In this guide, we explain how to buy Meta stock with a regulated stock trading platform.

We also explore the many fundamentals that suggest Meta is a popular stock to watch in 2022.

Step 1: Choose a Stock Broker

Below, we review a handful of popular trading platforms, which should be helpful for those deciding on where to buy Meta stock.

Key metrics we look at include regulatory standing, fees charged to invest in Meta stock, features, and more.

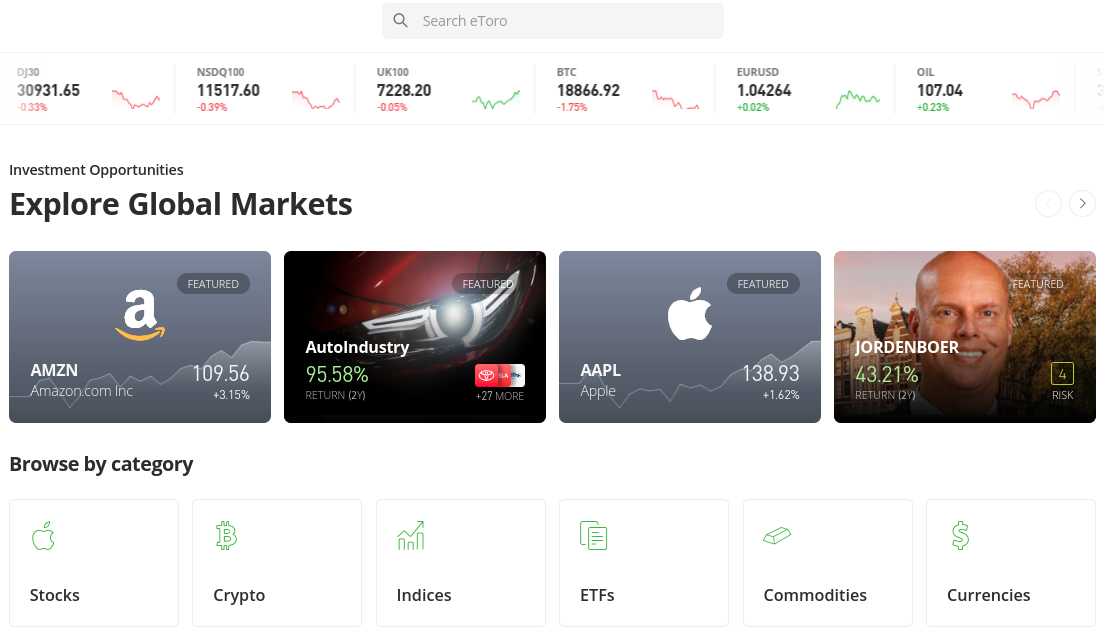

1. eToro

eToro allows people from 140 countries to access more than 2,500+ stocks. This is a tier-1 regulated trading platform that holds multiple licenses. Financial regulators include the SEC, the FCA, CySEC, and ASIC.

Traders at eToro can buy Meta stock without having any prior investment experience. The platform was designed to be simple to navigate.

Diversification is achieved as this broker offers stocks from exchanges such as the NASDAQ, the NYSE, Frankfurt, the LSE, Paris, Milan, Brussels, Stockholm, and various others. Other assets include forex, cryptocurrencies, commodities, and indices.

Traders should check what’s available in their country of residence. Fractional investing is available at this brokerage, which means that traders can buy stock in Meta by allocating as little as $10.

Traders could also opt to allocate $500 or more to a Smart Portfolio, which is an investment management service offered by eToro. There are dozens of Smart Portfolios that are made up entirely of stocks.

Smart Portfolios track a bundle of stocks, so this allows the investor to add multiple equities to their account with a single purchase. For exposure to Meta stock, traders could check out BigTech, a Smart Portfolio that includes Apple, Google, and many more from the same sector.

Another option to buy stocks automatically is Copy Trading. In this case, people can copy the trades of an experienced investor by allocating $200 or more. Traders can copy people based on their risk score, performance, and asset preference.

