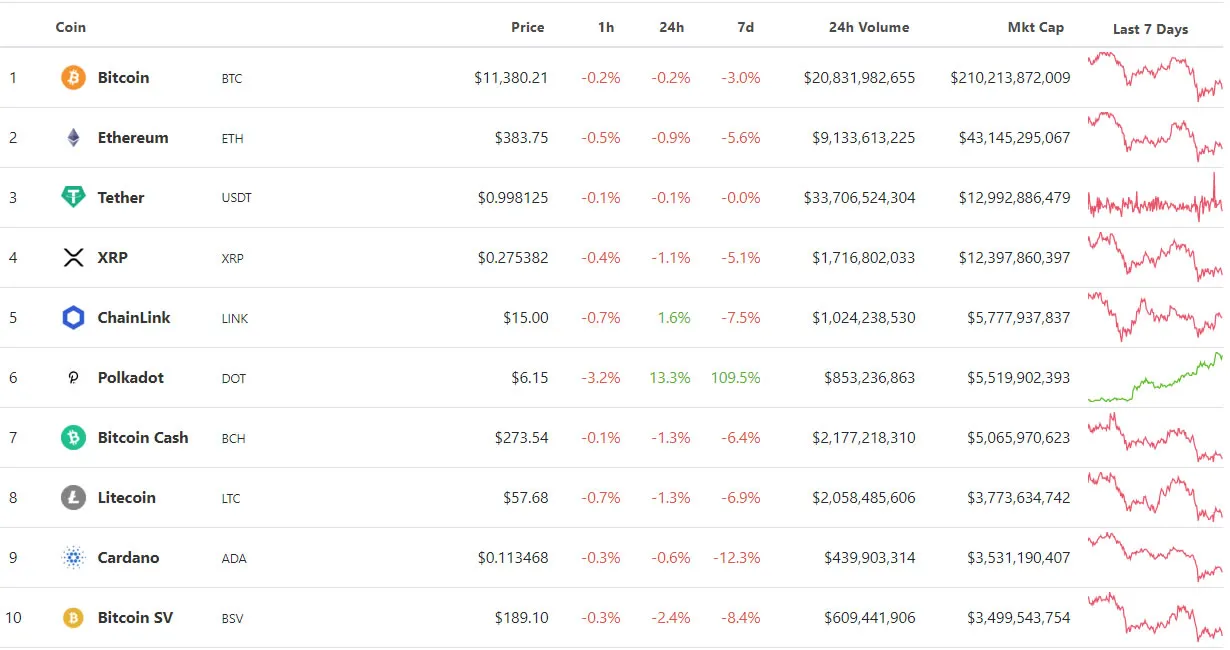

It has been touted as the latest ‘Ethereum killer’ but will it live up to that lofty ambition? Today’s hype on crypto twitter is all about Polkadot. The majority of digital assets are either sideways or predominantly red today, that is except DOT. According to leading crypto market analytics websites Coingecko, Livecoinwatch, and Cryptocompare, DOT has a market cap of around $5.5 billion, which puts it at sixth place in the charts. This is just below Chainlink with $5.7 billion and above Bitcoin Cash with a market cap of $5 billion.

Source: coingecko.com

Source: coingecko.com

DOT token prices are up 12% over the past 24 hours according to Coingecko and they have doubled since the same time last week. Trading volume over the past day has been reported as $860 million with 35% of that on Binance alone.

Not Represented on Binance

Strangely, Binance-owned CoinMarketcCap (CMC) had not updated its market cap figures for DOT, which remained ranked at 2,168 on the website. CMC did not respond for comment, though, a notice on its page for the token offers some explanation,

This page refers to New Dot which is 100x smaller than DOT (OLD). On 21 August 2020 at 16:40 UTC (block number 1,248,328), the DOT token underwent a redenomination from its original sale. There is no difference between New Dot and DOT (OLD) except for their denomination.

