Silicon Anode Material Battery Market Growth Forecast with Competitive Analysis 2032

Introduction

The Silicon Anode Material Battery Market includes advanced battery anode materials that replace or blend with conventional graphite to improve lithium-ion battery energy capacity. Silicon anodes store more lithium ions than graphite, enabling batteries with higher energy density, faster charging, and improved performance. These materials are supplied in different forms including nanopowder silicon, silicon-graphite composites, silicon oxide (SiOx), and doped silicon blends engineered for commercial battery manufacturing.

The global importance of this market is directly linked to electric mobility, renewable energy storage, and rising demand for compact high-capacity consumer electronics. Silicon anodes bring structural efficiency inside lithium-ion cells, allowing extended range for EVs, longer device runtime for portable electronics, and durable charge cycles for grid-level energy applications. Governments, automotive manufacturers, battery producers, and material science firms consider silicon anode development a critical path to next-generation electrochemical storage systems.

In 2025, the market valuation of silicon anode materials is estimated at USD 1.9 billion. The relevance of the market continues to increase as EV battery adoption grows, lithium-ion cells shift toward performance-driven chemistries, and manufacturers prioritize fast-charge capability without increasing pack size. The current size, investment inflow, patent activity, production scalability, and institutional support make this segment one of the fastest-developing sub-categories inside the global battery materials industry.

Learn how the Silicon Anode Material Battery Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/global-silicon-anode-material-battery-market

The Evolution

Historical Development

Early development of lithium-ion batteries focused on graphite as the primary anode material due to stability, cost feasibility, and manufacturing simplicity. Silicon was researched as an alternative as early as the 1990s, but large-scale adoption was limited due to volumetric swelling, cycle degradation, and structural instability inside the cell.

From 2010 to 2016, research intensified around nano-silicon engineering, binder chemistry, and pre-lithiated silicon. Material trials demonstrated energy capacity gains of up to 40–60% in laboratory cells, and initial commercial pilots for silicon-graphite composite anodes began in consumer electronics.

From 2017 to 2023, major battery firms, EV OEMs, and R&D institutions invested in SiOx and silicon-graphite hybrid formulations due to improved swelling control and higher charge retention under fast-charge loads. The market shifted from pure R&D stage toward initial production scale and global supply qualification with automotive-grade validation standards.

Key Innovations and Milestones

-

Nano-engineered silicon powders enabled improved mechanical resilience.

-

Silicon-graphite composite materials introduced reduced cell failure from swelling pressure.

-

SiOx (Silicon Oxide anode blends) allowed mass production with better cycle stability than pure silicon.

-

Elastic polymer binders controlled silicon volumetric expansion inside the cell structure.

-

Pre-lithiation techniques reduced initial capacity loss and improved first-cycle efficiency.

-

Carbon-coated silicon anodes delivered higher conductivity and lower structural fracture.

-

Production line scaling (2022+) created regional availability across Asia-Pacific, the U.S., parts of Europe, and Middle East battery material sourcing hubs.

-

Integration inside EV battery platforms (2023-2025 pilots) positioned silicon anode chemistries for long-term mass adoption.

Shifts in Demand and Technology

Demand trends shifted from experimental silicon trials toward hybrid silica-based commercial anode blends that guarantee:

-

Fast-charge support,

-

Higher range-to-weight ratios,

-

Compatibility with NMC, LFP, solid-state hybrids, and high-nickel lithium cells,

-

Large-scale contract manufacturing feasibility,

-

Automotive safety certification compliance.

Technology focus is now on energy-to-volume efficiency, swelling suppression, binder elasticity, and commercial production consistency with minimal contamination and high purity.

Market Trends

Consumer and Industry Trends

-

Electric vehicles require longer battery range without increasing pack size.

-

Consumer electronics manufacturers want higher mAh ratings without adding device weight.

-

Energy storage systems demand cycle stability even at high depth-of-discharge levels.

-

Major battery producers are shifting toward silicon-graphite and SiOx blended anodes.

-

Rising market sentiment favors silicon anodes as a strategic material in 2030+ cell platforms.

-

Increased focus on cost-scalable silicon composite production, not pure silicon.

-

Higher qualification standards for contaminant-free nano silicon supply.

-

Regional supply chain diversification to avoid dependency on a single material export region.