Deposit methods include e-wallets such as PayPal, Skrill, and Neteller. Other supported methods of payment are credit/debit cards, ACH, and bank wire. The minimum deposit ranges depending on location. The amount required for US and UK clients is $10, $50 for many European and Asian countries, and $1,000 for a handful of other locations.

There is a simple 0.5% charge when funding an account in a currency other than US dollars. As such, those in the US can make a deposit using any method with no fees payable at all. Traders can buy and sell shares and check the Meta stock chart on the go via the eToro app, which is free to download. eToro is one of the most popular trading platforms new and experienced investors can use in 2022, our eToro review covers all the key metrics and features that separate this broker from the crowd.

| Number of Stocks | 2,500+ |

| Deposit Fee | Free for US clients |

| Fee to Buy Meta Stock | Commission-Free |

| Minimum Deposit | $10 in the US/UK. Otherwise between $50 and $1,000 depending on location |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Capital.com

Capital.com offers over 5,000 stock CFDs on a commission-free basis. Capital.com facilitates orders of $1 or more.

As a CFD platform, this means traders are not able to buy Meta stock outright. Instead, the CFD tracks the underlying asset and traders can speculate on its rise or fall. This is achieved by placing a buy order to go long. On the other hand, a sell order needs to be placed to go short if it’s thought the stock price will fall.

Being able to benefit from rising and falling markets offers traders a level of flexibility. Capital.com also facilitates leveraged stock trading. This allows people to boost their position by as much as 1:5 depending on the type of investor and account balance.

Do note that US clients are not accepted at Capital.com as CFDs are prohibited in the country.

To get started, deposit $20 or more with a credit/debit card, Apple Pay, Neteller, Skrill, iDEAL, Sofort, Trustly, or WebMoney. Bank wires require a minimum deposit of $250.

| Number of Stocks | 5,000+ |

| Deposit Fee | FREE |

| Fee to Trade Meta Stock | Commission-Free |

| Minimum Deposit | $20 |

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

3. Webull

Webull is a popular option for US traders looking to invest in Meta stock on a budget. In addition to the standard cash and margin accounts, this broker also offers various IRAs.

Webull is a popular option for US traders looking to invest in Meta stock on a budget. In addition to the standard cash and margin accounts, this broker also offers various IRAs.

This platform facilitates fractional share investments of just $5 or more. Furthermore, all US-listed companies can be invested in without any trading fees. As such, Meta stock is offered on a commission-free basis.

There are some non-US stocks that are offered as ADRs, however, note that there will be a fee to pay. According to the platform, this ranges between $0.01 and $0.03 per stock. There is no minimum deposit, however, anyone who wishes to fund the account via a wire transfer will be charged $8 per transaction.

$25 will be charged on all domestic bank wire withdrawals too. ACH deposits are free, however, this method can be slow to clear. There is a range of charts, stock screeners, technical indicators, and company fundamentals.

The Webull workstation is customizable, and like the other brokers on this list, a free app is available so traders can buy Meta stock on the move. Note that traders who wish to open a margin account will need to have a minimum balance of $2,000 to qualify.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Meta Stock | Commission-Free |

| Minimum Deposit | $0 |

Step 2: Research Meta Stock

Research is an essential part of evaluating a stock.

With this in mind, the information included below covers metrics surrounding the company’s business model, its stock performance on the NASDAQ, price predictions, and more.

What is Meta?

Meta, formally Facebook, was founded in 2004 by Mark Zuckerburg and his college roommates Chris Hughes, Andrew McCollum, Dustin Moskovitz, and Eduardo Saverin. The firm is a multinational technology company.

Meta, formally Facebook, was founded in 2004 by Mark Zuckerburg and his college roommates Chris Hughes, Andrew McCollum, Dustin Moskovitz, and Eduardo Saverin. The firm is a multinational technology company.

The social networking platform Facebook was initially created to connect university students to one another in the US. However, by 2006, the platform became accessible globally and anyone over the age of 13 could register.

