For all intents and purposes, crypto savings accounts operate in a similar way to a traditional certificate of deposit (CD).

This is because, by depositing your digital tokens into a crypto savings account – you will be paid a rate of interest. And, just like CDs, your APY will depend on whether you opt for a fixed or flexible term.

In this guide, we help clear the mist by reviewing the best crypto savings accounts for 2022 – based on yields, minimums, supported coins, safety, and fees.

The Best Crypto Savings Accounts for 2022 List

For a quick glance at the overall best crypto savings account in the market right now – consider the providers below.

- Aqru – Overall Best Crypto Savings Account for 2022

- Crypto.com – One of the Best Crypto Savings Accounts Stablecoins

- BlockFi – Top Crypto Savings Account for Safety

- Binance – High-Interest Crypto Savings Accounts

- Coinbase – Trusted Crypto Savings Account With FDIC Insurance on USD Balances

We review the above crypto savings account in great detail in the following sections of this guide.

Top Crypto Savings Platforms Reviewed

In narrowing our list of the best crypto savings accounts down to just five providers, we focused on key factors surrounding supported coins, APYs, withdrawal terms, fees, and most importantly – safety.

No two crypto savings platforms are the same – so be sure to read each review in full before making a decision.

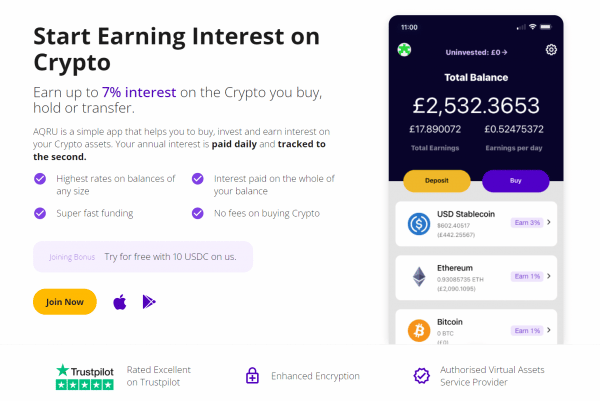

1. Aqru – Overall Best Crypto Savings Account for 2022

Our number one pick for the best crypto savings account in the market is Aqru. This user-friendly platform supports a range of assets – all of which offer an attractive APY helping you to make money with cryptocurrency. For example, you can earn up to 7% per year on cryptocurrency deposits, which is one of the best rates in the market.

Staking is available for BTC, ETH, USDC, and USDC Maple. Moreover, should you wish to earn interest on traditional fiat money, Aqru offers savings accounts on GBP and EUR. As such, this top-rated platform gives you lots of flexibility in terms of choosing which asset you wish to generate interest on. And flexibility is the keyword here, most crypto interest accounts available on the Aqru platform come without a minimum redemption period.

This means that at any given time, you can withdraw your funds out of your Aqru crypto savings account. In terms of fees, Aqru makes its money by charging a higher interest rate to those that use the platform to borrow capital. This means that the APY you see is the specific rate that you receive – without reductions.

Another factor that makes this yield farming crypto platform stand out as the overall best crypto savings account is that the provider offers an easy-to-use mobile app. Available on both iOS and Android devices, the app gives you access to all account functionality. This includes deposits and withdrawals, the ability to switch savings accounts, and access to real-time stats on your earnings. Finally, should you require assistance with your Aqru account, you will find a live chat facility on the main website.

Read our Aqru review to learn more about this crypto savings platform.

| APR Offered on Cryptocurrencies | · Stablecoins (USDC, USDC Maple) – Up to 7% · Non-Stablecoins (BTC, ETH) – 1% |

