Nike is a global leader in sporting apparel that has retained its status as a trusted brand for many decades.

While Nike has seen its stock price take a major hit in the first half of 2022, it has still outperformed the broader markets over a 5-year period.

In this guide, we explain the process of buying Nike stock online in under five minutes without paying any commission. We also analyze whether or not Nike stock is a worthy buy for risk-averse investors in the current economic climate.

Buying Nike Stock – An Overview

Nike – as an NYSE-listed company with a large market capitalization, can be invested in from just about any online stock broker.

Follow the guide below to learn to buy Nike stock via a regulated platform:

- ✅ Step 1: Open an Account

It takes just two minutes to open an account with a broker. Head over to the website, click ‘Join’, and fill in the online registration form. Upload a copy of a government-issued ID to complete the registration process. - 💳 Step 2: Deposit Funds

Most large brokers will support a range of payment methods. Choose from an e-wallet like PayPal, a debit/credit card, or ACH. - 🔎 Step 3: Search for Nike Stock

To find Nike stock, type the name of the firm into the search bar and click on ‘Trade’ when it appears. - 🛒 Step 4: Buy Nike Stock

An order box will appear – type in the total investment amount. Click ‘Open Trade’ to buy Nike stock instantly at the next available price.

As is evident from the above guide on buying Nike stock, a regulated broker makes the process simple, fast, and cost-effective.

With that said, for a more in-depth tutorial on buying stocks – read on.

Step 1: Choose a Stock Broker

The initial step required when finding about buying Nike stock is to choose an online broker.

When exploring where to buy stocks online, investors need to consider fees, minimum deposits and investment requirements, accepted payment types, and regulations.

For an overview of where to buy Nike stock today, consider the trading platforms discussed below.

1. eToro

We considered dozens of leading brokers that are active in this marketplace and found that eToro supports buyomg Nike stock online. This broker offers a simple trading platform that is suitable for investors of all experience levels and skillset.

In fact, we found that it took just five minutes from start to finish to open an account, upload ID, and subsequently invest in Nike. The KYC process, in particular, is impressive insofar as eToro will validate the documents instantly. US clients can get started with a minimum deposit of just $10.

Another benefit of depositing funds into an eToro account is that no transactions are charged. This is the case across all payment methods. In addition to debit and credit cards, this is inclusive of ACH, Paypal, Skrill, Neteller, and more. Buying Nike stock – or any supported equity for that matter requires a minimum investment of just $10 when using eToro.

This is because fractional trading is supported, which means that users can purchase just a small portion of a stock. When it comes to trading fees, eToro offers 0% commission markets on all of its supported stocks – including Nike. In total, eToro supports thousands of stocks – not only in the US but further afield.

This includes leading stock exchanges in London, Frankfurt, Hong Kong, Amsterdam, Toronto, and many others. ETFs are also supported on eToro and these can be traded commission-free too. eToro account holders might also look to buy cryptocurrency here, as the minimum stake amounts to just $10 and fees are competitive at 1%.

Not only does eToro allow users to buy Bitcoin, but 70 other digital currencies. eToro is also the place to buy Nike stock for those that prefer passive investment tools. At eToro, this includes a Copy Trading feature that allows users to copy other investors. There are thousands of verified traders that can be copied, some of which have a superb track record.

eToro also offers Smart Portfolios, which are professionally managed on behalf of investors and consist of a diversified basket of stocks. Each Smart Portfolio will track a specific area of the stock market – such as renewable energy or BigTech. The eToro app for iOS and Android is also worth downloading so that investors can trade on the go.

We also like that eToro allows users to switch over to ‘Virtual Portfolio’ mode at the click of a button. This subsequently transitions into a demo account with a pre-loaded balance of $100,000. And finally, when exploring the regulatory standing of eToro, we were pleased to see that the broker is regulated by the SEC and FINRA, as well as CySEC, FCA, and ASIC.

| Number of Stocks | 2,500+ |

| Deposit Fee | FREE |

| Fee to Buy Nike | Commission-Free |

| Minimum Deposit | $10 |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull

The second broker to consider when learning to buy Nike stock is Webull. This platform has a reputation in the US investment scene – especially among beginners. Across the Webull app for iOS and Android, as well as the main website, users can buy and sell stocks without needing any prior experience.

