Insights:

Credit history plays a role in what you pay for auto insurance in most states.

Your credit score impacts many areas of your life, not just when you want to borrow money. One example is car insurance. This is especially an issue for car insurance for drivers with poor credit.

Many car insurance companies consider a person’s credit when evaluating an application and setting premiums. So if your credit isn’t great, you might be wondering if it’s possible to get affordable auto insurance.

Read on to find out how your credit score impacts your car insurance and how to find the best car insurance companies and rates with a poor credit score.

KEY TAKEAWAYS

- Your credit history can lead to you paying hundreds or even thousands more for your car insurance.

- Car insurers believe a person with a poor credit history is more prone to file a claim, so companies charge higher premiums to those drivers.

- People with bad credit should shop around and get insurance quotes from multiple car insurance providers.

- Repairing your credit history can lead to lower rates, such as paying down your debts, paying bills on time, and limiting new credit applications.

Does credit score affect car insurance?

Your credit score impacts your car insurance rates in most states. Most state regulators don’t allow insurance companies to base decisions solely on your credit. Instead, insurers evaluate your credit history as one of many factors when determining whether to give you an auto insurance policy and how much to charge.

Your credit history helps to determine if you’re a possible liability, depending on the mistakes you may have made in the past.

“If you have a bad credit score because you were late on a bunch of payments, or have large amounts of debt, the insurance company will consider you at much higher risk to make choices that will result in an accident or costly claims,” says Julie Bausch, managing editor of Car Talk.

In general, the better your credit score, the better the rate you can get. FICO scores and VantageScores both range between 300 and 850. Scores below 600 are usually considered bad or poor.

How much more do drivers pay with bad credit?

Drivers with poor credit pay an average of 71% higher car insurance rates than a driver with good credit. That’s more than $1,000 a year.

Companies don’t simply use your credit score at face value, though. Insurance companies use proprietary algorithms to translate certain aspects of your credit profile into an insurance score. Having an excellent credit score doesn’t necessarily mean you have an excellent insurance score, says Kevin Hamill, owner of the Alliances Insurance Agency in Chester County, Pennsylvania.

Credit scoring was designed for lenders to evaluate a person’s ability to pay back debt, so insurance companies’ algorithms might focus more heavily on aspects of your credit profile that lenders consider low impact.

How to find the best car insurance with poor credit

To find the insurance company that best fits your insurance needs, you should review your insurance policy and get quotes from multiple insurance companies each year. You can do this online on a site like Insure.com or with insurance agents.

You should know the difference between types of agents if you go that route. Some insurance agents are considered “captive,” meaning that they represent only one insurance carrier. Other agents are “independent,” meaning they represent multiple carriers.

“To secure the best policy at the best price, you should consult a few agents rather than one,” Hamill says.

Why bad credit auto insurance varies by state

The cost of auto insurance differs by state because the laws for minimum amounts of required insurance coverage and regional actuarial tables vary.

“Weather conditions, population data, (and) the amount of accidents per year in a particular region will all affect the cost of car insurance,” Bausch says.

States that don’t allow insurers to use credit scores

However, there’s also a handful of states that don’t allow insurance companies to factor in your credit score at all when setting rates:

- California

- Hawaii

- Massachusetts

- Michigan

- New Jersey

“If you live in one of these states, you are in luck,” Bausch says. “If not, then you should be prepared to shop around for the best rates and do your research.”

Additionally, insurance companies in Oregon, Maryland, and Utah are limited in how they can use your credit history. They can determine your rates for a new policy but can’t deny your application, cancel your policy, refuse to renew your policy or increase your insurance premiums when you renew because of your credit score. The exact rules depend on the state.

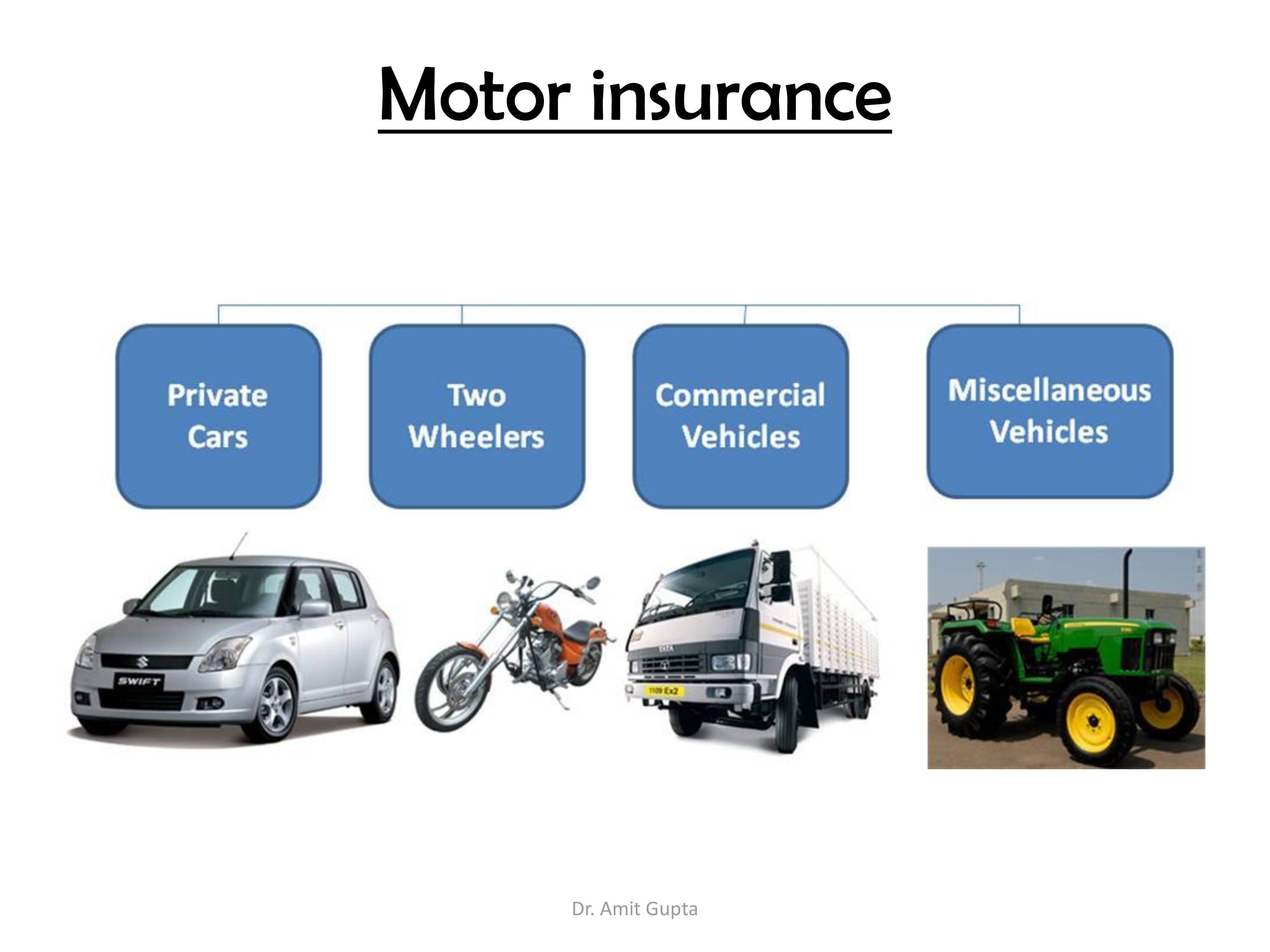

Check out the average auto insurance rates by vehicle type.

QuickTake

Auto insurance rates for bad credit by state

Michigan often has the highest car insurance rates and that includes for people with poor credit. Here are the averages for all drivers and those with poor credit and the differences.

| State | Average rate | Rate with poor credit | Difference |

|---|---|---|---|

| Michigan | $2,368 | $6,316 | $3,948 |

| New Jersey | $1,419 | $2,925 | $1,506 |

| Arizona | $1,399 | $2,711 | $1,312 |

| Texas | $1,644 | $3,170 | $1,526 |

| Utah | $1,212 | $2,316 | $1,104 |

| Nevada | $1,578 | $2,986 | $1,408 |

| Illinois | $1,176 | $2,198 | $1,022 |

| New York | $1,214 | $2,255 | $1,041 |

| Minnesota | $1,339 | $2,471 | $1,132 |

| Pennsylvania | $1,438 | $2,572 | $1,134 |

| Vermont | $1,166 | $2,070 | $904 |

| South Carolina | $1,353 | $2,386 | $1,033 |

| Alabama | $1,304 | $2,296 | $992 |

| Tennessee | $1,339 | $2,342 | $1,003 |

| Florida | $2,250 | $3,926 | $1,676 |

| Maine | $884 | $1,540 | $656 |

| Rhode Island | $2,011 | $3,496 | $1,485 |

| Montana | $1,589 | $2,756 | $1,167 |

| Colorado | $1,675 | $2,890 | $1,215 |

| Kentucky | $1,611 | $2,766 | $1,155 |

| Nebraska | $1,287 | $2,203 | $916 |

| Idaho | $1,019 | $1,742 | $723 |

| Indiana | $1,057 | $1,806 | $749 |

| Missouri | $1,288 | $2,197 | $909 |

| Louisiana | $2,228 | $3,797 | $1,569 |

| Delaware | $1,838 | $3,128 | $1,290 |

| South Dakota | $1,250 | $2,119 | $869 |

| Arkansas | $1,556 | $2,621 | $1,065 |

| Oklahoma | $1,469 | $2,468 | $999 |

| Ohio | $959 | $1,610 | $651 |

| Georgia | $1,815 | $3,040 | $1,225 |

| DC | $1,887 | $3,153 | $1,266 |

| North Dakota | $1,123 | $1,873 | $750 |

| Oregon | $1,325 | $2,193 | $868 |

| Kansas | $1,412 | $2,320 | $908 |

| Washington | $1,307 | $2,117 | $810 |

| Iowa | $1,073 | $1,728 | $655 |

| Virginia | $993 | $1,595 | $602 |

| New Mexico | $1,498 | $2,404 | $906 |

| Maryland | $1,541 | $2,464 | $923 |

| Wisconsin | $1,147 | $1,832 | $685 |

| New Hampshire | $1,156 | $1,846 | $690 |

| Mississippi | $1,504 | $2,358 | $854 |

| Connecticut | $1,980 | $3,095 | $1,115 |

| West Virginia | $1,467 | $2,167 | $700 |

| Alaska | $1,246 | $1,789 | $543 |

| Wyoming | $1,577 | $2,179 | $602 |

| North Carolina | $1,170 | $1,317 | $147 |

| California | $1,783 | $1,783 | $0 |

| Hawaii | $1,255 | $1,255 | $0 |

| Massachusetts | $1,616 | $1,616 | $0 |

Best car insurance companies for drivers with bad credit

What is the best auto insurer if you have bad credit? Here are the average car insurance rates for drivers with good credit and poor credit and the difference between the two.

| Company | Good credit rate | Bad credit rate | Difference |

|---|---|---|---|

| Allstate | $1,868 | $2,906 | $1,038 |

| Farmers | $1,753 | $3,039 | $1,279 |

| Geico | $1,109 | $2,094 | $986 |

| Nationwide | $1,598 | $2,244 | $646 |

| Progressive | $1,483 | $2,644 | $1,161 |

| State Farm | $1,400 | $3,012 | $1,613 |

| Victoria | $1,591 | $2,193 | $603 |

How to improve your credit score and get cheap car insurance

Here are steps to take for improving your credit score if your credit isn’t in great shape and you want cheapest car insurance costs.

Fix credit report errors

Your credit reports contain information that’s used to calculate your credit score. And these reports contain errors more often than you might think.

About one-third of consumers found at least one error in their reports, according to a new Consumer Reports investigation. That can cause your score to be lower than it should be.

To check your reports for errors, get a free copy from each major credit bureau — Equifax, Experian and TransUnion — at annualcreditreport.com. If you find a mistake, you can dispute it directly with the bureau reporting it.

Make all your payments on time

Your payment history is the most heavily weighted credit score factor, accounting for 35% of your score. Your score could drop quite a bit if you miss even just one payment on a bill.

Plus, the higher your score, the harder it could be hit by a missed payment. So make all your payments in full and on time to continue building up a good credit score.

Pay down debt

Another important credit score factor is the amounts owed, also known as your “credit utilization.” This measures how much debt you owe compared to the total amount of credit available to you.

Revolving credit (such as credit cards) are weighted more heavily than installment loans (student loans, car loan, mortgage, etc.). Keeping your total outstanding debt as low as possible will improve your score.

Build up a thin file

If you don’t have a lot of experience using credit, you might have what is known as a “thin credit file.”

This means there isn’t much information available to calculate your score, and you may not even have a score at all yet. But that doesn’t mean you need to go into debt to build good credit.

Try opening a secured credit card or credit-builder loan — both of which are backed by an upfront deposit that you get back — to grow your credit history and improve your score.

Limit applications for new credit

Whenever you apply for a credit card or loan, the lender pulls a copy of your credit reports. This is known as a “hard credit inquiry.”

Usually, credit inquiries have a minimal impact on your score. That is unless you rack up several within a short timeframe, which can be a red flag that you’re too reliant on credit to pay your obligations.

Avoid hard inquiries whenever possible if you’re working on improving your credit.