What banks do

A regular bank can offer you many services. You can open a standard or business account. You can also open a savings account so you can increase the value of your funds. You can take different types of loans, for example, short-term, long-term, or business loans. You can also insure yourself or your property. You can save on your pension with a bank or other financial institution. Basically, you give your money to someone else who invests it for you. You can find other financial products on the market, but for the purposes of our article, we only need these.

Financial institutions need your identity, your payment history, and other information about your assets. A bank will offer you the best possible interest based on all this information. If you have a good payment history, reputation, and own several properties, you will get a higher loan and lower interest. This also applies vice versa. If the risk is higher, the interest rate increases accordingly. This is how it works in developed countries. If you have a negative entry in the register, you will probably not get a loan. Let’s add that in developing countries you often don’t even have a chance to borrow.

The bank is primarily a middleman, which always has enough funds for loans and profitable investments. Commercial banks manage people’s money and lend it to other people. Banks profit from all offered financial products. Banks and financial institutions have the right to hold and use our money for their benefit. They also have the right to lend and invest money. This right is guaranteed by the states. People trust banks mostly because the state and the legal system guarantee their fair behavior. Moreover, the state is often in a position to decide who can set up a bank and what conditions it must meet. Banks thus have a kind of monopoly on making money from citizens’ money. In addition, banks have the right to handle our personal information and monitor our transactions. They may even freeze some suspicious transactions and ask for details.

What current generation of cryptocurrencies are not able to do

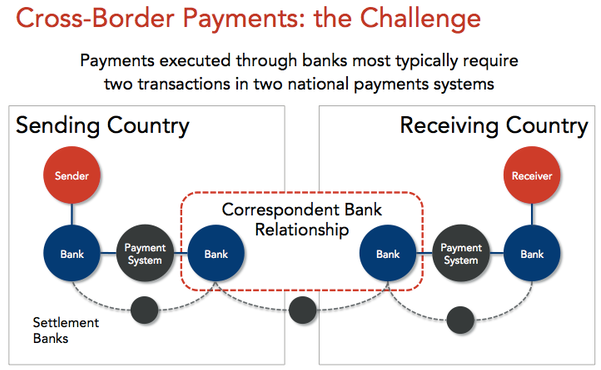

Today’s cryptocurrencies can do just one thing — sending transactions from Alice to Bob. Blockchain users can open their own account and send coins back and forth. It only works well between people who know each other and trust each other. This alone cannot threaten or replace banks. Banking transactions are very complex, especially cross-border ones. These transactions are slow, expensive and there is a high error rate. Some blockchain technologies are definitely a better solution. However, as we have seen above, the bank business is about something else.

Cross-border payment.

Cross-border payment.

If you need to send a transaction to someone you do not know, you run the risk that the counterparty will not meet its obligation. A typical example is buying goods at the bazaar. If you find a great guitar for a good price on the internet and pay the unknown seller first, the seller may not send you the promised guitar. If you fail to persuade the seller to send it to you, you will need to ask the legal system for help.

Do you know what you are missing in the above scenario? You are missing a trusted middleman. More specifically, you are missing someone who knows the exact terms of the transaction and decides what should happen if one party fails to meet the terms. You are missing a contract where the terms are clearly defined and a mechanism that would help with the execution. As you can see, current transaction systems do not cover all possible use cases.

Let’s have a look at whether it is possible to disrupt bank business. Imagine a situation where Alice lends Bob 1 BTC. Bob promises Alice to return 0.1 BTC each month until the debt is paid. Maybe it would work if Bob and Alice knew each other well. Alice can physically contact Bob and push him to pay the debt. If they don’t know each other and Bob stops paying off the debt, Alice can’t do anything at all. Notice that we are completely in the digital world and there is no connection to the physical world as in the example with the guitar.

If the bank lends you the money, there is always a paper contract between you and the bank. The legal system will help the bank recover the debt. Notice that the same legal system also protects you because the bank must act according to the rules set by the state or other authorities.

Bob can borrow money from the bank. Whether he trusts the bank more or less, he is sure that if he borrows and repays, nothing bad will happen. If Alice and Bob enter into a paper contract, the legal system will also protect both Alice and Bob. Making use of the legal system means that Alice and Bob need to provide evidence of everything that happened. The evidence will be, for example, a paper contract, bank transfers, emails, and claims of all participants.

The traditional system does not take into account the right to privacy at all. It is simply not possible to borrow anonymously. If a decentralized product could do it, it would have a competitive advantage. However, anonymity costs something. If you want to borrow anonymously, you must pledge the equivalent of the borrowed value. Crypto is quite popular as collateral. However, because it is volatile, you often have to provide collateral greater than you actually borrow. This will not suit people who have nothing to provide as collateral. These people can reveal their real identities, but still, they have to accept higher interest rates. They can ask a friend to provide something valuable as collateral and help them to get the loan. As you can see, it is a relatively complex financial contract.

There is another aspect. Privacy means that to prove an event might be complicated in the case of troubles. The privacy should work in a way that transactions and contracts are private but participants can still prove all details to a third party if needed.

What crypto must be able to do

To create an alternative to banks, blockchain technology must ensure the following:

- Play the role of a trusted middleman for participants who don’t know each other and thus do not trust each other. This can be achieved through decentralization. A decentralized network can act as a trusted middleman between parties. However, we need to combine decentralization with other capabilities to cover more use-cases.

- Replacing the bank’s role means allowing participants to negotiate the terms of the contract. Luckily, we have already invented smart contracts. A digital form of contract. This will give context to transactions. Alice and Bob’s addresses will be part of the contract. The contract will be able to verify that Alice lent to Bob. Furthermore, the smart contract is able to verify that Bob repays the loan on time. Bob has to send 10 transactions to Alice to the same address. This is the necessary context of transactions for the contract. A smart contract is basically just a logic that expects some events to happen and act based on that.

- Replacing the role of the legal system means that the smart contract will make it possible to oversee the events associated with the agreement and to enforce some corrective action in case of problems. If Bob sends back only half of the debt and then stops paying off, the smart contract has to make things right. Part of the contract is also an event that occurs when Bob stops paying off.

Replacing the legal system is perhaps the most difficult part. But not necessarily. If both participants are to remain anonymous, Bob must pledge something precious in the value of the loan. For example, a Netflix annual subscription, a 1000-liter gasoline voucher, or another cryptocurrency. A smart contract can keep these things in custody and if Bob stops paying off, Alice gets those things. Possibly just part of them. There may also be a reputation system that will reduce Bob’s credibility. Finally, there is nothing to prevent the legal system from being used. If the real identity of participants is known, the smart contract can use it and reveal it to authorities. This is despite the fact that both participants were anonymous at the beginning. The system can ensure that they are both from a country where the same legal system applies. Thanks to the blockchain and other applications logic, all the necessary contact information, and related transactions will be put together easily. Once Oracles are part of the infrastructure, it will not be a problem to create the documents needed to contact local authorities.

Smart contracts will be a powerful part of our decentralized future.

Smart contracts will be a powerful part of our decentralized future.

Traditional paper contracts today are complex and well understood by only one party. Most contracts and all their details are more understood by banks and their legal department than ordinary people. Digital contracts could be much simpler. The source code of the contract could be translated into easy-to-understand sentences that everyone can easily understand. There will be no room for footnotes or unexpected unilateral changes during the course of the contract.

The transaction system, together with smart contracts, can replace some of the bank’s financial products and financial institutions. Working with debt can be relatively easy as everything happens in the digital world. Insurance can work similarly, but here, in most cases, it will require a connection to the physical world through Oracles. Oracles can provide information on the cost of assets, weather, aircraft arrivals, match results, and other things. One day we can see the current authorities, which is generally trusted. Alternatively, collective voting can be used. The interested group can vote on something and the result of the voting will be an event to which the smart contract will respond. It can also be a relatively reliable link to the physical world at the local level. Oracles and voting are not always necessary. We can imagine a solution that can largely work fully in the digital world. With the increasing asset tokenization, other options will be available. You can be insured in case someone does not send you Tesla shares in time.