The second broker to consider when learning to buy Nike stock is Webull. This platform has a reputation in the US investment scene – especially among beginners. Across the Webull app for iOS and Android, as well as the main website, users can buy and sell stocks without needing any prior experience.

Getting started with an account takes no time at all and Webull does not have a minimum deposit requirement in place on standard plans. Retirement and margin accounts, however, do come with certain stipulations, so users are advised to check this before signing up.

Nonetheless, casual investors will appreciate that Webull offers Nike stock at a minimum trade size of just $5. Just like eToro, this is because Webull is a proponent of fractional stock trading. It is also notable that Webull allows its users to buy Nike stock without paying any trading commission.

In addition to Nike, Webull is home to thousands of other stocks from the NYSE and NASDAQ. This is in addition to a few hundred ADRs, which means that Webull is not the right broker for international diversification. With that said, Webull does offer stock trading options, as well as ETFs and cryptocurrencies.

Although Webull is suited for newbies, we should also note that experienced traders will find the platform sufficient. It offers a full suite of advanced trading tools – such as live charts and dozens of economic indicators. Furthermore, as noted above, Webull also allows US clients to buy Nike stock on margin, albeit, this requires a minimum balance of $2,000.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Nike Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

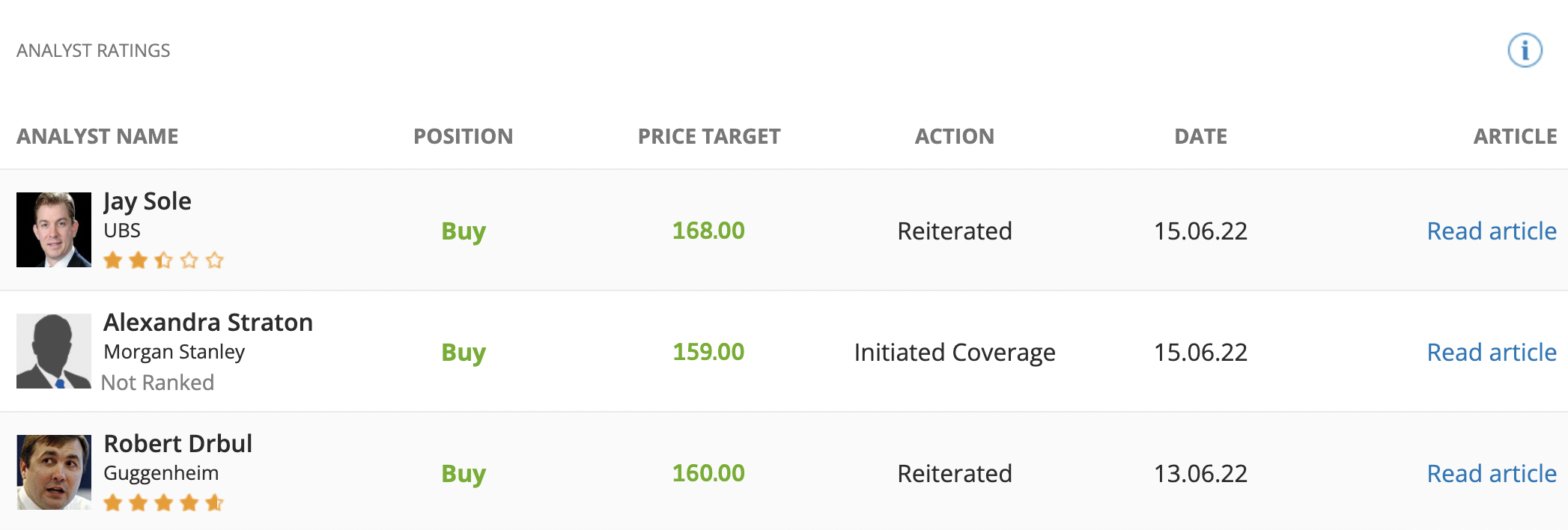

Step 2: Research Nike Stock

When learning to invest in Nike stock, an important step is to research the ins and outs of whether the firm represents a viable investment.

