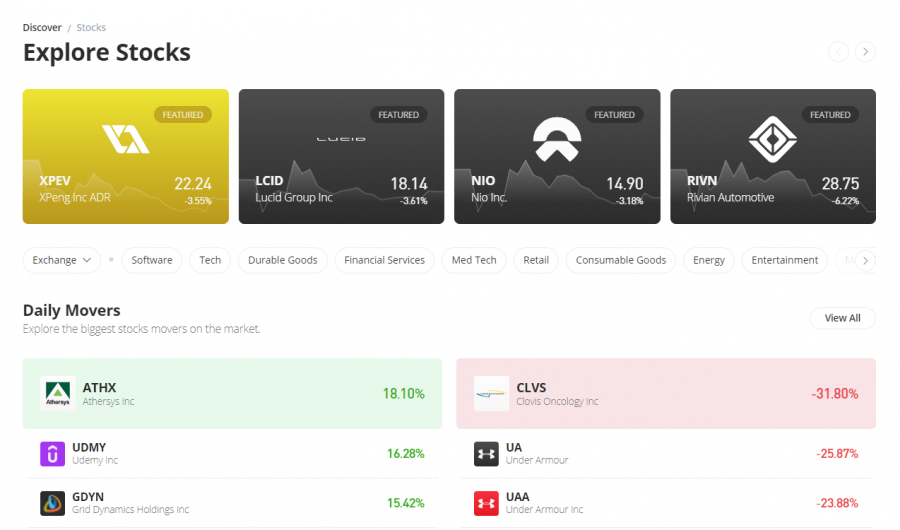

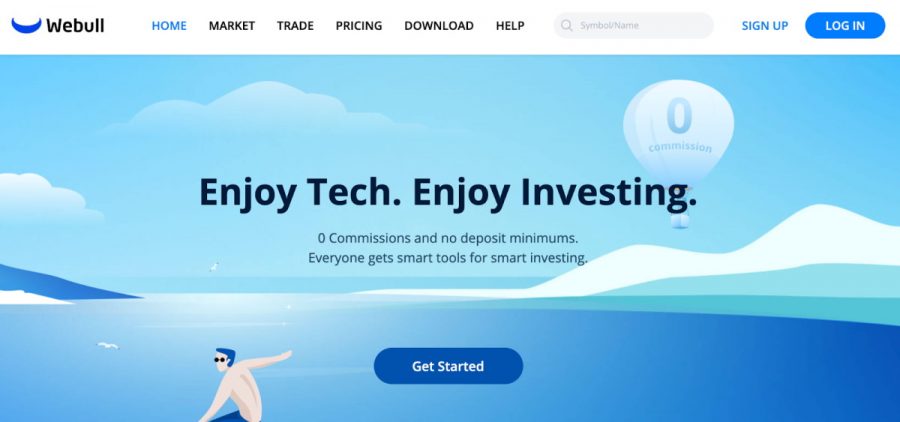

2: Webull

Based in New York, Webull is a popular stock trading platform.

Based in New York, Webull is a popular stock trading platform.

With 5,000 stocks on offer, investors will not be stuck for choice. Webull features a diverse range of equitites, with popular oil stocks and tech stocks, as well as consumer staples and more exotic options like biotech stocks.

With its emphasis on the OTC (over-the-counter) market, Webull users may be able to pick up some cheap stocks that are not listed on any exchange. Compared to eToro, though, only a fraction of Webull stocks are international; these can be traded via an ADR (American Depositary Receipt).

When it comes to other assets, Webull offers crypto, ETFs, index options (for advanced traders) and IRA accounts (Individual Retirement Accounts).

As with eToro, Webull users can buy stocks via credit card by charging their Webull account. A $8 fee applies with Webull for depositing with credit card.

| Number of Stocks: | 5000+ |

|---|---|

| Pricing System: | Spread fee, no commission |

| Cost of Buying Samsung: | Spread fee: not available |

Your capital is at risk.

Step 2: Research Samsung Stock

What is Samsung?

![]() When investors research how to buy Samsung Stock, they will discover that the Samsung stock is actually Samsung Electronics listed under the Samsung stock ticker SMSN.

When investors research how to buy Samsung Stock, they will discover that the Samsung stock is actually Samsung Electronics listed under the Samsung stock ticker SMSN.

Samsung vs. Samsung Electronics

- The Samsung Group is a giant tech conglomerate headquartered in Samsung Town, Seoul, South Korea.

- Of roughly 80 Samsung subsidiaries, Samsung Electronics is the flagship brand.

- The Samsung Group is not listed on stock exchanges for trade.

- But Samsung Electronics is available to trade.

- US investors can buy Samsung Electronics stock with eToro via the London Stock Exchange using the ticker SMSN.L.

- Thus when investors say they want to buy Samsung, they mean they want to buy Samsung Electric stock.

- The stock ticker SSNLF is used for OTC (Over-The-Counter) trading in Samsung Electronics.

In discussing Samsung Electronics below, we use the abbreviated term ‘Samsung.’

Samsung Electronics

Samsung Electronics manufactures:

- Semiconductor chips: memory chips, flash drives, solid-state drives.

- Consumer electronics: LCD/LED panels, televisions, digital cinemas, laptops.

Investors considering whether to buy Samsung stock will be glad to hear that, in Q1 2022, Samsung became the world’s leading producer of smartphones globally with a market share of 23.4%. That is 5% more than Apple.

Table: Global Smartphone Share By Vendor Q1 2022

| Smartphone Supplier | Market Share |

|---|---|

| Samsung | 23.4% |

| Apple | 18% |

| Xiaomi | 12.7% |

| OPPO | 8.7% |

| vivo | 8.1% |

| Others | 29.1% |

(Data compiled from Statista.com)

Samsung Stock Price – How Much is Samsung Stock Worth?

From the Samsung stock chart below, we can see that the Samsung stock price today is $1,148.97.

- The Samsung stock price is a new 52-week low.

- This is a 44% drop from Samsung’s high on 11th January 2021 of $2055.

- The current price is just under 10% higher than Samsung’s pandemic low of $825 on 23rd March 2020.

Samsung Stock History 2021

The Samsung stock price recovered strongly from its pandemic low of $825 in late March 2020. Demand for consumer electronics was high.

After peaking at $2,055 in early January 2021, the Samsung stock price fell by 19% over 2021. During the same period, key competitor TSMC (the Taiwan Semiconductor Manufacturing Company) managed to put on 4%. Stock in fellow memory giant Micron was up 25% and consumer electronics rival Apple stock was up over 30%.

So why did Samsung do so badly in 2021?

Forbes reports that, ‘investors are a bit concerned about the outlook for memory prices, particularly for DRAM, which is the single largest driver of Samsung’s profitability.’ Also, supply chain issues for smartphone parts cooled positive investor sentiment.

Samsung Stock History 2022

During 2022, the Samsung price has continued to fall. So too have shares in most semi-conductor companies. Rival TSMC has lost $100bn in share value since the new year. The S&P Semiconductors Select Industry Index – which tracks the biggest US semiconductor companies – is down 38% in 2022.

As well as producing chips, Samsung produces consumer electronics (like its Galaxy smartphone). Supply chain issues have hit consumer electronics companies this year, as well as inflationary pressures. With consumers having less discretionary income, there is less demand for consumer electronics. And the Ukraine crisis continues to exacerbate the situation.

Samsung: Three Key Financial Metrics

Investors looking to research Samsung stock can get an overview of its financials on the Samsung eToro homepage.

| Metric | Definition | Shows? |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making |

| P/E Ratio (Price/Earnings Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

| Debt-to-Equity Ratio | Long-term debt divided by shareholder equity | How much debt the company is in as a proportion of shareholder equity |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Samsung EPS (Earnings Per Share): $81.6

Samsung has made $81.6 net profit for every common share outstanding.

