- Celsius to return $50 million of users’ funds, CEL spikes by 35%

- Robinhood lists Cardano (ADA) on its platform ahead of the Vasil upgrade

- Stablecoin issuer Tether asks for the removal of counsel Roche Freedman

- Think tank unveils “Technical Sandbox” for exploring CBDC in the U.S.

- Multi-chain liquidity hub Kyber Network loses $265k in latest exploit

Celsius to Return $50 Million of Users’ Funds, CEL Spikes by 35%

Bankrupt cryptocurrency lender Celsius Network has filed to return a portion of its customers’ tokens worth $50 million. According to Celsius, these funds are not part of the bankruptcy estate.

Only customers with assets worth US$7,575 or less in Celsius’ Custody and Withhold Accounts, used for storage but not generating any returns, will be eligible. The hearing for the token release will take place on October 6.

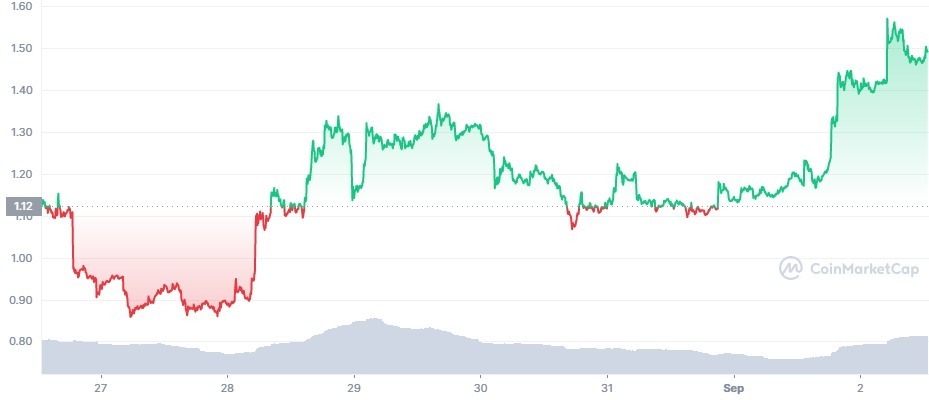

The news sparked a major rally for the Celsius CEL token. CEL has gained more than 25% in 24 hours to become the biggest gainer on Friday, September 2.

The 24-hour price chart for Celsius (CEL). Source: CoinMarketCap

Celsius (CEL) now trades at $1.50, after setting a new weekly high at $1.57. Celsius remains the biggest gainer of the week, rising by +35%. The project’s market cap has also spiked up to $358 million, making it the 91st largest crypto.

The 7-day price chart for Celsius (CEL). Source: CoinMarketCap

Flipsider:

- Despite wanting to release $50 million, nearly 65,000 users hold assets in Custody and Withhold Accounts worth approximately $225 million.

Why You Should Care

Celsius’ filing comes a day after an organized group of 64 customers claiming around $25 million in custody holdings also petitioned the court for their funds back.

Robinhood Lists Cardano (ADA) on Its Platform Ahead of the Vasil Upgrade

San Francisco-based retail investment platform Robinhood Markets announced the listing of Cardano (ADA), the eighth-largest cryptocurrency in the world with a $15.3-billion market cap.

On September 1, Robinhood announced that its users can now trade ADA and gain exposure to its spot price. According to Robinhood, ADA was listed on the platform due to popular demand.

The listing on Robinhood also serves as a boon for the exchange as it prepares for its upcoming Vasil upgrade, especially as Cardano developer IOHK reported that they are close to hitting three critical mass indicators before the Vasil Upgrade.

According to IOG, over 80% of SPOs have upgraded and more than 70% of the top dApps have upgraded their nodes. The IOG also notes that it is working with exchanges on updating their nodes in preparation for the upgrade.

Flipsider:

- The listing comes as Robinhood faces a class-action lawsuit on the grounds of market manipulation during the meme stock rally last year.

Why You Should Care

Joining Robinhood could be a big boost for Cardano (ADA) as the brokerage platform lists only a select few cryptocurrencies.

Stablecoin Issuer Tether Asks for the Removal of Counsel Roche Freedman

Tether, the issuer of the USDT stablecoin, has asked U.S. District Judge Katherine Polk Failla that law firm Roche Freedman should be removed as counsel from the Bitfinex and Tether case, following a motion from Kyle Roche to be removed as counsel.

In addition to removing Roche Freedman, the law firm representing Tether and Bitfinex – Elliot Greenfield of Debevoise & Plimpton LLP requested the return or destruction of all defendant-issued documents and confirm they haven’t been shared with any third party.

Kyle Roche had filed a notice of motion to be removed as counsel in the case amid the recent CryptoLeaks allegations. CryptoLeaks had alleged that he used investor lawsuits to target competitors of Ava Labs in exchange for AVAX tokens and Ava Labs equity.

The Bitfinex and Tether class-action lawsuit initiated in 2019 claimed that Tether and Bitfinex manipulated the crypto market by issuing unbacked USDT to signal the market an organic demand for cryptocurrencies.

Flipsider:

- Despite denying the CryptoLeaks allegations, Roche Freedman has withdrawn from the Tron, BitMEX, Nexo, Binance, Solana, and Dfinity lawsuits.

Why You Should Care

The ongoing Bitfinex and Tether case is to determine whether the companies recklessly and unlawfully covered up massive financial losses to keep their schemes going.

Think Tank Unveils “Technical Sandbox” for Exploring CBDC in the U.S.

Reports have revealed that a United States-based think-tank has unveiled a project, Technical Sandbox, to explore the possibility of deploying a central bank digital currency (CBDC) in the U.S.

According to the reports, the Technical Sandbox project aims to provide the federal government, policymakers, and the private sector with an understanding of how a potential CBDC would be operated in the United States.

In a tweet, the Digital Dollar Project (DDP) explained that the project aims to explore “technical and business implementation” questions revolving around a U.S. CBDC. The program will begin in October, starting with cross-border payments.

The program will be launched in two phases, an educational and a pilot phase. The organizations behind the Technical Sandbox project are Ripple, Digital Asset, Knox Networks, and banking solutions firm EMTECH.

Flipsider:

- The U.S. is yet to decide whether or not it will launch a CBDC despite exploring the potential risks and benefits that come with them.

Why You Should Care

The Technical Sandbox project could help the U.S. catch up with other countries that have reached advanced stages of CBDC development and testing.

Multi-Chain Liquidity Hub Kyber Network Loses $265k in Latest Exploit

On Thursday, September 1, multi-chain DeFi liquidity hub Kyber Network announced that it had “identified” and “neutralized” an exploit on its front end, two hours after it was discovered by its team.

According to Kyber, the exploit was carried out through a malicious code in their Google Tag Manager (GTM), which inserted a false approval, allowing the hacker to transfer the user’s funds to their address.

Kyber explained that the attack was focused on whale addresses, with two Kyber users losing $265,000 to the exploit. Kyber has also compiled a list of suspicious wallet addresses active during the exploit.

In addition, Kyber has said that it will completely reimburse users whose funds were lost in the exploit. All other functions on Kyber, including swap aggregator, adding liquidity, and farming, were not affected and are fully functional.

Flipsider:

- Kyber has also advised other DeFi projects to run thorough checks on their frontend code & associated Google Tag Manager (GTM) scripts, as they could also be targets.

Why You Should Care

The quick action of Kyber in neutralizing the attack helped in limiting the number of tokens the hackers were able to steal.