Technology Adoption and Advancements

-

SiOx adoption is increasing faster than nano-silicon powders due to better swelling control.

-

Silicon-graphite composites are leading revenue market share.

-

Carbon-encapsulated and carbon-coated silicon for conductivity improvement.

-

AI-modeled electrode expansion simulations helping manufacturers optimize material blends before production.

-

Roll-to-roll electrode compatibility prioritized in material selection.

-

4 mm to 6 mm electrode coating uniformity testing becoming standard for advanced silicon dispersion.

-

Battery cell digitization ecosystems increasing demand for fast-charging anodes.

Regional and Global Adoption Patterns

-

Asia-Pacific leads global raw material supply and commercial silicon-composite production.

-

North America leads demand-side adoption through EV and grid-battery contracts.

-

Europe shows fast growth in sustainable energy storage, material science investment, and automotive platform pilots.

-

Middle East & Africa adoption focuses on energy storage systems, solar grid stability projects, and import-based material qualification.

-

Latin America adoption is emerging through EV OEM expansion into Brazil, Mexico, and Chile but remains import-driven for materials.

Challenges

Industry Challenges

-

Volumetric swelling of silicon inside battery cells, requiring composites.

-

Manufacturing equipment refinement needed for ultra-fine silicon anode dispersion.

-

Purity standards increase production cost.

-

Electrode fracture risks increase when silicon content is not optimized.

-

Specialized binders required for commercial stability.

-

Import dependency for battery-material-grade silicon powders in many regions.

-

High defect sensitivity for nano materials during storage and transit.

Economic & Supply Chain Barriers

-

Price pressure on battery materials.

-

Limited high-volume silicon composite producers that meet automotive cell grade standards.

-

Shipping sensitivity for nano silicon powders (moisture, vibration, contamination).

-

Demand scales faster than production qualification timelines.

Market Risks

-

Raw material shortages for high-purity silicon.

-

Technology risk if swelling control solutions do not scale at commercial speed.

-

Competition from alternative next-generation anodes including lithium-metal and solid-state hybrids.

-

Environmental risk from chemical processing by-products during silicon refinement.

Market Scope

Segmentation by Application

-

Electric Vehicle Batteries

-

Consumer Electronics

-

Energy Storage Systems

-

Industrial Power Banks

-

Aerospace & Defense Batteries (specialized lightweight cells)

-

Fast-Charge Device Batteries

End-User Industries

-

Automotive

-

Consumer electronics

-

Energy and utilities

-

Renewable storage firms

-

Defense battery manufacturers

-

Portable device OEMs

-

Battery cell contract manufacturers

Regional Market Analysis

North America

-

EV battery manufacturers integrating silicon-graphite and SiOx blends.

-

Government incentives for electric mobility increasing material adoption rates.

-

Strong demand through automotive OEM wide-range pilots.

Europe

-

Tesla, Volkswagen, BMW, Northvolt, VARTA, and European battery alliances funding silicon-anode battery pilots.

-

Rapid adoption through renewable grid storage contracts across Germany, France, the UK, Sweden, and Norway.

-

Focus on regulatory-backed safety sharps and strong electrode stability testing environments.

Asia-Pacific

-

Largest manufacturing hubs for silicon-graphite composites and SiOx.

-

China, Japan, South Korea, and India lead supply-side material production.

-

Electronics OEM fast-charge platforms significantly increase consumption volume.

Latin America

-

Emerging EV adoption through Brazil, Mexico, Chile, Argentina, and Colombia.

-

Material import-driven adoption for SiOx and silicon composites.

Middle East & Africa

-

Primary adoption through energy storage systems.

-

Solar-backed grid stabilization increases battery scaling requirements.

-

Growing import qualification partnerships with global material suppliers.