Samsung P/E Ratio: 14.36

One way of interpreting the P/E ratio is to say that the figure (Samsung: 14.36) shows how much an investor will have to pay per share for $1 of earnings.

The lower the P/E ratio, the cheaper the company. The higher the P/E ratio, the more highly investors are pricing in potential revenue in the future; tech companies have, in recent years, had very high P/E ratios which have been exposed by the recent correction in the markets.

It is useful to see that Samsung’s figure of 14.36 compares well to pricier Apple’s figure of 21.14.

Samsung Stock Dividends

Samsung considered to be one of the most popular dividend stocks. That is because it is committed to paying out dividends regularly.

- Dividends are payments made to stockholders on a discretionary basis by companies.

- Companies are not obliged to pay dividends.

- The key metric with dividends is what is called the ‘dividend yield’.

- Dividend yield shows how much of a company’s share value is paid out in dividends.

- Samsung’s dividend yield for 2021 was 1.8%.

Table: Samsung Dividend Yield, Common Shares, 2017-2021

| Year | Samsung Dividend Yield |

|---|---|

| 2021 | 1.8% |

| 2020 | 4.0% |

| 2019 | 2.6% |

| 2018 | 3.7% |

| 2017 | 1.7% |

- For 2022 and 2023, Samsung plan to return to investors KRW 9.8 Trillion annually via dividends. This amounts to $7.6bn.

- The ‘Record Date’ by which investors must own Samsung stock to benefit from its next quarterly dividend is 30th July, 2022.

Researching Samsung Stock

Today the Samsung stock price is $1148.

As we can see from the eToro price chart for Samsung below, Samsung stock has not been this cheap for 21 months, back on the 7th September 2020.

(Here we have used eToro‘s horizontal and vertical drawing tool to pinpoint today’s price on the right, and the last time the price was this cheap on the left.)

Reporting Q1 2022 revenues of £64.59bn with a net income of $9.4bn for the quarter — as well as a debt-to-equity ratio of under 6% some market analysts have argued that Samsung fundamentals are strong.

The share price has been hit by macro factors that have affected other companies in semiconductors and consumer electronics:

- Supply chain woes.

- Global price inflation.

- The Ukraine crisis.

Samsung: One of the Most Undervalued Stocks?

Using eToro’s powerful suite of charting tools, we have displayed below two moving averages for the Samsung share price: the 50-day and the 200-day moving average.

- The 50-day moving average, displayed as a green line, shows how the share price has been doing recently.

- The 200-day moving average, displayed as a red line, shows how the share price has been doing over the long-term.

We can see that the on the 13th August 2021, the 50-day moving average crossed below the 200-day moving average. In real terms, this means that the price began to fall behind its longer-term performance.

This crossing point is (rather dramatically) called the ‘Death Cross’ among charting experts.

What it means is either that investors think that Samsung has real problems, or that the stock is relatively undervalued and weathering tough market conditions. Investors considering whether to buy Samsung stock will want to know which applies.

Certainly market conditions have been chaotic and tough for Samsung. Chip rival TSMC is a constant thorn in Samsung’s side in particular.

Samsung: Innovation

Samsung is no stranger to innovation.

- In 2021, the Samsung Group was ranked third in the world for its Intellectual Property activity by WIPO, the World Intellectual Property Organization.

This is not a company that will decline over time because it is too scared to push forward technologically. It must do so in order to compete with its rivals.

Samsung Tech vs TMSC Tech

Competition between Samsung and chief chip rival TMSC has been intensifying over 3nm chip technology.

Competition between Samsung and chief chip rival TMSC has been intensifying over 3nm chip technology.

- 5nm technology is the mainstream technology currently used in the Samsung Galaxy S22 and the Apple iPhone 13, for example.

- 3nm technology is more powerful and more energy-efficient.

Samsung (according to Techwire Asia) looks like it is going to beat TMSC into production with 3nm chips.

- Samsung is getting into mass production of 3nm right now, whereas TMSC hope to follow suite in the second half of 2022.