| Min & Max Deposit Limits | €100 (£110.80) minimum; no maximum stated. |

| Lock-In Period | No lock-in period; flexible withdrawals offered |

| Security & Regulation Features | · Regulated by the Republic of Lithuania

· VASP under Lithuanian law |

| Additional Rewards Offered | N/A |

| Interest Payout Frequency | Daily |

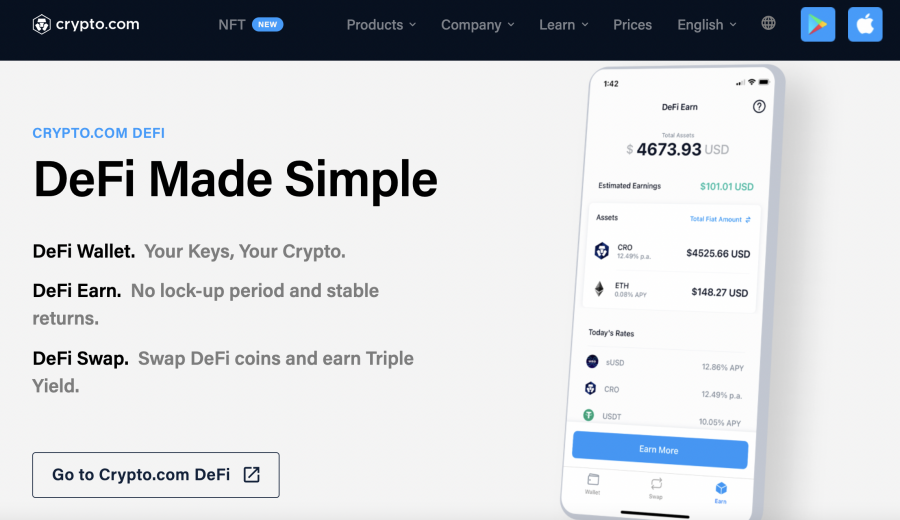

2. Crypto.com – One of the Best Crypto Savings Accounts Stablecoins

Crypto.com is one of the best crypto savings accounts for those of you that wish to earn interest on stablecoins. These are digital currencies pegged to a fiat currency like the US dollar or euro, meaning that volatility is virtually non-existent. This means that in theory, you know exactly how much you will make by depositing your stablecoins in a Crypto.com savings account.

For instance, Some of the options you have in this respect include Tether, TrueGBP, TrueAUD, USDC, and DAI – all of which yield up to 14% APY. However, in order to get this highly attractive rate, certain conditions need to be met. This includes taking at least 40,000 CRO tokens and agreeing to a lock-up period of three months. If you don’t fancy staking any CRO tokens or you require 24/7 access to your funds – lower APYs are offered.

For example, if you reduce the lock-up period from three months to 1-month, but still stake over 40,000 CRO tokens, Crypto.com offers an APY of 12% on stablecoins. But, by switching to a flexible plan with no staked CRO tokens, the APY is reduced to 6%. Nevertheless, in addition to stablecoins, Crypto.com offers savings accounts for dozens of conventional cryptocurrencies. Among many others, this includes the likes of Bitcoin, Algorand, EOS, Cardano, BNB, and Litecoin. You can also reap several crypto rewards via the Crypto.com credit card.

APYs can and will vary depending on which digital assets you want to earn interest on, so check the Crypto.com website to assess what’s on offer. In terms of distributions, you will receive interest payouts daily on a non-compounding basis. In choosing Crypto.com as your go-to savings account provider, you will also have access to exchange services, alongside margin and derivatives trading, a software wallet app, and a Visa debit card.

If you like the idea of earning interest on your crypto holdings then you might be interested in learning how to earn free Bitcoin in 2022 with some of the leading providers.

| APR Offered on Cryptocurrencies | · Stablecoins (USDT, USDC, DAI, etc) – Up to 14%

· Non-Stablecoins (BTC, ETH, CRO, LTC, etc) – Up to 14.5% |

| Min & Max Deposit Limits | · Minimum – Varies depending on coin (e.g. 0.005 BTC, 0.15 ETH)

· Maximum – $500,000 (USD equivalent) |

| Lock-In Period | Customisable – three months, one month, or flexible |

| Security & Regulation Features | · Tier 4 assessment from NIST Cybersecurity

· Stress-tested by Kudelski Security |

| Additional Rewards Offered | APR increases as the amount of CRO staked increases. |