For long-term investors, it is a solid idea to focus on the fundamentals. This includes the outlook of its balance sheet and free cash flow levels, alongside recent revenue and profit figures.

Those with limited time to dedicate to researching Nike stock will appreciate the following sections:

What is Nike

Nike is a global leader in sports apparel. This includes everything from trainers and t-shirts to caps and hoodies. Nike is also a major sponsor for some of the biggest sports and teams globally.

This covers football, baseball, golf, soccer, NBA, and much more. The brand is recognized in virtually all corners of the globe, as it has been for many decades.

Nike was founded in 1964 and as we discuss shortly, the firm went public in 1980. Since then, Nike has grown to become one of the largest companies globally, and a core constituent for many major index funds like the S&P 500.

Nike Stock Price Today – How Much is Nike Stock Worth

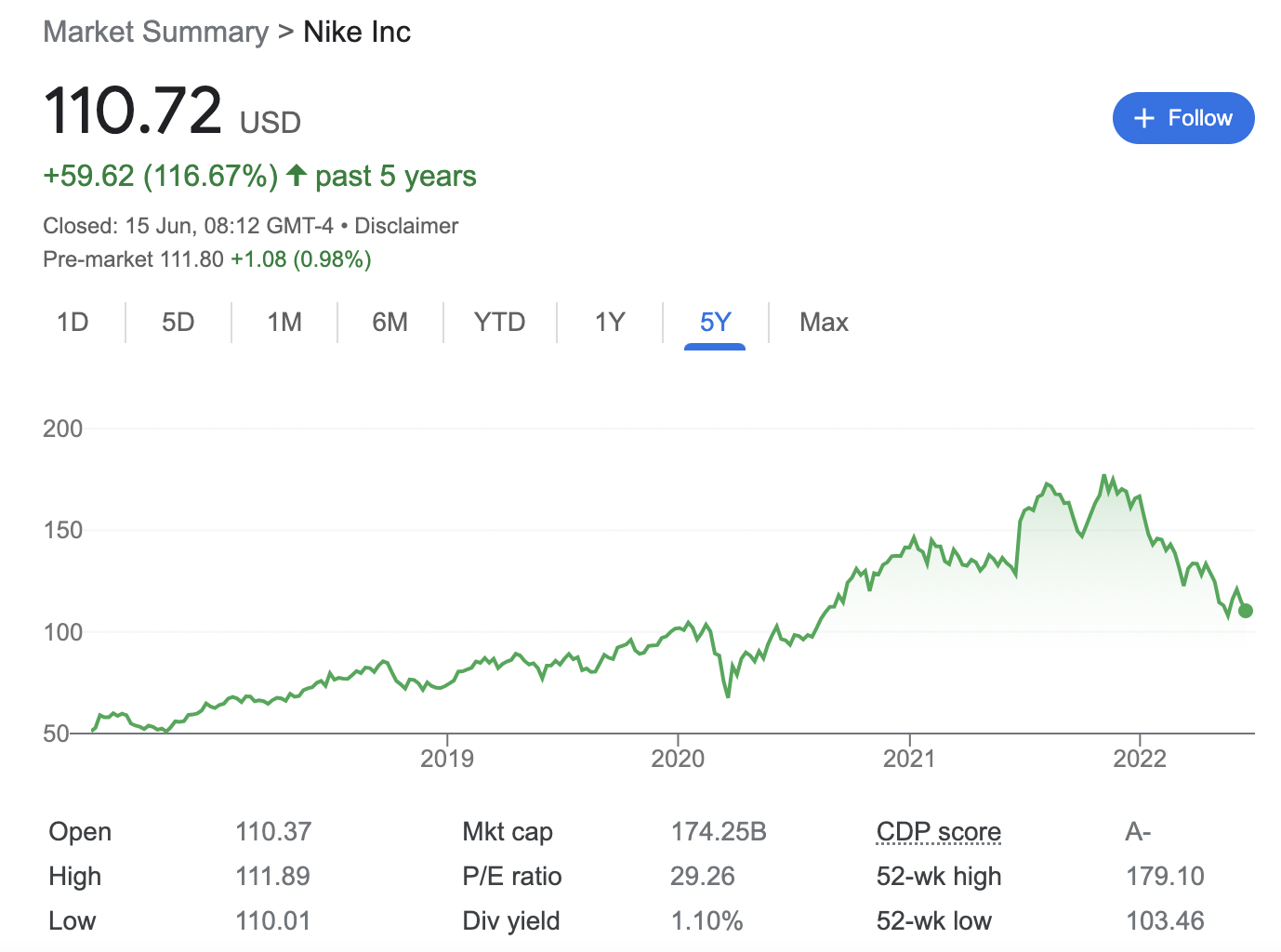

When Nike first went public on the NYSE in 1980, it traded at just $22 per share. However, as there have been several Nike stock splits since going public, its initial listing price should be adjusted to $0.24. Considering that Nike last hit an all-time high of $179 in late 2021, this shows just how much the stock has generated since being a public company.

In fact, those who invested $1,000 during the Nike IPO and held on until late 2021 would have been looking at end-to-end gains of over 74,000%. Therefore, a $1,000 investment would have been worth $740,000. With that said, and like all stocks in 2022, Nike has since seen its value decline. In the first six months of 2022, for instance, Nike stock dropped in value by over 30%.

Over the prior five years, however, Nike stock has generated gains of over 116%. In comparison, the S&P 500 and Dow Jones have grown by just 53% and 42% respectively. Therefore, those looking for a solid, established stock that continues to outperform the wider markets might look to buy Nike.

This is especially the case considering that Nike stock can be purchased on the cheap – as per its 2022 decline. Ultimately, Nike dominates its sector and its brand is trusted globally. Therefore, there is no reason to believe that Nike will not recover its previous highs – as and when the broader markets turn bullish.

EPS and P/E Ratio

The Nike EPS over the prior three fiscal years was as follows:

2022: $2.85

2021: $3.56

2020: $1.60

In terms of its P/E ratio, based on prices as of writing, Nike is trading at 29 times. In comparison, major competitive Adidas is carrying a P/E ratio of just 15 times. However, Adidas stock has struggled in recent years, so this figure is somewhat skewed.

Nike Stock Dividends

Nike began paying dividends in 1985 – just five years after it became a public company. There have been no dividend suspensions since, which is impressive considering that many S&P 500 stocks did so in the midst of COVID-19.

Moreover, Nike has increased the size of its dividend annually for 15 consecutive years. If this trend continues for another decade, this will make Nike a dividend aristocrat.

With all that being said, Nike doesn’t pay the most yield on Wall Street. At the time of wiring, for instance, Nike is offering a running dividend yield of just over 1%.

Factors Affecting Nike Stock

In the sections below, we cover the core factors that need to be considered when exploring buying Nike stock.

This will help ensure that prospective investors gain exposure to Nike only after performing adequate research.

Nike Continues to Outperform Major Index Funds

First and foremost, we should reiterate that Nike – although an established company with limited growth potential, continues to outperform most major index funds.

For instance, over the prior year, the NYSE Composite has grown by a mere 22% and, as we mentioned earlier, the S&P 500 and Dow Jones have grown by just 53% and 42% respectively.

In comparison, Nike stock has grown by over 116% over the same time frame.

Solid Dividend Stock

While Nike doesn’t offer a massive yield, it is still a solid dividend stock with a prolonged track record. As noted above, it was paid dividends without fail since 1985.

Moreover, over the prior 15 consecutive years, Nike has increased the size of its dividend payment. Therefore, those in the market for dividend stocks for consistency might want to consider Nike.

Buy the Market Dip

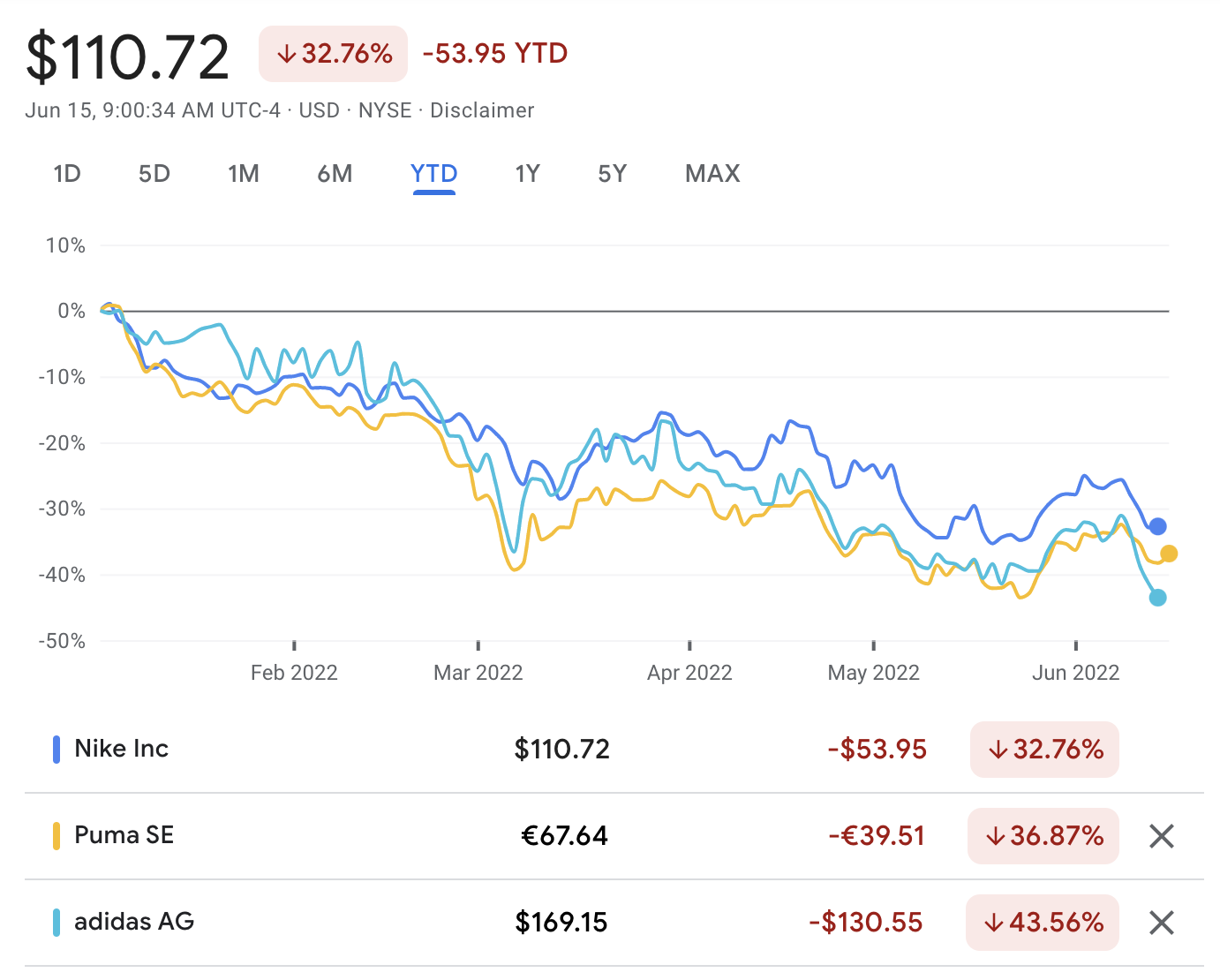

It is important to remember that while Nike stock has seen rapid losses in the first half of 2022, this is in response to a broader market sell-off.

For instance, over the same period, Adidas stock is down over 43%. Puma has also performed poorly, with losses of 36%. Ultimately, Nike is a solid company with a robust balance sheer – not to mention one of the most trusted brands globally.

Therefore, those looking to buy Nike stock could take advantage of the broader market dip..

Nike has Brand Value

Perhaps the most important thing going for Nike is that it has significant brand value. As we noted earlier, it sponsors some of the most successful teams globally from just about every sport possible.

This will ensure that the Nike brand remains relevant throughout the course of time.

Robust Balance Sheet

As should be expected from a company as consistent as Nike, the firm has a robust balance. As per its most recent earnings report, Nike holds $38.5 billion in assets, compared to $23.7 billion in total liabilities.

Even more impressively, Nike is holding over $13.4 billion in cash and short-term investments. Therefore, irrespective of broader economic conditions, Nike has the resources to weather any future storms.

Furthermore, Nike has plenty of free cash flow on its book, so expect further acquisitions when the right opportunity arises.

Step 3: Open an Account & Buy Stock

In this section of our step-by-step guide, we will explain the process of buying Nike stock via a regulated broker.

Step 1: Open an Account

To open an account with a broker, head to its website and complete the sign-up process by typing in the required personal information and contact details.

Choose a suitable username and password too.

The broker will also send an SMS to the cell phone number that has been registered. When it arrives, type in the unique code to verify the number.

Step 2: Upload ID

Large brokers have the fastest KYC processes in the online brokerage space. In most cases, after uploading the required documents, the account will be verified in less than a minute.

First, the broker will need a copy of a government-issued ID. This can be a passport, driver’s license, or state ID – just make sure it is still in date.

Second, the broker requires proof of residency. This can be a document from a bank or utility company, issued within the prior three months.

Step 3: Deposit Funds

Next, a deposit will need to be made into the brokerage. The minimum requirement is just $10. The most convenient payment method supported by most brokers is a debit/credit card – as this will be processed instantly.

Step 4: Search for Nike Stock

Once the account is funded, look for the search bar and type in ‘Nike’.

Nike stock will appear and when it does – click ‘Trade’.

Step 5: Buy Nike Stock

The final part of the Nike stock investment process is to place a buy order. At most brokers, this requires just one piece of information – the total stake.

To confirm everything, click on the ‘Open Trade’ button.

Nike Stock Strength

While Nike is somewhat of a slow and steady stock with limited growth potential – at least in the coming years, it still continues to outperform the broader markets. Not only does this include its key competitors – such as Puma and Adidas, but index funds like the S&P 500 and Dow Jones.

Furthermore, while the outlook for growth is questionable – considering that it already dominated most of the markets that it operates in, Nike is home to a robust balance. Therefore, it has the financial resources to diversify into other markets when the right opportunity arises.

Sure, there are other stocks in this marketplace that will perhaps generate more gains. But, those in the market for a solid blue-chip stock likely won’t go too far wrong with Nike. Moreover, Nike is a consistent dividend payer. While its yield isn’t the number one in this space, it has increased the size of its dividend for 15 consecutive years.

Conclusion

Learning to buy Nike stock is a very straightforward process. However, it is also important for investors to analyze and research whether Nike is right for their portfolio and trading objectives before proceeding.

For those that have already done the groundwork and wish to invest in Nike – a regulated broker is a must.

#stocks #stockmarket #investing #trading #money #forex #investment #finance #invest #bitcoin #business #investor #entrepreneur #cryptocurrency #trader #financialfreedom #crypto #wallstreet #wealth #daytrader #motivation #forextrader #success #daytrading #nifty #forextrading #sharemarket #stock #millionaire