- Another feather in Samsung’s cap is that it will be using its latest GAA transistor design, whereas TSMC will still be using the older FinFET design.

Although Samsung currently lags behind TSMC in chip production, Samsung aims to outstrip its rival by 2030 in volume sales. Taiwan (TSMC) and South Korea (Samsung) between them account for 83% of processor chips produced globally and 70% of memory chips.

Samsung: Expansion

Samsung Set to Expand into Car Chips according to third party sources

![]() Samsung is currently reported to be planning to acquire Netherlands-based chipmaker NXP. (Investors can buy NXP stock with eToro).

Samsung is currently reported to be planning to acquire Netherlands-based chipmaker NXP. (Investors can buy NXP stock with eToro).

This makes sense for Samsung because NXP makes chips for the global automotive sector, and there is currently a shortage of chips. What’s more, NXP is a client of Samsung rival TSMC.

Samsung Plans to Gain from US Chip Subsidy

Despite being based in South Korea, Samsung is building a $17bn chip plant in Taylor, Texas. The plant is expected to be operational by 2024.

Congress will soon consider whether to deliver $52bn in subsidies to chip manufacturers in the US with the Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Act. With a giant chip plant in the US, Samsung — as well as TMSC — is campaigning to get a slice of this US subsidy.

Step 3: Open a Trading Account with a Regulated Broker

Investors looking to buy Samsung stock will need to sign up with an online stock trading platform.

1: Sign up

- Head to the website of the broker of your choice.

- Enter a few personal details.

- Or sign up faster with Facebook/Google.

- Press ‘Create Account’ to proceed.

Samsung Stock: Investor Sentiment

Professional analysts are overwhelmingly bullish on Samsung stock.

But according to some market analysts Samsung has recently scaled back its supply inventory, suggesting that it thinks sales will falter over 2022.

BUY: 85% of Wall Street Journal Analysts Say BUY Samsung

85% of 34 investment analysts polled by the Wall Street Journal currently support buying Samsung stock.

Table: Analyst Recommendations on Samsung compiled by Wall Street Journal

| Position | Number of analysts in favour |

|---|---|

| Buy | 29 |

| Overweight | 3 |

| Hold | 2 |

| Underweight | 0 |

| Sell | 0 |

This overwhelmingly positive consensus is reinforced by opinions polled by Marketscreener.com.

BUY: 92% of Marketscreener.com Analysts Bullish on Samsung

Table: Analyst Recommendations on Samsung compiled by Marketscreener.com

| Position | Number of analysts in favour |

|---|---|

| Buy | 24 |

| Outperform | 10 |

| Hold | 3 |

| Underperform | 0 |

| Sell | 0 |

Of 37 analysts polled by Marketscreener.com, 65% said ‘Buy’, 27% said ‘Outperform’ and 3 said ‘Hold’. As with the analysts polled by the Wall Street Journal, none recommended ‘Sell’.

Analysts posit a mean target price 54% higher than its current level.

SELL: Samsung Scales Back Inventory

News outlet Nikkei Asia reported in the second week of June 2022 that, due to ‘global inflation concerns’ Samsung Electronics is halting new procurement orders and requesting many of its suppliers to either delay or shrink their consignments.

Samsung thinks it will not need as many parts to make its smartphones and other consumer electronics. That is because, with price inflation on the rampage, consumers globally will have less discretionary income and therefore less money to spend on electronic kit.

According to market experts Chinese smartphone producers Xiaomi, Vivo and Oppo have trimmed their inventory orders too over ‘battered consumer confidence’.

Conclusion

Above we have aimed to give an overview to investors considering how to buy Samsung stock in 2022 with a regulated broker.

#stocks #stockmarket #investing #trading #money #forex #investment #finance #invest #bitcoin #business #investor #entrepreneur #cryptocurrency #trader #financialfreedom #crypto #wallstreet #wealth #daytrader #motivation #forextrader #success #daytrading #nifty #forextrading #sharemarket #stock #millionaire