Market Size and Factors Driving Growth

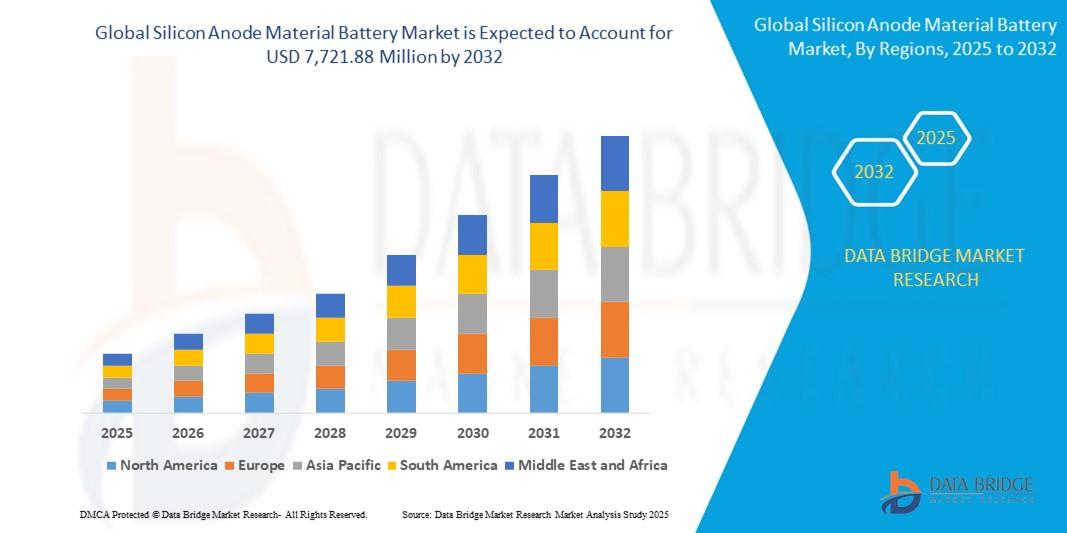

- The Global Silicon Anode Material Battery Market size was valued at USD 378.98 Million in 2024 and is expected to reach USD 7,721.88 Million by 2032, at a CAGR of 45.76% during the forecast period

Key Growth Drivers

-

Battery range limitations in EVs pushing manufacturers toward silicon blends.

-

Device miniaturization trend requiring higher capacity anode solutions.

-

Increased investment in material science for swelling suppression, binder stability, carbon encapsulation, and hybrid silica solutions.

-

Higher fast-charge adoption in consumer and automotive batteries.

-

Government sustainability goals promoting lower-weight, higher-efficiency battery chemistries.

-

Population and electrification growth increasing battery deployment volume.

-

Rising renewable energy storage contracts across Europe and MEA.

-

Increased adoption of battery-compatible silicon oxide (SiOx) blended anodes due to commercial feasibility.

-

Advanced testing certification environments increasing material qualification approvals.

-

Growing strategic partnerships between OEMs and nano-material suppliers.

Regional Opportunities

-

Europe scaling renewable storage platforms.

-

Middle East solar-grid battery scaling programs.

-

Asia-Pacific manufacturing contracts for silicon composites.

-

North America EV demand volume growth.

-

Latin America urban EV deployment expansion.

FAQ

-

What is the current market size of the Silicon Anode Material Battery Market?

-

What is the expected CAGR from 2025 to 2035?

-

Which product segments dominate the market today?

-

Why is SiOx adoption increasing faster than nano-silicon powders?

-

How do silicon-graphite composites suppress volumetric swelling?

-

What role do binders play in silicon anode performance?

-

Which battery chemistries use silicon blended anodes?

-

Which regions are scaling silicon composite manufacturing capacity?

-

What challenges exist in shipping high-purity nano silicon powders?

-

How does fast-charging demand influence silicon anode adoption?

-

Which end-user industries consume the most silicon anode materials?

-

What innovations are improving silicon anode cycle stability?

-

What environmental risks are associated with silicon anode processing?

-

How do silicon anodes affect EV overall vehicle range and weight ratios?

-

What policy incentives support silicon-anode battery adoption?

- Browse More Reports:

Global Solid State Battery Market

Global Avocado Processing Market

Global Hot Drinks Market

Global Edible Insects Market

Global Cold Chain Market

Global Shea Butter Market

Global Liquefied Natural Gas (LNG) Carrier Market

Global Smart Health Watches Market

Global Anti-Drone Market

Global Expanded Polystyrene Market

Global Polycystic Ovarian Syndrome (PCOS) Market

Global Fats and Oil Market

Global Radio-Frequency Identification Technology (RFID) Market

Global Organic Electronics Market

Global Automated Fingerprint Identification System (AFIS) MarketAbout Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com