| Interest Payout Frequency | Weekly |

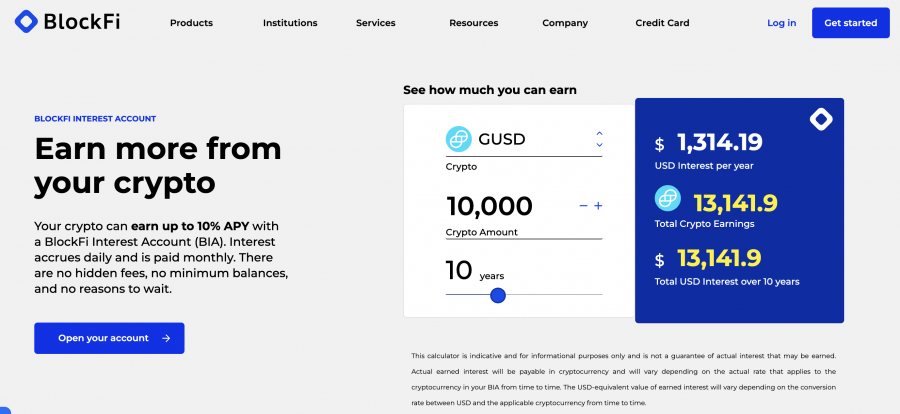

3. BlockFi – Top Crypto Savings Account for Safety

Although BlockFi does not offer the most attractive yields in the market, this crypto lending platform does have a reputation as being one of the safest crypto savings account providers. Since launching its platform in 2017, BlockFi has made every effort possible to ensure that it provides a safe means to earn interest on your crypto investments.

For example, BlockFi claims that the vast bulk of client digital funds are kept at various locations in cold storage. This includes a partnership with US-based broker Gemini, which is regulated by the New York State Department of Financial Services. Moreover, BlockFi ensures that all users go through a KYC process before they access any services – which subsequently requires a copy of a government-issued ID.

When it comes to supported digital currencies, BlockFi offers savings accounts for both stablecoins and conventional crypto assets. The former includes DAI, USDC, Tether, Gemini Coin, and more. The latter covers everything from Bitcoin, Filecoin, and Ethereum to Polkadot, Solana, and Litecoin. As is the case with all of the best crypto savings account providers we discuss today, APYs will depend on your preferred digital currency and lock-up terms.

Nevertheless, to give you an idea of potential interest rates, Tether and Gemini Coin yield up to 9.25% and 8.75% respectively. BlockFi offers a range of alternative crypto-centric services – such as a fully-fledged exchange, cryptocurrency wallet, and support for institutional products. Moreover, BlockFi also offers a crypto credit card and an avenue to borrow funds.

| APR Offered on Cryptocurrencies | · Stablecoins (USDT, USDC, BUSD, etc) – Up to 9.25%

· Non-Stablecoins (BTC, ETH, LTC, etc) – Up to 5% |

| Min & Max Deposit Limits | No minimum or maximum deposit |

| Lock-In Period | No lock-in period; flexible withdrawals offered |

| Security & Regulation Features | · Currently going through the regulatory process with the SEC

· Licensed with the Bermuda Monetary Authority |

| Additional Rewards Offered | Monthly compounded interest |

| Interest Payout Frequency | Monthly |

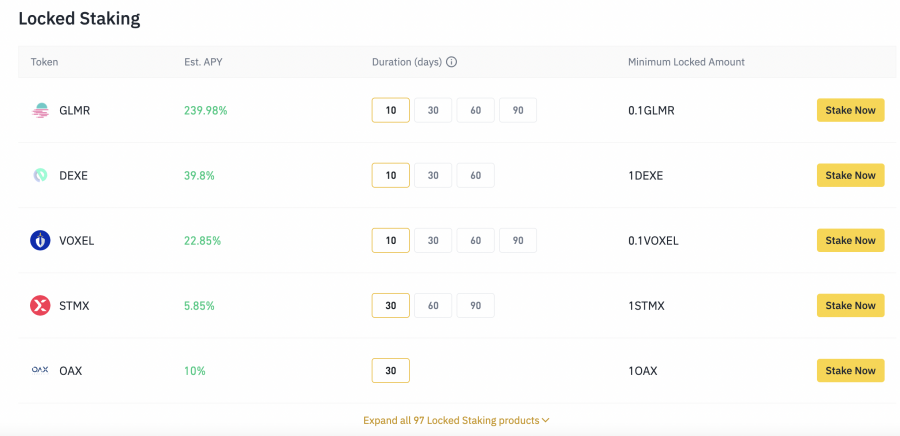

4. Binance – High-Interest Crypto Savings Accounts

Binance is a great option for those seeking high-interest crypto savings accounts. In fact, as of writing, a number of supported digital currencies can be deposited at Binance in return for interest of over 100% per year. Moreover, Binance offers support for a large number of crypto assets across both large-cap and medium-cap projects. This will suit those of you that wish to diversify your crypto-earning objectives.