Meta quickly went on to overtake existing social media platforms like MySpace. As of Q1 2022, Meta notes that over 3.6 billion people were using at least one of its platforms per month. Meta stock is part of the FAANG group.

This is an acronym that refers to the five leaders in the technology sector, which also include Amazon, Apple, Netflix, and Alphabet (Google).

Additionally, this company owns multiple well-known platforms and services, such as WhatsApp, Instagram, Oculus VR, Beluga, and, of course, Facebook. The vast majority of Meta’s revenue comes from advertising.

Facebook became Meta in 2021. Meta’s re-branding signified a shift from just being a social media platform to becoming a metaverse ecosystem with various AR and VR products and apps.

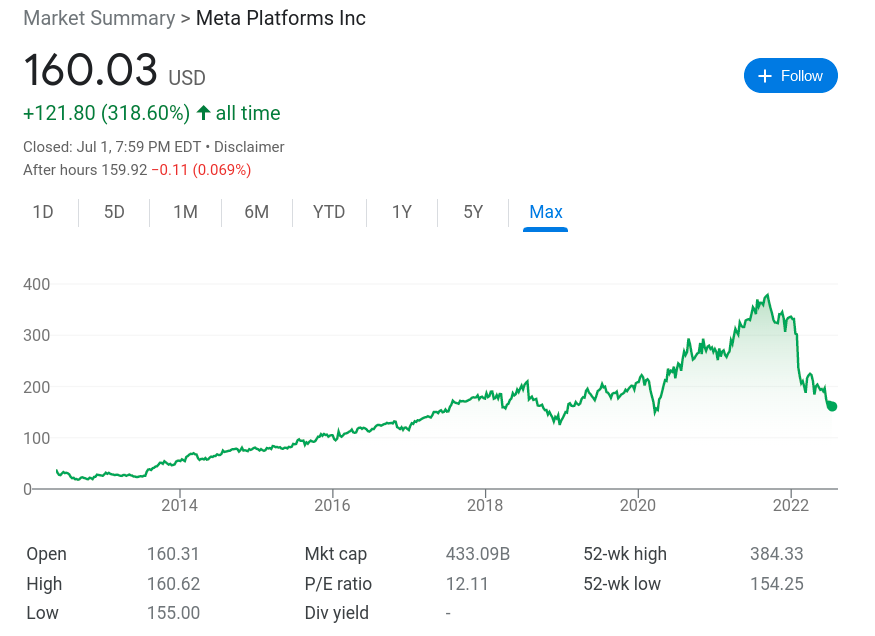

Meta Stock Price – How Much is Meta Stock Worth?

Meta stock was added to the NASDAQ in May 2012 at a little over $38. The all-time highest value of Meta was in September 2021 when the stock hit almost $380. After this, the company lost billions of dollars in market value.

This followed the uncertainty of the Omicron variant of COVID-19, negative news developments, supply chain problems, and other issues. That said, the first half of 2022 saw many tech and growth stocks plummet. This was mostly down to fears surrounding rising inflation and interest rates.

Moreover, Apple changed its rules and software surrounding app privacy. This made it much harder for advertisers to track people’s behaviors, which means less revenue for firms that make most of their money this way – like Meta. As a result, in February 2022, Meta announced a disappointing financial forecast.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Meta released a statement citing Apple’s privacy changes as well as competition from other platforms as the primary reason. So, what happened to Meta stock? On February 2nd, 2022, the stock price was $232 per share. By March 1st, 2022, Meta stock was trading at $203. This illustrates a drop of 37% in less than a month.

With that said, many sell-side analysts rate Meta a strong buy, so this could represent a bargain price. We talk about why this might be a worthy addition to an investment portfolio shortly, for anyone still making their mind up on whether or not to buy Meta stock.

EPS and P/E Ratio

To get a clearer indication of the financial health of a company they wish to invest in, traders can look at the quarterly financials.

