Who Can Benefit from E&O Insurance?

In today's litigious society, protecting oneself or a business against potential legal claims is crucial. Errors and Omissions (E&O) insurance, also known as Professional Liability insurance, provides a safety net for professionals and businesses who face the risk of negligence or mistakes in their work. This article explores the various individuals and entities that can benefit from E&O insurance and emphasizes the importance of having appropriate coverage.

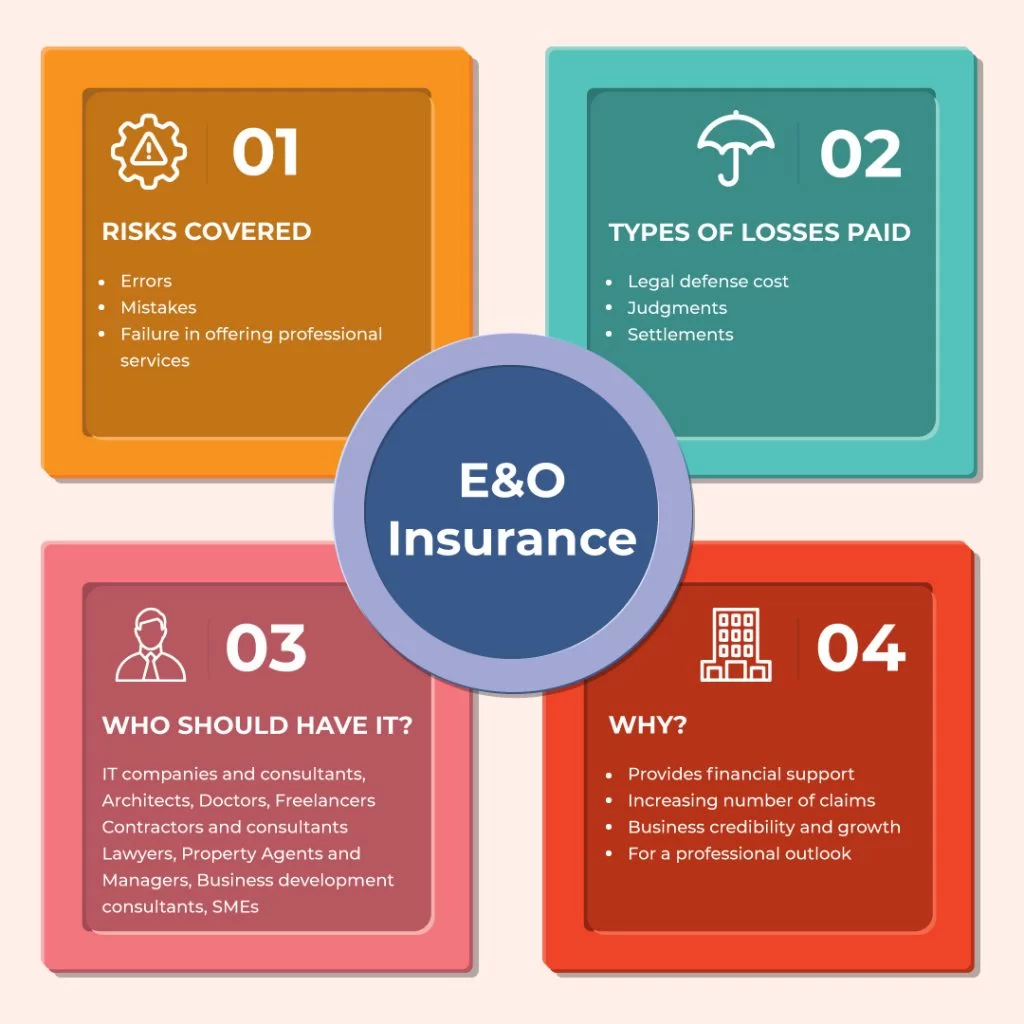

Mistakes happen, and no matter how skilled or experienced professionals are, errors can occur in any industry. E&O insurance serves as a safeguard, offering financial protection and legal assistance in the event of claims arising from errors, omissions, negligence, or inadequate work. Let's delve into the specific professions and businesses that can greatly benefit from this type of insurance coverage.

Understanding E&O Insurance

Before diving into the beneficiaries of professional indemnity insurance, it's crucial to grasp the fundamentals of what this insurance entails. E&O insurance is designed to protect professionals and businesses against claims resulting from mistakes, misrepresentation, negligence, or failure to deliver promised services. It covers legal costs, settlements, and judgments, providing financial security and peace of mind.

Professionals and Businesses at Risk

3.1. Doctors and Medical Professionals: Healthcare professionals, including doctors, nurses, and surgeons, face a substantial risk of malpractice claims. E&O insurance protects them in case of errors or negligence resulting in patient harm, misdiagnosis, surgical errors, or medication mistakes.

3.2. Lawyers and Legal Professionals: Attorneys, law firms, and legal professionals can make errors that may lead to lawsuits from dissatisfied clients or adverse legal outcomes. E&O insurance provides coverage for professional errors, breach of duty, or failure to provide adequate legal representation.

3.3. Architects and Engineers: Architects and engineers are responsible for designing and overseeing construction projects. If a design flaw or structural failure occurs, E&O insurance can shield them from financial ruin due to lawsuits and claims from property owners or construction companies.

3.4. Real Estate Agents: Real estate transactions involve significant financial investments. If a real estate agent makes a mistake during the transaction process or fails to disclose crucial information, d&o insurance can protect them from potential legal action and financial loss.

3.5. Financial Advisors: Financial advisors are entrusted with managing clients' wealth and providing advice on investments. Any errors or omissions in financial planning, investment recommendations, or failure to meet fiduciary duties can result in substantial monetary damages. E&O insurance helps mitigate these risks.

3.6. Technology Companies: With the increasing reliance on technology, software developers, IT consultants, and technology companies face the risk of errors, software bugs, or data breaches that may lead to financial losses for clients. E&O insurance safeguards them against liability arising from technology-related mistakes.

Importance of E&O Insurance

4.1. Protection against Claims: E&O insurance provides a safety net, protecting professionals and businesses from the financial burdens associated with claims and lawsuits. It covers legal expenses, settlements, and judgments, allowing individuals and companies to continue their operations without severe disruptions.

4.2. Financial Security: Lawsuits can result in substantial financial damages. E&O insurance ensures that professionals and businesses have the financial means to defend themselves in court and compensate claimants, safeguarding their assets and preserving their financial stability.

4.3. Enhanced Reputation: By having negligence quotes, professionals demonstrate their commitment to accountability, responsibility, and maintaining high standards in their respective fields. This commitment enhances their reputation, as clients and partners feel more confident knowing there's a safety net in place should any errors occur.

Cost of E&O Insurance

The cost of E&O insurance varies depending on several factors, such as the profession, coverage limits, claims history, and location. Generally, the premium is determined by the level of risk associated with the profession or business. Despite the costs involved, the potential financial consequences of a lawsuit far outweigh the expense of insurance coverage.

How to Choose the Right E&O Insurance

6.1. Assessing Coverage Needs: Professionals and businesses should evaluate their specific risks and coverage requirements. This involves considering the nature of their work, the potential exposure to claims, and the financial implications of different coverage options.

6.2. Researching Insurance Providers: It's crucial to research reputable insurance providers with expertise in errors and omissions. Evaluating their reputation, financial stability, and customer reviews can help ensure reliable coverage.

6.3. Comparing Policies: Comparing policies from different insurance providers allows professionals and businesses to identify the most suitable coverage at competitive rates. Paying attention to policy details, exclusions, deductibles, and coverage limits is essential.

In conclusion, E&O insurance provides essential protection for a wide range of professionals and businesses. Doctors, lawyers, architects, real estate agents, financial advisors, and technology companies, among others, can significantly benefit from this insurance coverage. It safeguards against costly legal claims, offers financial security, and enhances professional reputation. By carefully assessing coverage needs and selecting the right insurance policy, individuals and businesses can protect themselves and thrive in their respective fields.