Another reason why Binance offers one of the best crypto savings accounts in the market is that you can choose from a wide variety of lock-up terms. For instance, some digital tokens can be locked away from 10, 30, 60, or even 90 days. In other cases, you might even be offered the option of a flexible savings account – which means you can make a withdrawal at any time. A good example of this is the Bitcoin savings account at Binance – which is not flexible, but yields 5% per year.

We should note, however, that we came across a number of attractive APYs that were subsequently sold out. This is because, with some supported digital currencies, a maximum allocation is put in place by Binance. Nevertheless, if you can’t find a crypto savings account that meets your needs, Binance also offers staking services. This works much the same way, as you will be paid a rate of interest for locking away your tokens.

The only difference is that instead of generating income by loaning out tokens, this is covered by blockchain transaction fees. Additionally, Binance also offers farming pools that allow you to grow your crypto wealth by providing the platform with liquidity. You might also like Binance for its crypto exchange services. Across more than 1,000 markets, you can buy and sell digital currencies at a commission of just 0.10%.

| APR Offered on Cryptocurrencies | · Up to 7% on stablecoins; up to 25% on non-stablecoins.

· APR is tiered for each asset e.g. <0.01 BTC is 5%, <0.5 BTC is 0.80%, >0.5 BTC is 0.10%, etc. |

| Min & Max Deposit Limits | Minimum is one lot, maximum is 100,000 (lot size varies depending on asset) |

| Lock-In Period | Can choose between lock-in period or flexible access |

| Security & Regulation Features | · Applying for UK trading license

· Money Transmitter license in numerous US states |

| Additional Rewards Offered | Higher APR offered when reaching higher tiers |

| Interest Payout Frequency | Daily on flexible plans; end of stated period on lock-up plans |

5. Coinbase – Trusted Crypto Savings Account With FDIC Insurance on USD Balances

If you don’t mind paying higher fees than the market average, Coinbase offers some of the best crypto accounts in terms of security and user-friendliness. Regarding the former, if you’re based in the US and keep idle US dollars in your Coinbase account, this is protected by FDIC insurance. This means that should the unthinkable happen and Coinbase goes bankrupt – you’re covered up to $250,000.

However, it is crucial to note that this does not apply to crypto asset balances. With that said, Coinbase is regulated in the US by the SEC and it’s now a publicly-traded company on the NASDAQ. Moreover, you will need to pass two-factor authentication when logging into your account and 98% of client digital assets are kept offline in cold storage. Taking all of this into account, Coinbase offers a safe and secure way to earn interest on your crypto investments.

In terms of what Coinbase offers, the platform supports interest-earning opportunities for six crypto assets. This includes Ethereum, Cosmos, Algorand, DAI, USDC, and Tezos. The APYs offered by Coinbase are below the industry average, especially when compared to Aqru. For example, while Aqru pays up to 7% on stablecoin deposits, at Coinbase, you’ll get a mere 0.15%.

And, as mentioned earlier, Coinbase is also expensive – especially when depositing US dollars into your account. For example, ACH crypto purchases will set you back 1.49%. If using Visa or MasterCard for this purpose, the fee increases to 3.99%. Withdrawals can also be costly, albeit, this depends on the payment method itself. All in all, although we like Coinbase for its commitment to user security and regulation, this does come at a premium when you factor in costs.

| APR Offered on Cryptocurrencies | · Stablecoins (USDC, DAI) – Up to 2%

· Non-Stablecoins (ETH, ATOM, ALGO, XTZ) – Up to 4% |

| Min & Max Deposit Limits | Not stated |

| Lock-In Period | Flexible withdrawals offered |

| Security & Regulation Features | · Regulated by the SEC

· Listed on the NASDAQ |

| Additional Rewards Offered | N/A |

| Interest Payout Frequency | Daily |

Best Crypto Savings Accounts Compared

If you’re still not sure which crypto savings account is right for you – we have summarized our findings in the comparison table below.

| Top APY on BTC/ETH | Top APY on Stablecoins | Terms for Best Rate | |

| Aqru | 1% | Up to 7% | Flexible |

| Crypto.com | 8.50% | Up to 14% | 3 Months, Plus CRO Staking |

| Blockfi | 4.50% / 5% | Up to 9.25% | Maximum of 0.10 BTC, 1.5 ETH |

| Binance | 5% / 2.4% | 7% on USDT | Flexible |

| Coinbase | N/A / 4% | 2% | Flexible via Staking |

What is a Crypto Savings Account?