Here’s a quick breakdown of the EPS reported in the previous four earnings calls from Meta:

- Q2 2021, reported EPS was $3.61. This was a 17.94% surprise

- Q3 2021, reported EPS was $3.22. This was a 1.32% surprise

- Q4 2021, reported EPS was $3.67. This was a -4.12% surprise

- Q1 2022, reported EPS was $2.72. This was an 8.13% surprise

Below is the revenue from the same reports:

- Q2 2021, reported revenue was $29.08 billion. This was a 4.27% surprise

- Q3 2021, reported revenue was $29.01 billion. This was a -1.74% surprise

- Q4 2021, reported revenue was $33.67 billion. This was a 0.70% surprise

- Q1 2022, reported revenue was $27.91 billion. This was a -1.13% surprise

Looking at this information when learning how to invest in Meta stock will allow traders to assess the P/E ratio.

This can be done by dividing the share price by the EPS. Based on the Meta stock price at the time of writing, the P/E ratio is 12.1 times.

Market Capitalization

At the time of writing, the market capitalization of Meta is at just over $433 billion.

Although Meta stock has lost value in recent months, much like the Snap stock it is still among one of the largest companies globally by market cap.

Index Funds

People can also buy Meta stock via an index fund or ETF.

Some of the more popular funds that Meta is a component of are listed below:

- NASDAQ 100

- S&P 500

- The Communication Services Select Sector SPDR

- The SPDR Euro Stoxx 50 ETF

All of the funds listed above are available to buy at eToro without paying any commission.

Read More: Traders of all skill-sets can learn how to trade ETFs here.

Meta Stock Dividends

Meta does not distribute dividends to investors. The company says that it retains its earnings instead. This is in order to finance the long-term growth of the business.

For anyone who finds this disappointing, eToro lists some popular dividend stocks all of which can be purchased commission-free.

Meta Stock – Investor Sentiment

As we mentioned, the majority of Wall Street analysts have Meta stock as either a ‘buy’ or ‘strong buy’.

That said, below, we discuss some of the core reasons why traders might opt to buy Meta stock right now:

Meta is Invested in a Virtual Reality Future

Meta is always working on staying relevant and has gone from a social networking company to one of the most popular metaverse stocks to buy.

- Meta has invested billions of dollars into VR/AR. In 2021, the company invested $10 billion in the metaverse

- Meta will invest $20 billion in capital projects in 2022 and approximately $25 billion in 2023

- In June 2022, Meta introduced three new AI models which focus on visual-audio understanding. These models, which emphasize human voices in videos, are intended to move people toward a more immersive reality

- Moreover, the company has developed a VR platform called Horizon Worlds. This allows people to connect in a virtual reality world, create their own avatars, host parties and even partake in professional meetings

- Meta believes its metaverse will be the future of the way we interact and will enable people to play, work and connect with others in online and immersive experiences

- The company also aims to monetize it by creating a digital ecosystem where people can purchase avatars and other virtual goods

In February 2022, Meta announced it has surpassed 300,000 monthly users on its Horizon Worlds platform. Furthermore, Horizon Home is the latest social space on its metaverse. This is included in the Quest 2 headset update.

Horizon Home joins Worlds, Venues, and Workrooms. Meta’s Horizon Home offers a wide range of distinctive surroundings via VR headsets, from a cutting-edge cyberpunk flat to a cozy cabin.

Moreover, as a welcome addition for metaverse fans, users can now view immersive films, invite their friends into their homes to hang out, and play cooperative video games.

Invest In Meta: Buy the Dip

Traders looking at the Meta stock price may be surprised to see its low valuation.

This is in part due to its reported earnings miss, as well as the aforementioned rising inflation, alongside political unrest in Europe.

A rise in interest rates also led to advertisers spending less than expected. In the first six months of trading in 2022, Meta stock fell by almost 53%. At the time of writing, Meta stock is down more than 58% from the 52-week high.

