Bitcoin protocol has been running successfully for more than 10 years. In today’s article, we will look at how the level of decentralization has evolved over time for the project that has been running the longest. The shift in the quality of decentralization from a relatively high level to low is significant and it is interesting to see why it happened.

After investigating how and why the level of decentralization decreased in the Bitcoin network we will look at how the Cardano project approaches decentralization and how it has learned from its predecessor’s mistakes. Charles Hoskinson sometimes says that Cardano will be 50x more decentralized than Bitcoin. We will show you how the level of decentralization can be objectively assessed and why it is possible to say that.

We hope that our observations will be interesting for you.

Decentralization is a dynamic process

Decentralization is not something a protocol could achieve once, and then it would have forever. Decentralization is a dynamic process and will change over time. Decentralization is mainly about the number of independent and self-organized people involved in the network consensus. People act on the basis of their economic interests and their desire for power. A distributed protocol has some potential and prerequisites that people can use to start and maintain a decentralized network. The protocol consensus is only a set of rules and algorithms that programmers have created to allow the network to reach a majority consensus in an adversary environment according to these rules. Network consensus rules may work well for some time, but as the conditions in the physical world evolve, protocol rules might need to be adapted if it is unable to keep the required properties.

Cryptocurrencies are only at the beginning and therefore the environment is very unstable and changeable. The instability of the environment is caused by an economic and incentive model, which changes over time. For example, the network subsidy could decrease at regular intervals which has an impact on the security budget. Another reason may be the speed of adoption that cannot be estimated in advance. The number of people using the protocol is constantly changing and probably grows as the protocol slowly becomes popular. With the increasing importance of the Protocol, power interests grow from outside but also from within the ecosystem. And of course, we cannot forget the price volatility of the coin on the market.

The digital world cannot communicate with the physical world in a fully decentralized way. The digital world cannot fully understand the physical world and all relations. In other words, the protocol never knows what is exactly happening around it and whether it is good or bad. A protocol can just strictly follows algorithms and make some deterministic decisions. People from the physical world are the ones who can spot some problems with protocol decentralization and can point to a specific algorithm that does not work properly. Therefore, only people can solve arising problems by modifying the rules of the consensual protocol algorithm. Clear rules must, therefore, be defined on how and under what conditions the team can modify the protocol rules. There must be also established some form of communication from network users towards the team. Within a decentralized network, the protocol should not be owned by the team, but by all people. In other words, decision-making power should be distributed as much as possible, since ownership often represents a chance to gain some advantage.

Ideal decentralization is an unattainable goal

Satoshi Nakamoto designed a well-decentralized network. Let’s look straight into the whitepaper:

The steps to run the network are as follows:

- New transactions are broadcast to all nodes.

- Each node collects new transactions into a block.

- Each node works on finding a difficult proof-of-work for its block.

- When a node finds a proof-of-work, it broadcasts the block to all nodes.

- Nodes accept the block only if all transactions in it are valid and not already spent.

- Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.

One of the computers used to mine Bitcoin at the beginning. Lucky winner god 50 BTC approximately every 10 minutes.

One of the computers used to mine Bitcoin at the beginning. Lucky winner god 50 BTC approximately every 10 minutes.

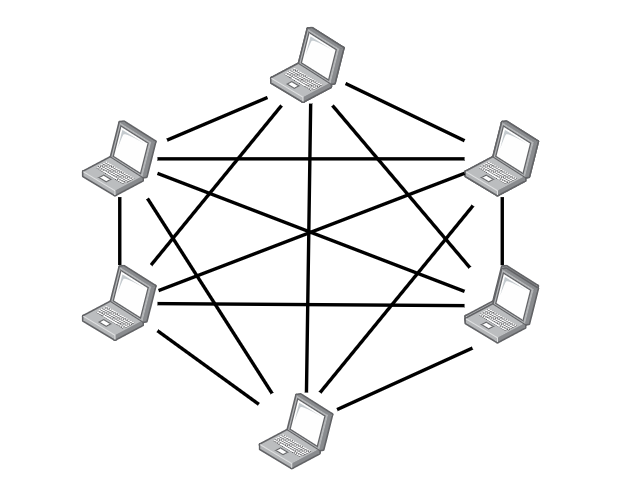

In the beginning, all nodes in the network had almost the same position. We can say that everyone had the same decision-making rights. Each individual had a full mining node and could mine a new block. Thus, each node could autonomously decide which transactions to put in a block, or which block to follow in the case of a fork. The mining full node is also an important part of the power distribution when a hard fork is going to happen. So the network had no single point of failure and no center of power. All nodes had the same decision-making power. The network looked similarly as in Figure 1.