The move has been widely discussed by the crypto community over the past few hours as DOT becomes the latest crypto hot cake. Derivatives trader, Cantering Clark [@CanteringClark], was quick to note that DOT could soon overtake LINK:

$DOT about to over-take $LINK

— Cantering Clark (@CanteringClark) August 26, 2020

You know what is next after that…

He also pointed out that there are higher cap altcoins in the top ten that don’t actually do that much, insinuating that Polkadot could go a lot further. The FOMO is already mounting it appears, with managing partner at Moonrock Capital, Simon Dedic [@scoinaldo], stating in a tweet last week,

Can you remember what $ETH caused from 2016-2017? $DOT is in the middle of causing the exact same from 2020-2021. Buckle up

So, What is Polkadot, and Can it Kill Ethereum?

It’s clear from the offset that the project aims to dethrone Ethereum with this rather bold statement on its official website,

Polkadot will enable a completely decentralized web where users are in control.

It was founded by Ethereum co-founder Gavin Wood, technology director of the Web3 Foundation, Peter Czaban, and core developer at Parity Technologies, Robert Habermeier. It has been in development since 2016 and raised $145 million during the 2017 ICO boom. The project entered the final phases of its launch in July 2020 and is now finally live. Polkadot is essentially a multi-chain which has a number of ‘parachains’ (called shards in Ethereum) and works on its own technology called ‘Substrate’, which is a blockchain framework. Sound complicated? It may be for the layman, but for developers and coders, the software allows the creation of new chains and applications relatively quickly, without delving into the complexities of smart contracts. The platform is fully interoperable, allowing any other blockchain to connect to the network as a sidechain using ‘bridge chains’. The built-in parachain technology will give it the instant ability to scale and process thousands of transactions per second. For Ethereum, this is still a long way off unless Layer 2 solutions are employed. The main Polkadot blockchain is known as the Relay Chain. It supports smart contracts and is secured by a type of Delegated Proof-of-Stake consensus, which Polkadot calls Nominated Proof-of-Stake, (NPoS). There are already a number of projects using the Polkadot framework, almost 200 according to data from PolkaProject.

DOT Prices Pumping

Its native DOT token has just gone through a ‘denomination’ as part of a decentralized governance system, similar to those operated by leading DeFi platforms. This likely accounts for its massive hundred-fold expansion in market cap.

The token has not been trading long and has already gained massive momentum, topping out at an all-time (just ten days) high of $6.50 today, according to Tradingview.com. Major exchanges such as Binance and Kraken have already listed DOT following this denomination. Momentum is likely to continue if Coinbase joins the fray, potentially giving it exposure to U.S. crypto investors. Blocktown partner, Joseph Todaro [@JosephTodaro_], said that the Kraken listing DOT ahead of Coinbase and Binance U.S. has been a massive win and that he’s been directing investors to the exchange.

Spartan Group partner and former partner at Goldman Sachs, Kelvin ‘Spartan Black’ Koh [@SpartanBlack_1], is confident that Polkadot can become one of the top three blockchains in the world in terms of market cap. He is not far off that prediction as DOT is already at number six.

But is it Really Competing?

Koh added that he believes that Polkadot would not compete with Ethereum in an interconnected world,

I believe in a multi-chain world inter-connected by bridges. Polkadot and Cosmos will not replace Ethereum. Also wouldn’t rule out chains like Near, Solana, AVA, TRON and others seeing development activity.

There have been many so-called Ethereum killers that have emerged over the past couple of years that have failed to live up to the gargantuan task. EOS, Cardano, and Tron instantly come to mind, but there are others. Ethereum is the current industry standard with a thriving developer community and thousands of dApps. It also powers the entire DeFi ecosystem, albeit at a high price to its users at the moment. In time, Polkadot may emerge as the future of decentralized blockchain technology, however, it has a long way to go and a lot of work to do to if an entire industry is to make the switch. The next year or two will reveal whether Polkadot can do what it claims to.