The Company’s Advertising Revenue Growth

Meta is facing short-term headwinds. This is due to inflation hitting a 41-year high in the US, rising interest rates, and also the impact of Russia’s invasion of Ukraine.

According to market analysts:

- Nearly all of Meta’s revenue comes from its advertising division, which enjoys a near-duopoly with Alphabet in the US and other important areas

- The revenue of Meta climbed by 37% to $118 billion in 2021. With practically flat sales in Q2 2022, Meta anticipates the downturn to continue

- The disappointing projection, according to Meta, was mostly caused by Apple’s privacy update for iOS

- That said, Apple didn’t impose any privacy restrictions, and it even made some changes to its SKAdNetwork that would provide Meta with more advertising choice

- As the short-term obstacles subside, the company’s advertising revenue growth is likely to pick up speed once more

- In 2021, the company’s share of the global digital advertising market was around 23%

- Over 10 million advertisers use the personalized ad tools offered by Meta

Meta is Investing in the Short-Form Video Trend

Meta has faced fierce competition from platforms such as TikTok.

However, the company is focused on its short-form video technology to capitalize on this ongoing trend.

- Meta increased its investment in new short films for Instagram and Facebook as its revenue growth slowed

- It’s hoped that products such as Meta’s Instagram Reels help the company fight off competition from TikTok

- The company said Reels has become one of its fastest-growing content formats, as well as engagement growth on Instagram

Traders should take the aforementioned Meta stock price predictions with a grain of salt.

Reality Labs and Family of Apps

Meta is behind some of the most popular apps globally. Meta’s so-called ‘Family of Apps’ includes Facebook and Messenger, WhatsApp, and Instagram.

There’s also the ‘Reality Labs’ side of the business, which includes the VR and metaverse division.

Management modified how the firm reported its financials when it changed its name from Facebook to Meta. This would see the company reporting on its Family of Apps, as well as Reality Labs.

As such, Meta now has two reportable segments.

Here’s some information from the Q1 2022 highlights:

- Daily active users reported was 2.87 billion in March 2022. This illustrates a rise of 6% from the previous year

- As of March 31, 2022, there were 3.64 billion monthly active users. This is an increase of 6% over the previous year

- Daily active users on Facebook increased by 4% between March 2021 to March 2022, to an average of 1.96 billion

- As of March 31, 2022, there were 2.94 billion monthly active users on Facebook, up 3% from the previous year

- In Q1 2022, the average price per ad fell by 8% year over year

- Meanwhile, the number of ad impressions provided throughout Meta’s Family of Apps climbed by 15%

Despite spending $10 billion on its metaverse journey, the firm’s free cash flow increased from $23.6 billion in 2020 to $39 billion in 2021.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Meta Stock – Recap

- Out of 55 sell-side Wall Street analysts over the prior 90 days, 32 rate Meta stock a ‘strong buy’, and 14 have the firm as a ‘buy’

- The company aims to give TikTok a run for its money with short-form video tech via Instagram and Facebook. This is called Reels

- The majority of Meta’s revenue comes from advertising. At the time of writing, the company has more than 10 million ad firms using its service

- In its Q1 2022 financial report, the company beat EPS estimates by over 8%.

- The company changed its name to illustrate it was expanding its products and services to include the metaverse

- By February 2022, Horizon Worlds, which is part of the company’s metaverse, had drawn in over 300,000 users. Horizon Worlds was only released in December 2021

Furthermore, new tools will be available in the near future.

Conclusion

Today, we’ve offered traders a full explanation of how to buy Meta stock in under five minutes with any regulated stock trading platform. Meta stock has been trading at its lowest price since April 2020 and many sell-side Wall Street analysts are rating it a ‘strong buy.

#stocks #stockmarket #investing #trading #money #forex #investment #finance #invest #bitcoin #business #investor #entrepreneur #cryptocurrency #trader #financialfreedom #crypto #wallstreet #wealth #daytrader #motivation #forextrader #success #daytrading #nifty #forextrading #sharemarket #stock #millionaire