The decentralization described in Figure 1 is probably unattainable for a consensual network if the number of participants is in the tens of millions. In the PoW network, those with a higher hash-rate have proportionally a higher chance of producing the block. It may happen that some participants will never produce a block if there is a certain number of participants with a high hash-rate. Thus, participants with a low hash-rate would never be rewarded despite trying to keep the network decentralized and consuming electricity. It turned out that there was a need to divide the roles of network users.

Pools and ASIC miners changed rules of the game

How to make sure that even people with less hash-rate can participate in mining and get rewards? The solution was to introduce the concept of pools. The problem has been solved, as more individuals could join together and create a group. They could combine their hash-rate and mine together one block.

It soon became apparent that it was better to use graphics cards (GPU) for mining than CPU. People who wanted to have an advantage in a higher hash-rate began to build mining rigs, using many CPU or GPU. Subsequently, it was possible to buy specialized mining hardware — ASIC miners. To see the difference, a Bitcoin ASIC miner can calculate hashes ~100,000 times faster than even the best CPU.

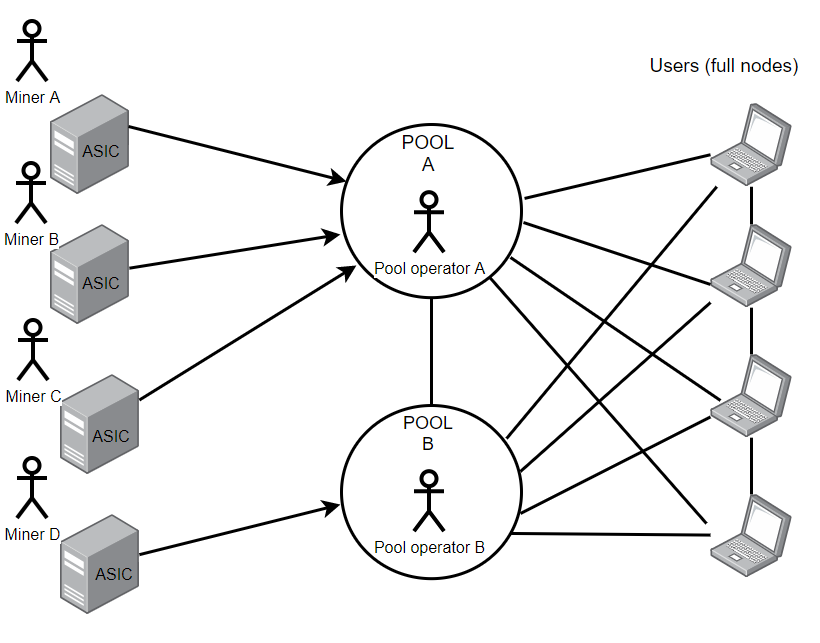

The network started to look like as in Figure 2.

Figure 2 shows that users are divided into miners and users. Miners usually do not maintain a full node and do not need it. A specialized ASIC miner only provides a hash-rate to the pool. The pool decides on which part of the mining task (proof-of-work job) each individual miner will work. Network users can run a full node, but they don’t have to. The safest storage of private keys is in the hardware wallet, ie in cold storage. Coin holders thus basically have no need to maintain a full node and rely on someone else to provide them with blockchain information.

Notice, that in the early days of Bitcoin, there was no such thing as a non-mining full node. In Bitcoin’s whitepaper, the word node is the equivalent of a miner. In the beginning, every node was a miner. As Satoshi wrote in his whitepaper:

‘As long as a majority of CPU power is controlled by nodes that are not cooperating to attack the network, they’ll generate the longest chain and outpace attackers.’