Do you know what purpose a loan estimate serves when you apply for a mortgage? Checking the latest national average mortgage rates can only take you so far when you’re planning to buy or refinance a home. To know what interest rate you might pay in real life, you have to get in touch with a mortgage lender and give them some specifics.

When you do, you’ll get a loan estimate, an important document showing the key details of the mortgage for which you have applied. You’ll want to review your loan estimate carefully before moving forward with the underwriting process to see if you understand the loan and can comfortably afford it.

KEY TAKEAWAYS

- The loan estimate can help you understand any mortgage you apply for, whether you’re buying a home or refinancing one.

- For the amount, type, and term of the loan you’ve applied for, the loan estimate will show your projected closing costs, monthly payment, interest rate, and annual percentage rate, among other details.

- Because any lender who wants your business is required to give you one, you can use this form to easily compare offers, avoid being overcharged, and get the best deal.

- Hang on to the loan estimate you receive from your lender because you’ll want to check it against the closing disclosure before you sign your closing documents.

What Is a Loan Estimate?

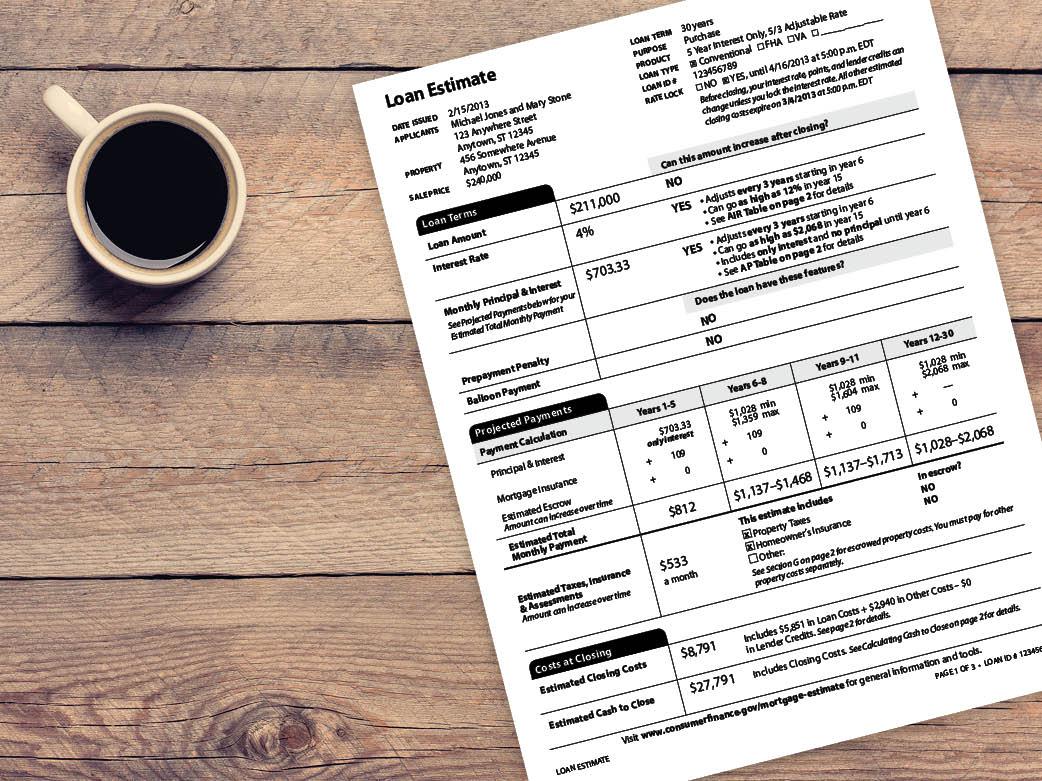

A loan estimate is a three-page form that presents home loan information in an easy-to-read format, complete with explanations. This standardization not only makes the information easy to digest; it also makes it easy to compare offers among lenders to see which one is offering you the best deal.1

You’ll get a loan estimate within three business days of applying for a mortgage unless you don’t meet the lender’s basic qualifications and your application is rejected.2 If that happens, the lender must give you a written notice within 30 days stating why your application was rejected.3 The only fee you may have to pay to get a loan estimate is a credit report fee.4

When you receive a loan estimate, it’s valid for 10 business days. If you want to accept a loan offer, try to do it within that time frame; the lender may change the terms and issue a new loan estimate if you take more time to decide.5

You won’t necessarily get a different offer or a worse offer, but things can change with market conditions and your credit. In fact, mortgage rates can change multiple times within a single day. Of course, it might take you longer than 10 days to identify a property you want to buy and make an offer, and you should take your time with such important decisions.

Try to get all your loan estimates on the same day, so you can see which terms different lenders offer under the same market conditions. It’s also important to apply for the same loan type and term with each lender in order to make accurate cost comparisons.6

You can and should get a loan estimate before you find the property you want to buy, especially in a seller’s market, wherein buyers often need to act quickly to make a purchase offer. You want to have mortgage preapproval and maybe even pre-underwriting to be confident you can get financing.

However, you do need a property address and purchase price to get a loan estimate. What’s the solution if you haven’t pinned one down yet? Provide a property address for a similar home and the purchase price for which you want approval. A loan estimate is not an official preapproval, but it gets you moving in the right direction.7 The lender can issue a revised loan estimate after you have chosen a property.8

Reading a Loan Estimate: Page 1—The Fundamentals

Which items appear on a loan estimate? We’ll walk you through it page by page and help you understand each one.

The basics

Page 1 begins with basic information:

- Lender’s name and address

- Applicant’s name and address

- Property address and sale price

- Loan term, type, and purpose

- Loan ID number

- Loan estimate date

- Rate lock information

Loan terms

Next is a box with the loan’s terms:

- Loan amount and whether it can increase after closing

- Interest rate and whether it can increase after closing

- Monthly principal and interest payment and whether it can increase after closing

- Prepayment penalty (if any, and if so, how much and when it applies)

- Balloon payment (if any)

These days, most loans don’t have prepayment penalties or balloon payments. Also, your loan amount is unlikely to increase after closing. These three disclosures relate to features that were more common during the housing bubble of the early to mid-2000s.

It’s also unlikely that your interest rate or monthly principal and interest payment would increase after closing. If you are taking out an adjustable-rate mortgage, they may. Most people get fixed-rate mortgages.

Projected payments and costs at closing

The second box on Page 1 goes into more detail about your projected monthly payment. In addition to your monthly principal and interest payment, it shows two items that are likely to apply if you’re putting down less than 20%: your estimated monthly mortgage insurance payment and your estimated monthly escrow payment of homeowners insurance and property taxes.

Finally, the third box on Page 1 shows your estimated closing costs and estimated cash to close.9 Page 2 will break down these costs in detail.

Page 2—Itemized Mortgage Costs

The loan estimate’s second page itemizes the loan’s closing costs and shows how much cash you’ll need to finalize the loan.

Origination charges

The typical mortgage origination fee is around 1%. It might be higher if you choose to pay points to lower your interest rate. The loan’s underwriting and application fees are included here too. These fees compensate the lender for its efforts to qualify you for a loan and get you the money so you can buy a home. They also vary by lender and can be a good place to save money.

Closing services for which you cannot shop

Many other vendors are involved in making your mortgage happen. Some vendors you can choose, while for others, your lender gets to choose.

- Your lender will order an appraisal to make sure the home is worth what you’ve offered to pay for it.

- A credit report tells the lender whether you have a history of repaying the money you borrow (or not).

- Flood determination and monitoring fees go toward finding out if your property is in an area that’s at high risk of flooding. If it is, you’ll have to buy flood insurance, which is separate from homeowners insurance. Homeowners insurance doesn’t cover flooding.

- The tax monitoring fee and tax status research fee will go toward making sure you pay your property taxes in full and on time every year.10

Closing services for which you can shop

- You’ll pay a pest inspection fee to a professional who comes out and examines the home you want to buy for evidence of wood-destroying insects such as termites and carpenter ants. Any significant damage will need to be repaired before closing.

- The survey fee verifies the property’s boundaries.

- The four title fees go toward making sure you can take ownership of the property free and clear of claims by any third party, such as a previous owner’s relative or a tax authority. You’ll also have to buy a title insurance policy that protects the lender against claims that might arise later that weren’t uncovered during the title search. The title company is also often the company that handles your loan closing, so there’s a fee for that too. This fee might be listed as an escrow agent or settlement agent.

It doesn’t matter whether the cost of these closing services differs from one lender to the next when you’re deciding on a lender. They’re just estimates, and you’ll be able to shop around for these providers and decide how much to pay.

Taxes and other government fees

Any fees your local government charges when a property is transferred and a new deed of ownership is recorded go here.

Prepaids

Lenders require homeowners to have their homeowners insurance in place before the loan can close, so there’s a charge for that here that will usually cover six or 12 months’ worth of insurance.

You might have to prepay mortgage insurance premiums and property taxes, and you’ll probably have a charge for prepaid interest. It covers the days you’ll have the loan between your closing and the first of the following month when you’ll make your first principal and interest payment.

Initial escrow payment at closing

If the loan requires you to maintain an escrow account (shown on Page 1 of your closing disclosure, also called an "impound account"), then this section will show how much you have to fund that account to cover future homeowners insurance premiums, mortgage insurance premiums, and property taxes. Lenders are allowed to keep a two-month cushion in this account, so that’s probably what they’ll charge you here.

Other

Remember that lender's title insurance policy you have to buy? It doesn’t cover you. It’s a good idea to buy an owner’s policy as well, and that fee will show up in this section.

Total closing costs

This line sums up all of the above charges. It should match the estimated closing costs from the bottom of Page 1. If you’re getting any lender credits, you’ll see those subtracted here.

Calculating cash to close

This section totals up your closing costs and down payment and subtracts any earnest money deposit you make.11

Page 3—Comparisons and More Loan Characteristics

Additional information about this loan

The top of Page 3 says who your loan officer is, what their license number is, and how to contact them (you might also be interested to know how loan officers are compensated). Here’s what else you’ll learn on Page 3:

Comparisons

This box provides four numbers you can use to compare one loan estimate with another.

- Total principal, interest, mortgage insurance, and loan costs you will have paid after having the loan for five years (remember, loan costs are on Page 2)

- Total principal you will have paid off after five years, or how much equity you will have in your home, excluding any increase or decrease in its market value

- Annual percentage rate, a figure that accounts for the loan’s interest rate and fees combined

- Total interest percentage, a figure that shows how much interest you will pay over the entire loan term as a percentage of how much you’re borrowing. For example, your total interest percentage would be 50% if you paid $50,000 in interest on a $100,000 loan.

Other considerations

This section tells you six more things about the loan for which you've applied:

- The lender may order an appraisal to determine the home’s value. You’ll have to pay for the appraisal, and you’ll get a copy of it.

- If you sell or transfer the home to someone else, can they take over your loan instead of getting their own? Usually, the answer is no, but some government-guaranteed mortgages can be assumable.

- You’re required to get homeowners insurance, and you can choose the company, as long as the lender approves of that company. See our beginner’s guide to homeowners insurance if you need help.

- If your monthly mortgage payment is late, at what point will you have to pay a late fee, and how much is the fee?

- Don’t assume you'll be able to refinance this loan later, because your finances and the market might not allow for it.

- The lender you’ve applied with plans to service your loan, meaning they will be the one to collect your monthly payments, manage your escrow account if you have one, and send your monthly statements. Conversely, they could plan to have another company service your loan after closing.12

Keep the loan estimate for the lender with which you ultimately move forward. Before closing, you’ll receive another CFPB-created form called the closing disclosure. By comparing it with your loan estimate, you can make sure the lender hasn’t made any mistakes or tried to slip any last-minute charges by you.4

The Bottom Line

The Consumer Financial Protection Bureau (CFPB) designed the loan estimate to help you understand any mortgage you apply for, whether you’re buying a home or refinancing one. Because any lender who wants your business is required to give you a loan estimate, you can use this form to easily compare offers from different lenders and get a better deal. You can also make sure you aren’t being overcharged for any services and that you understand all the loan’s costs and features. This important form is definitely one to review closely. Ask your lender questions about anything you don't understand.