Mortgage amortization is how a home loan is paid down: The debt diminishes slowly at the beginning and then rapidly toward the end.

-

At first, most of each mortgage payment goes toward interest.

-

In later years, most of the payment reduces debt.

The gradual shift from paying mostly interest to mostly debt payment is the hallmark of an amortized mortgage.

Using a mortgage amortization calculator, you can:

-

Find out how much total interest you would pay over the life of a loan.

-

Determine the remaining loan balance in any given month.

-

Figure out how much of each month's payment goes toward principal (debt reduction) and interest.

-

Compare the total cost of a 30-year loan versus a mortgage with a shorter term, such as 15 years.

-

Know when you're approaching 20% equity, so you can cancel private mortgage insurance.

"Amortization" is pronounced am-ur-ti-ZAY-shun. "Amortize" is pronounced AM-ur-tize.

When loan officers talk about amortization, they often mean the loan's term, or the number of years it will take to pay it in full. A "30-year amortization" and a "30-year mortgage term" mean the same thing.

» MORE: Mortgage amortization calculator, with instructions

Mortgage amortization definition

Amortization is a repayment feature of loans with equal monthly payments and a fixed end date. Mortgages are amortized, and so are auto loans.

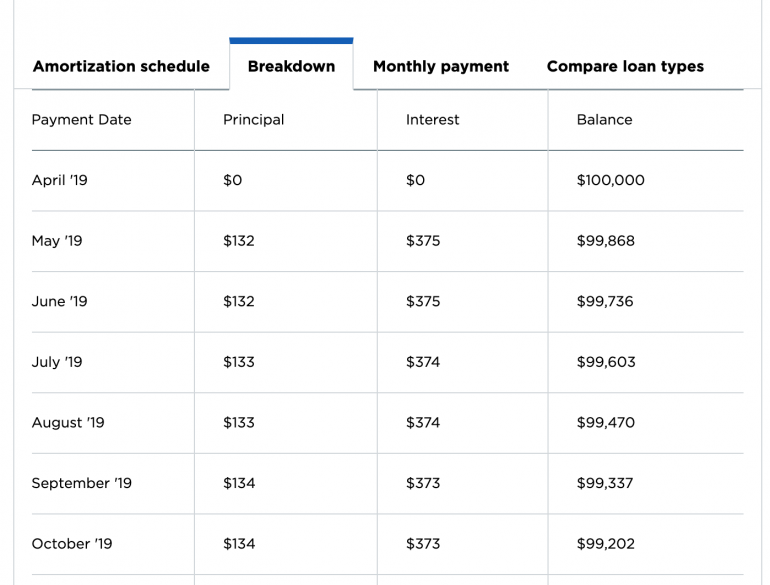

Monthly mortgage payments are equal (excluding taxes and insurance), but the amounts going to principal and interest change every month. Take the example of a $100,000 mortgage with an interest rate of 4.5%, amortized over 30 years. Monthly principal and interest would total $507:

-

With the first payment, $375 would go toward interest and $132 would go to principal.

-

Halfway through the loan term, at the end of the 15th year, $249 would go toward interest and $257 would go to principal.

-

With the last payment, $2 would go toward interest and $505 would go to principal.

How does mortgage amortization work?

A mortgage amortization table, also called a mortgage amortization schedule, is the easiest way to visualize the concept. The mortgage amortization table is a grid that displays the amount of each payment that goes toward principal and interest.

“An amortization table displays the amount of each payment that goes toward principal and interest.”

This excerpt of a mortgage amortization schedule shows what happens with the first payments on that 30-year mortgage for $100,000 with a 4.5% interest rate. In addition to detailing how much of each payment goes to principal and interest, it shows the remaining balance after each payment. With this loan, the balance is $99,202 after six payments.

What does amortization mean in a mortgage?

An amortized mortgage means that the loan balance decreases gradually at first. That means your payments build equity slowly in the first years of the mortgage. The good news is that you build equity more quickly in the final years of the mortgage.

To accountants and business owners, "amortization" has other meanings, too. But for homeowners, mortgage amortization means the monthly payments pay down the debt predictably over time.