Crypto prices are mostly consolidating in narrow ranges ahead of the US FOMC and Fed rate decision on November 2. Following several FOMC members’ dovish comments last week, if Powell indicates he’s fine with financial loosening, the rise could continue. However, squeezing retail investors in recent months is downside insurance, unlike stocks, if Fed pivot optimism fades.

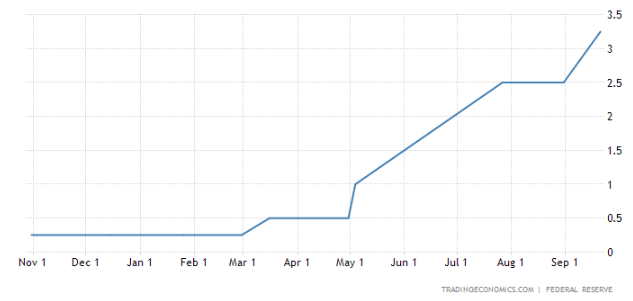

According to Nick Timiraos’ October 21 Wall Street Journal article, Federal Reserve policymakers are on track to raise interest rates by 0.75 percentage points at their November 1-2 meeting. Furthermore, they will likely discuss whether and how to indicate plans to approve a smaller hike in December.

Federal Reserve Policy Updates

“avoid the far greater economic suffering associated with entrenched high inflation, including the significantly tighter policy and more severe restraint on economic activity that would eventually be needed to restore price stability.”

Reasons to Take a Hawkish Stance

There are signs that the US economy is slowing, but it is difficult to say that the fight against inflation is nearing its end. For the following reasons, the Fed and its Chair, Jerome Powell, will send a hawkish message. Rising core inflation suggests that changing attitudes is premature. Fed officials may have differing views on the current state of the economy. The most important comments are made by the person at the top, and after establishing rates, the impacting time. As a result, it is too early to send a reassuring message to customers.

The Fed announces its decision only six days before the midterm elections when voters’ primary concern is inflation. Powell should not give any indication that he is willing to back down politically at this point. He requires a poor performance review to appear more dovish to the public. The market has significantly reduced hope. Stock prices have risen as bond yields have fallen. As a result, Timiraos’ weekend article was inspired by the market’s tendency to move too far in one direction.

Why Crypto Prices Are Set For More Advances if Powell Says This

During its November meeting, the Fed did not present updated forecasts, instead focusing on other factors, most notably Powell’s attitude. He will be dovish if he expresses concerns about the housing market. However, there is a greater likelihood of an aggressive, hawkish tone on inflation.

Powell made it clear that the Fed bases its decisions on facts and makes them meeting by meeting, without even hinting at what might happen in December. Because of the uncertainty, stocks may fall and the safe-haven dollar may rise. Furthermore, due to the positive correlation with stocks, cryptos may fall as a result of aggressive rate hikes.