As the name suggests, crypto savings accounts allow you to store your digital currencies via a third-party provider. And in doing so, you will have the opportunity to earn interest on your deposits.

As noted earlier, this concept mirrors that of a traditional CD account. This is because crypto savings accounts pay various rates of APYs depending on the term you agree to.

For example, if you were to keep Tether in a Crypto.com savings account on a flexible basis – meaning withdrawals are not penalized, you earn an APY of 6%. However, the same provider offers up to 14% on a 3-month lock-up term.

And, just like traditional CDs, the amount of interest on offer is also determined by your chosen crypto savings account provider. This is why it often pays off to shop around so that you get the best deal in the market.

Crypto Loans Fund Savings Accounts

If you’re wondering how the best crypto savings accounts are able to pay you regular interest, this is facilitated via third-party cryptocurrency loans.

For example, once you make a deposit into your chosen account, the provider will use the tokens to fund lending agreements. Those borrowing funds will subsequently repay the money alongside interest.

And, in the vast majority of cases, the borrower will need to transfer a minimum amount of crypto as a security deposit. This is a safeguard in the event the borrower defaults.

- For high-yield crypto savings accounts to make a profit, providers charge the end borrower a premium.

- By this, we mean that the APY that you get will be lower than what the end borrower pays.

- For instance, if you’re 7% per year on XRP deposits, then the borrower might pay an APR of 10%.

- The difference here funds the operations of the respective crypto savings account provider.

Ultimately, this business model has been used by banks for many centuries. That is to say, those depositing money into a traditional bank account earn interest. And this interest is funded by people that use the bank to take out loans.

Which Platforms Have the Best Crypto Savings Rates?

Our in-depth research found that the best crypto savings rates will depend on a variety of factors. As such, when assessing which platform is right for you, metrics such as lock-up terms need to be considered alongside APYs.

- For example, you might find that a crypto savings account offers a top-rate APY for your chosen digital currency.

- But, upon further exploration, you might find that you need to lock up your tokens for at least three months.

- As noted, you then have platforms like Crypto.com, which only offer their top-tier rates to those willing to stake CRO tokens.

- And, when you consider that the highest rates on offer at Crypto.com require a minimum staking requirement of 40,000 CRO, based on prices as of writing, this amounts to over $16,000.

With this in mind, we found that the overall best platform for high-interest crypto savings accounts without unfavorable terms is Aqru.

As we pointed out in our review, the platform offers up to 7% on stablecoins with flexible lock-up period or crypto staking requirement.

What Cryptos Can You Save and Earn Interest On?

The best crypto savings account that we came across generally offers support for two segments of the blockchain asset industry.

First, you have stablecoins that are pegged to fiat currencies like the US dollar. In all but a few rare cases, stablecoins attract the highest interest rates at crypto savings platforms.

Naturally, this is because the platform doesn’t need to take any volatility risk on, as stablecoins like USDT and USDC remain at $1 at all times – give or take a few micro-percentage points.

Second, you have cryptocurrencies outside of the stablecoin arena – which covers everything from Bitcoin, Litecoin, and EOS to Cardano, XRP, and Dogecoin. Ultimately, any coin can be supported by a crypto savings account, as the concept remains the same.

That is to say, by depositing a digital token into the platform, the provider will subsequently lend the funds to a third party, which, in turn, will pay interest.

On the other hand, if you are looking to earn interest on an obscure cryptocurrency, you struggle to find a platform that supports the token. As such, it’s best to stick with large-cap projects for the purpose of earning interest.

How to Setup a Crypto Savings Account?

The process of getting started with a crypto savings account is relatively straightforward.

In most instances, it’s simply a case of:

- Opening an account with your chosen provider

- Depositing the crypto tokens that you wish to earn interest on

- And sitting back and allowing your digital assets to work for you

If, however, this is your first time using a crypto savings account provider, the guidelines below will walk you through the set-up process with top-rated platform Aqru.

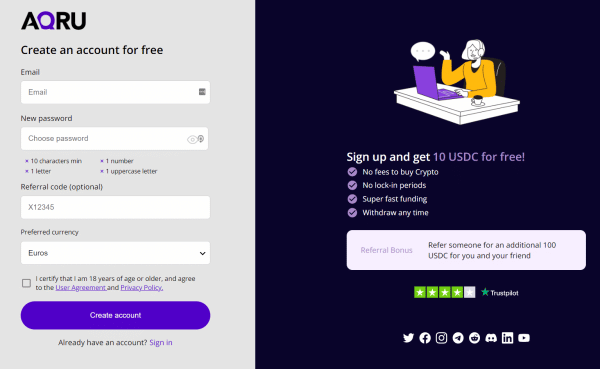

Step 1: Open an Account

In order to start earning interest on your crypto investments at Aqru, you first need to go through a quick account opening process. This is split into two sections.

First, you will need to provide some personal information – such as your name, nationality, and email address. Next, you will need to upload a copy of your government-issued ID.

This is because unlike many crypto savings account providers in this space, Aqru companies with regulations surrounding anti-money laundering controls.

The entire account opening procedure at Aqru should take no more than five minutes from start to finish.

Step 2: Deposit Funds

The next step is to deposit some funds into your Aqru account. The most efficient way of doing this is to deposit the specific digital asset that you want to earn interest on.

- For instance, if you’re looking to earn annual interest on Bitcoin, deposit BTC. You might also want to check out the best crypto banks in 2022.

- To do this, you will first need to copy the wallet address that is unique to your Aqru account.

- Then, head over to your private wallet and transfer the funds to Aqru address you just copied.

If, however, you do not have any cryptocurrencies to hand, Aqru allows you to deposit fiat money. Supported currencies here include euros and British pounds – and the minimum requirement stands at £/€ 100.

Step 3: Earn Interest

Once you have made a deposit into your chosen Aqru crypto savings account – there is nothing more for you to do. As each day passes, you will receive an interest payment directly in your account.

And, this will continue to be the case until you decide to cash out. When you eventually decide to make a withdrawal, you will get your principal amount back, plus the respective interest.

This means that if the respective crypto asset has increased in value, your investment will now be worth more.

Are Crypto Savings Accounts Safe?

Before you proceed to open a crypto savings account, several risks need to be considered. We discuss these risks in the sections below.

No Insurance or Government Protection

There is a significant difference in the risks involved between traditional bank accounts and crypto savings platforms.

After all, when you deposit US dollars into a bank account that is a member of the FDIC, you are covered up to the first $250,000 – should the financial institution collapse.

This is the same with the UK’s FSCS program, which covers bank deposits up to the first £85,000. However, when depositing funds into a crypto savings account – no such protection exists.

This means that if the worst happens and the platform runs into financial difficulties, your crypto savings are at risk. This is why crypto savings platforms offer much higher APYs when compared to traditional bank accounts.

APY Rate Change

Another risk to consider is that the APY you are offered by your chosen crypto savings account provider is not guaranteed. This means that at any given time, you might find that you are offered a less favorable rate.

This is much the same as opening a flexible savings account with a traditional bank.

Falling Crypto Prices

We mentioned earlier that when your crypto savings are loaned to third parties, the borrower must put up a security deposit in the form of collateral.

However, this collateral can very quickly lose value if the broader cryptocurrency markets go through a major downward trend. If this does happen, and defaults begin to increase at a rapid pace, the platform might not have enough equity to cover your balance.

Token Value vs APY

If you are looking to buy cryptocurrency with the sole intention of earning interest, you should proceed with caution.

This is because, while you might earn a decent rate of return via a crypto savings account, you must not forget that the value of your digital currency holdings will go up and down as per market forces. In the case of a downturn, from an investment perspective, you are worse off.

This is why it might be a much better idea to opt for a stablecoin when opening a crypto savings account. In doing so, you can alleviate the risk of volatility, as stablecoins like USDC are pegged to the US dollar.

Conclusion

This guide has covered the ins and outs of how crypto high yield savings accounts work. Put simply, by depositing your idle digital assets into a trusted crypto savings platform, you will be paid an attractive rate of interest. This allows you to sit back and earn passive income on your crypto investments.

The best crypto savings account in the market – as per our comprehensive research, is Aqru. It features great yields and high-end security. Best of all, crypto savings accounts at Aqru are flexible, so you can cash out at any time.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading

#cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket

#cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments

#cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution

#allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency

#cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment