Ethereum price prediction remains bullish above the $1,600 support level. Ethereum is the world’s second-largest cryptocurrency by market capitalization and as of 2022, before the Merge upgrade, Ethereum used between 46.31 and 93.98 TWh annually in energy.

Because of the Merge, one of the most important Ethereum blockchain improvements ever, the network’s energy consumption dropped by 99.9 percent almost instantly.

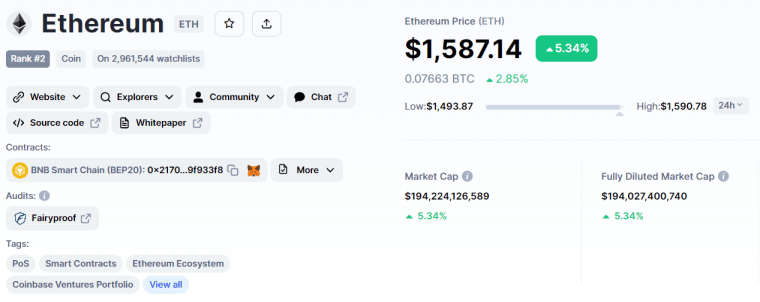

Ethereum Price Prediction & Tokenomics

The current price of Ethereum is $1,630, with a 24-hour trading volume of $20 billion. In the last 24 hours, Ethereum has surged more than 2%, and over 24% in the CoinMarketCap currently ranks #2, with a live market cap of $199 billion.

It’s possible that Ethereum’s price will increase significantly over the next several years, even surpassing $2,000. With its solid foundation, Ethereum is one of the most formidable cryptocurrencies available today. This paves the way for the widespread adoption of DeFi, gaming, and even NFTs, all of which benefit from the benefits of decentralization.

Ethereum Price & Tokenomics – Source: Coinmarketcap

Despite market volatility, this suggests that there is genuine demand for Ether tokens, the Ethereum blockchain’s base currency. The rise of Ethereum 2.0 and the platform’s popularity have encouraged investors.

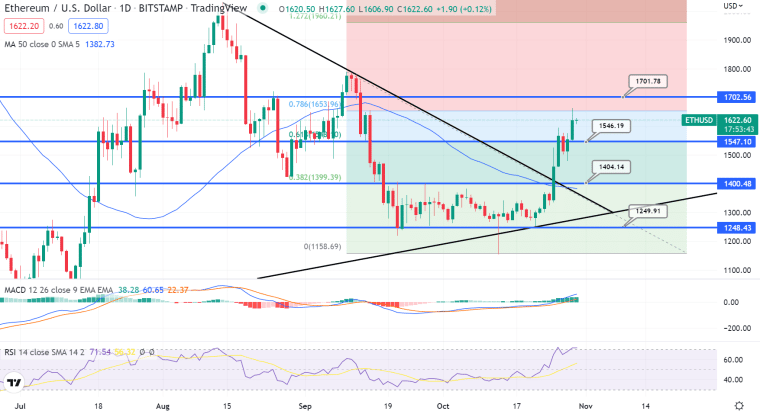

Technically, the fact that the ETH/USD pair has crossed over $1,600—where it has crossed over 61.8% Fibonacci retracement—raises the possibility of a bullish trend correction. The price of Ethereum has broken through the $1,625 resistance mark, signaling substantial bullish potential. The next likely price objectives for ETH are $1,655 and $1,700.

Ethereum Price Chart: Source: Tradingview

Both the RSI and the MACD are indicating strong bullish signs. As a result, over $1,625, Ethereum has strong odds of bullish continuation. Whereas, today’s support level reamin at $1,545. In the longer run, Ethereum has strongs odds of a exhabting 10X gaind in 2023.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrencynews #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrencyupdates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrencyfordummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney