Global shipping giant Maersk is the latest company to join the recession bandwagon. Several economists predict a global recession amid aggressive rate hikes by central banks globally.

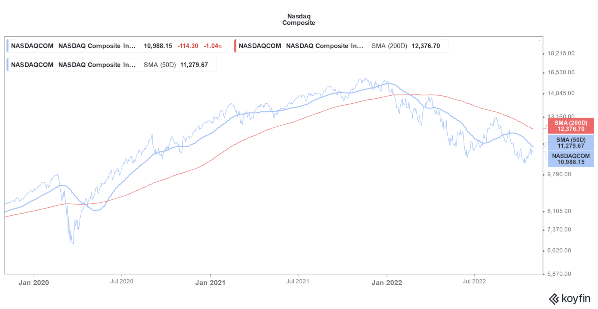

The US Federal Reserve has been the most aggressive major central bank globally. It has already raised rates by 3 percentage points this year. It started with a 25-basis point rate hike in March and has since taken a more hawkish approach.

The Fed is widely expected to raise rates by 75 basis points after the two-day FOMC meeting concludes today. Cathie Wood of ARK Invest believes that the US economy is headed for deflation and the Fed is making the mistake of overtightening.

Meanwhile, recession warnings have been piling up and several companies as well as leading economists have warned of an impending recession. While releasing its earnings, Maersk said, “With the war in Ukraine, an energy crisis in Europe, high inflation, and a looming global recession there are plenty of dark clouds on the horizon.”

It added, “This weighs on consumer purchasing power which in turn impacts global transportation and logistics demand.” In September, FedEx CEO Raj Subramaniam also warned of a global recession.

Recession Warnings Pile Up amid Economic Headwinds

Recently, Tesla’s CEO Elon Musk and Amazon’s co-founder Jeff Bezos also warned of an economic slump and the former predicted that a global recession could stretch until the spring of 2024.

Amazon posted its Q3 2022 earnings last week and the tepid guidance stoked recession fears. Amazon stock has plummeted this year but most Wall Street analysts see it as a buy. We have a guide on how beginners can buy Amazon stock.

Last month, Jamie Dimon of JPMorgan joined the recession bandwagon and said that the US economy might slip into a recession over the next six to nine months.

Dimon admitted that the US economy is still healthy. He however warned, “But you can’t talk about the economy without talking about stuff in the future — and this is serious stuff.” Dimon listed several headwinds including rising interest rates, high inflation, as well as the escalation in the Russia-Ukraine war.

Billionaire investor Paul Tudor Jones has also warned of a recession. He said, “I don’t know whether it started now or it started two months ago.” He added, “We always find out and we are always surprised at when recession officially starts, but I’m assuming we are going to go into one.”

Bond Yields Have Risen amid the Fed’s Rate Hikes

US bond yields are at multi-year highs amid aggressive rate hikes from the Fed. Bond guru Jeffrey Gundlach believes that bonds are an attractive investment option. Gundlach also said that the Fed is making the mistake of “overtightening.”

The Fed has taken a hawkish approach to curbing inflation which is still way above comfort levels. After the Fed’s September meeting, Powell said, “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.”

Fed is expected to raise rates by 75 basis points today which would mean a fourth consecutive rate hike of that quantum.

However, more than the rate hike, markets would watch Powell’s commentary on future rate hikes. The US economy is slowing down and even the tech majors are witnessing a growth slowdown. Almost all the tech companies are going slow on hiring and the outlook for 2023 does not look any rosier.

Could Fed’s Rate Hikes Push the US Economy Into a Recession?

On multiple occasions, Powell has said that the rate hikes might lead to recession. He also however emphasized that the Fed is not trying to force a recession. While recession impacts most sectors of the economy, some of the investments are largely recession-proof.

All said Fed’s rate hikes have started to take a toll on the US economy. Inflation has come off its highs and wage growth has moderated. Rental growth has also come down and in some markets rent as well as housing prices have dropped.

However, the escalation in the Russia-Ukraine war has complicated the picture for central banks across the world. Russia has suspended the pact to let Ukraine export its wheat which has led to a rise in wheat prices, fueling inflation fears. Energy prices have also bounded back after OPEC+ decided to cut its output.

Amid growing recession chatter, markets now await the commentary from Fed chair Jerome Powell. Since July, Powell has spooked markets with his hawkish comments as he has dashed all hopes of a pivot.

With the US economy slowing down and even the tech majors feeling the heat, markets expect Powell to take a somewhat dovish stance toward future rate hikes.