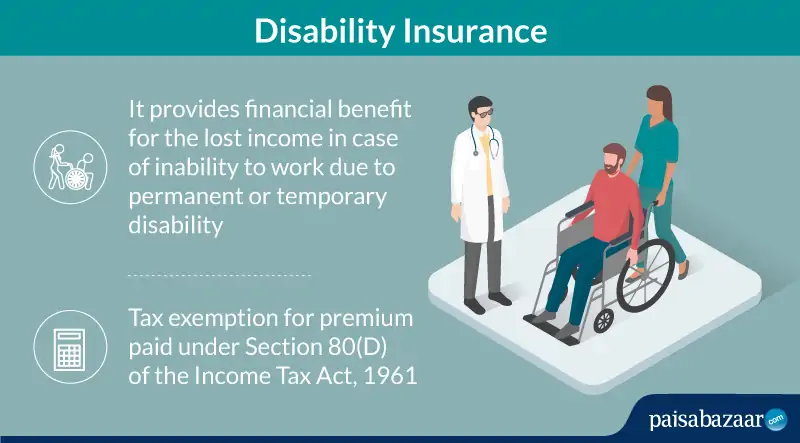

Disability insurance is a type of insurance that is intended to provide income in the event that a worker can no longer perform their work, as a result of a disability. Sometimes this disability prevents them from making money for a short period of time; in other cases, it may be for much longer periods of time.

There are specific rules as to what is considered a disability and how a person might qualify for the disability benefit. Short-term policies offer benefits for a short period—typically three to six months. On the other hand, long-term disability insurance offers benefits to those who are unable to work for a longer period—typically a period of over six months.

KEY TAKEAWAYS

- Disability insurance is a type of insurance that is intended to provide income in the event that a worker can no longer perform their work, as a result of a disability.

- To help limit the number of fraudulent disability claims, insurers refuse to replace 100% of the income that is lost due to a disability.

- A good benchmark for deciding what percentage of your income you'll want to aim to replace is to obtain enough coverage to maintain your family's current standard of living, up to the limits of what is offered by the insurer.

Limits to Disability Insurance Coverage

Disability insurance policies are designed to partially replace your income in the event that you become disabled and cannot continue to work. To help limit the number of fraudulent disability claims, insurers refuse to replace 100% of the income that is lost due to a disability. Most group disability insurance policies will only cover up to 60% of the earned income of the insured. If you receive disability income from a group policy under your employer, you will typically have to pay income tax on the benefits.

An individual may apply for individual coverage through an insurance company on their own to cover the gap between the group coverage and up to 90% of their income. Benefits received from an individual policy may be received income tax-free if policy premiums are paid with after-tax dollars.

Note that there are special cases where insurance companies have made exceptions for group plans for certain professions, such as medical interns, residents, fellows, and physicians. Insurance companies may allow for a policy to have coverage in excess of the 60% threshold for these professions. Policies for these professions are considered "special limits" policies; they typically have a guaranteed level premium cost up until age 65.

If you're looking to save money on premiums because you are new to your profession and have not yet climbed the pay scale, you can get what's called a "graded premium" disability insurance. This type of policy has the same benefits as level premium policies but the premium starts lower and increases each year.

With a graded premium disability insurance policy, you'll get a low-cost policy with a high level of insurance coverage (while still guaranteeing your insurability for future years). This is a good low-cost option that helps recent graduates get disability coverage while allowing them time to get established. At this time, you'll have the option to decide if you want to find a better policy with level premiums.

How Much Coverage Should You Consider Getting?

A good benchmark for deciding what percentage of your income you'll want to aim to replace is to obtain enough coverage to maintain your family's current standard of living, up to the limits of what is offered by the insurer.

When determining how much replacement income you'll need if you become disabled, it is best to go with a conservative estimate to make sure you'll have adequate coverage.

The Bottom Line

If you become disabled and are unable to work, what would happen to your household income? Hopefully, you would be in a position to still take care of your family, but if you're not confident that you can cover a lengthy loss of wages, then it might be a good time to cover that risk with disability insurance.